This version of the form is not currently in use and is provided for reference only. Download this version of

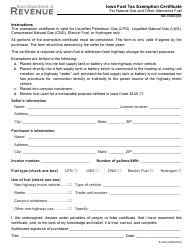

Form IA4136 (41-036)

for the current year.

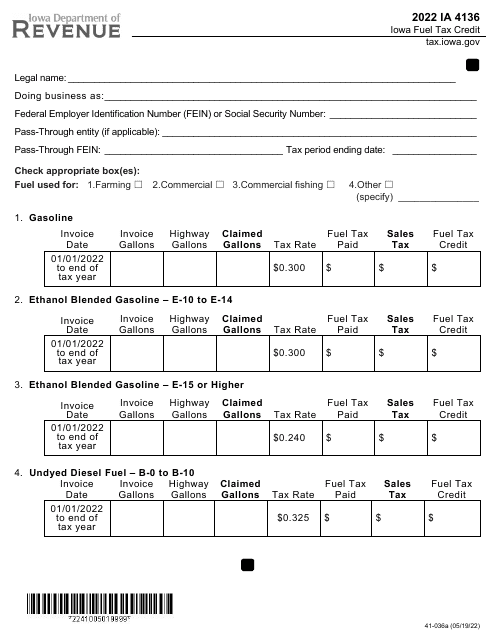

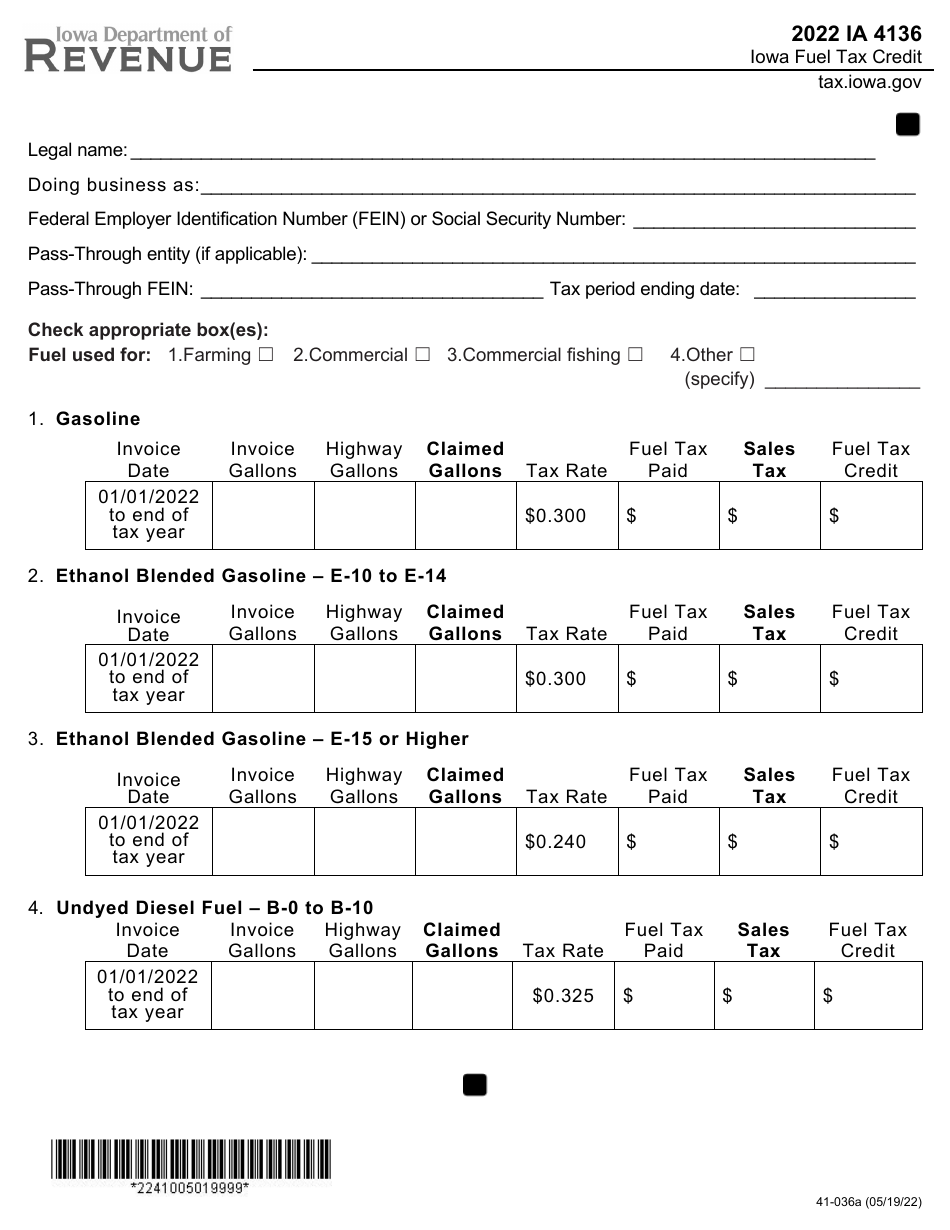

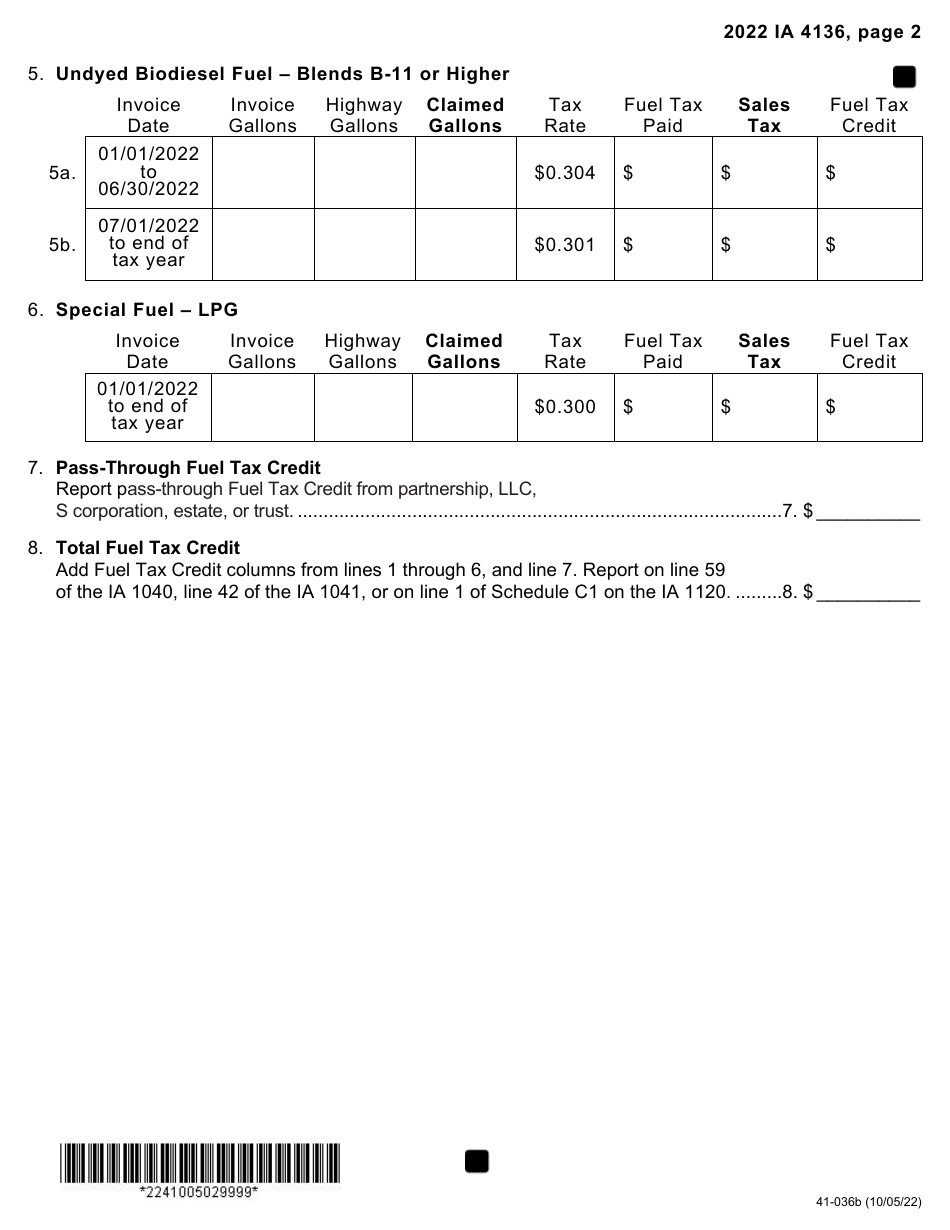

Form IA4136 (41-036) Fuel Tax Credit - Iowa

What Is Form IA4136 (41-036)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA4136?

A: Form IA4136 is a tax form used in the state of Iowa to claim a fuel tax credit.

Q: What is the purpose of Form IA4136?

A: The purpose of Form IA4136 is to claim a credit for fuel taxes paid in Iowa.

Q: Who should file Form IA4136?

A: Anyone who has paid fuel taxes in Iowa and is eligible for the fuel tax credit can file Form IA4136.

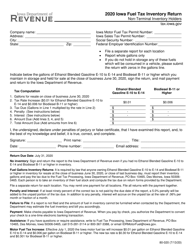

Q: How do I fill out Form IA4136?

A: You will need to provide information about your fuel purchases and calculate the amount of fuel tax credit you are eligible for.

Q: When is the deadline to file Form IA4136?

A: The deadline to file Form IA4136 is usually April 30th of the year following the tax year.

Q: Are there any eligibility requirements for the fuel tax credit?

A: Yes, you must meet certain criteria, such as using the fuel for a qualified purpose and not being eligible for certain exemptions.

Q: Can I claim the fuel tax credit if I am a non-resident of Iowa?

A: No, the fuel tax credit is generally only available to residents of Iowa.

Q: What supporting documents do I need to include with Form IA4136?

A: You may need to include copies of fuel receipts and other documentation to support your fuel tax credit claim.

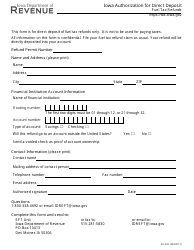

Q: Can I file Form IA4136 electronically?

A: Yes, Iowa allows electronic filing of Form IA4136.

Q: What should I do if I made an error on my filed Form IA4136?

A: If you made an error on your filed Form IA4136, you should file an amended form to correct the mistake.

Form Details:

- Released on May 19, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA4136 (41-036) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.