This version of the form is not currently in use and is provided for reference only. Download this version of

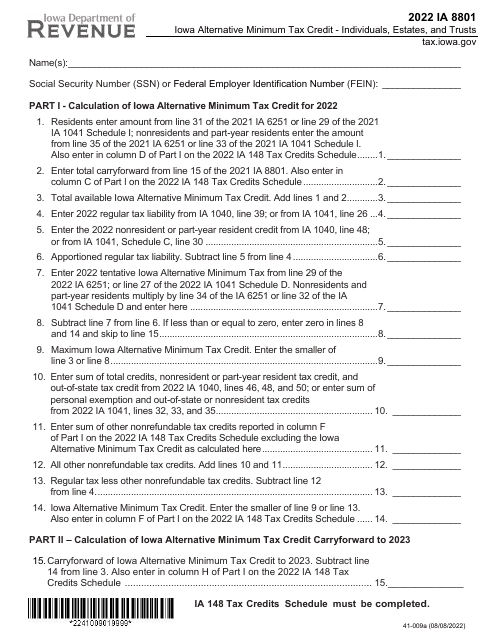

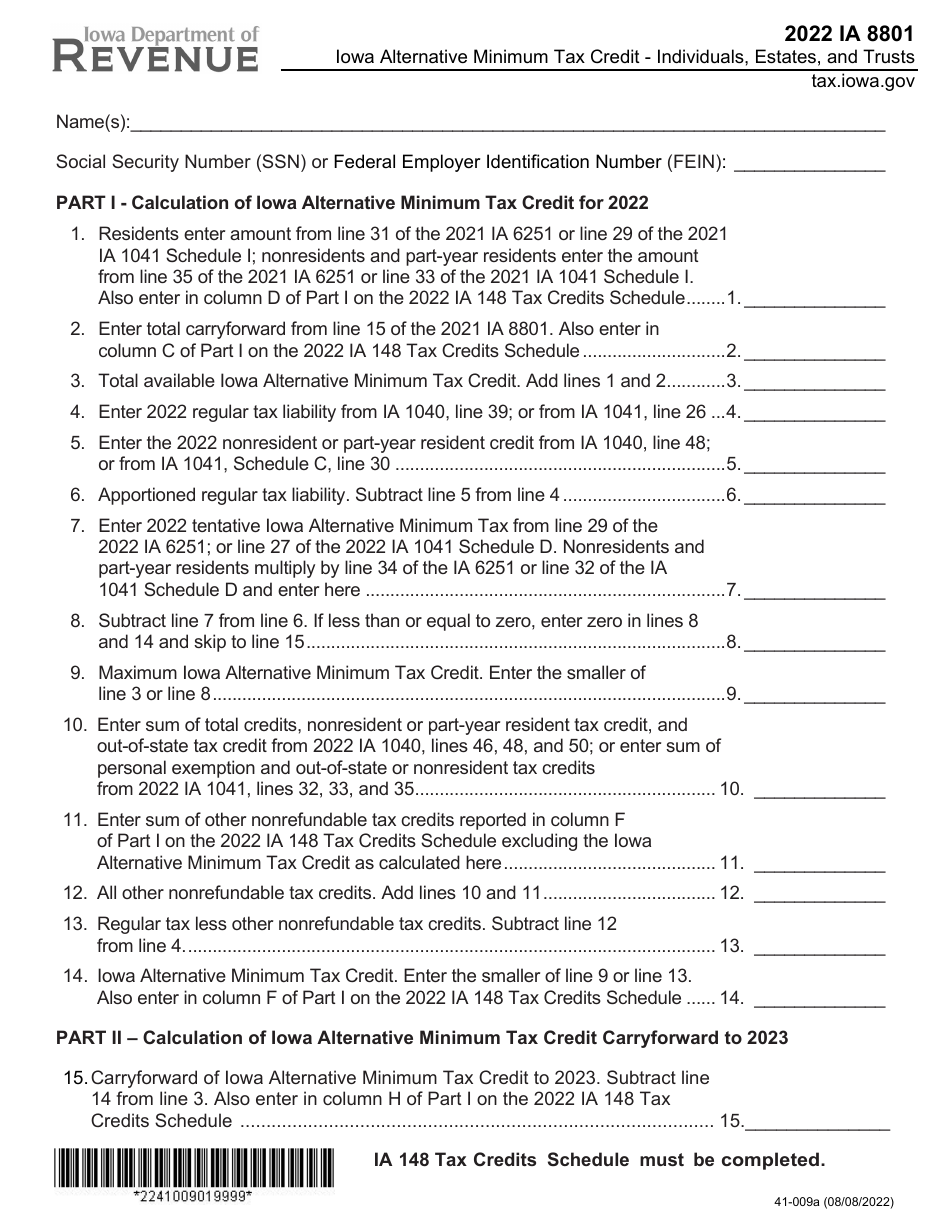

Form IA8801 (41-009)

for the current year.

Form IA8801 (41-009) Alternative Minimum Tax Credit - Individuals, Estates, and Trusts - Iowa

What Is Form IA8801 (41-009)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA8801?

A: Form IA8801 is the Alternative Minimum Tax Credit form for Individuals, Estates, and Trusts in Iowa.

Q: Who needs to file Form IA8801?

A: Individuals, Estates, and Trusts who are claiming the Alternative Minimum Tax Credit in Iowa need to file Form IA8801.

Q: What is the purpose of Form IA8801?

A: The purpose of Form IA8801 is to calculate and claim the Alternative Minimum Tax Credit for Individuals, Estates, and Trusts in Iowa.

Q: When is Form IA8801 due?

A: The due date for Form IA8801 is the same as the due date for your Iowa income tax return, which is usually April 30th.

Q: How do I fill out Form IA8801?

A: You will need to enter your qualifying AMT credit from your federal tax return and calculate the Iowa alternative minimum tax.

Q: Is there a fee to file Form IA8801?

A: There is no fee to file Form IA8801.

Q: Can I file Form IA8801 electronically?

A: Yes, you can file Form IA8801 electronically through the Iowa Department of Revenue's eFile & Pay system.

Q: What if I can't pay the tax owed when filing Form IA8801?

A: If you can't pay the tax owed when filing Form IA8801, you should still file the form on time and contact the Iowa Department of Revenue to discuss payment options.

Q: What if I make a mistake on Form IA8801?

A: If you make a mistake on Form IA8801, you can file an amended form using Form IA8801X to correct the error.

Form Details:

- Released on August 8, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA8801 (41-009) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.