This version of the form is not currently in use and is provided for reference only. Download this version of

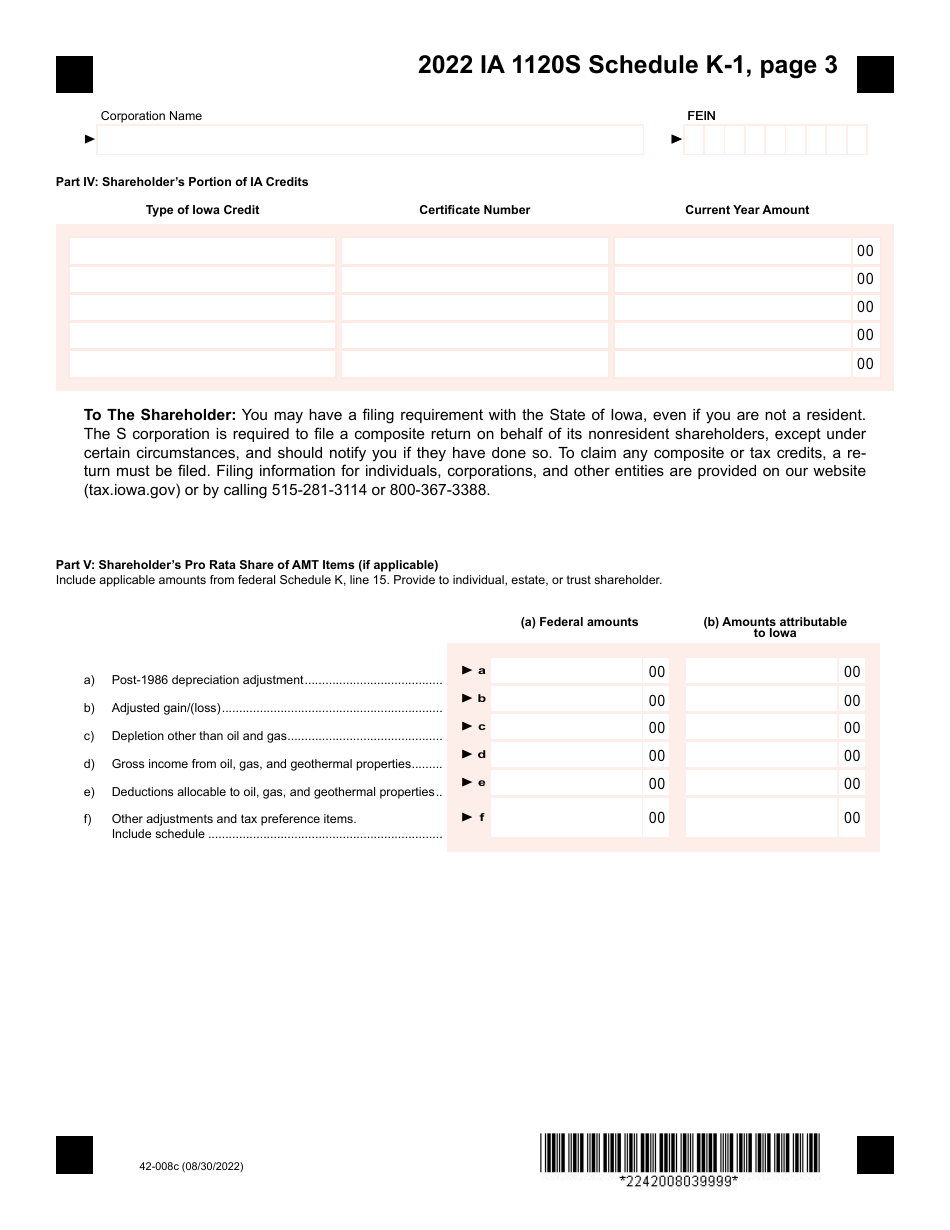

Form IA1120S (42-008) Schedule K-1

for the current year.

