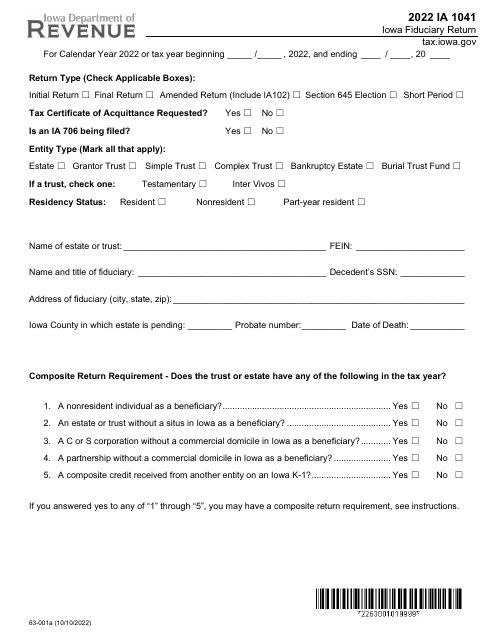

This version of the form is not currently in use and is provided for reference only. Download this version of

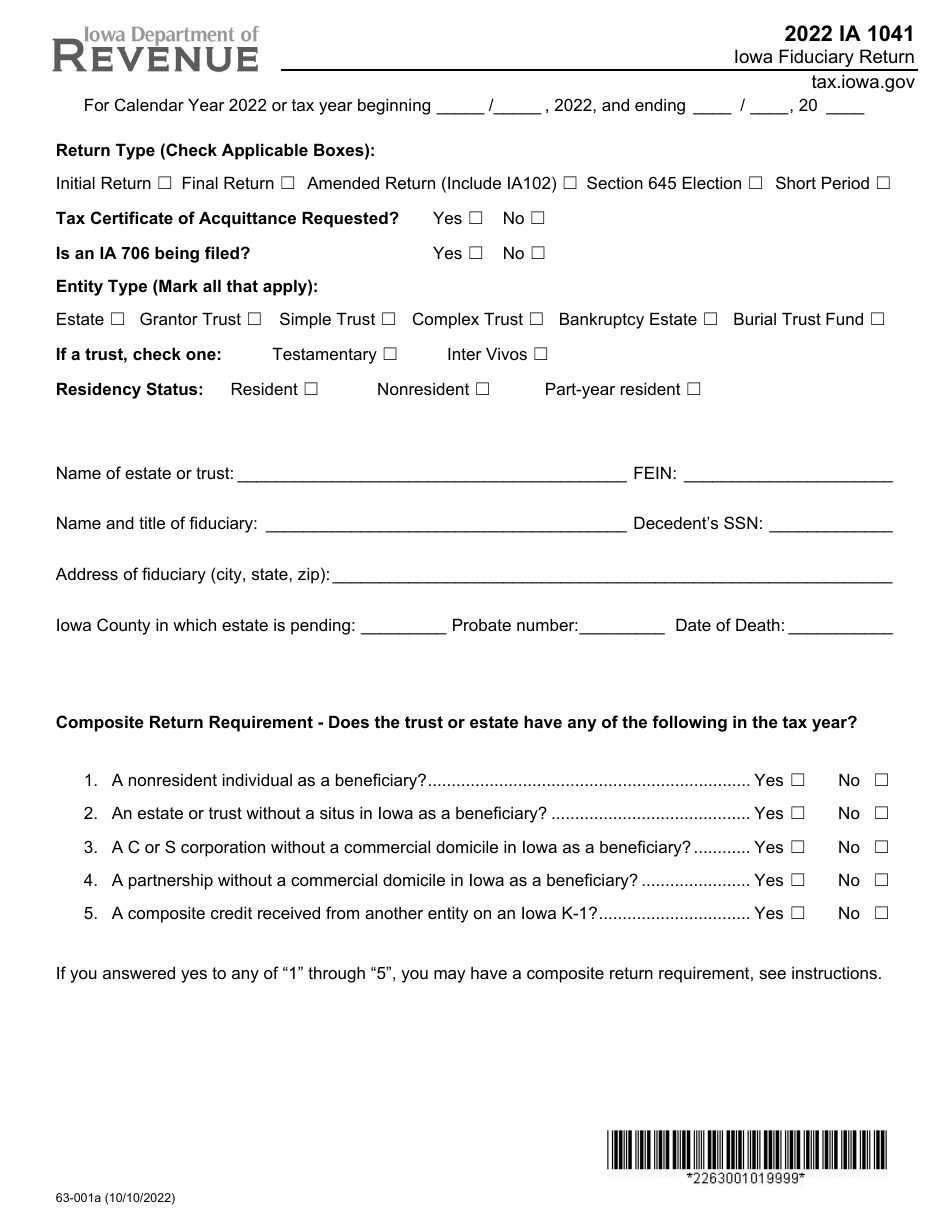

Form IA1041 (63-001)

for the current year.

