This version of the form is not currently in use and is provided for reference only. Download this version of

Form IA133 (41-133)

for the current year.

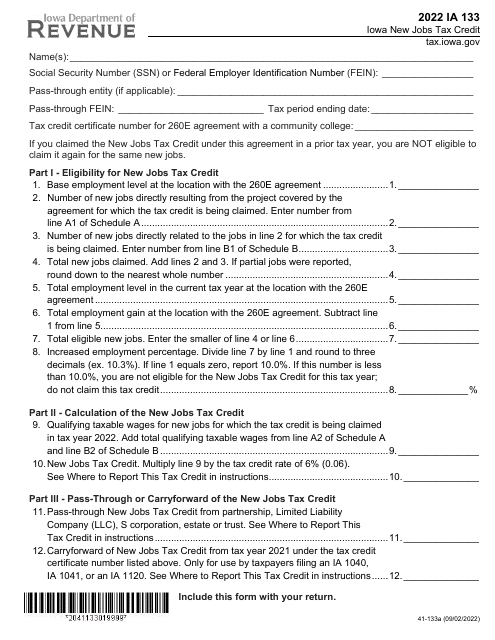

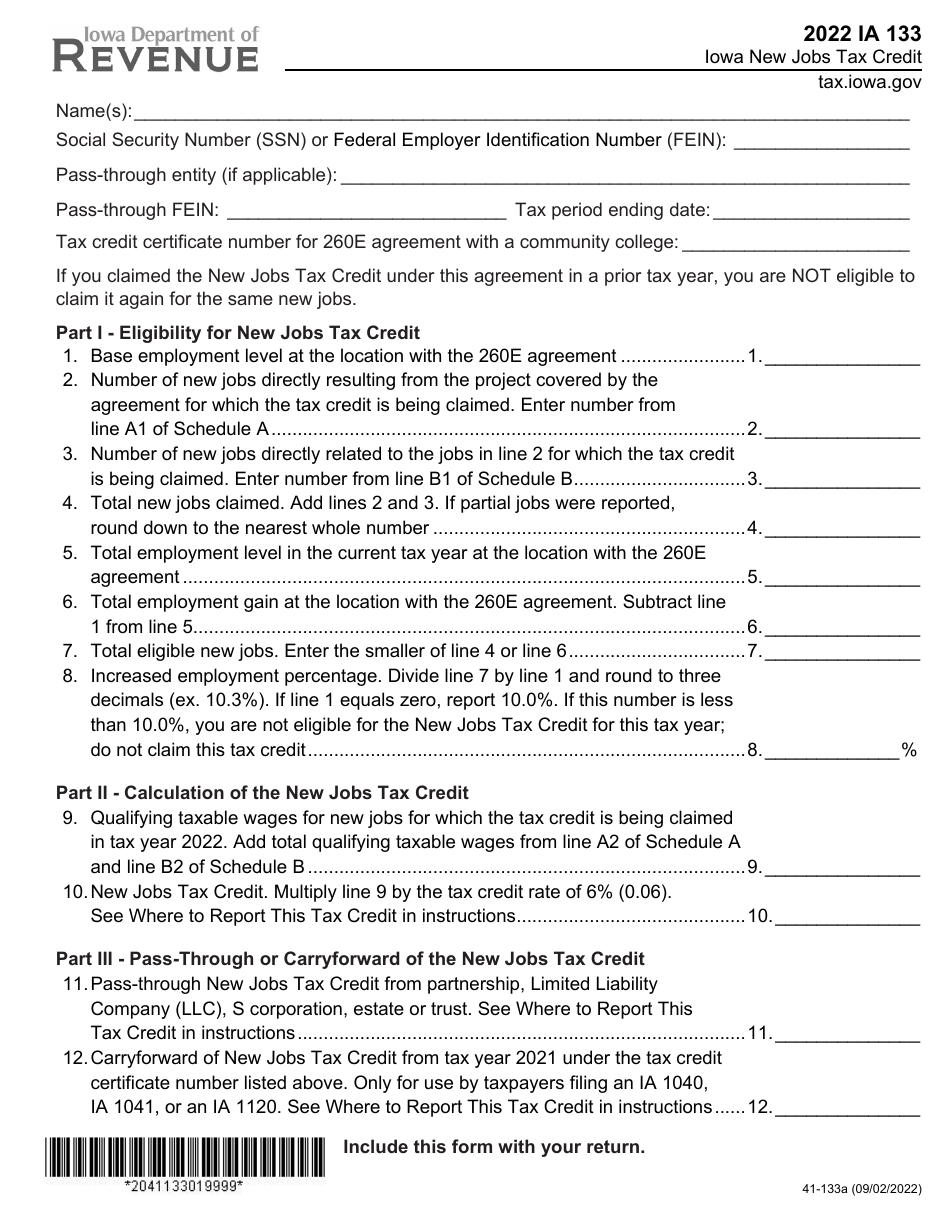

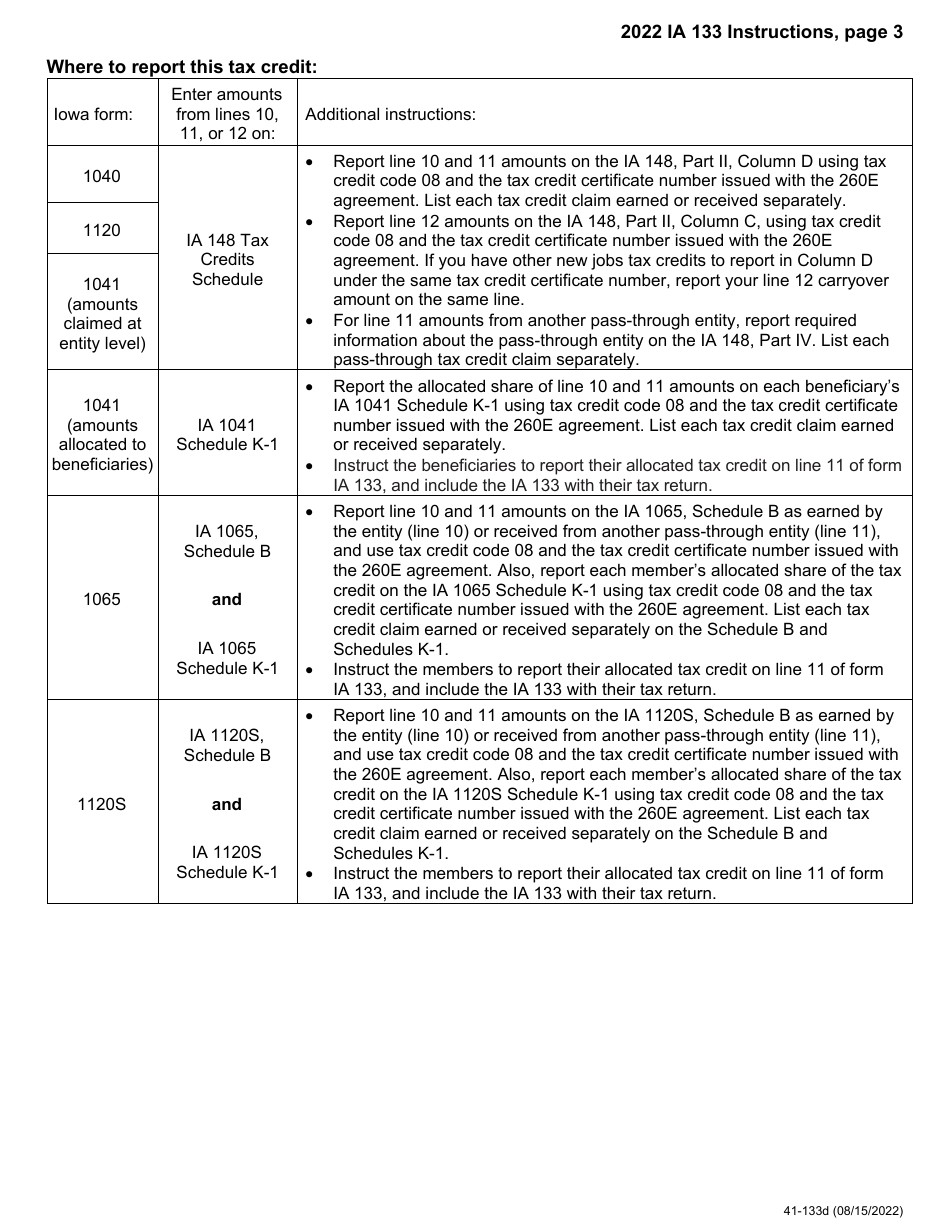

Form IA133 (41-133) Iowa New Jobs Tax Credit - Iowa

What Is Form IA133 (41-133)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA133?

A: Form IA133 is the Iowa New Jobs Tax Credit form.

Q: What is the purpose of Form IA133?

A: The purpose of Form IA133 is to claim the Iowa New Jobs Tax Credit.

Q: What is the Iowa New Jobs Tax Credit?

A: The Iowa New Jobs Tax Credit is a credit available to businesses that create new jobs in Iowa.

Q: Who is eligible for the Iowa New Jobs Tax Credit?

A: Businesses that create new jobs in Iowa may be eligible for the Iowa New Jobs Tax Credit.

Q: How do I claim the Iowa New Jobs Tax Credit?

A: To claim the Iowa New Jobs Tax Credit, you need to complete and file Form IA133.

Q: Is there a deadline to file Form IA133?

A: Yes, there is a deadline to file Form IA133. The deadline is typically April 30th of the year following the tax year for which the credit is being claimed.

Form Details:

- Released on September 2, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA133 (41-133) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.