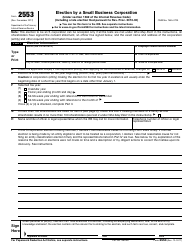

This version of the form is not currently in use and is provided for reference only. Download this version of

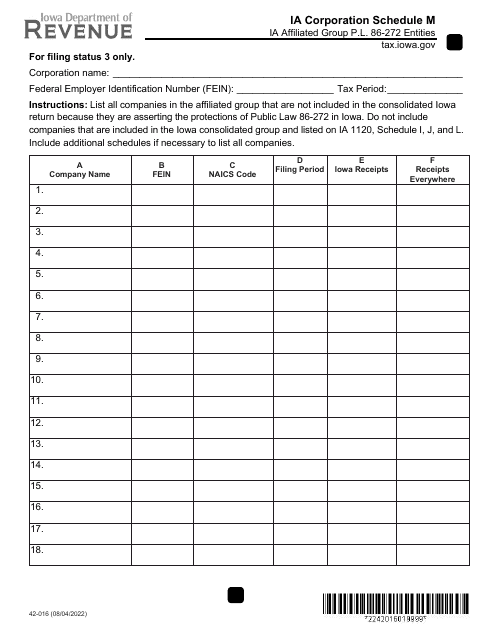

Form 42-016 Schedule M

for the current year.

Form 42-016 Schedule M Corporation Schedule - Iowa

What Is Form 42-016 Schedule M?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

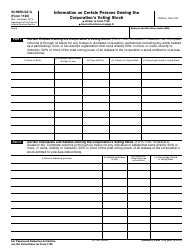

Q: What is Form 42-016 Schedule M?

A: Form 42-016 Schedule M is the Corporation Schedule for the state of Iowa.

Q: What is the purpose of Form 42-016 Schedule M?

A: The purpose of Form 42-016 Schedule M is to report the income and apportionment factors of a corporation operating in Iowa.

Q: Who needs to file Form 42-016 Schedule M?

A: Any corporation operating in Iowa that is required to file an Iowa corporation income tax return needs to file Form 42-016 Schedule M.

Q: What information do I need to complete Form 42-016 Schedule M?

A: You will need to provide information about the corporation's income, apportionment factors, and any other required details.

Q: Is Form 42-016 Schedule M the only form that needs to be filed for Iowa corporation income tax?

A: No, Form 42-016 Schedule M is an additional schedule that is filed along with the Iowa corporation income tax return.

Form Details:

- Released on August 4, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 42-016 Schedule M by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.