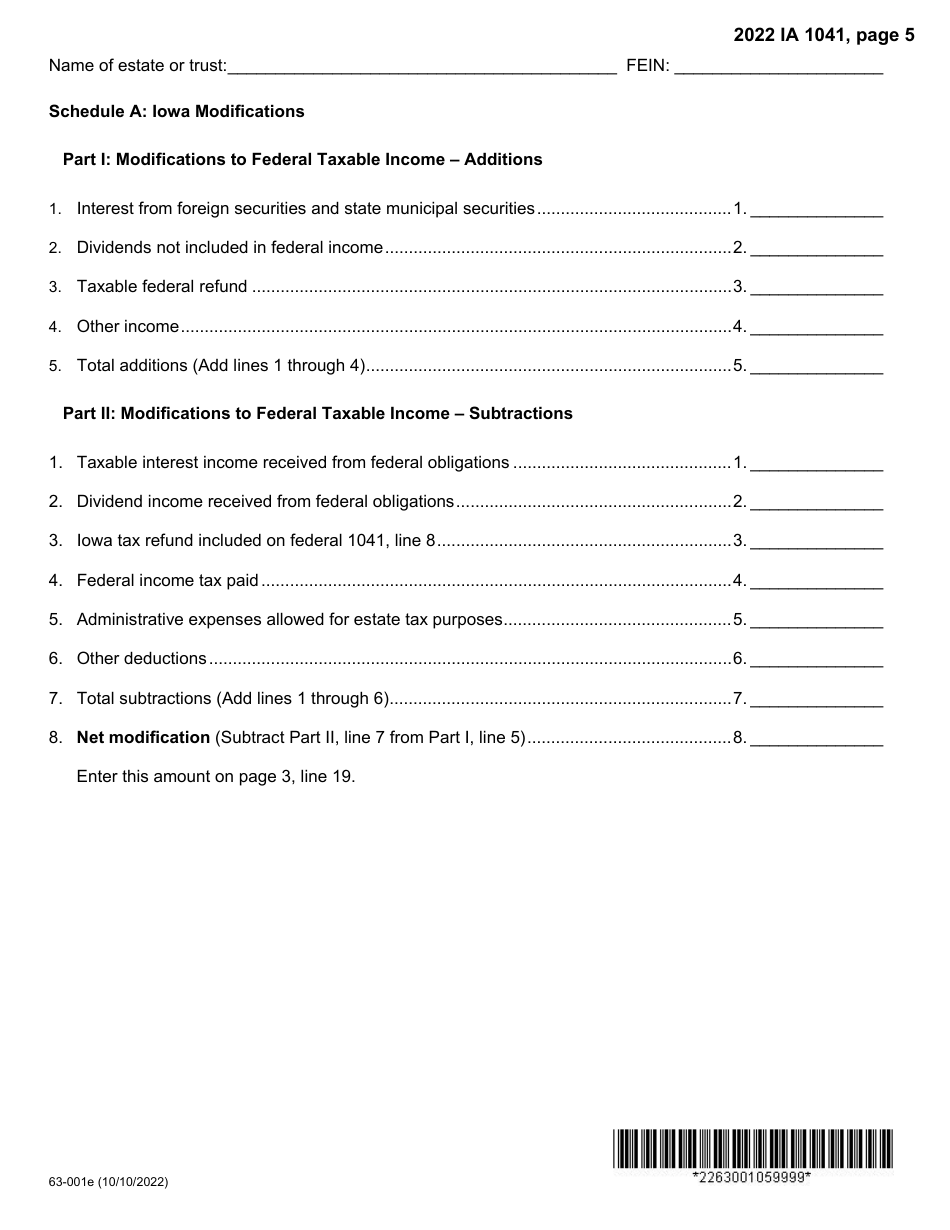

