This version of the form is not currently in use and is provided for reference only. Download this version of

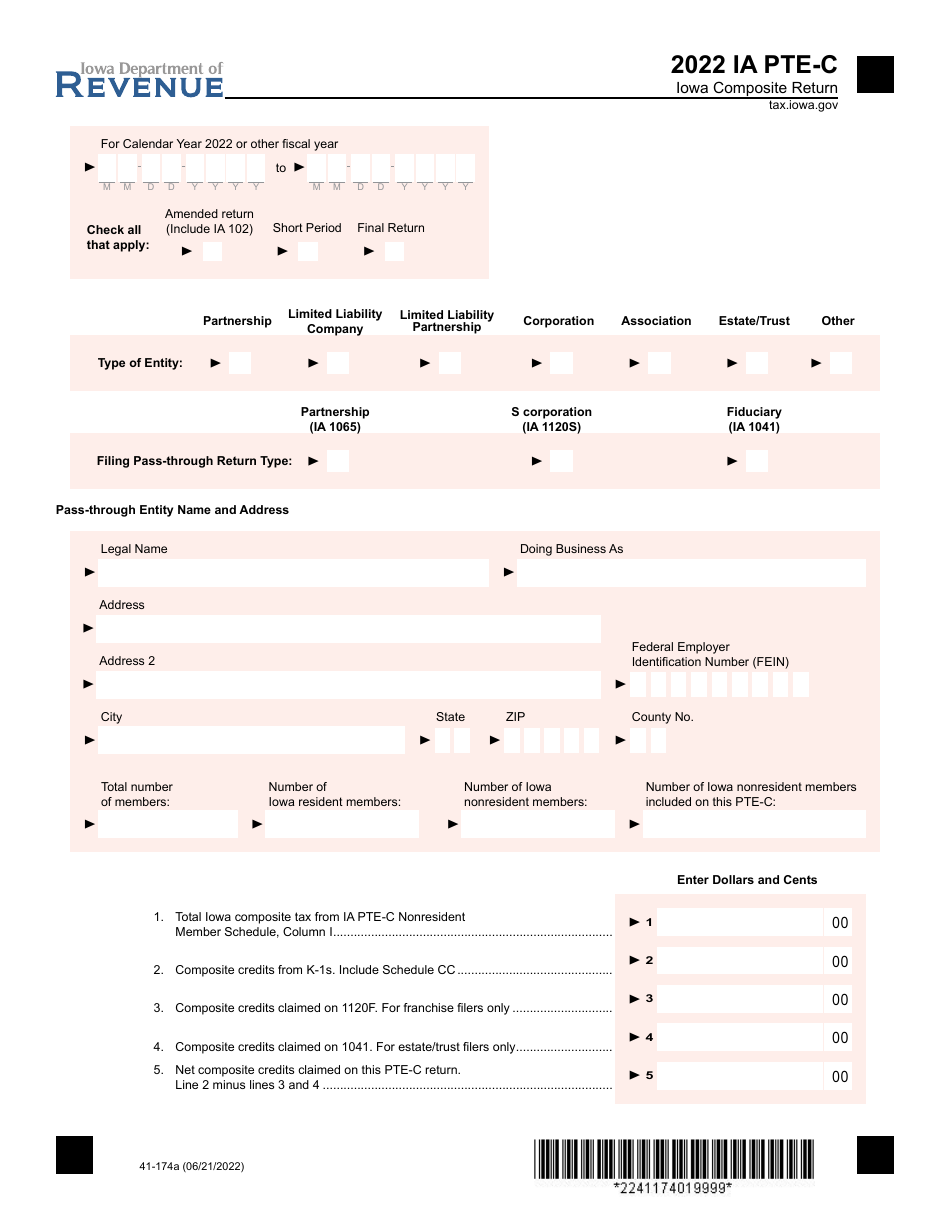

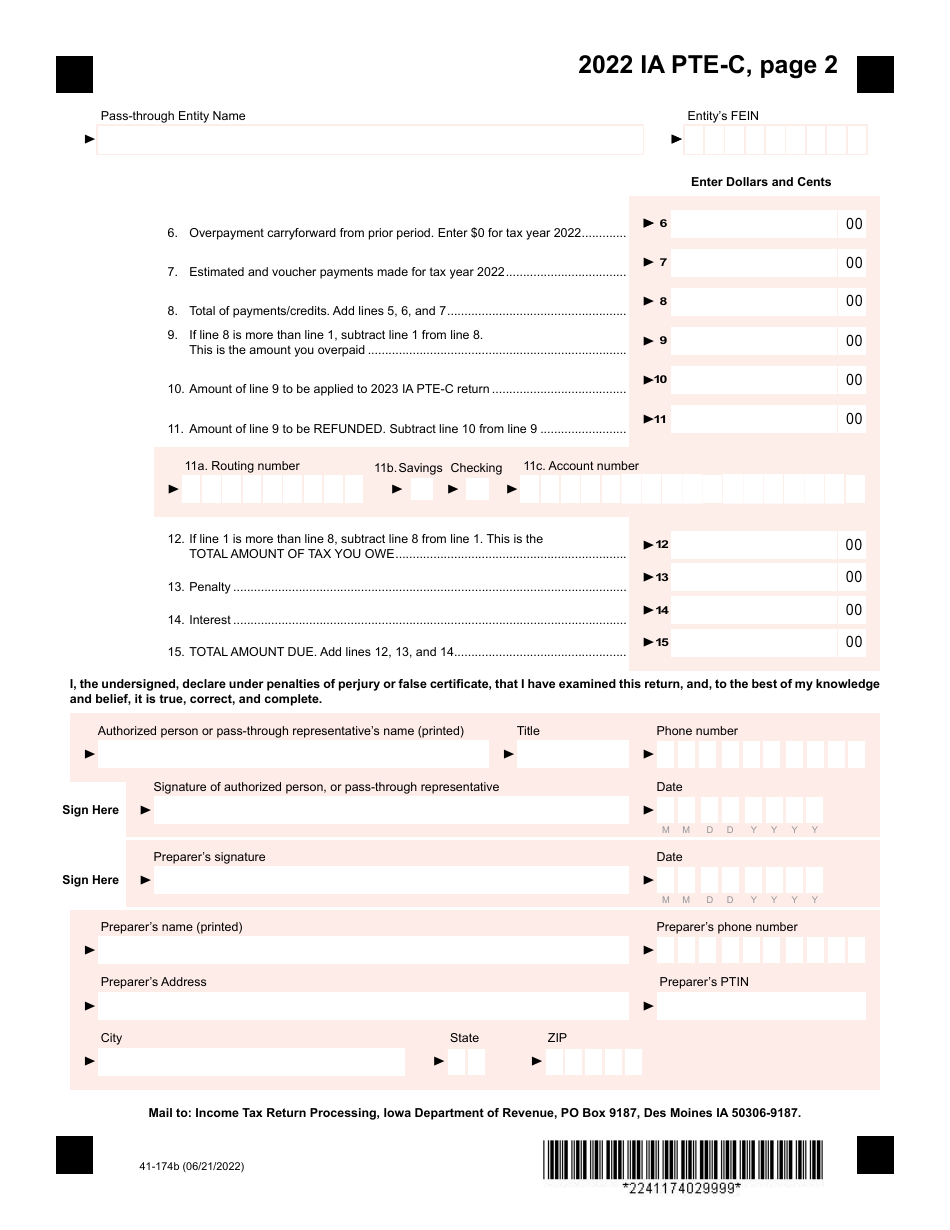

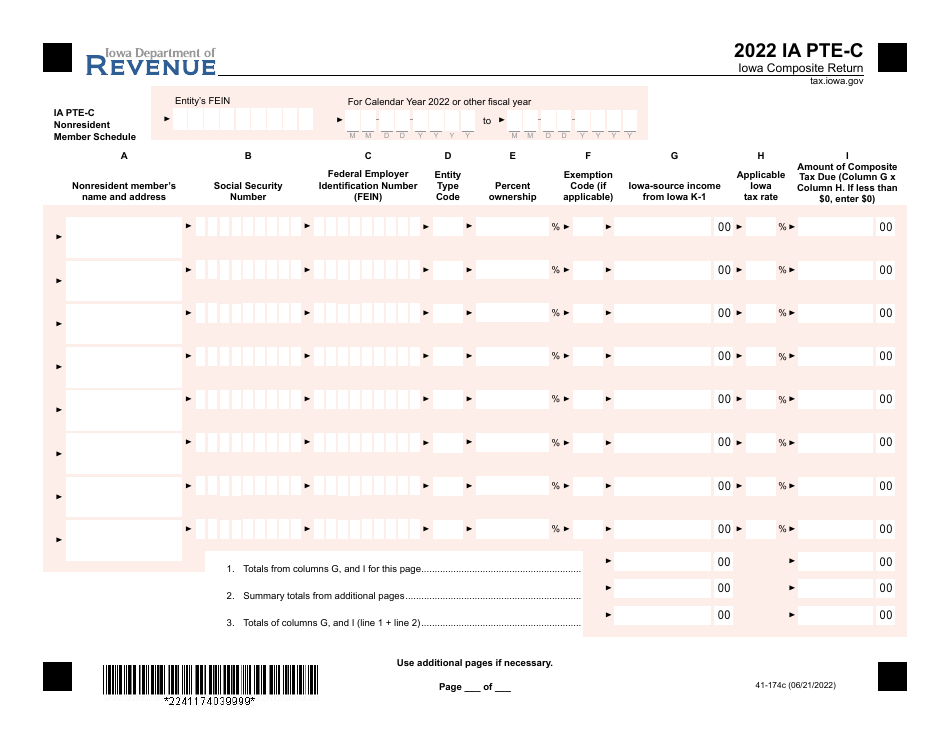

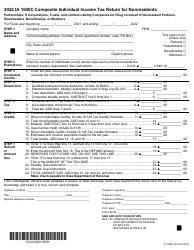

Form IA PTE-C (41-174)

for the current year.

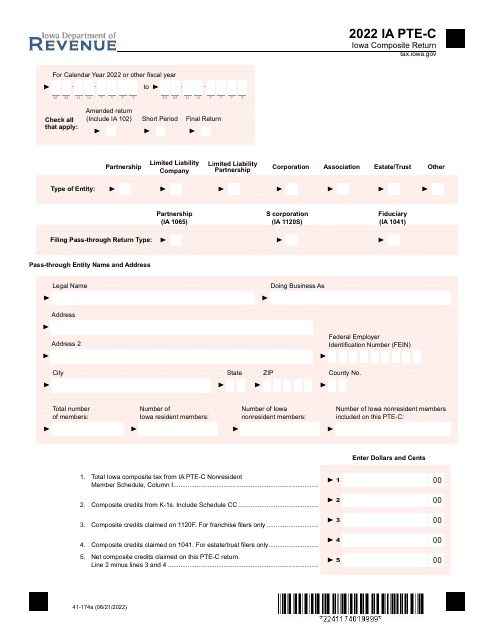

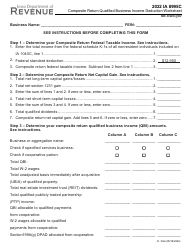

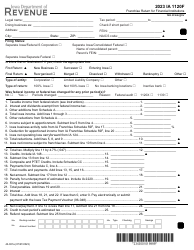

Form IA PTE-C (41-174) Iowa Composite Return - Iowa

What Is Form IA PTE-C (41-174)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IA PTE-C?

A: Form IA PTE-C is the Iowa Composite Return for Iowa.

Q: Who must file Form IA PTE-C?

A: Partnerships / S-Corporations with nonresident owners must file Form IA PTE-C.

Q: What is the purpose of Form IA PTE-C?

A: Form IA PTE-C is used to report and pay Iowa income tax on behalf of nonresident owners of partnerships / S-Corporations.

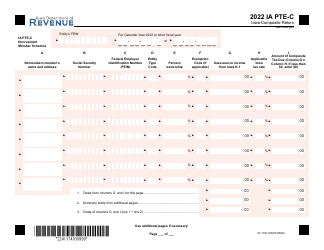

Q: What information is required on Form IA PTE-C?

A: Form IA PTE-C requires information about the partnership / S-Corporation and its nonresident owners, including income and withholding details.

Q: When is Form IA PTE-C due?

A: Form IA PTE-C is due on or before the 15th day of the fourth month following the end of the fiscal year.

Form Details:

- Released on June 21, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA PTE-C (41-174) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.