This version of the form is not currently in use and is provided for reference only. Download this version of

Form 54-139

for the current year.

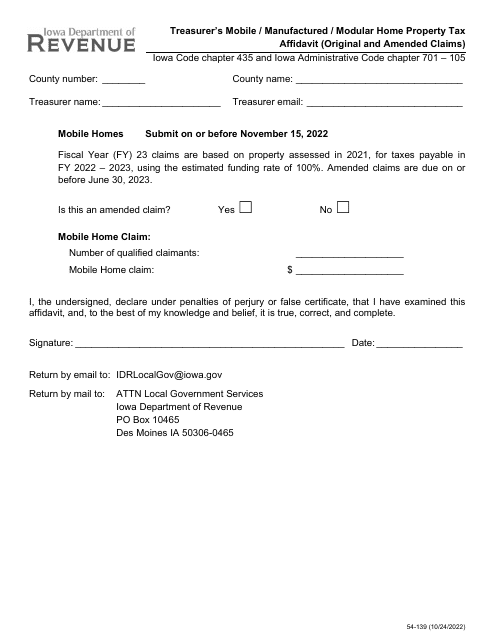

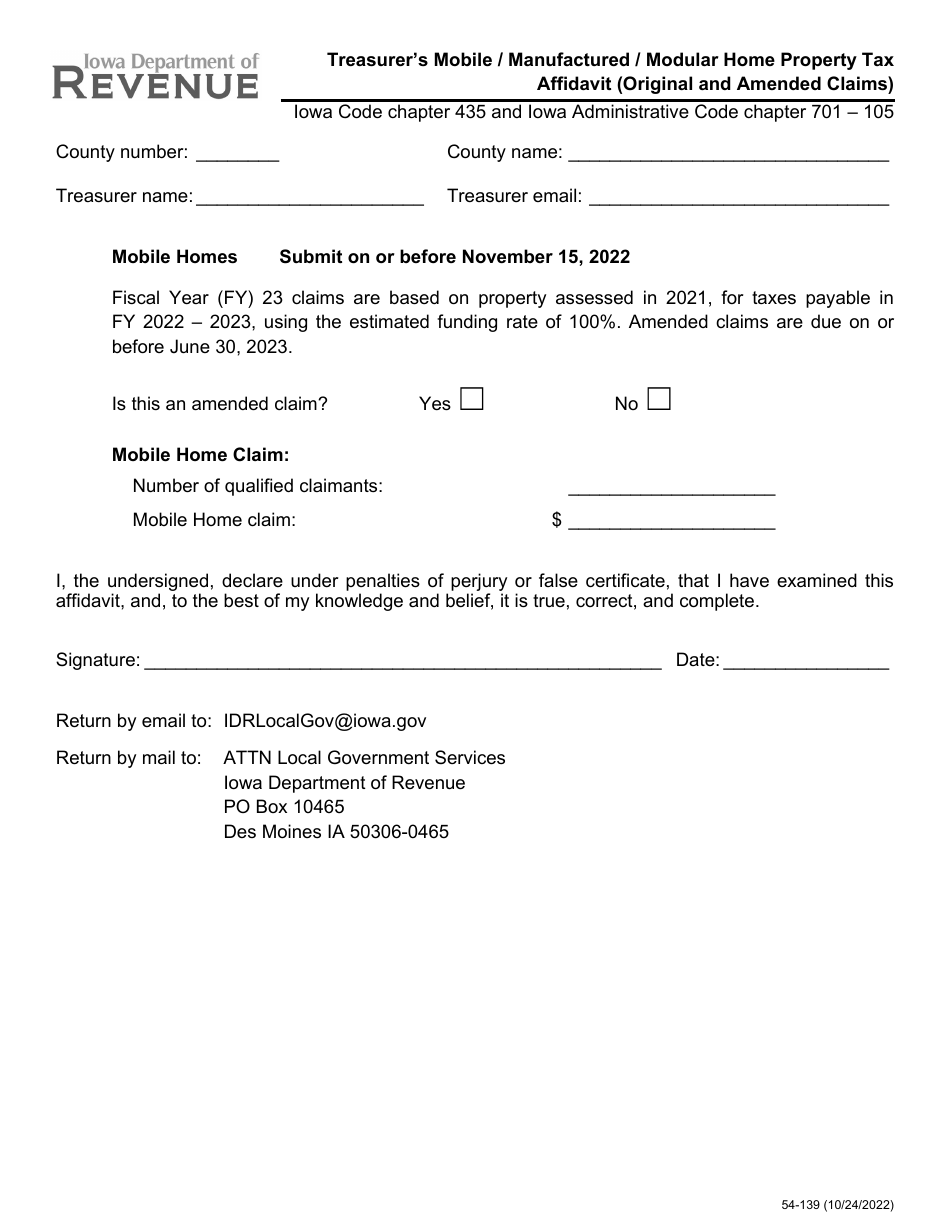

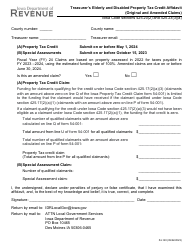

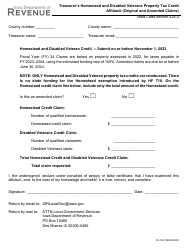

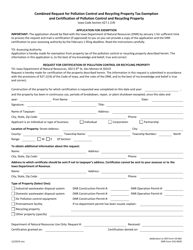

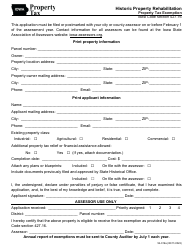

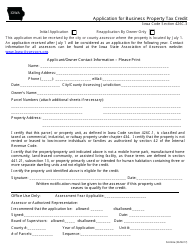

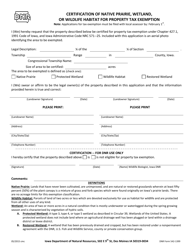

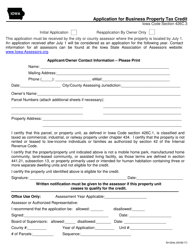

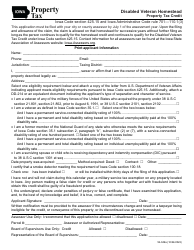

Form 54-139 Treasurer's Mobile / Manufactured / Modular Home Property Tax Affidavit (Original and Amended Claims) - Iowa

What Is Form 54-139?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 54-139?

A: Form 54-139 is the Treasurer's Mobile/Manufactured/Modular Home Property Tax Affidavit (Original and Amended Claims) used in Iowa.

Q: What is the purpose of Form 54-139?

A: Form 54-139 is used to declare the property tax status of mobile/manufactured/modular homes and submit original or amended claims.

Q: Who needs to fill out Form 54-139?

A: Owners or residents of mobile/manufactured/modular homes in Iowa need to fill out Form 54-139.

Q: What information is required on Form 54-139?

A: Form 54-139 requires information about the mobile/manufactured/modular home, property tax exemptions, and any changes to the original claim.

Q: When is Form 54-139 due?

A: Form 54-139 is due by January 31st of each year for the original claim, and within 60 days of any changes for amended claims.

Q: Is there a fee to file Form 54-139?

A: No, there is no fee to file Form 54-139.

Q: Are there any penalties for late filing of Form 54-139?

A: Late filing of Form 54-139 may result in penalties or loss of property tax exemptions.

Q: Who should I contact for assistance with Form 54-139?

A: You can contact the Treasurer's office in your county for assistance with Form 54-139.

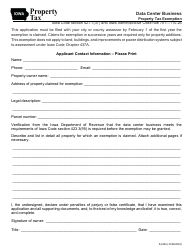

Form Details:

- Released on October 24, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 54-139 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.