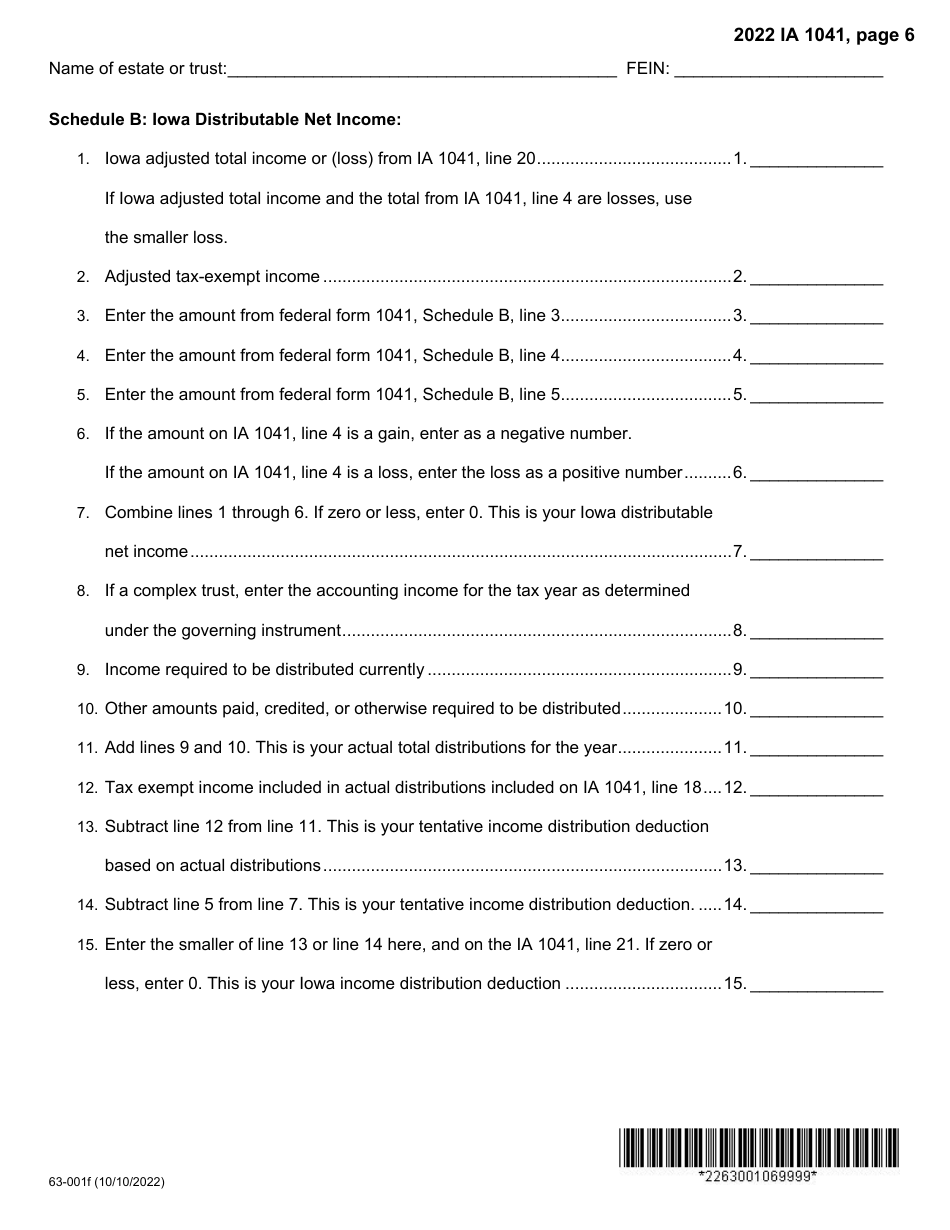

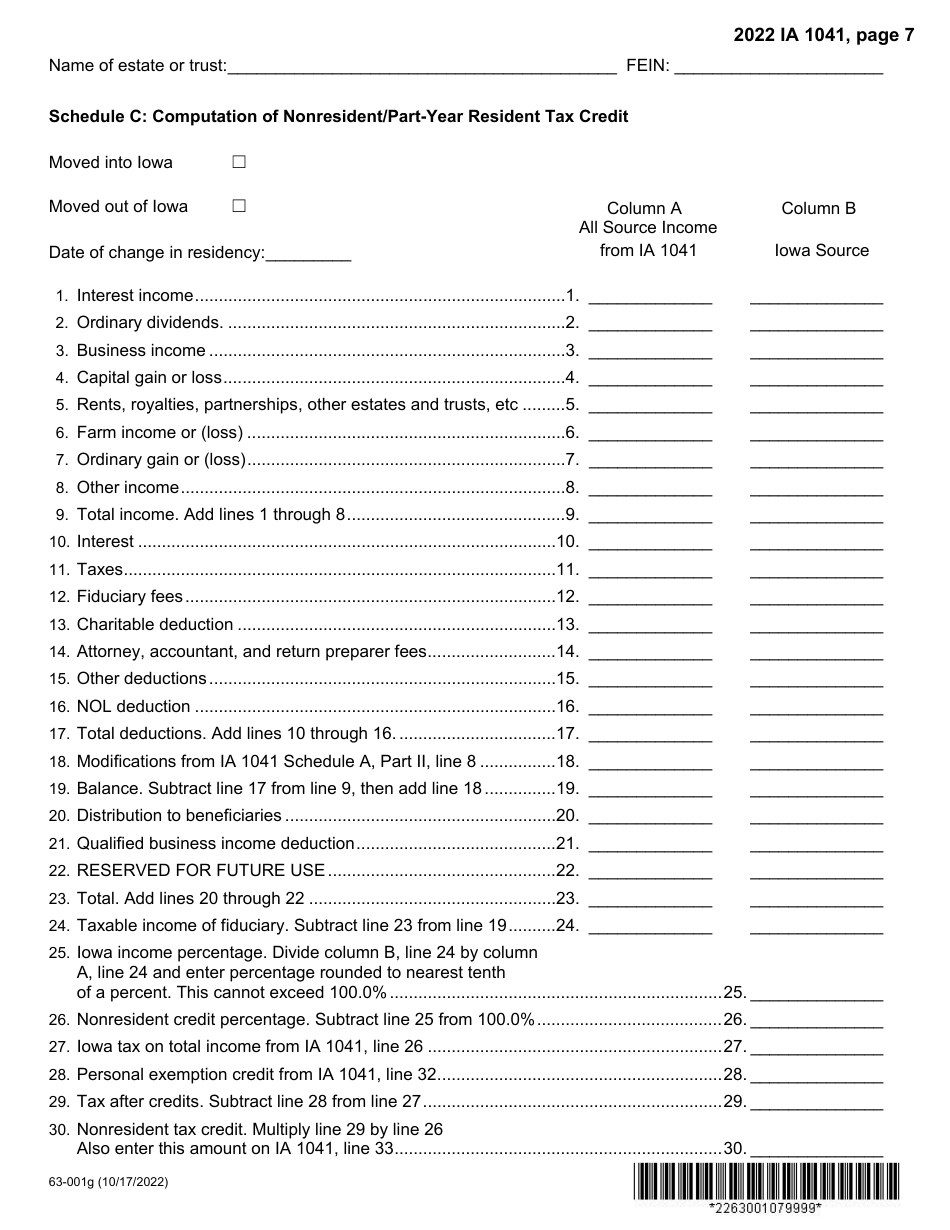

