This version of the form is not currently in use and is provided for reference only. Download this version of

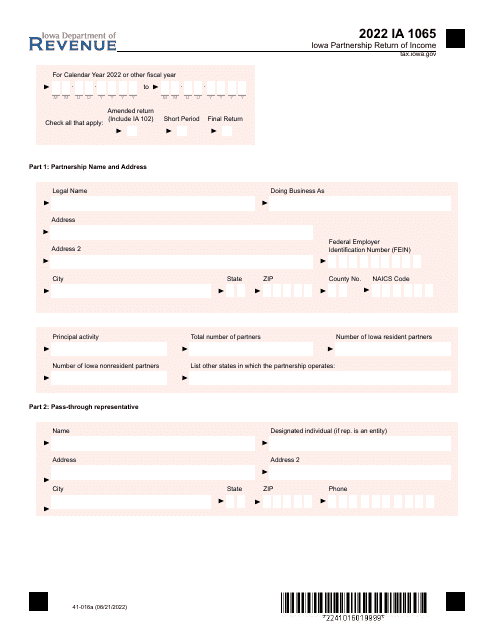

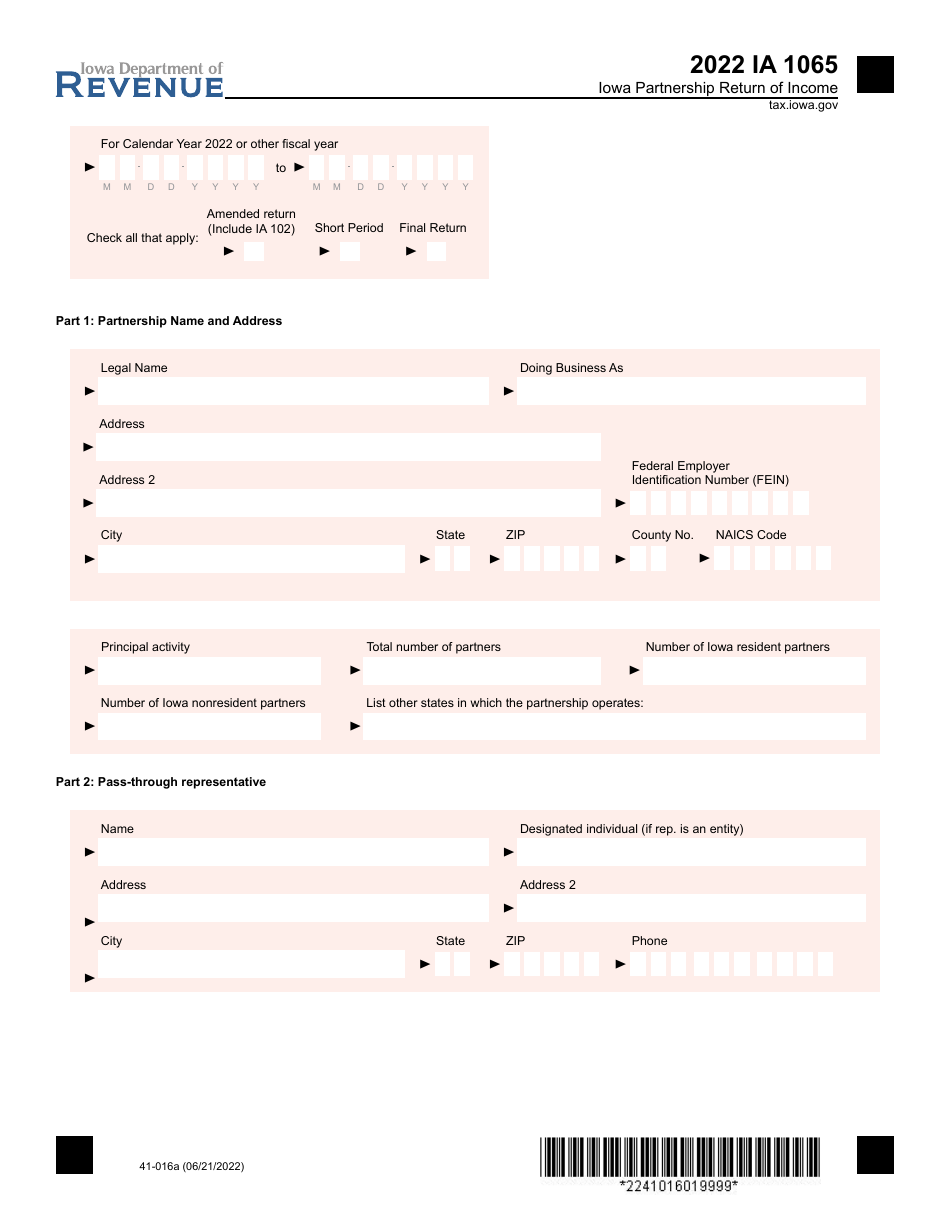

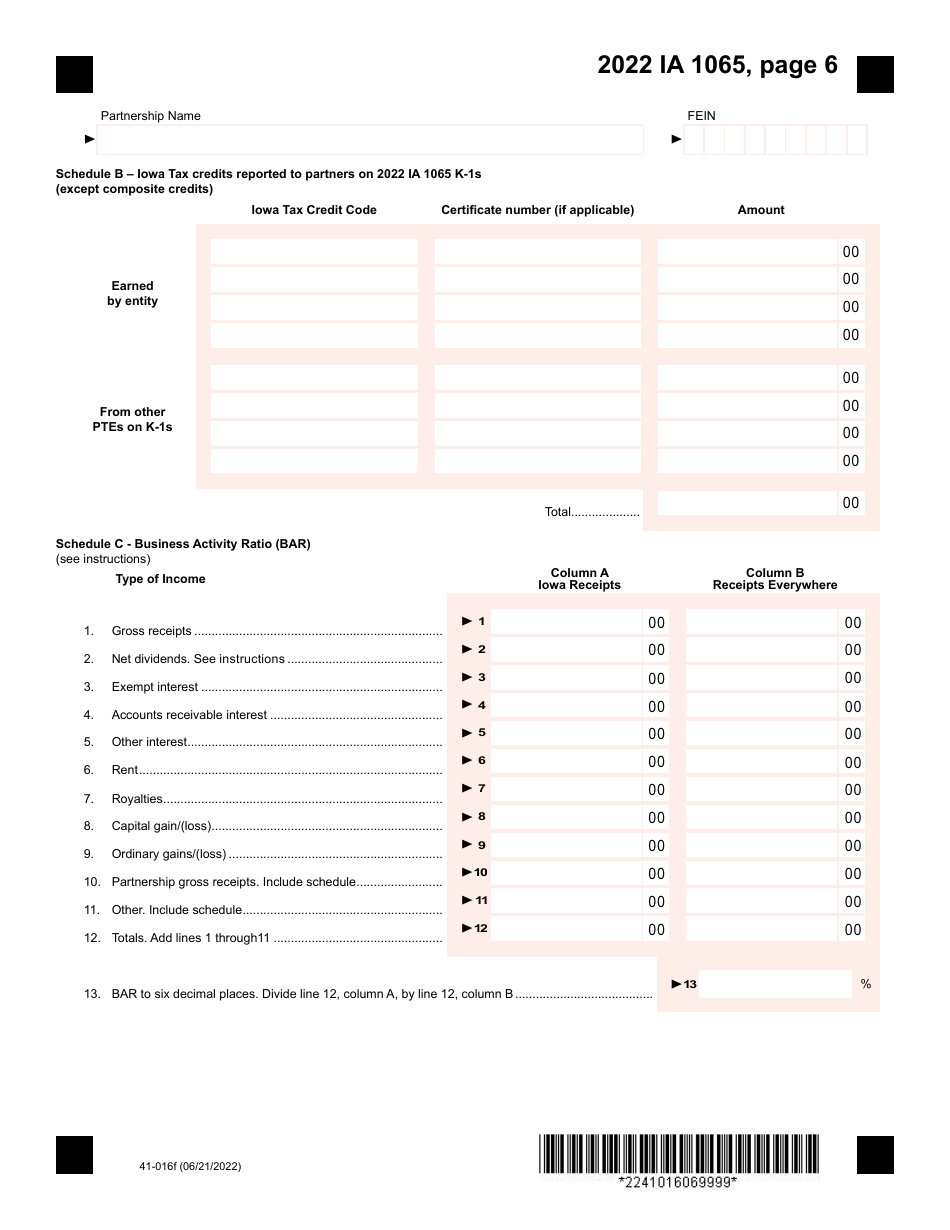

Form IA1065 (41-016)

for the current year.

