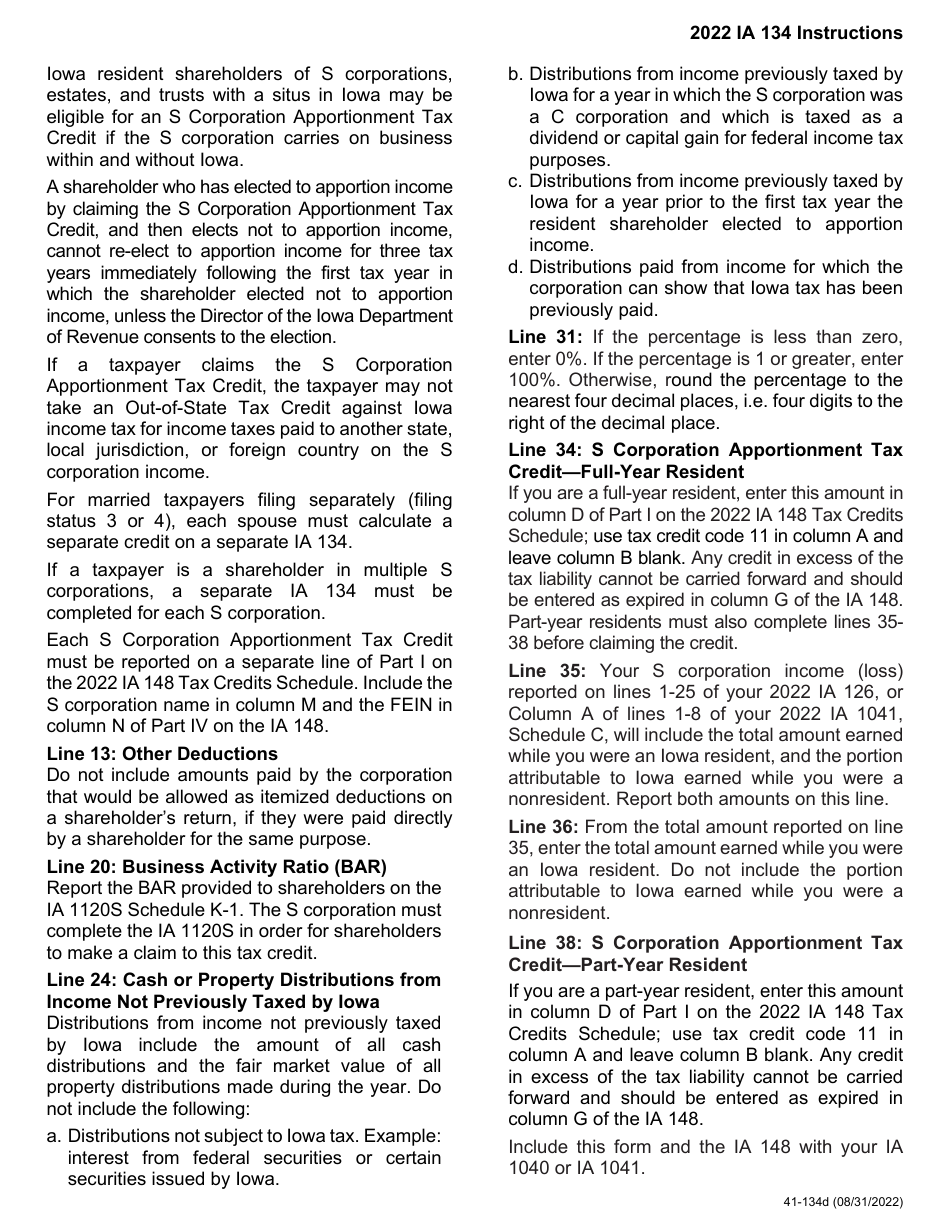

This version of the form is not currently in use and is provided for reference only. Download this version of

Form IA134 (41-134)

for the current year.