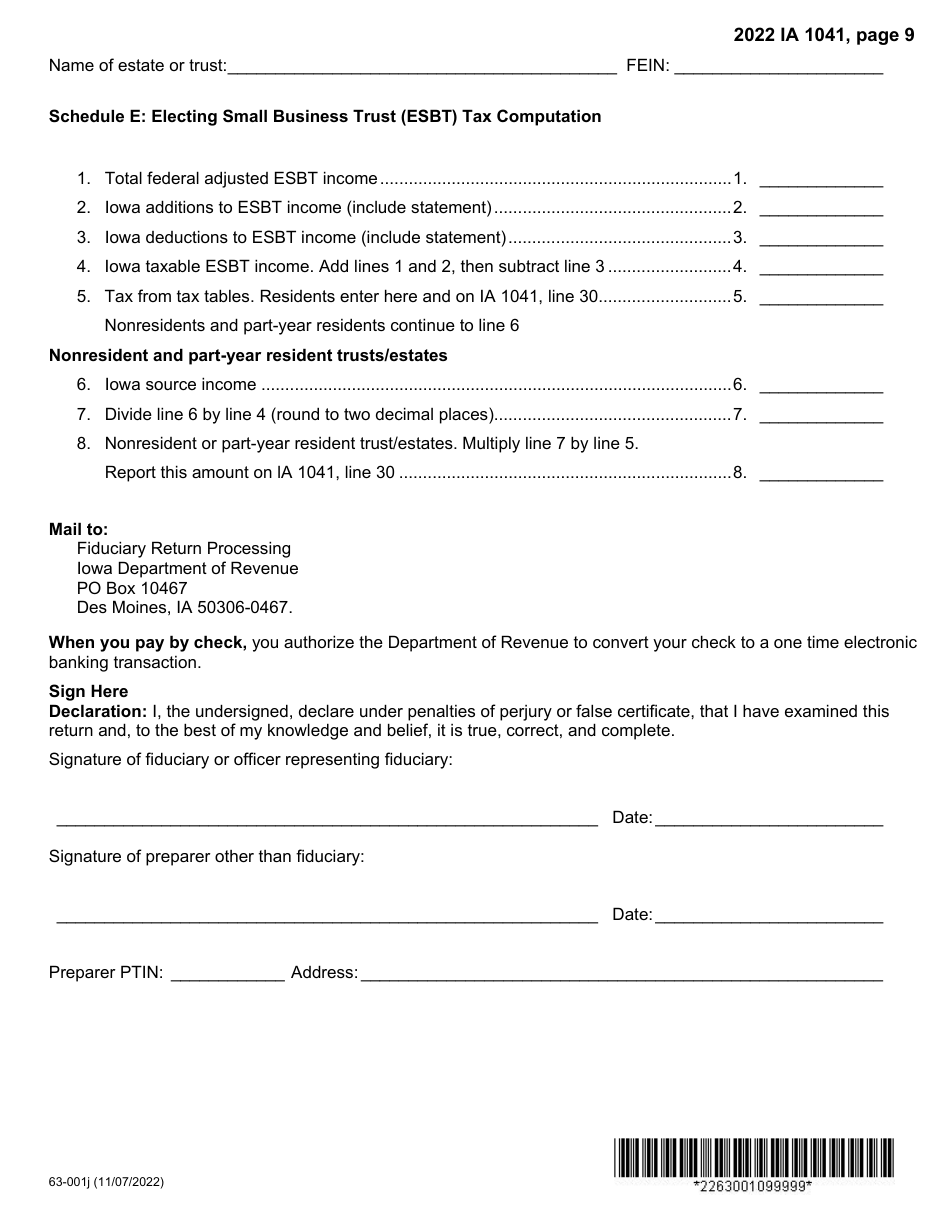

Form IA1041 (63-001) Iowa Fiduciary Return - Iowa

What Is Form IA1041 (63-001)?

