This version of the form is not currently in use and is provided for reference only. Download this version of

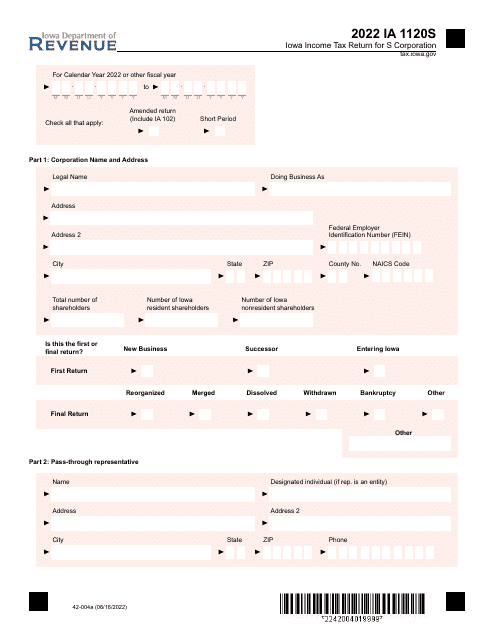

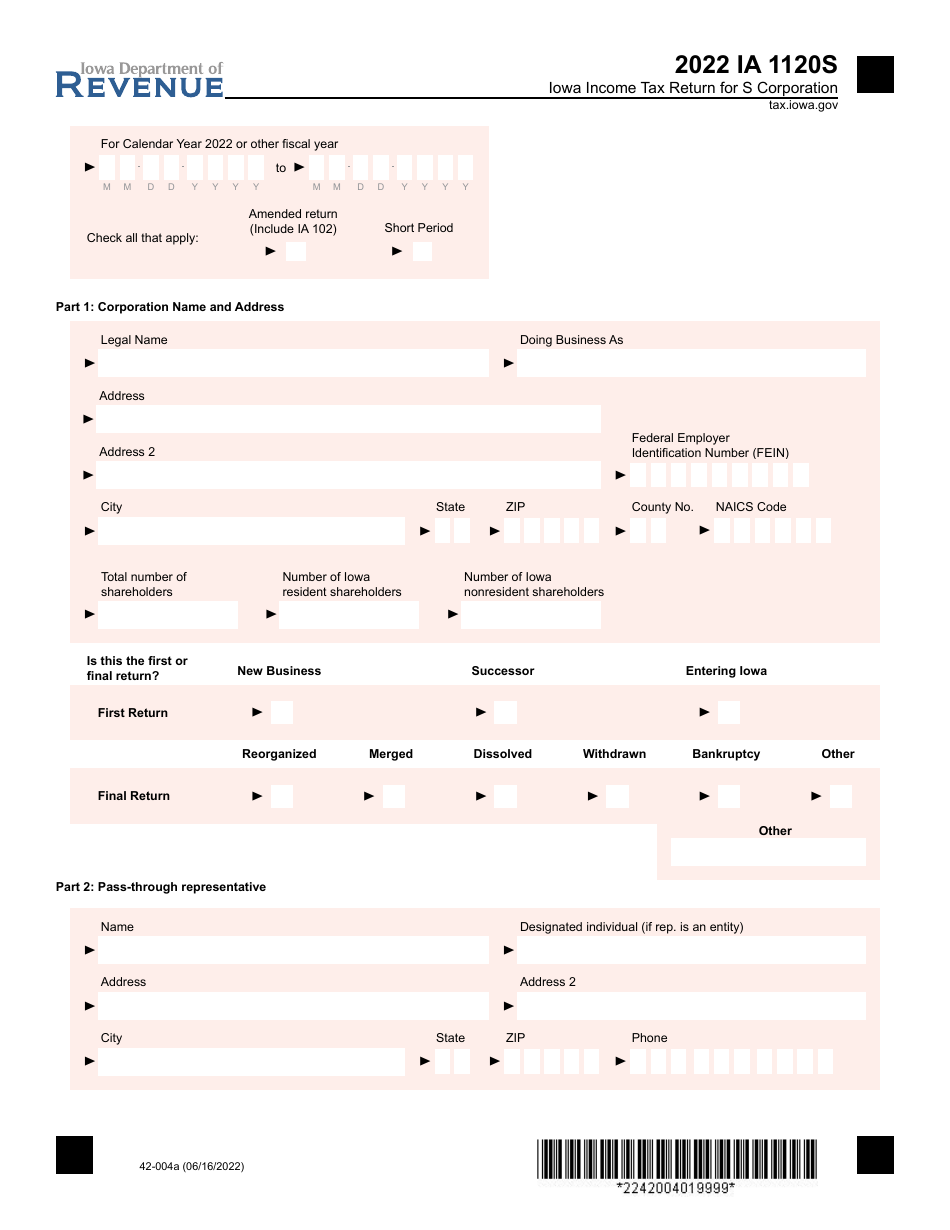

Form IA1120S (42-004)

for the current year.