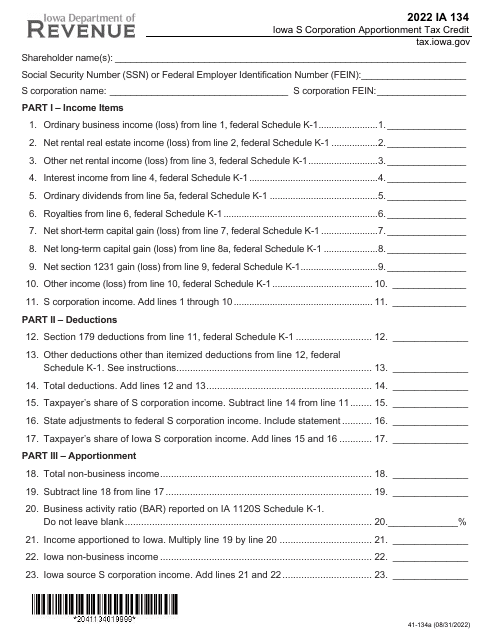

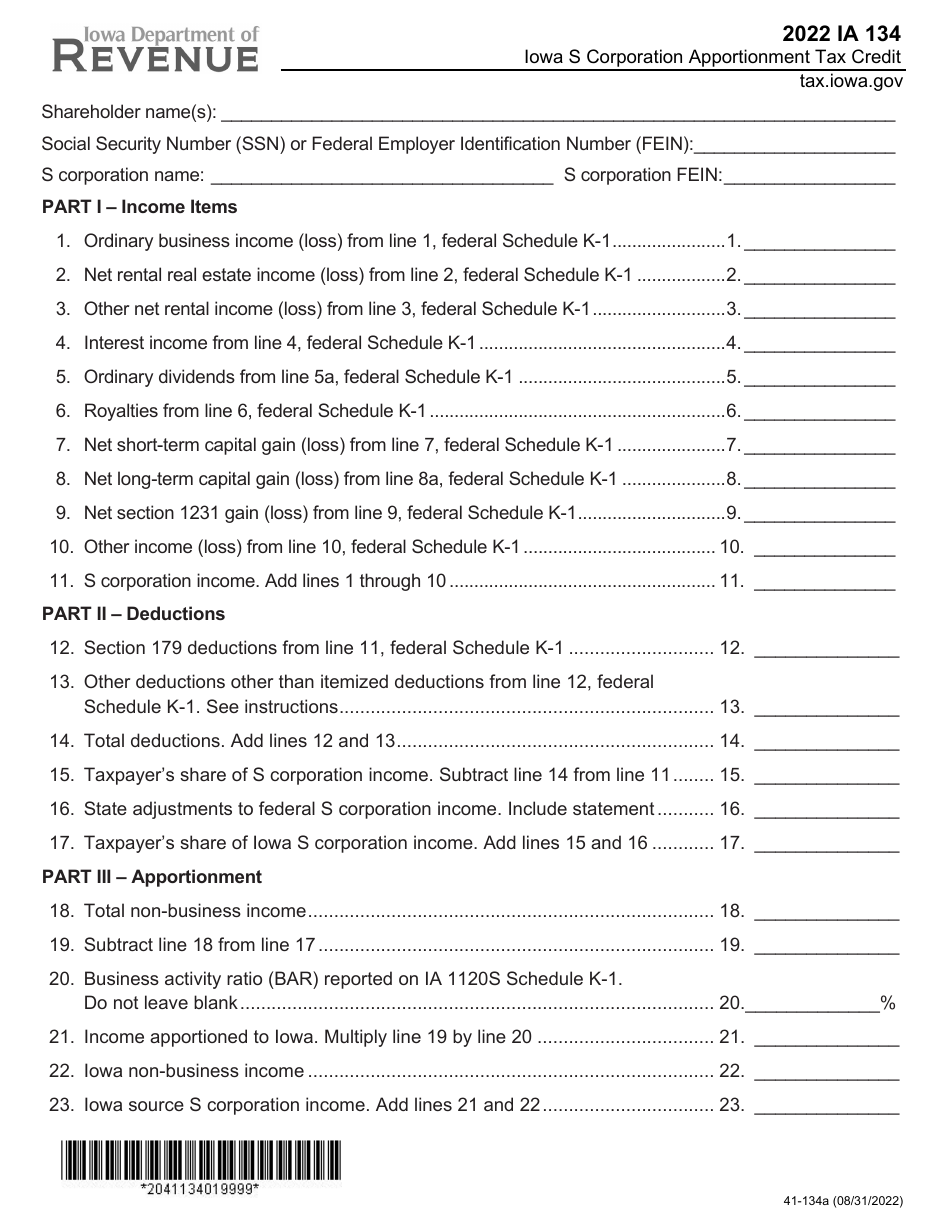

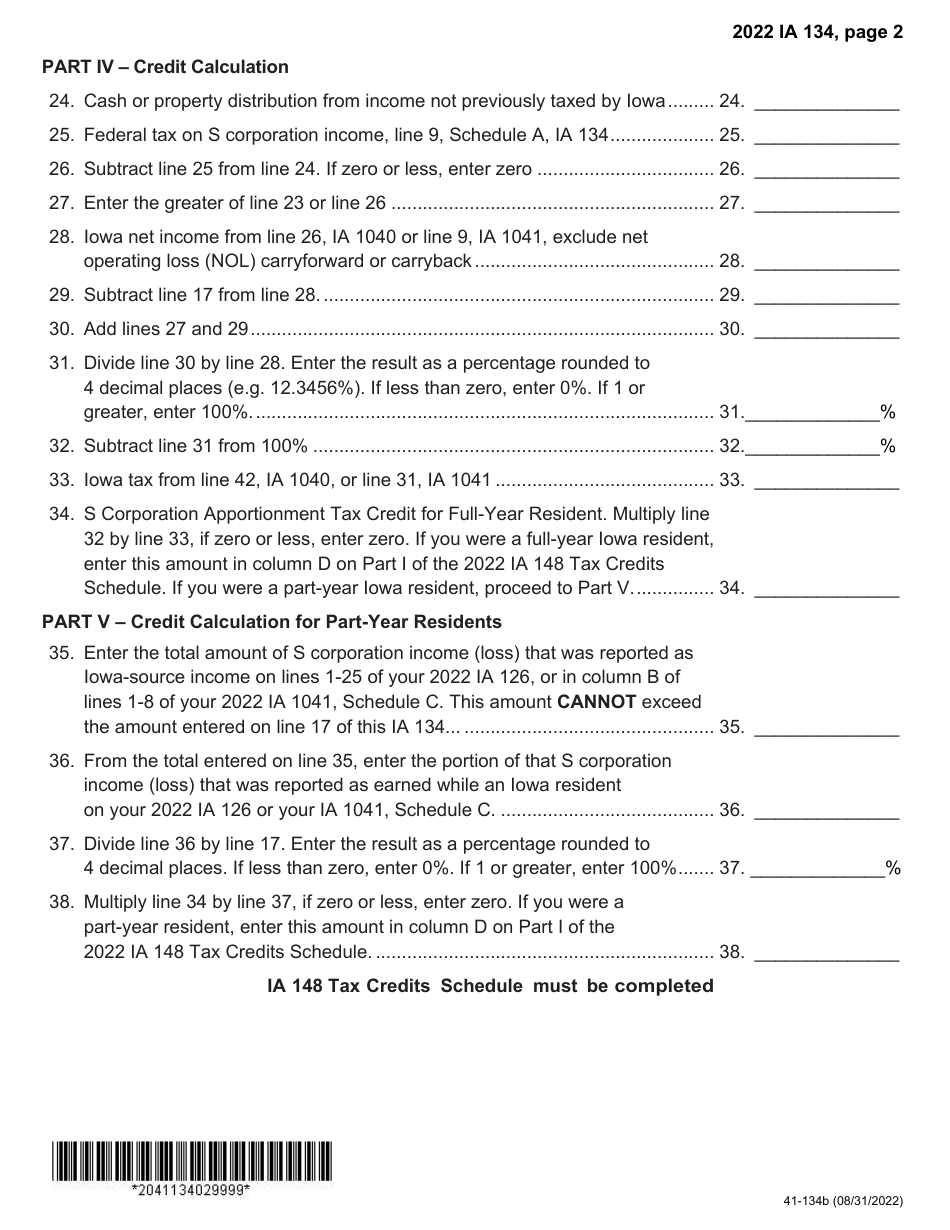

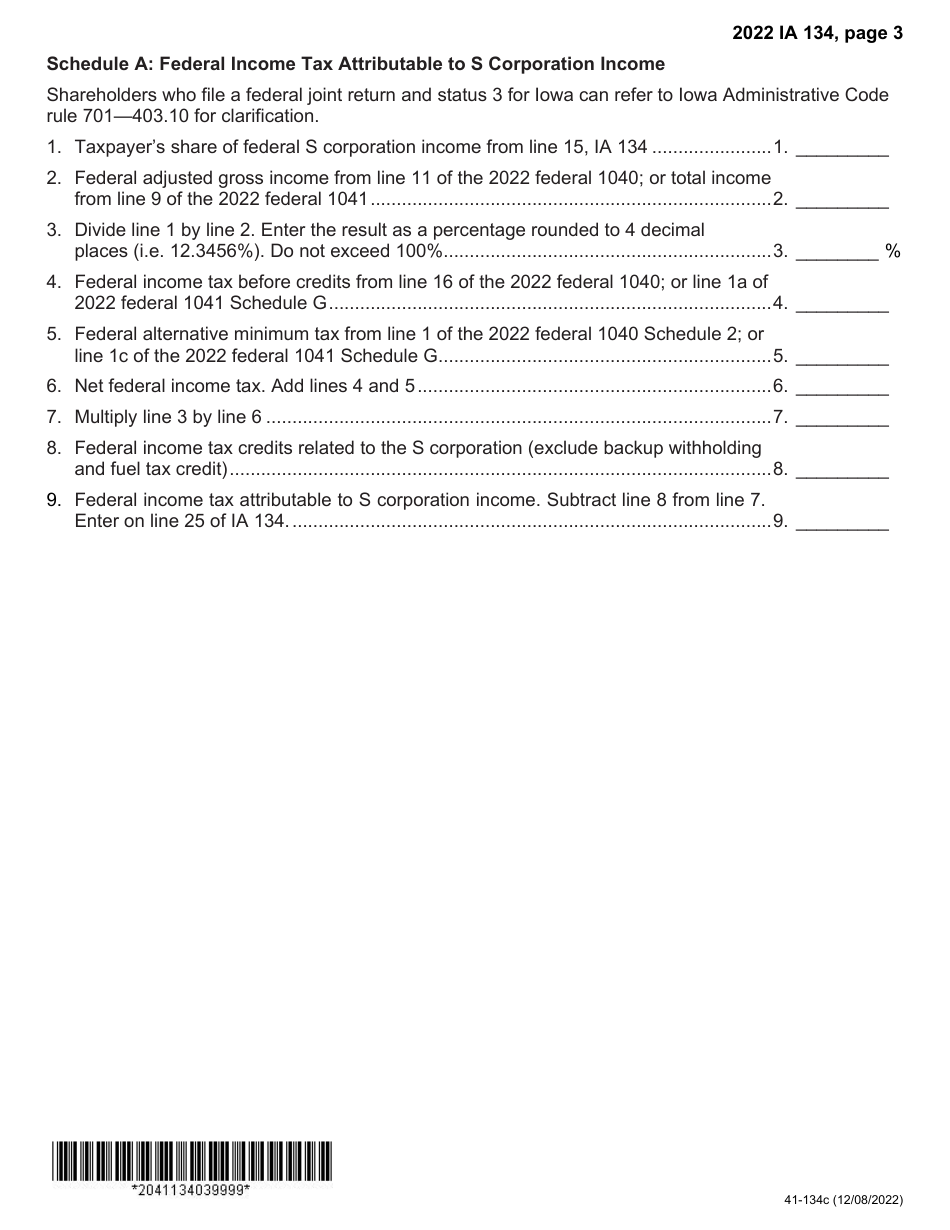

Form IA134 (41-134) S Corporation Apportionment Tax Credit - Iowa

What Is Form IA134 (41-134)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA134?

A: Form IA134 is a tax form used by S Corporations to claim the Apportionment Tax Credit in Iowa.

Q: What is the Apportionment Tax Credit?

A: The Apportionment Tax Credit is a tax credit available to S Corporations in Iowa for income attributable to activities outside of the state.

Q: Who can use Form IA134?

A: Form IA134 is specifically designed for S Corporations operating in Iowa.

Q: What is the purpose of Form IA134?

A: The purpose of Form IA134 is to allow S Corporations to claim the Apportionment Tax Credit in Iowa.

Q: When is the deadline to file Form IA134?

A: The deadline to file Form IA134 is typically the same as the deadline to file the S Corporation's Iowa income tax return.

Form Details:

- Released on August 31, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA134 (41-134) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.