This version of the form is not currently in use and is provided for reference only. Download this version of

Form IA128 (41-128)

for the current year.

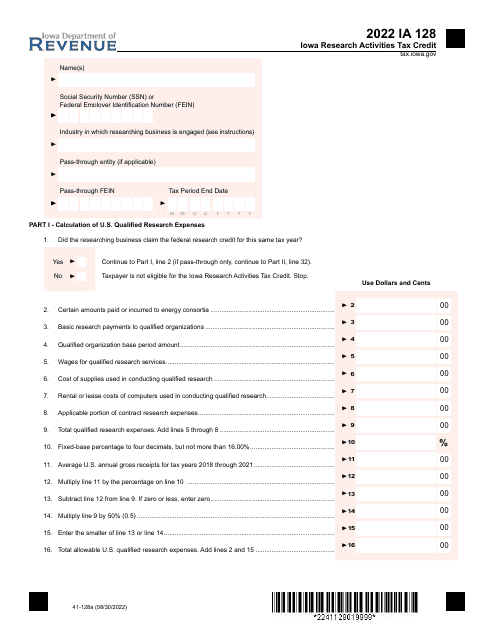

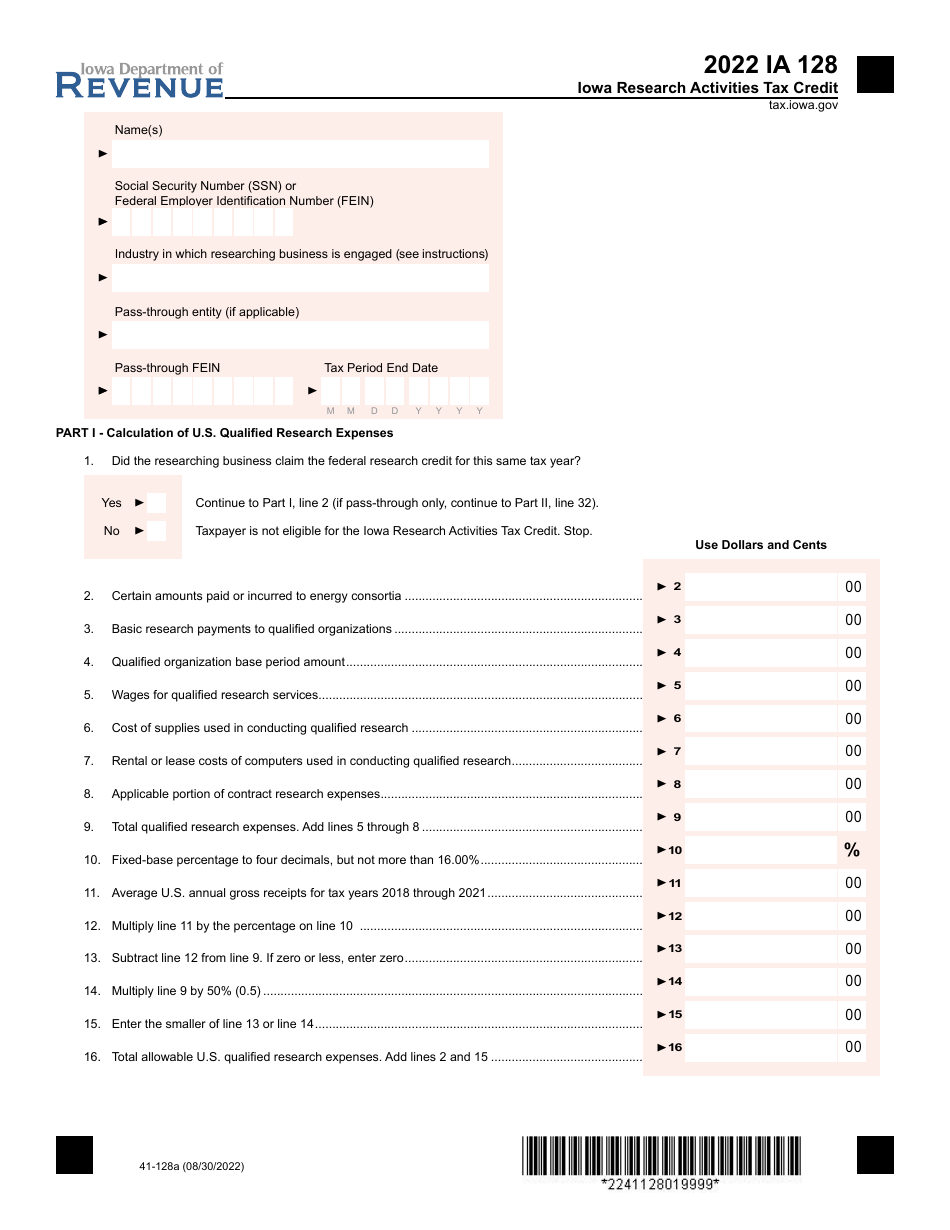

Form IA128 (41-128) Iowa Research Activities Tax Credit - Iowa

What Is Form IA128 (41-128)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA128?