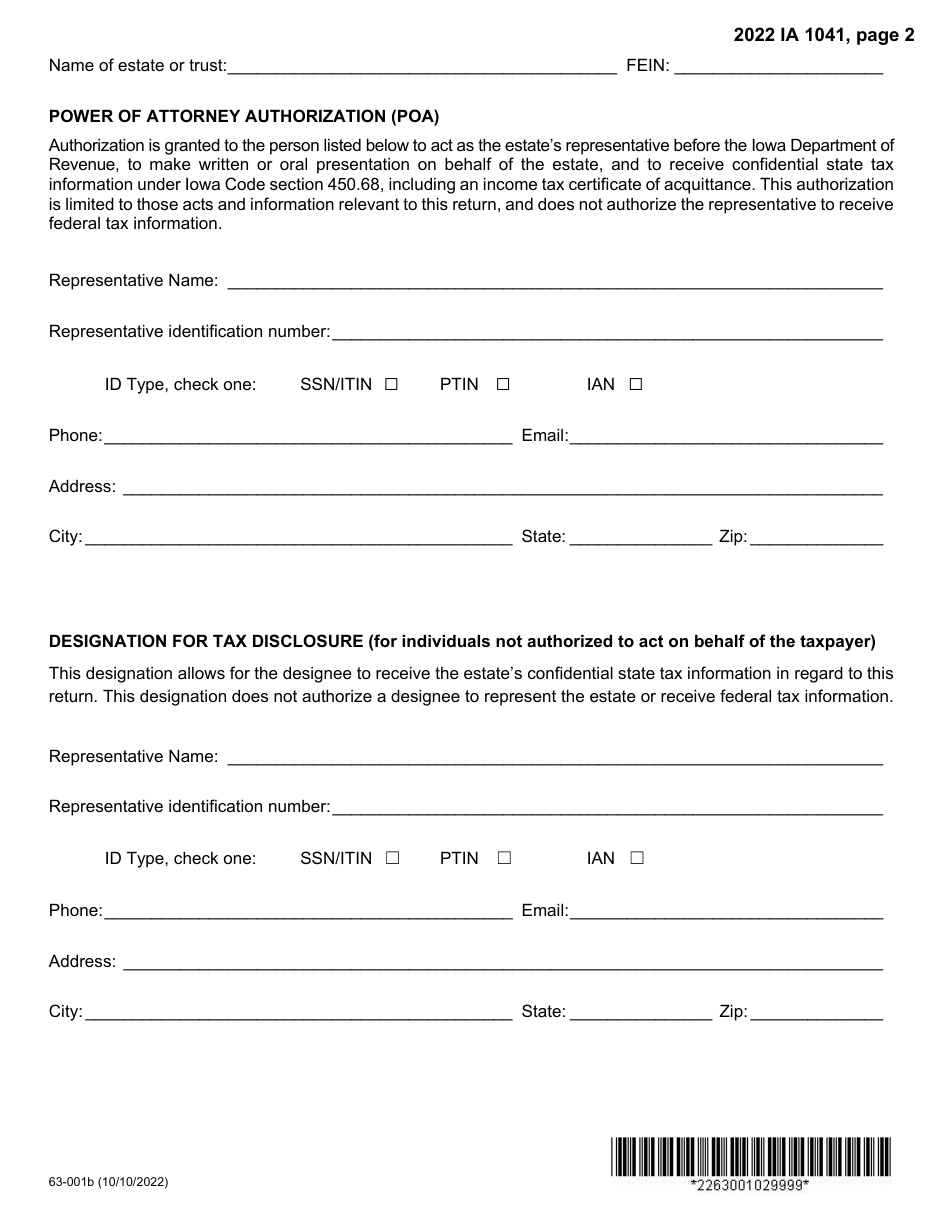

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IA1041?