Form IA1065 (41-016) Iowa Partnership Return of Income - Iowa

What Is Form IA1065 (41-016)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IA1065?

A: Form IA1065 is the Iowa Partnership Return of Income form used by partnerships in Iowa to report their income and expenses.

Q: Who needs to file Form IA1065?

A: Any partnership doing business in Iowa, regardless of whether it is based in Iowa or another state, needs to file Form IA1065.

Q: What information do I need to complete Form IA1065?

A: You will need to gather information about the partnership's income, expenses, assets, and liabilities for the tax year.

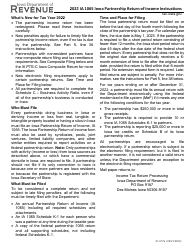

Q: When is the deadline for filing Form IA1065?

A: The deadline for filing Form IA1065 is on or before the 15th day of the fourth month following the close of the partnership's tax year.

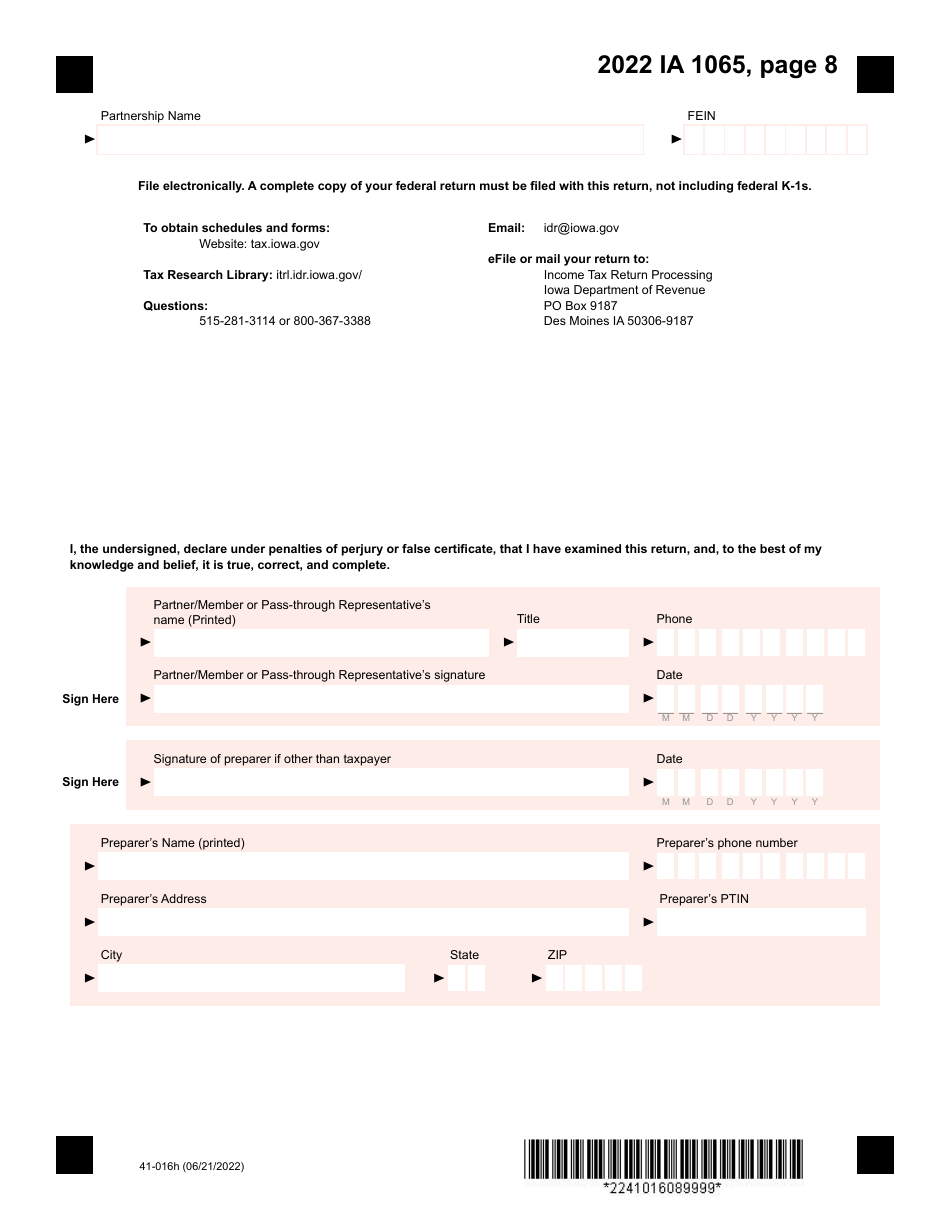

Q: Can Form IA1065 be filed electronically?

