This version of the form is not currently in use and is provided for reference only. Download this version of

Form IA200 (42-041)

for the current year.

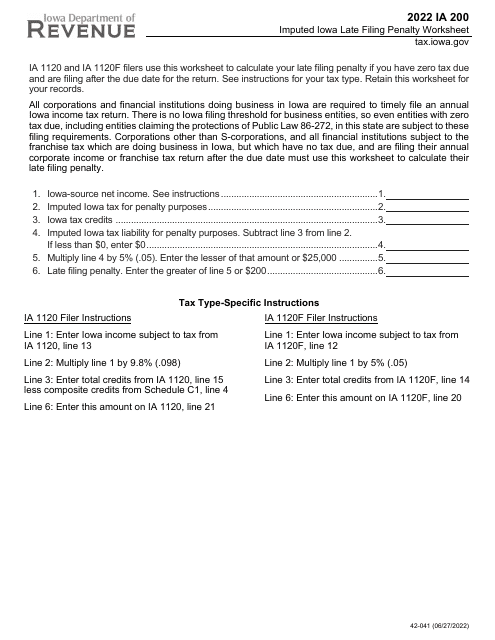

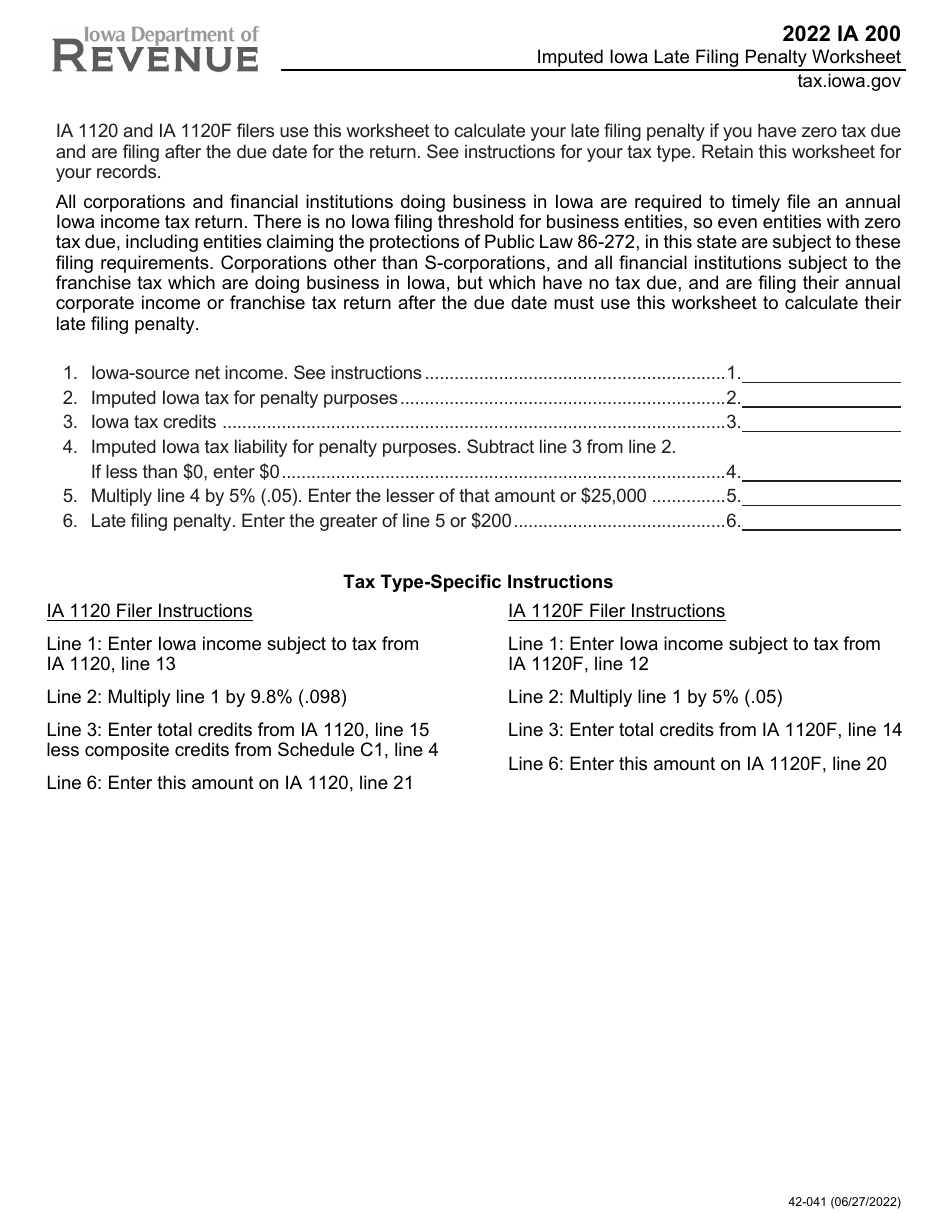

Form IA200 (42-041) Imputed Iowa Late Filing Penalty Worksheet - Iowa

What Is Form IA200 (42-041)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA200 (42-041)?

A: Form IA200 (42-041) is the Imputed Iowa Late Filing Penalty Worksheet.

Q: What is the purpose of Form IA200 (42-041)?

A: The purpose of Form IA200 (42-041) is to calculate the late filing penalty for missing the deadline to file Iowa taxes.

Q: Who needs to use Form IA200 (42-041)?

A: Anyone who missed the deadline to file their Iowa taxes and is subject to a late filing penalty needs to use Form IA200 (42-041).

Q: What does the Imputed Iowa Late Filing Penalty Worksheet calculate?

A: The Imputed Iowa Late Filing Penalty Worksheet calculates the amount of the late filing penalty based on the number of days late and the tax liability.

Q: When is the deadline to file Iowa taxes?

A: The deadline to file Iowa taxes is usually April 30th.

Q: What happens if I file my Iowa taxes late?

A: If you file your Iowa taxes late, you may be subject to a late filing penalty.

Q: Can I request an extension to file my Iowa taxes?

A: Yes, you can request an extension to file your Iowa taxes. However, this does not exempt you from paying any taxes owed by the original deadline.

Form Details:

- Released on June 27, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA200 (42-041) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.