This version of the form is not currently in use and is provided for reference only. Download this version of

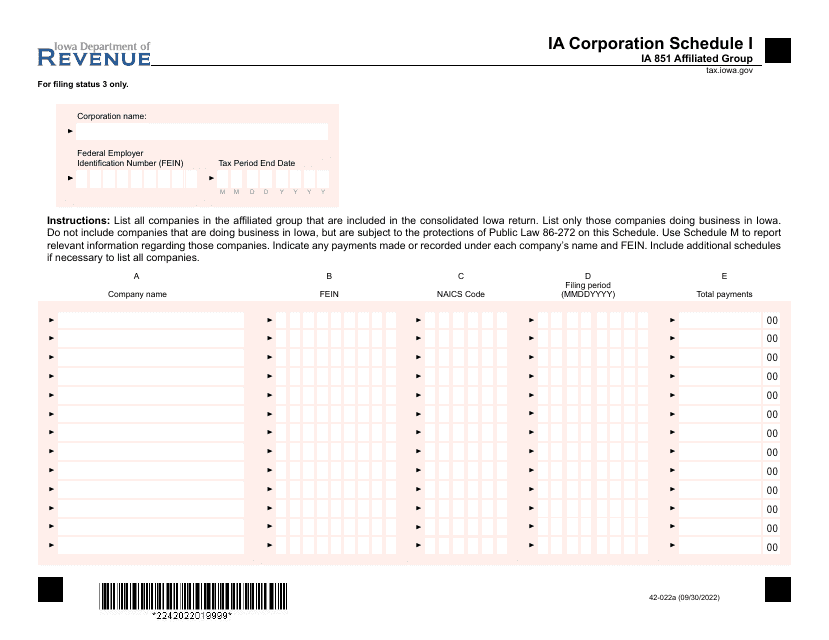

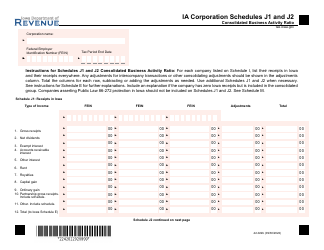

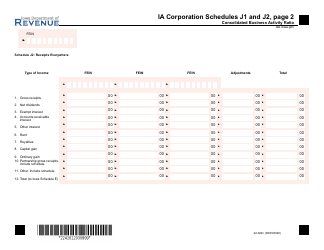

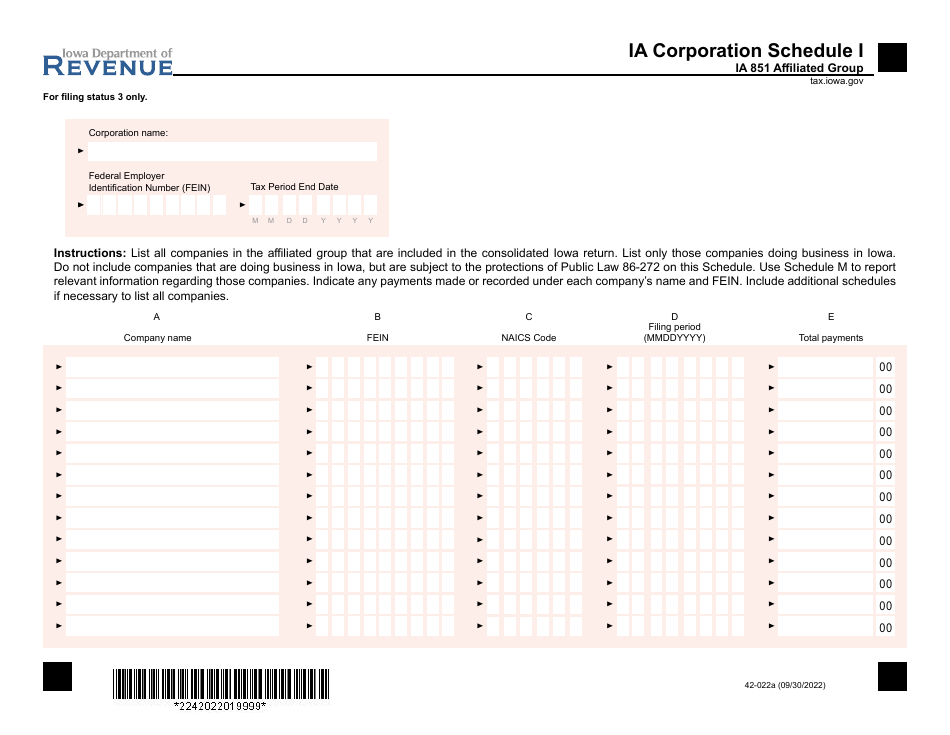

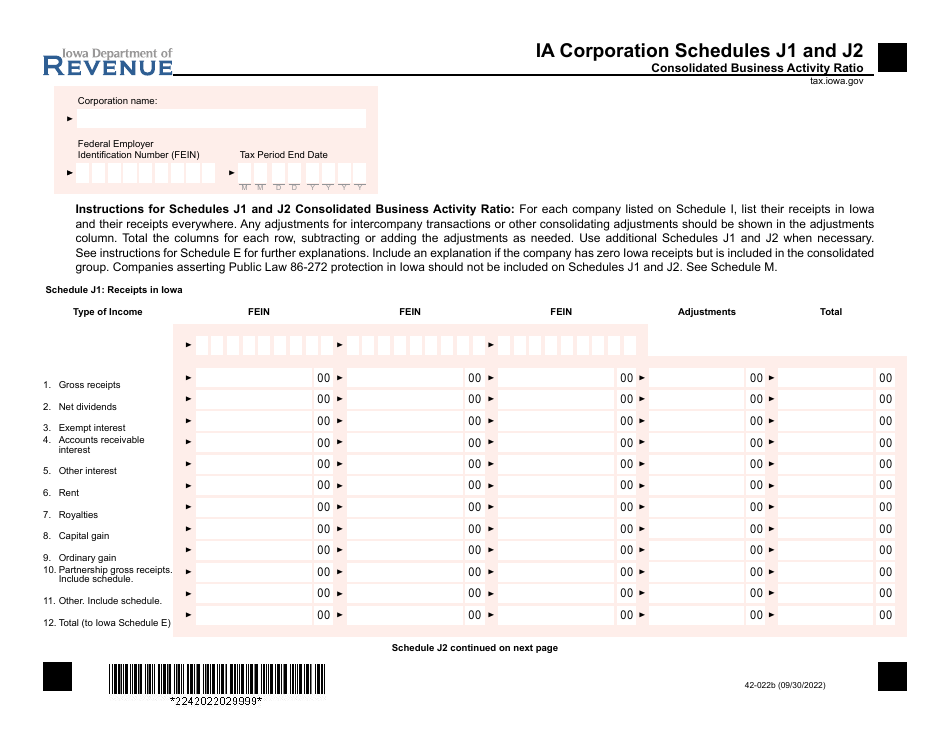

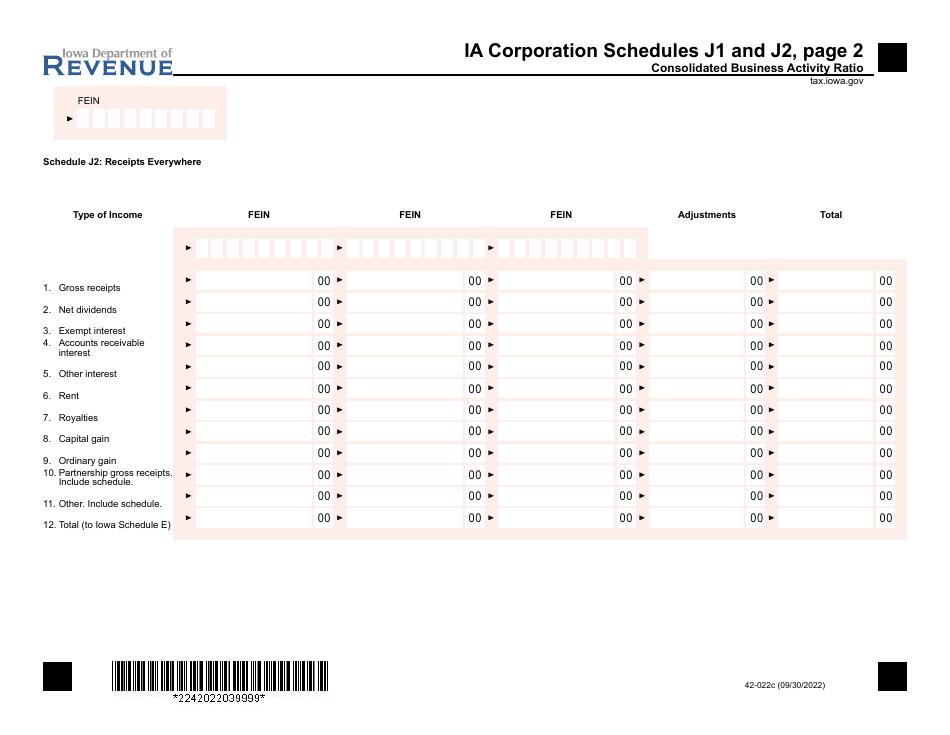

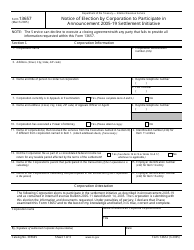

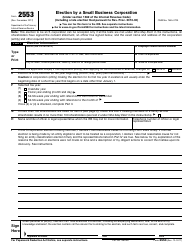

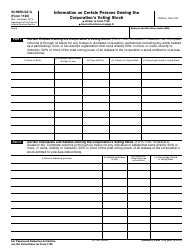

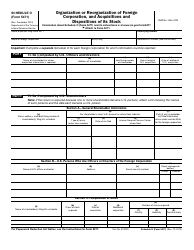

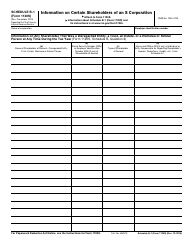

Form 42-022 Schedule I, J1, J2

for the current year.

Form 42-022 Schedule I, J1, J2 Corporation Schedule - Iowa

What Is Form 42-022 Schedule I, J1, J2?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 42-022 Schedule I, J1, J2?

A: Form 42-022 Schedule I, J1, J2 is a corporation schedule for filing taxes in Iowa.

Q: Who needs to file Form 42-022 Schedule I, J1, J2?

A: Corporations in Iowa need to file Form 42-022 Schedule I, J1, J2.

Q: What information do I need to complete this form?

A: You will need information regarding your corporation's income, deductions, credits, and other financial details.

Q: When is the deadline to file this form?

A: The deadline to file Form 42-022 Schedule I, J1, J2 is typically on or around April 30th of each year.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing, so it's important to submit your form by the deadline.

Q: Can I file this form electronically?

A: Yes, Iowa allows electronic filing for Form 42-022 Schedule I, J1, J2.

Q: What should I do if I need help completing this form?

A: If you need assistance with completing Form 42-022 Schedule I, J1, J2, you should consider consulting a tax professional or contacting the Iowa Department of Revenue for guidance.

Form Details:

- Released on September 30, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 42-022 Schedule I, J1, J2 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.