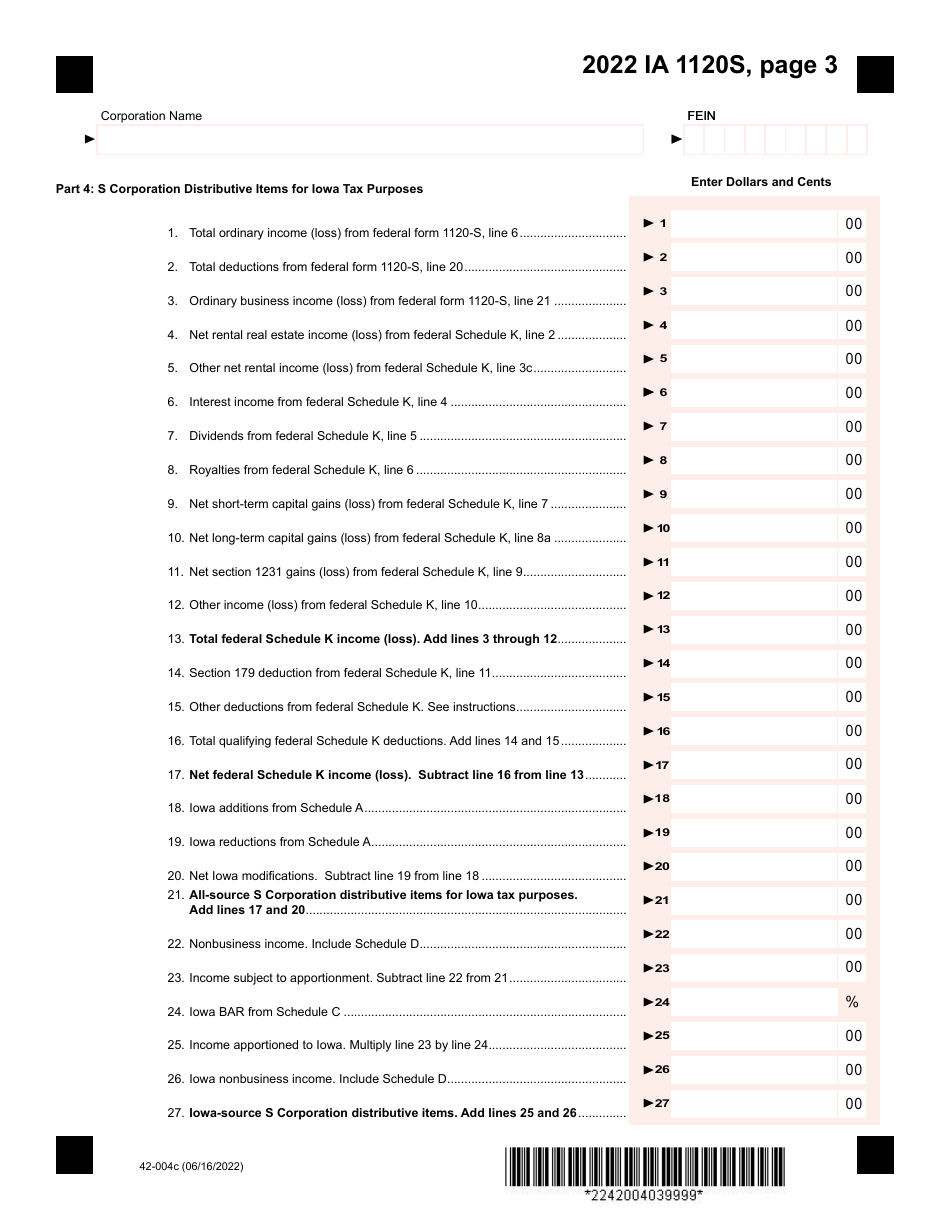

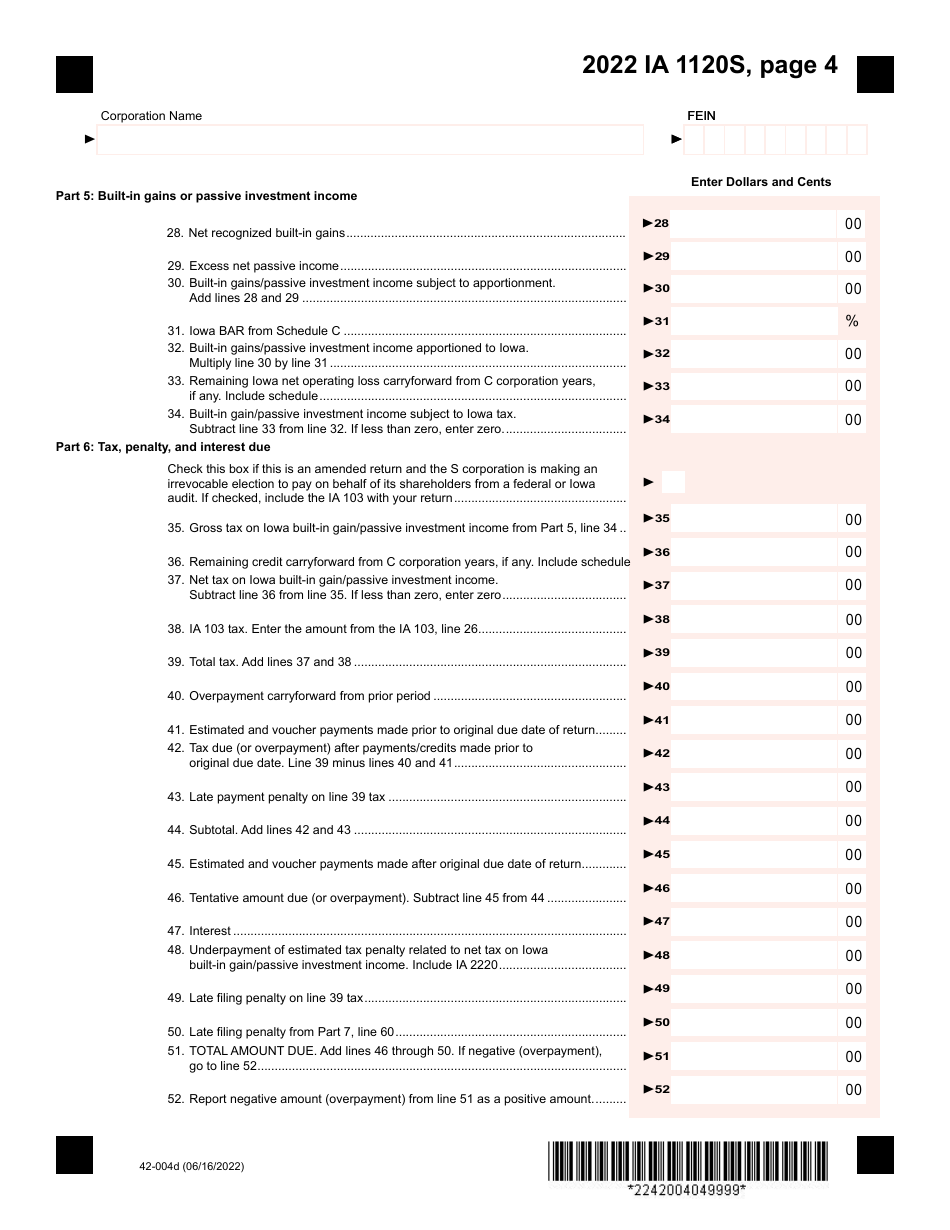

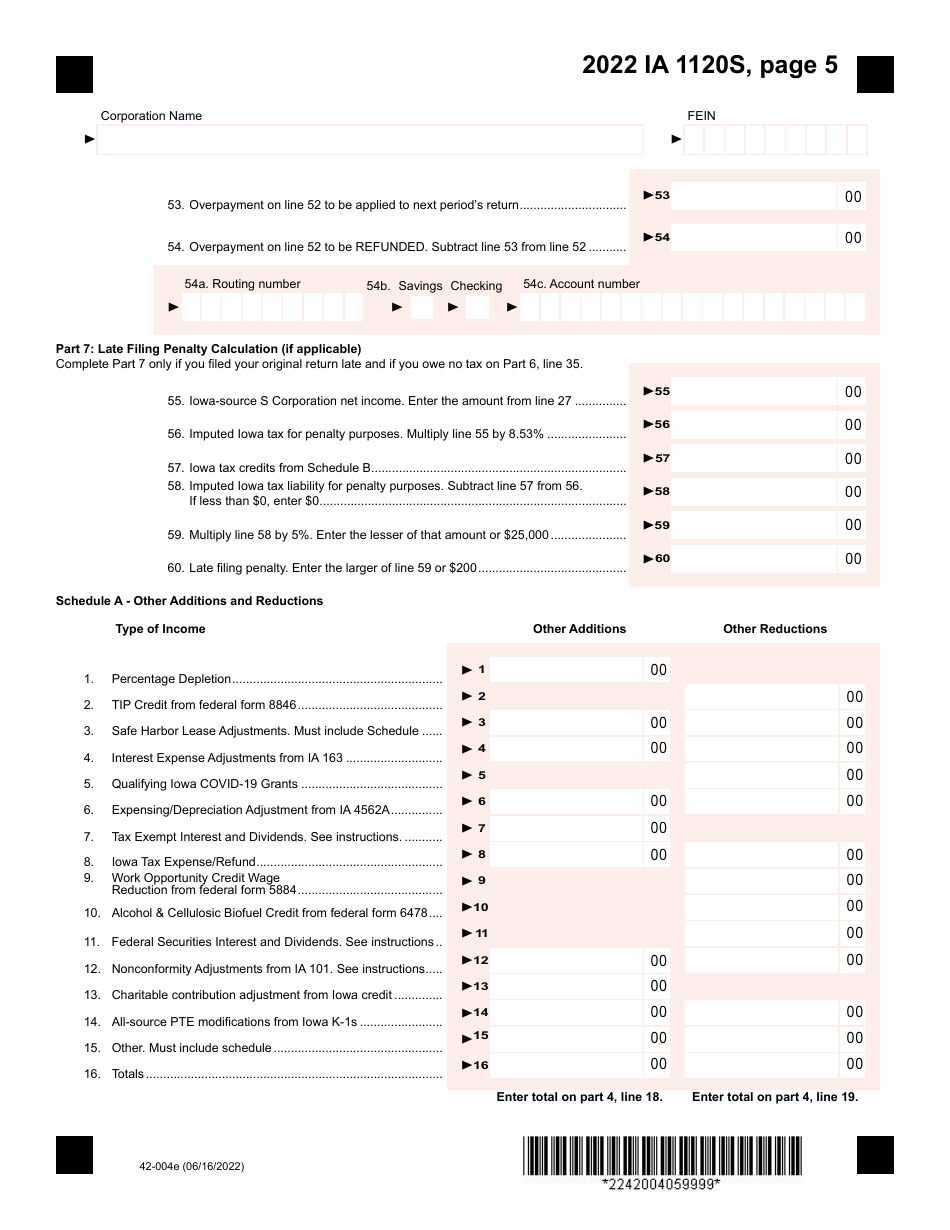

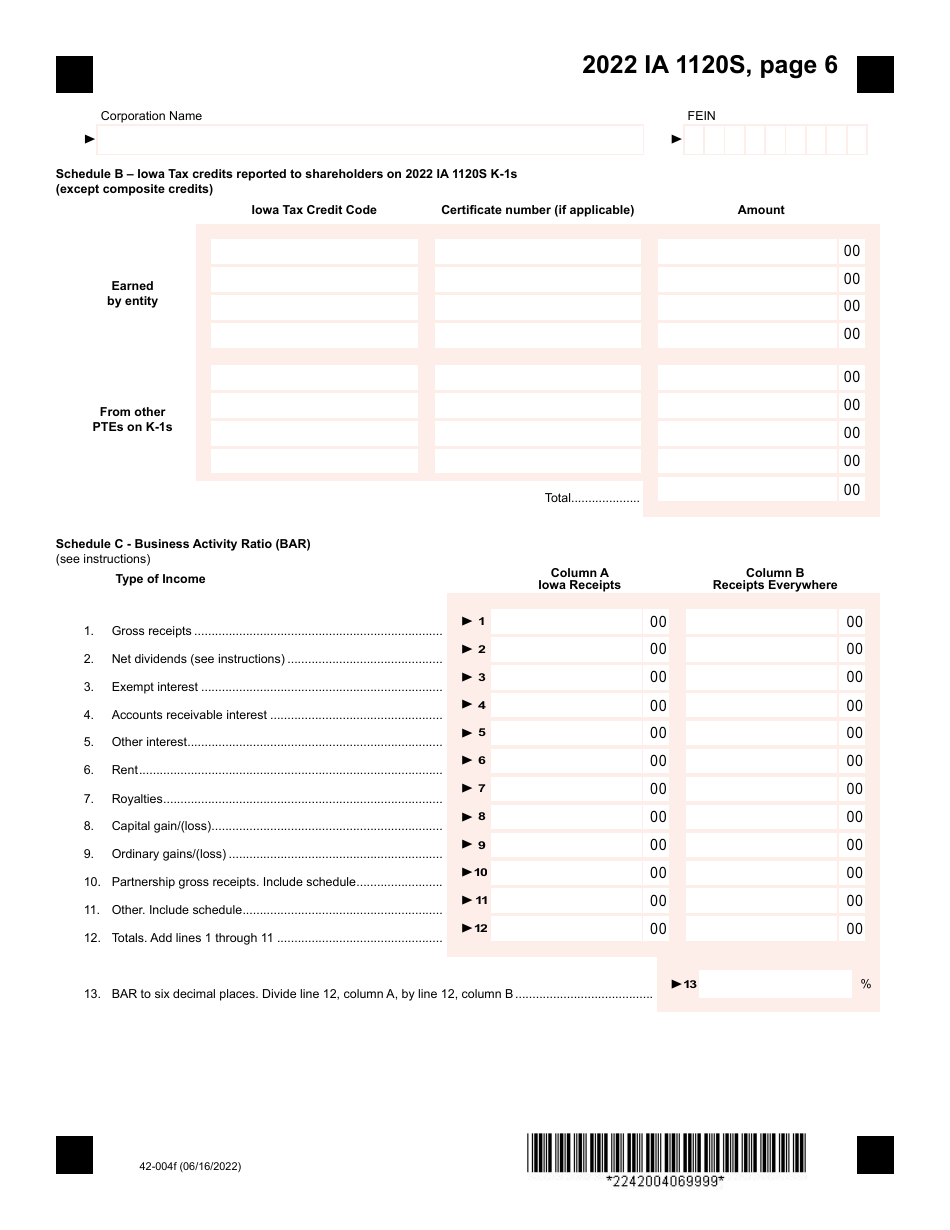