A: Form IA128 is the Iowa Research Activities Tax Credit form.

Q: What is the purpose of Form IA128?

A: The purpose of Form IA128 is to claim the Iowa Research Activities Tax Credit.

Q: What is the Iowa Research Activities Tax Credit?

A: The Iowa Research Activities Tax Credit is a tax credit designed to incentivize research and development activities in Iowa.

Q: Who can claim the Iowa Research Activities Tax Credit?

A: Businesses and individuals engaged in qualified research activities in Iowa may be eligible to claim the tax credit.

Q: What activities qualify for the Iowa Research Activities Tax Credit?

A: Qualified research activities include scientific testing, experimentation, and the development of new products, processes, or software.

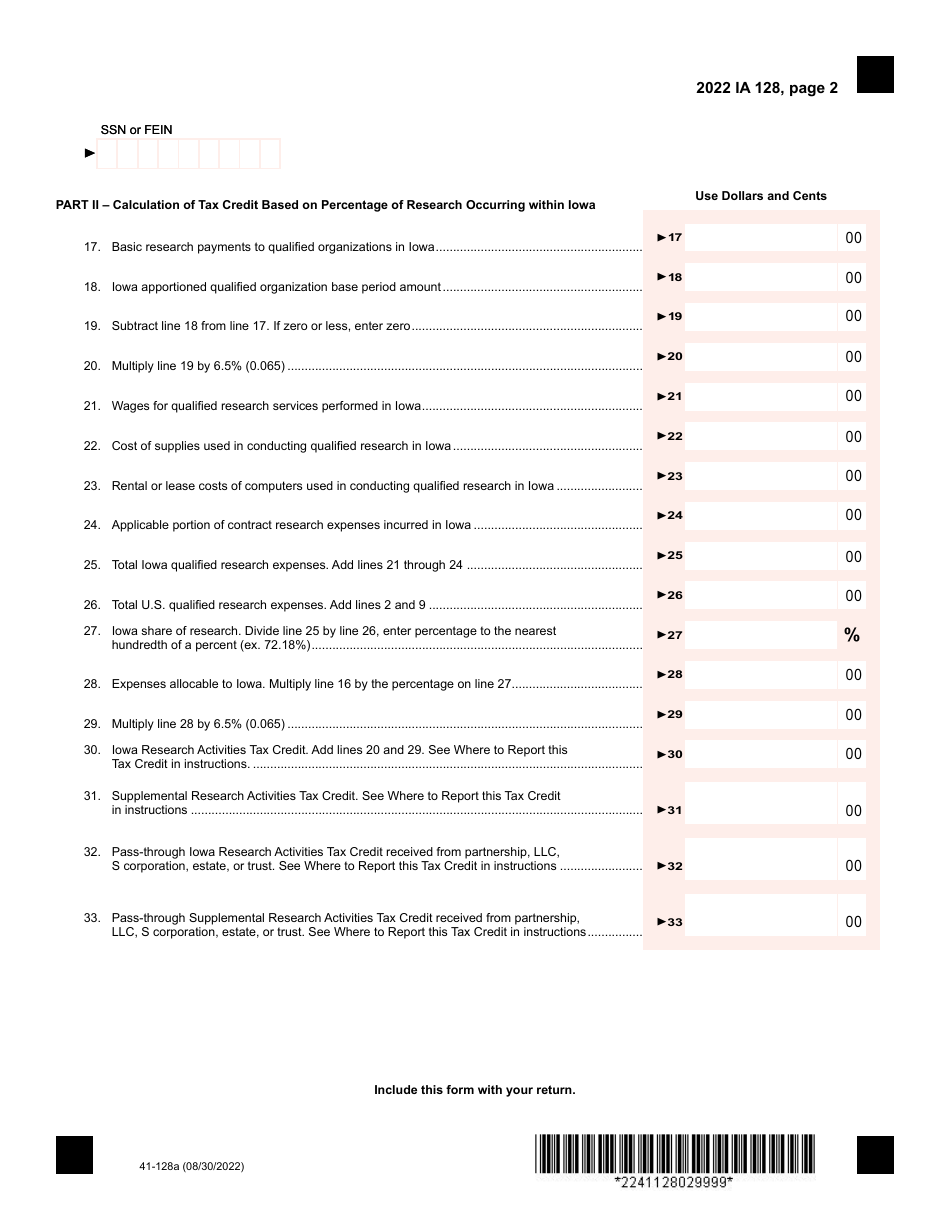

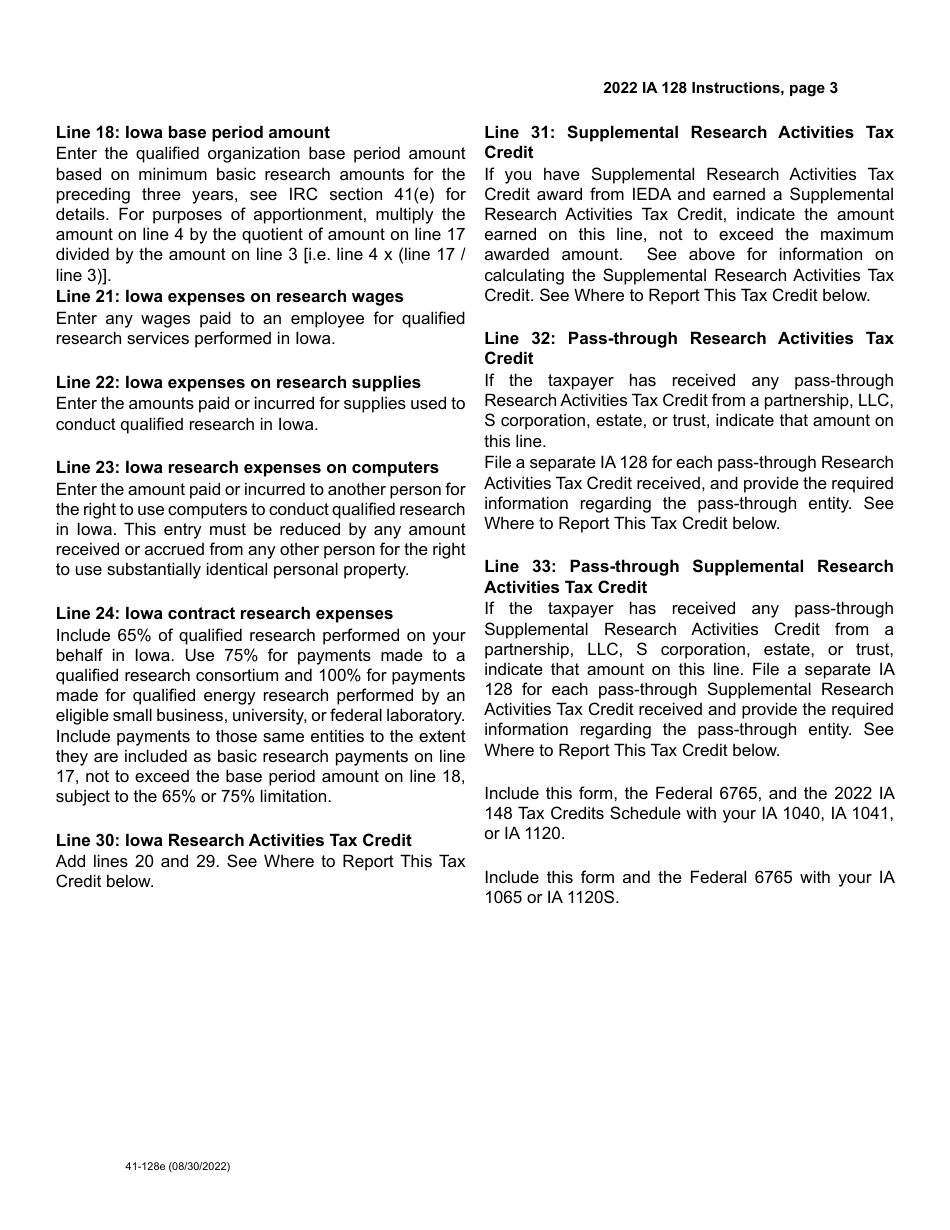

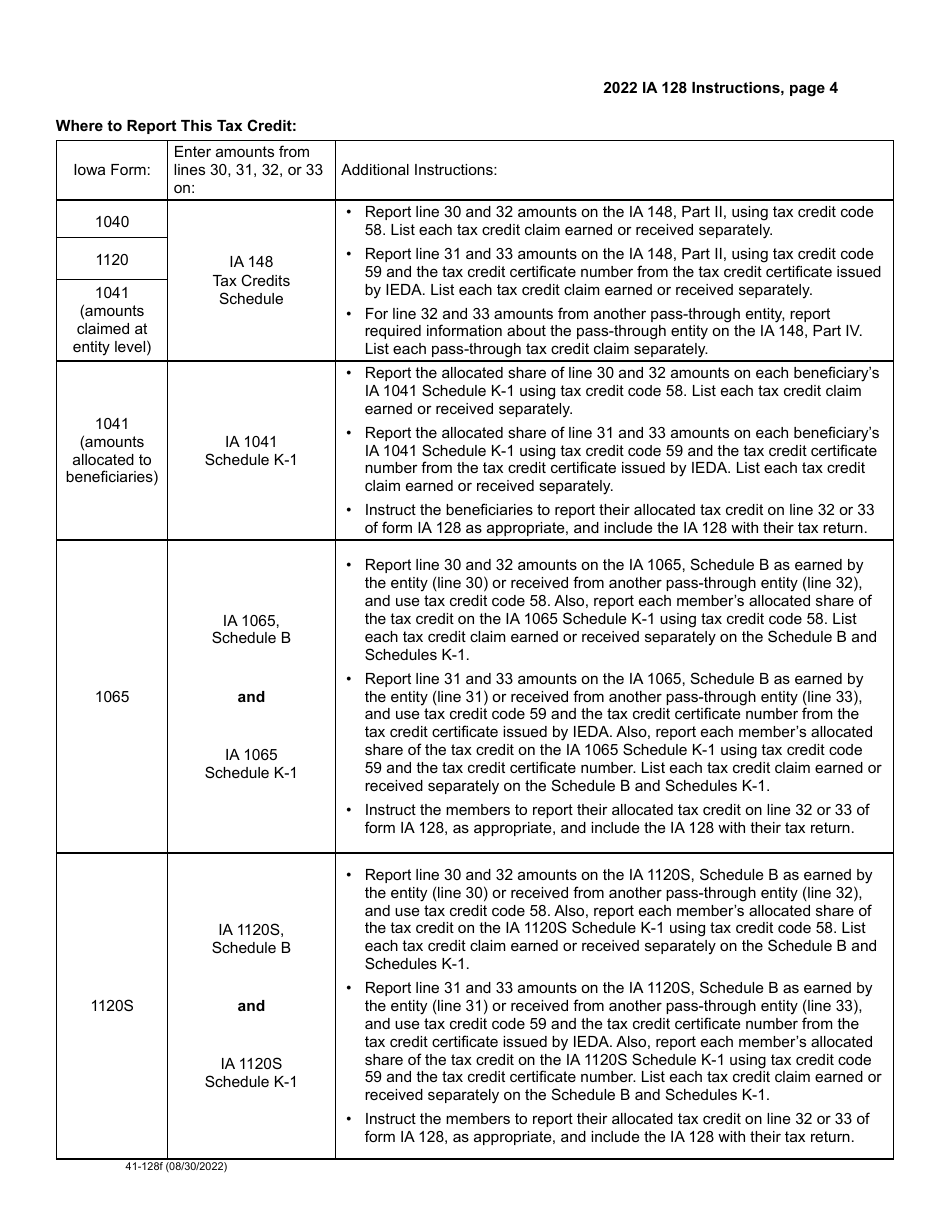

Q: How do I fill out Form IA128?

A: To fill out Form IA128, you will need to provide information about your research activities and calculate the amount of the tax credit.

Q: When is the deadline to file Form IA128?

A: The deadline to file Form IA128 is the same as the deadline for filing your Iowa income tax return, typically April 30th.

Q: Is there a fee to file Form IA128?

A: No, there is no fee to file Form IA128.

Q: Can I claim the Iowa Research Activities Tax Credit if I am not a resident of Iowa?

A: Yes, non-residents of Iowa may be eligible to claim the tax credit if they have qualifying research activities in the state.

Form Details:

- Released on December 8, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA128 (41-128) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.