This version of the form is not currently in use and is provided for reference only. Download this version of

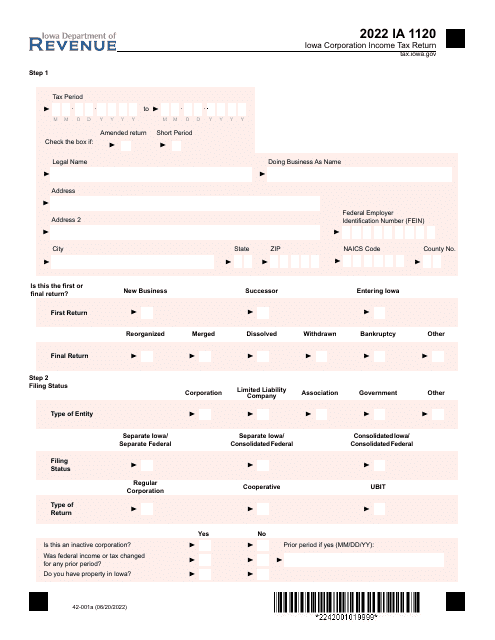

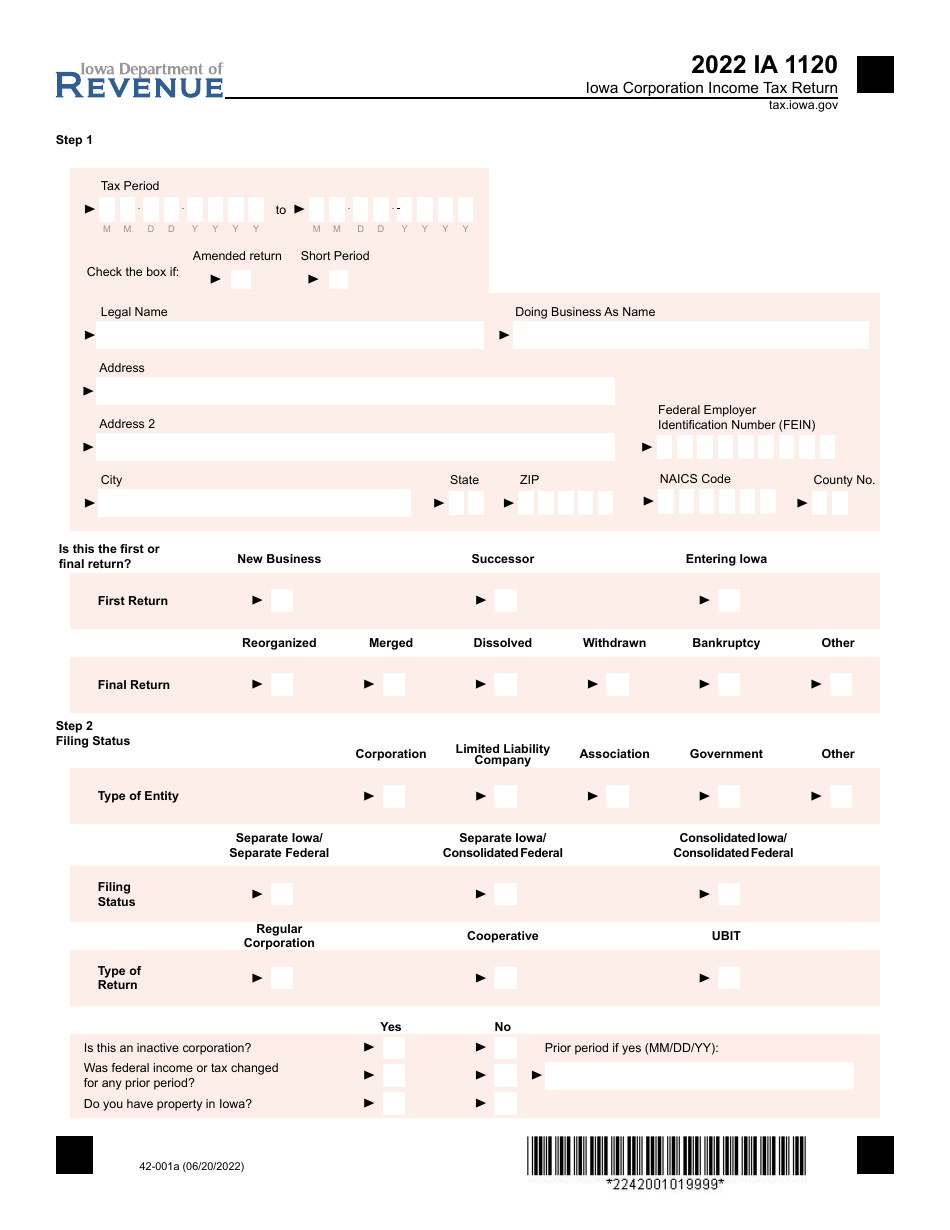

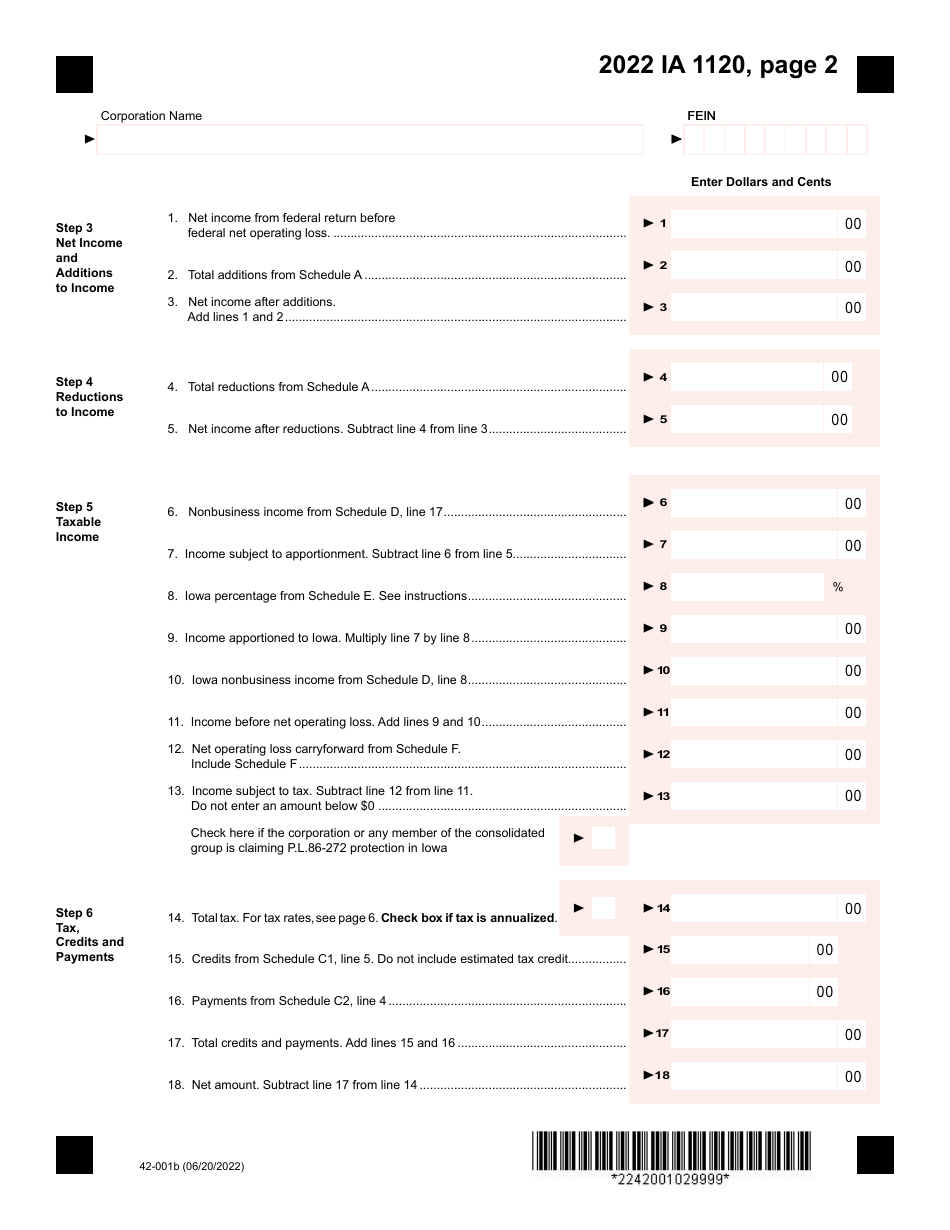

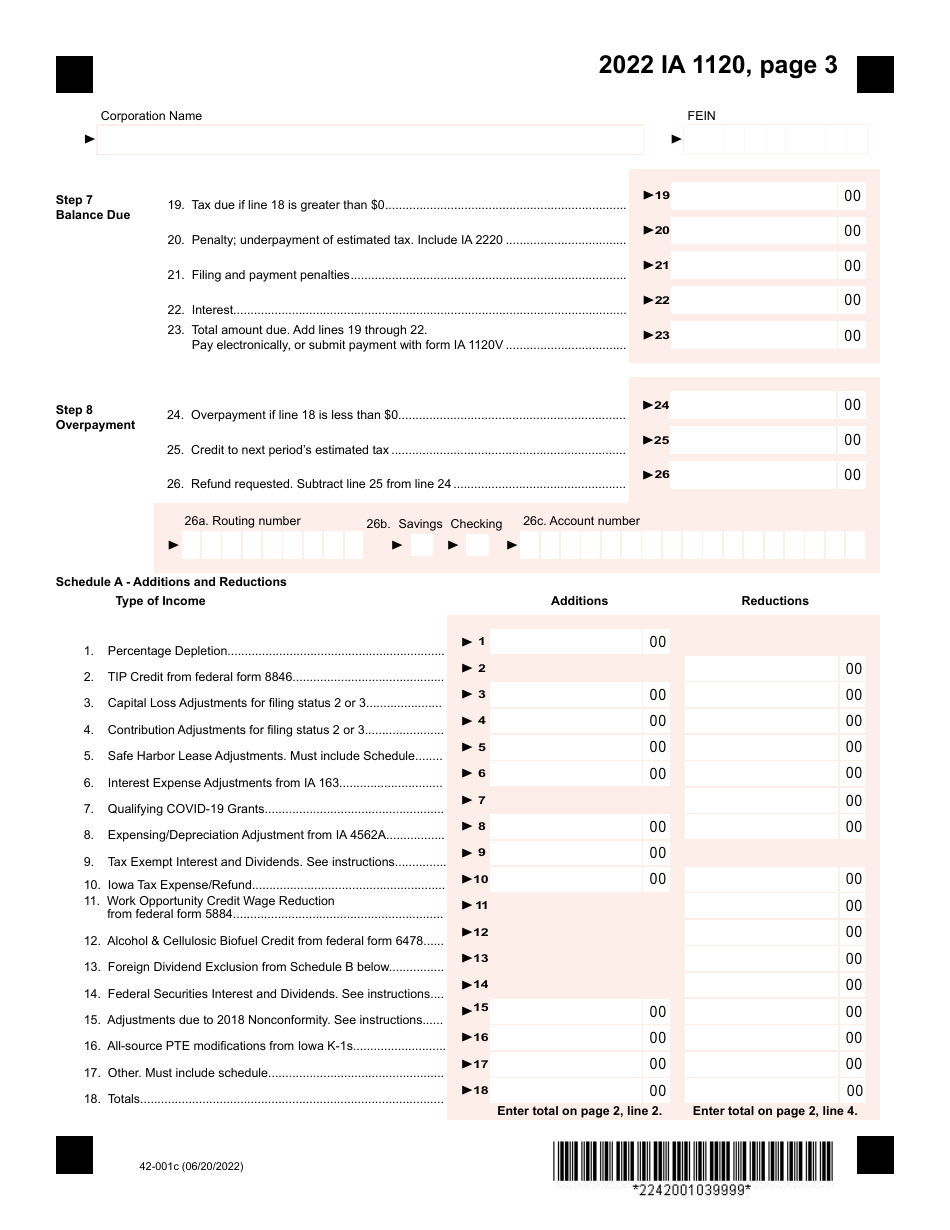

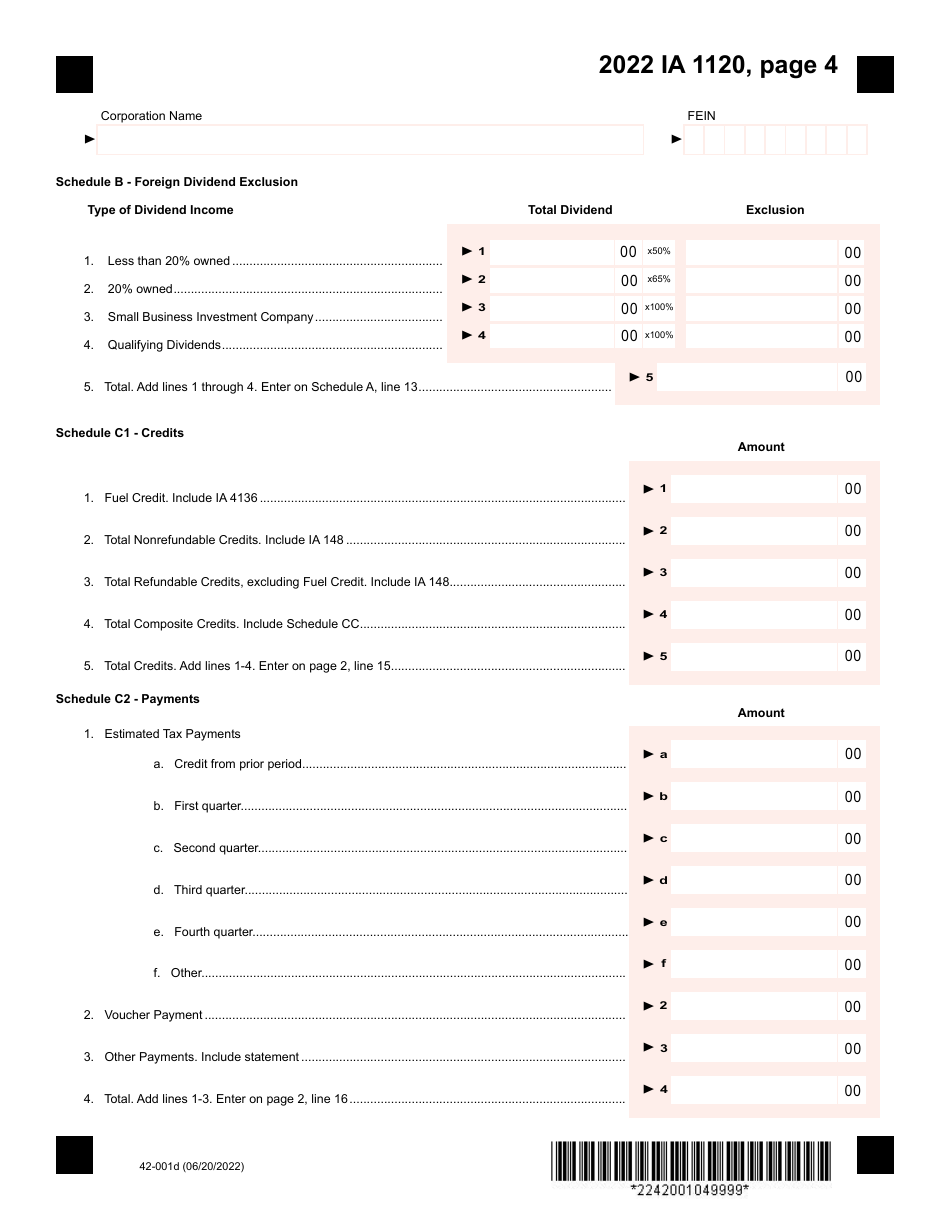