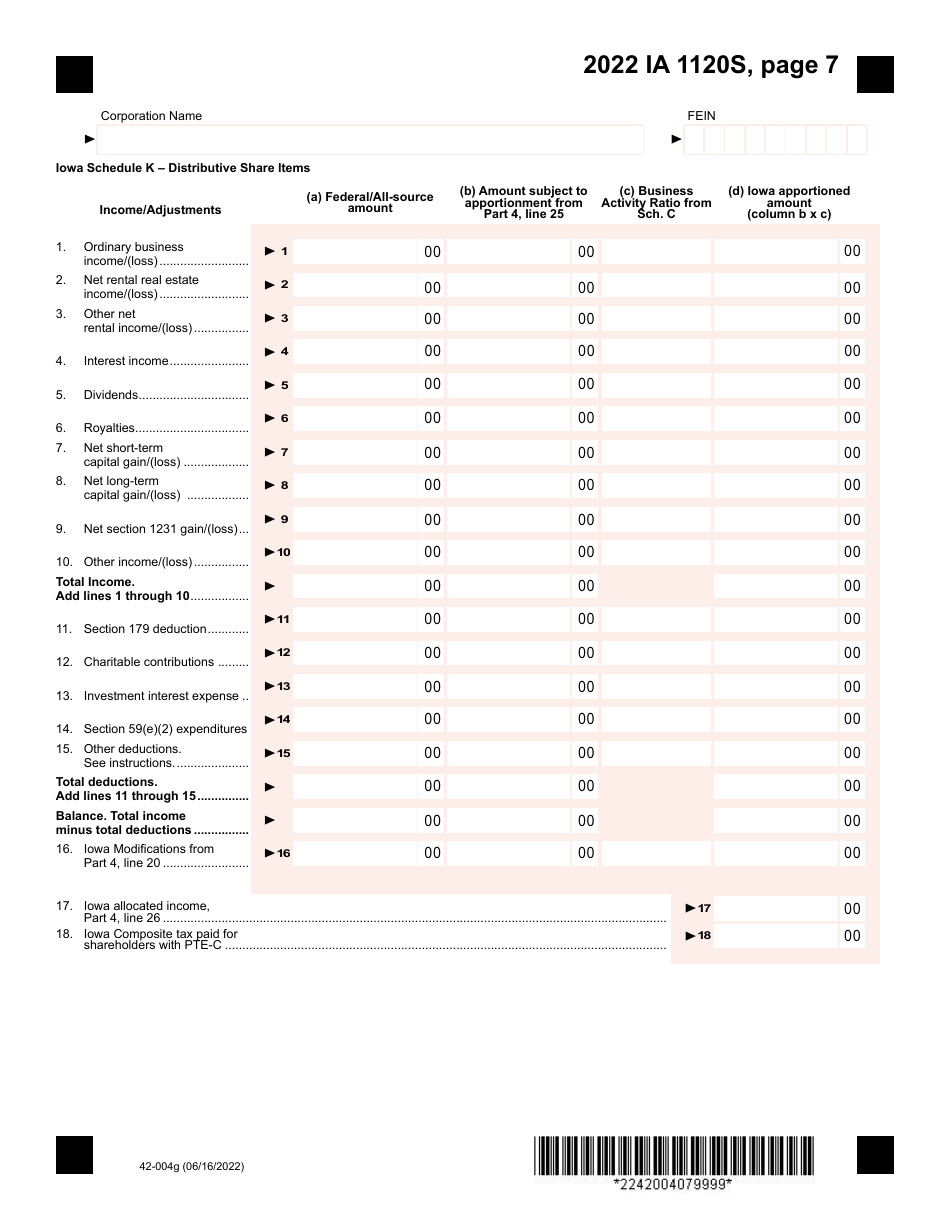

Form IA1120S (42-004) Iowa Income Tax Return for S Corporation - Iowa

What Is Form IA1120S (42-004)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA1120S?

A: Form IA1120S is the Iowa Income Tax Return specifically for S Corporations in Iowa.

Q: What is an S Corporation?

A: An S Corporation is a type of corporation that has elected to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes.

Q: Who needs to file Form IA1120S?

A: S Corporations operating in Iowa need to file Form IA1120S as their income tax return.