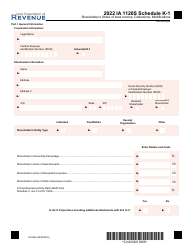

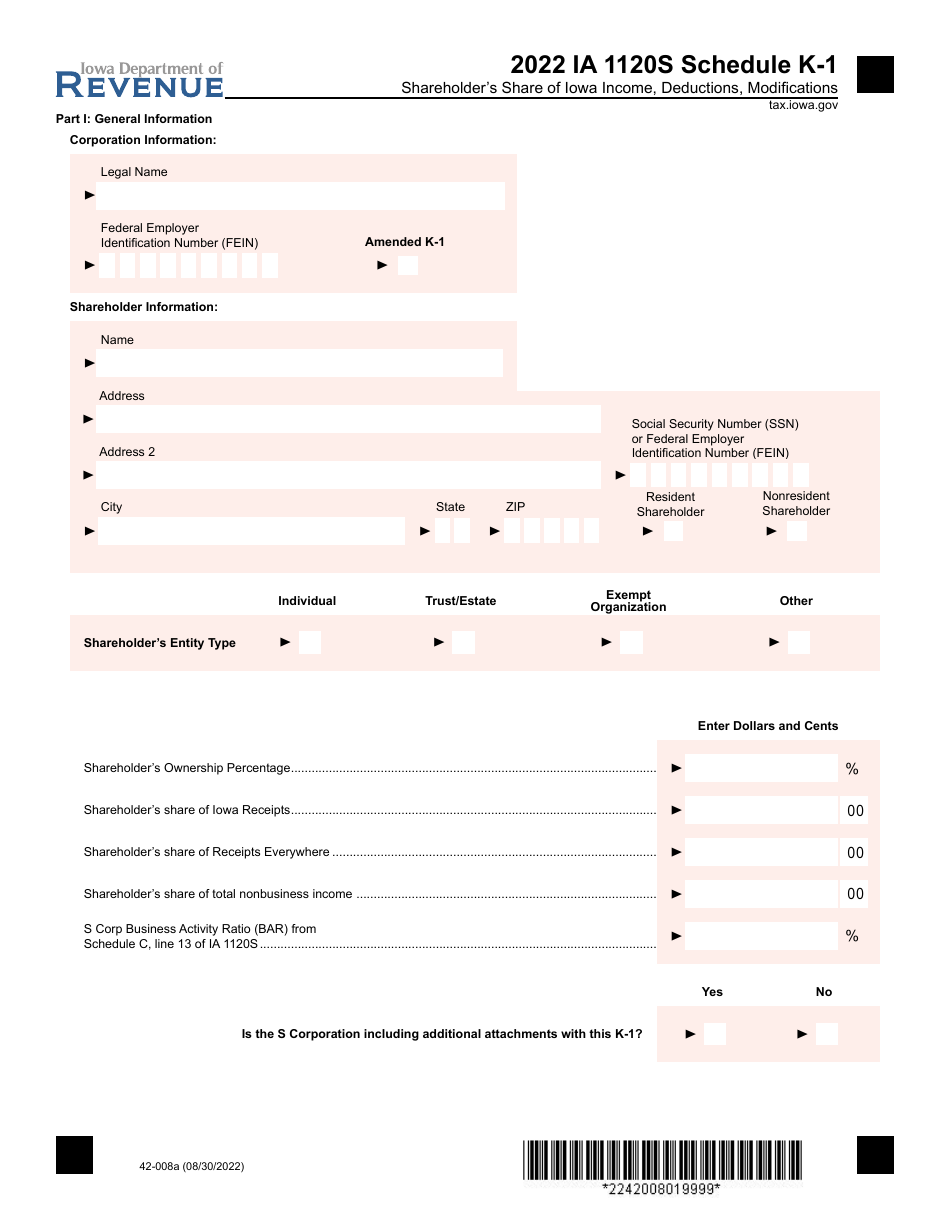

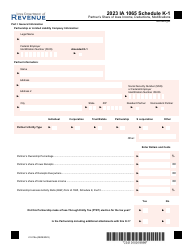

Form IA1120S (42-008) Schedule K-1 Shareholder's Share of Iowa Income, Deductions, Modifications - Iowa

What Is Form IA1120S (42-008) Schedule K-1?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa.The document is a supplement to Form IA1120S, Iowa Income Tax Return for S Corporation. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA1120S?

A: Form IA1120S is a form used by shareholders of an S corporation in Iowa to report their share of income, deductions, and modifications.

Q: What is Schedule K-1?

A: Schedule K-1 is a schedule attached to Form IA1120S that shows a shareholder's share of the S corporation's income, deductions, and modifications.

Q: Who needs to file Form IA1120S?

A: Shareholders of an S corporation in Iowa need to file Form IA1120S and Schedule K-1 to report their share of the S corporation's income.

Q: What information is reported on Form IA1120S?

A: Form IA1120S reports the shareholder's share of the S corporation's income, deductions, and modifications for the tax year.

Form Details:

- Released on August 30, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA1120S (42-008) Schedule K-1 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.