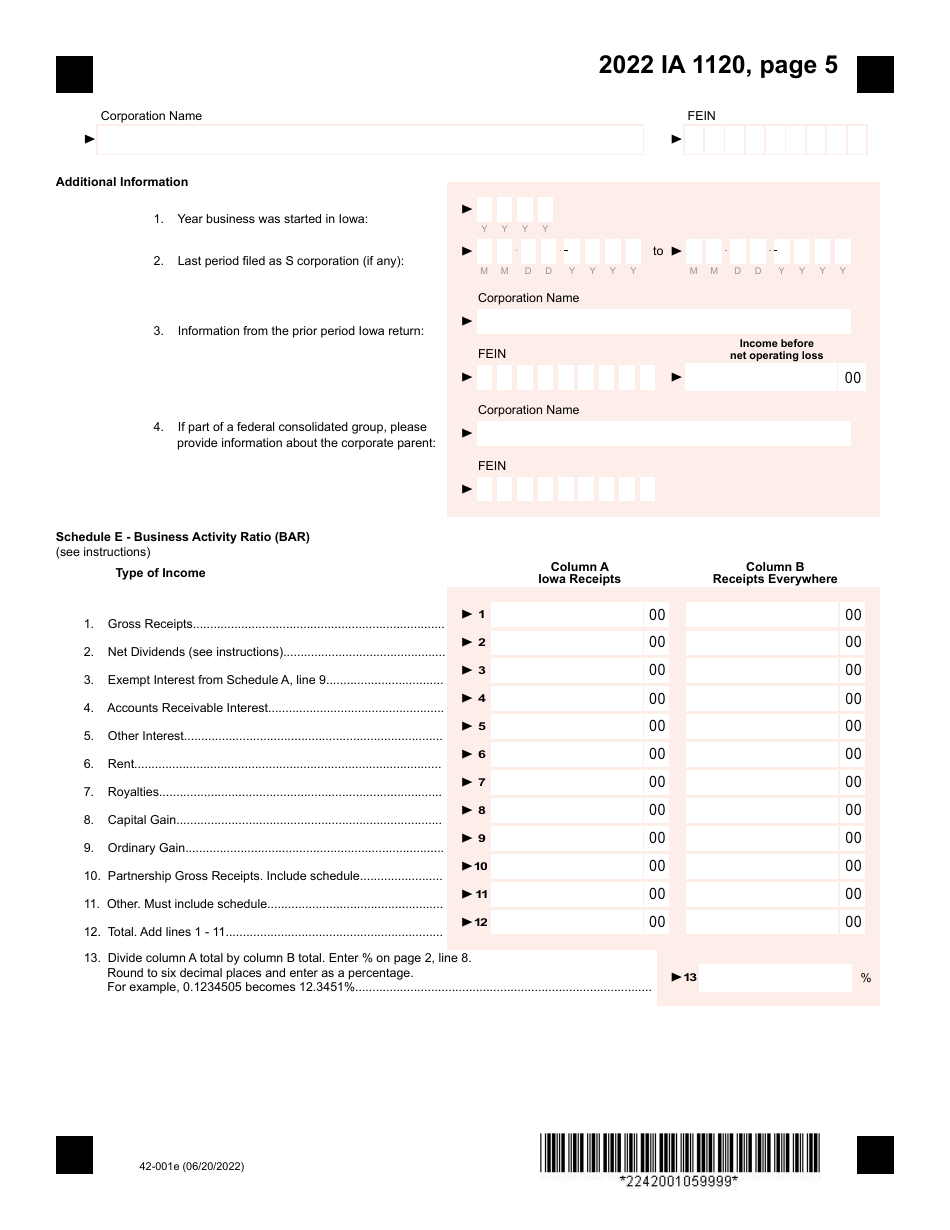

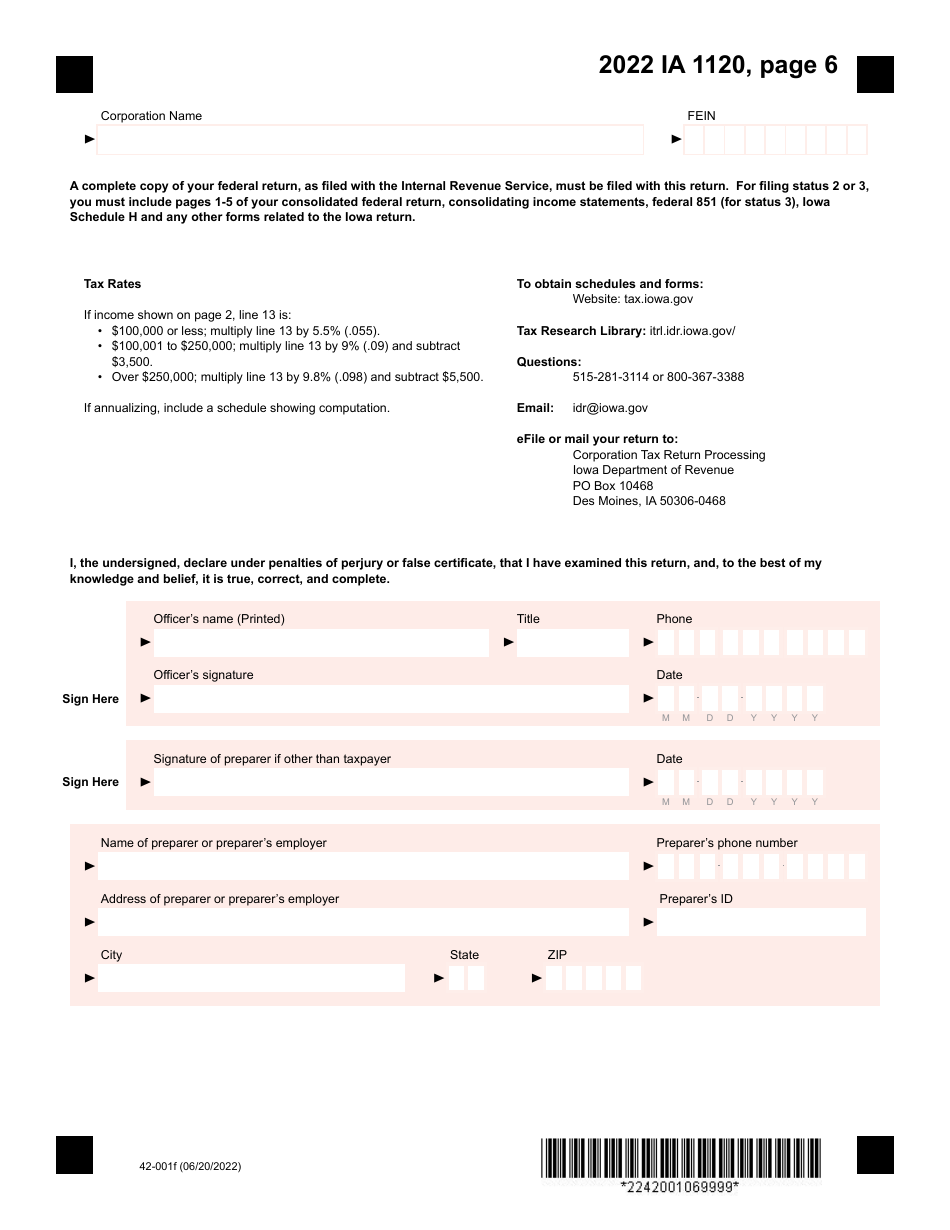

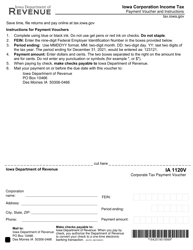

Form IA1120 (42-001)

for the current year.

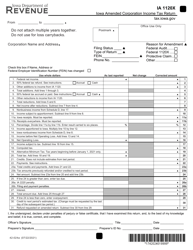

Form IA1120 (42-001) Iowa Corporation Income Tax Return - Iowa

What Is Form IA1120 (42-001)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IA1120?

A: Form IA1120 is the Iowa Corporation Income Tax Return for Iowa.

Q: Who should file Form IA1120?

A: Iowa corporations should file Form IA1120.

Q: What is the purpose of Form IA1120?

A: Form IA1120 is used to report Iowa corporation income tax.

Q: Are all Iowa corporations required to file Form IA1120?

A: Yes, all Iowa corporations are required to file Form IA1120, unless they are exempt.

Q: What information do I need to complete Form IA1120?

A: You will need information about your business activities, income, deductions, and credits.

Q: When is the deadline to file Form IA1120?

A: The deadline to file Form IA1120 is on or before the 15th day of the fourth month following the close of the corporation's taxable year.

Q: Can I file Form IA1120 electronically?

A: Yes, you can file Form IA1120 electronically using the Iowa eFile system.

Q: What should I do if I can't file Form IA1120 by the deadline?

A: If you can't file Form IA1120 by the deadline, you should request an extension using Form IA1120X.

Form Details:

- Released on June 20, 2020;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA1120 (42-001) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.