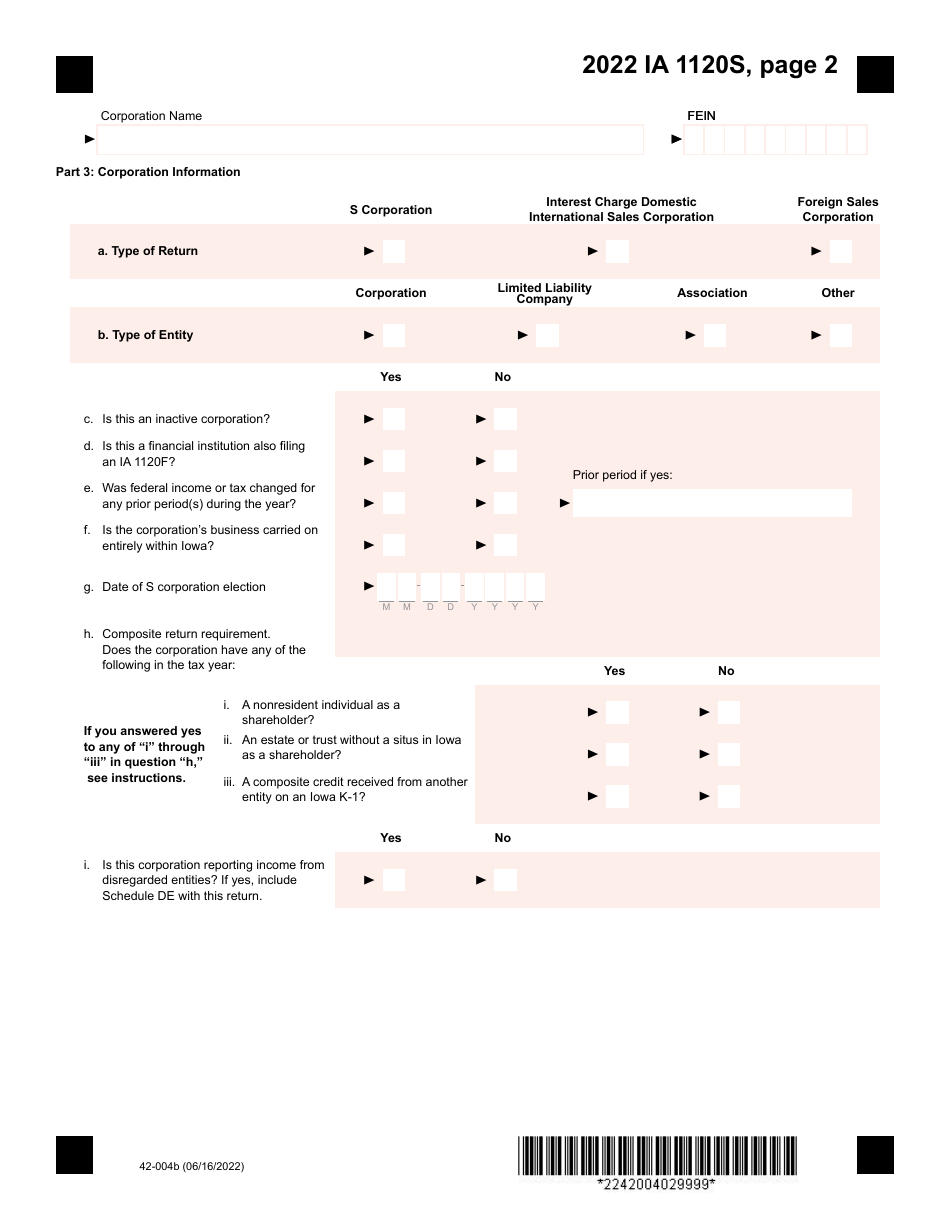

Q: What information is required on Form IA1120S?

A: Form IA1120S requires information about the S Corporation's income, deductions, credits, and other details relevant to its Iowa tax liability.

Q: When is Form IA1120S due?

A: Form IA1120S is due on the 15th day of the third month following the end of the S Corporation's tax year.

Q: Are there any additional forms or schedules that need to be filed along with Form IA1120S?

A: Yes, the S Corporation may be required to file certain schedules and attachments depending on its specific circumstances. These may include Schedule K-1, Schedule E, and others.