A: Yes, Iowa allows partnerships to file Form IA1065 electronically through the Iowa eFile system.

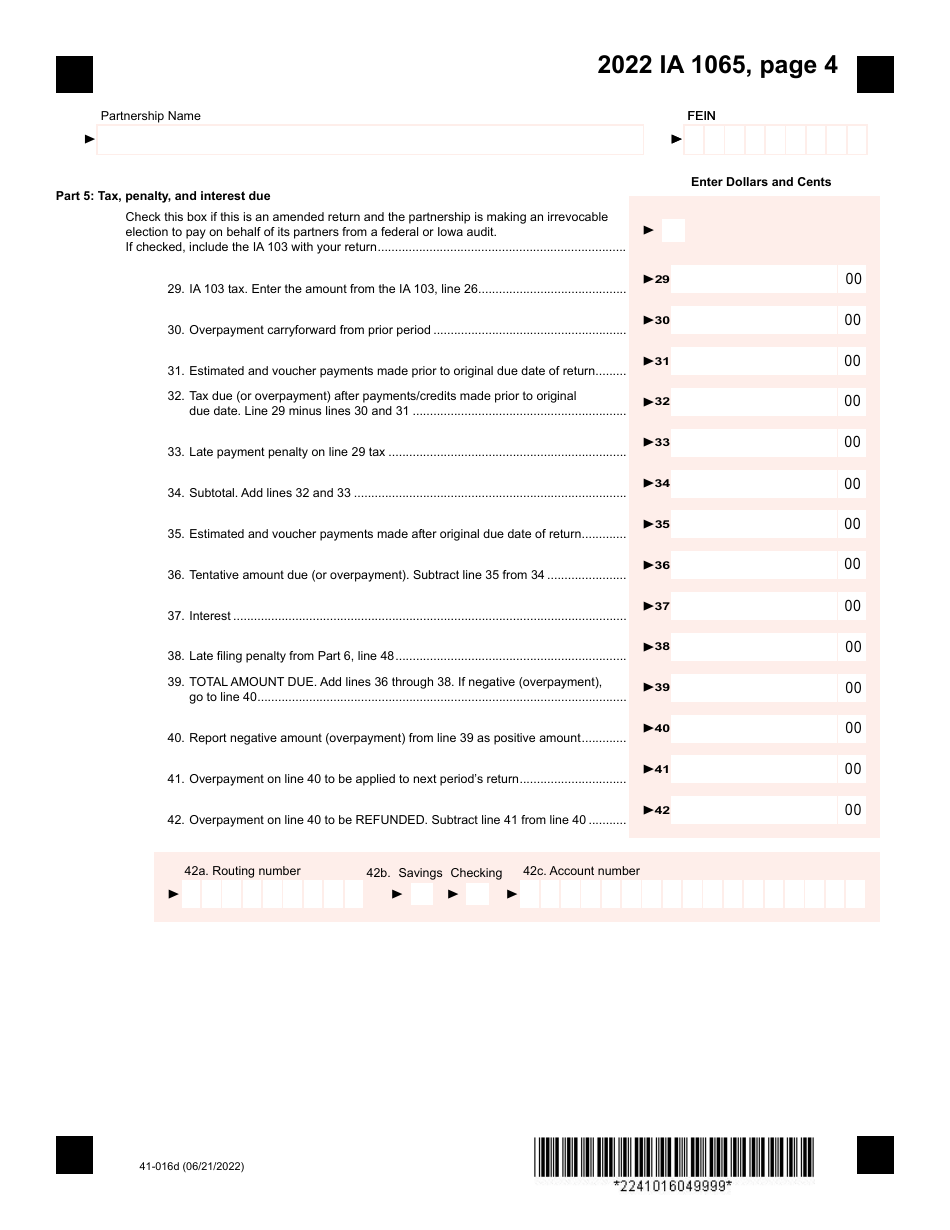

Q: What happens if I don't file Form IA1065?

