This version of the form is not currently in use and is provided for reference only. Download this version of

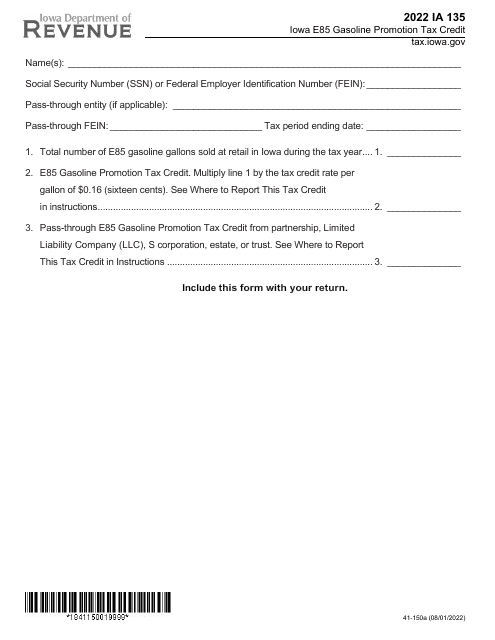

Form IA135 (41-150)

for the current year.

Form IA135 (41-150) Iowa E85 Gasoline Promotion Tax Credit - Iowa

What Is Form IA135 (41-150)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA135?

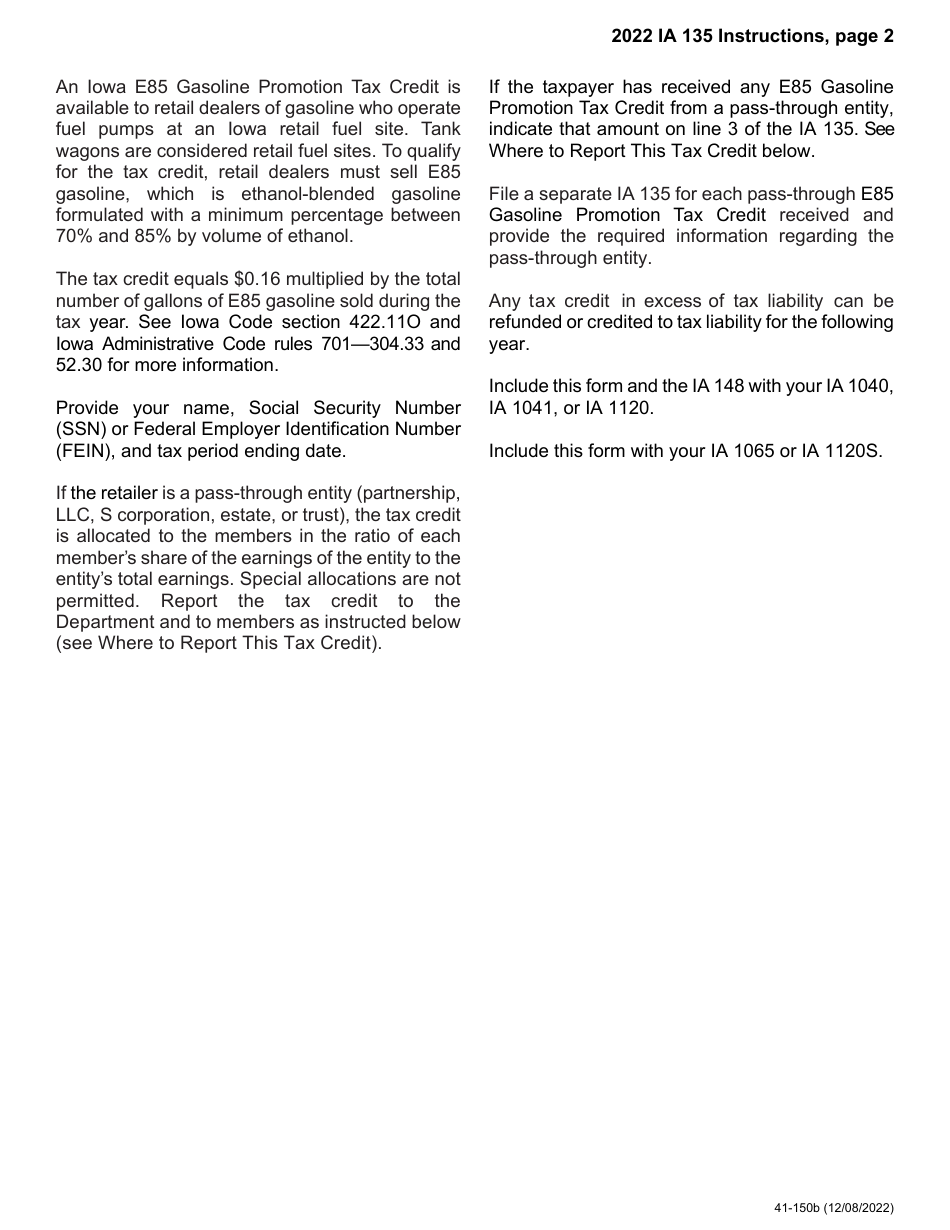

A: Form IA135 is a tax form in Iowa that is used to claim the E85 Gasoline Promotion Tax Credit.

Q: What is the purpose of the Iowa E85 Gasoline Promotion Tax Credit?

A: The purpose of the Iowa E85 Gasoline Promotion Tax Credit is to promote the use of E85 gasoline, which is a blend of ethanol and gasoline.

Q: Who is eligible to claim the Iowa E85 Gasoline Promotion Tax Credit?

A: Retailers who have sold E85 gasoline and individuals who have purchased E85 gasoline are eligible to claim the tax credit.

Q: How is the Iowa E85 Gasoline Promotion Tax Credit calculated?

A: The tax credit is equal to 20 cents per gallon of E85 gasoline sold or purchased.

Q: How can I claim the Iowa E85 Gasoline Promotion Tax Credit?

A: To claim the tax credit, you need to fill out Form IA135 and submit it to the Iowa Department of Revenue along with any required documentation.

Q: Are there any limitations or requirements for claiming the Iowa E85 Gasoline Promotion Tax Credit?

A: Yes, there are limitations and requirements, such as a minimum purchase or sale requirement and a cap on the total amount of tax credits that can be claimed.

Q: What is the deadline for claiming the Iowa E85 Gasoline Promotion Tax Credit?

A: The deadline for claiming the tax credit is the same as the deadline for filing your Iowa income tax return.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA135 (41-150) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.