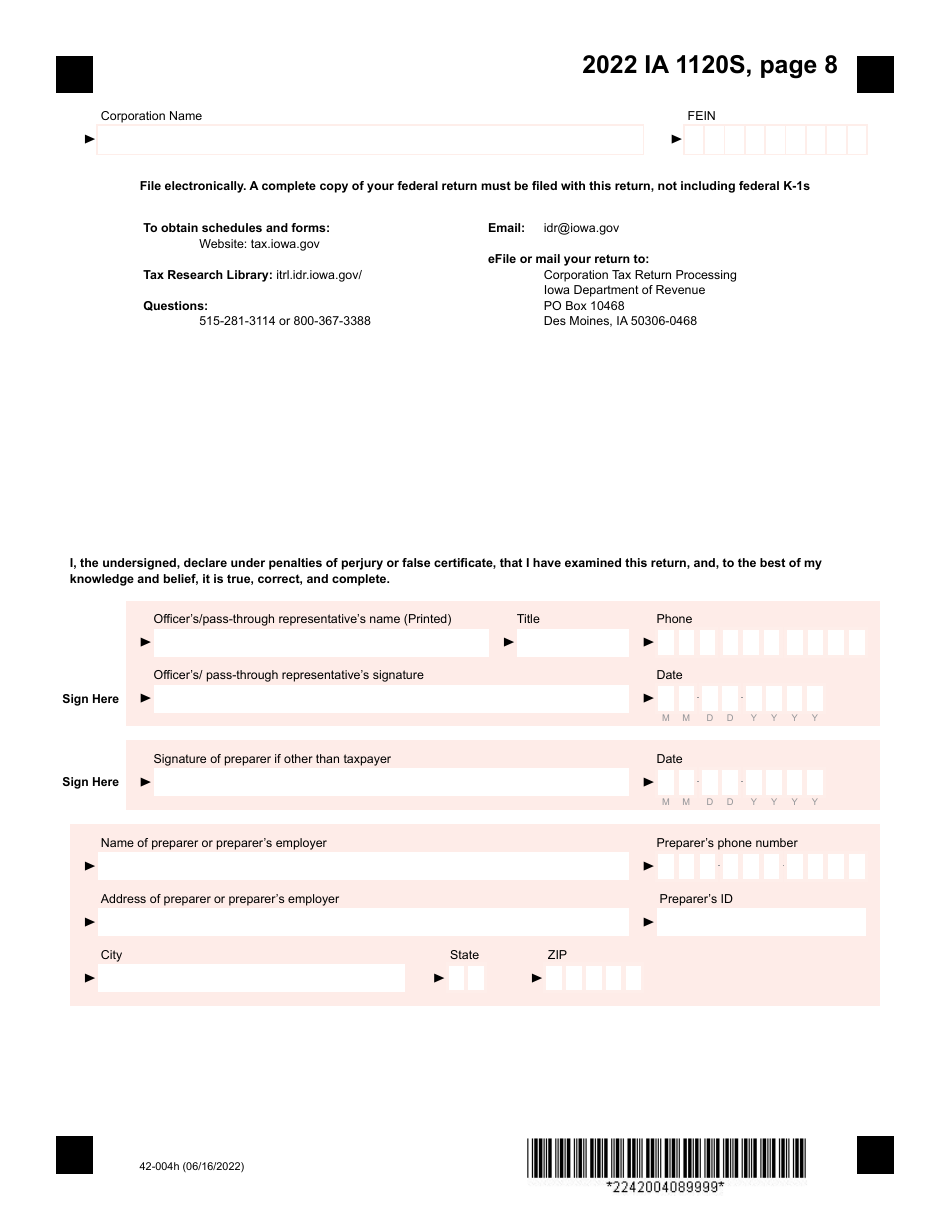

Q: Can Form IA1120S be filed electronically?

A: Yes, Iowa allows electronic filing of Form IA1120S.

Q: Is there a fee for filing Form IA1120S?

A: No, there is no fee for filing Form IA1120S.

Form Details:

- Released on June 16, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA1120S (42-004) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.