A: If you fail to file Form IA1065 by the deadline, you may be subject to penalties and interest on any unpaid taxes.

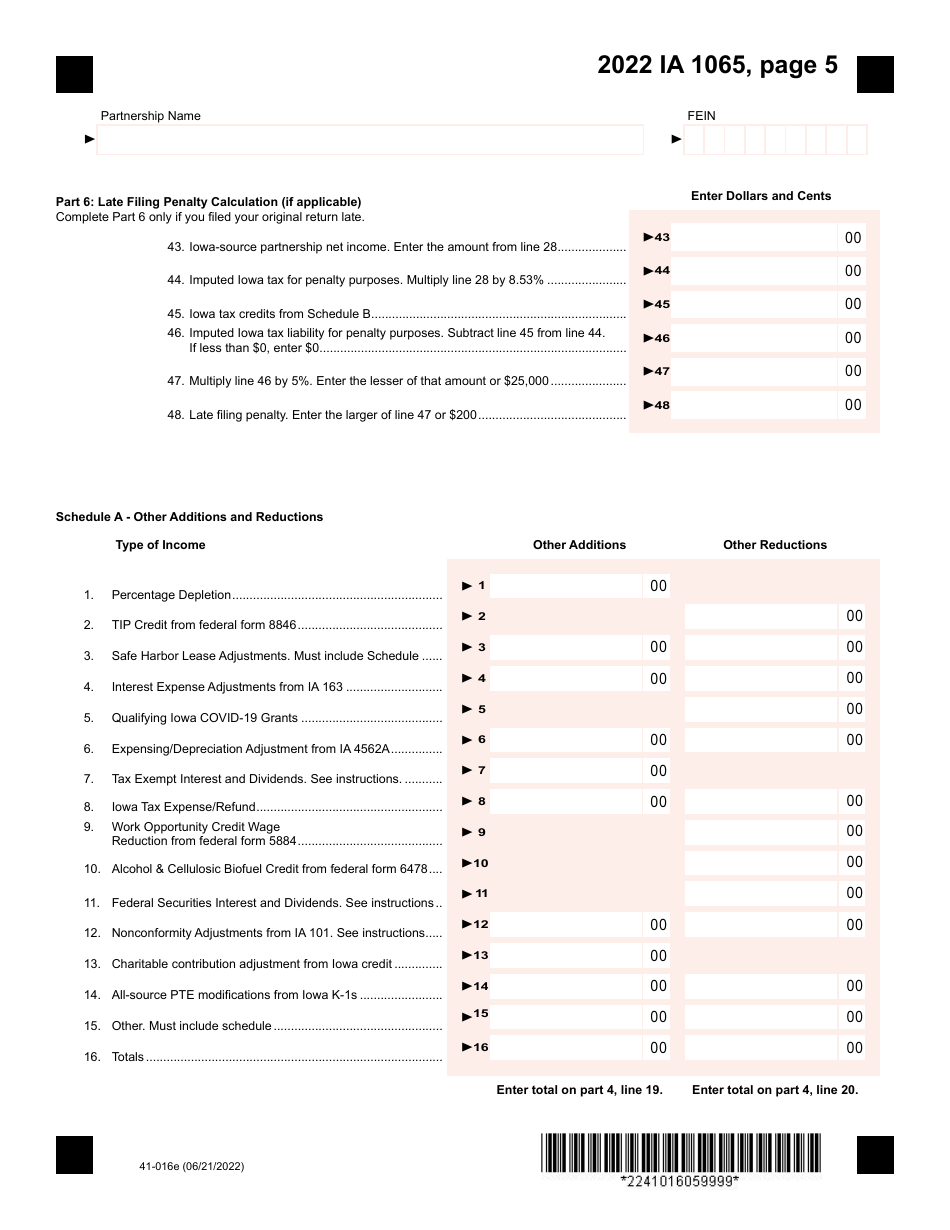

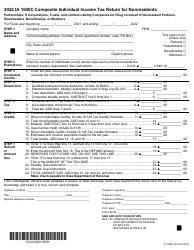

Q: Are there any additional schedules or attachments required with Form IA1065?

A: In some cases, you may need to attach additional schedules or forms, such as Schedule K-1, to report certain types of income or deductions.

Form Details:

- Released on June 21, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA1065 (41-016) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.