A: Form IA1041 is the Iowa Fiduciary Return.

Q: Who needs to file Form IA1041?

A: Any fiduciary who manages an estate or trust in Iowa needs to file Form IA1041.

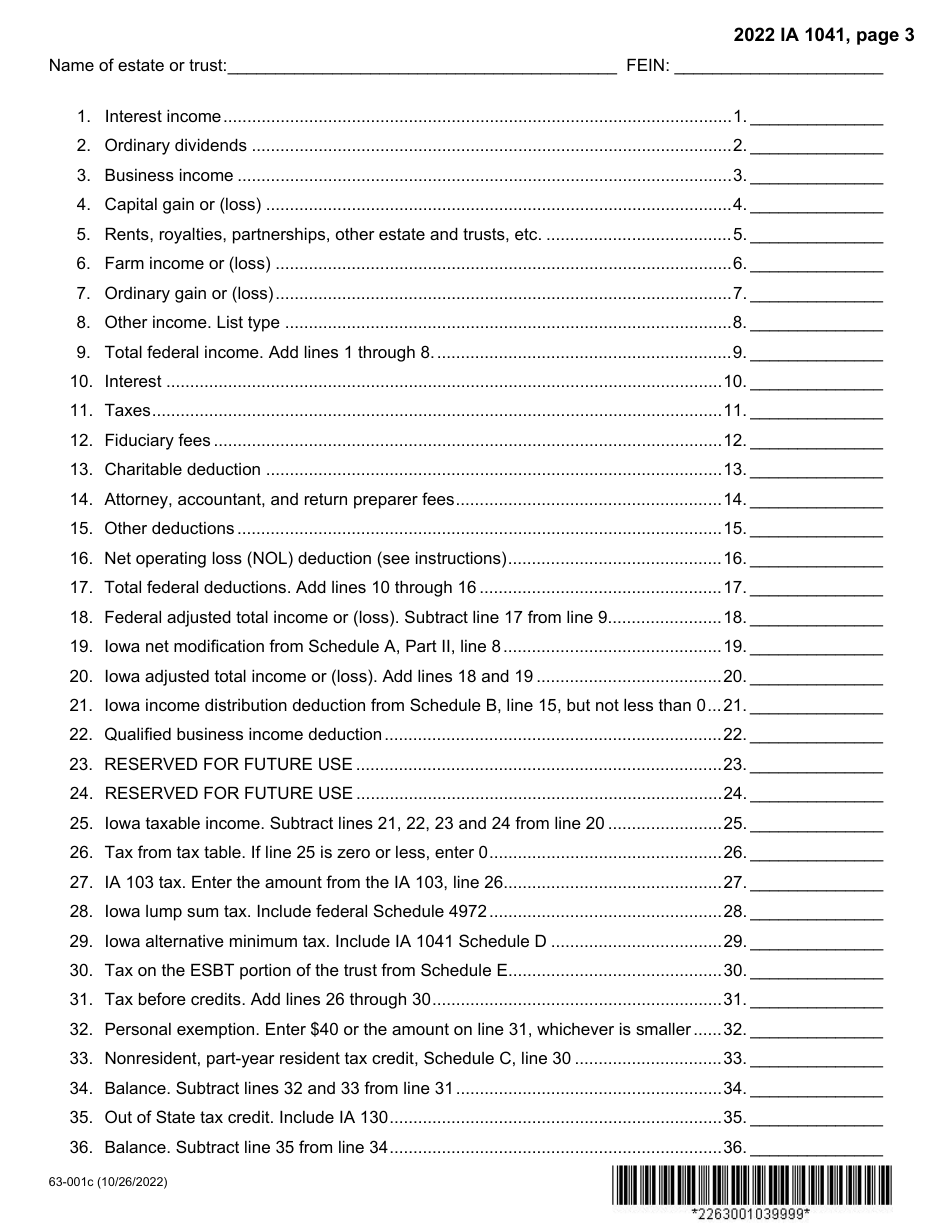

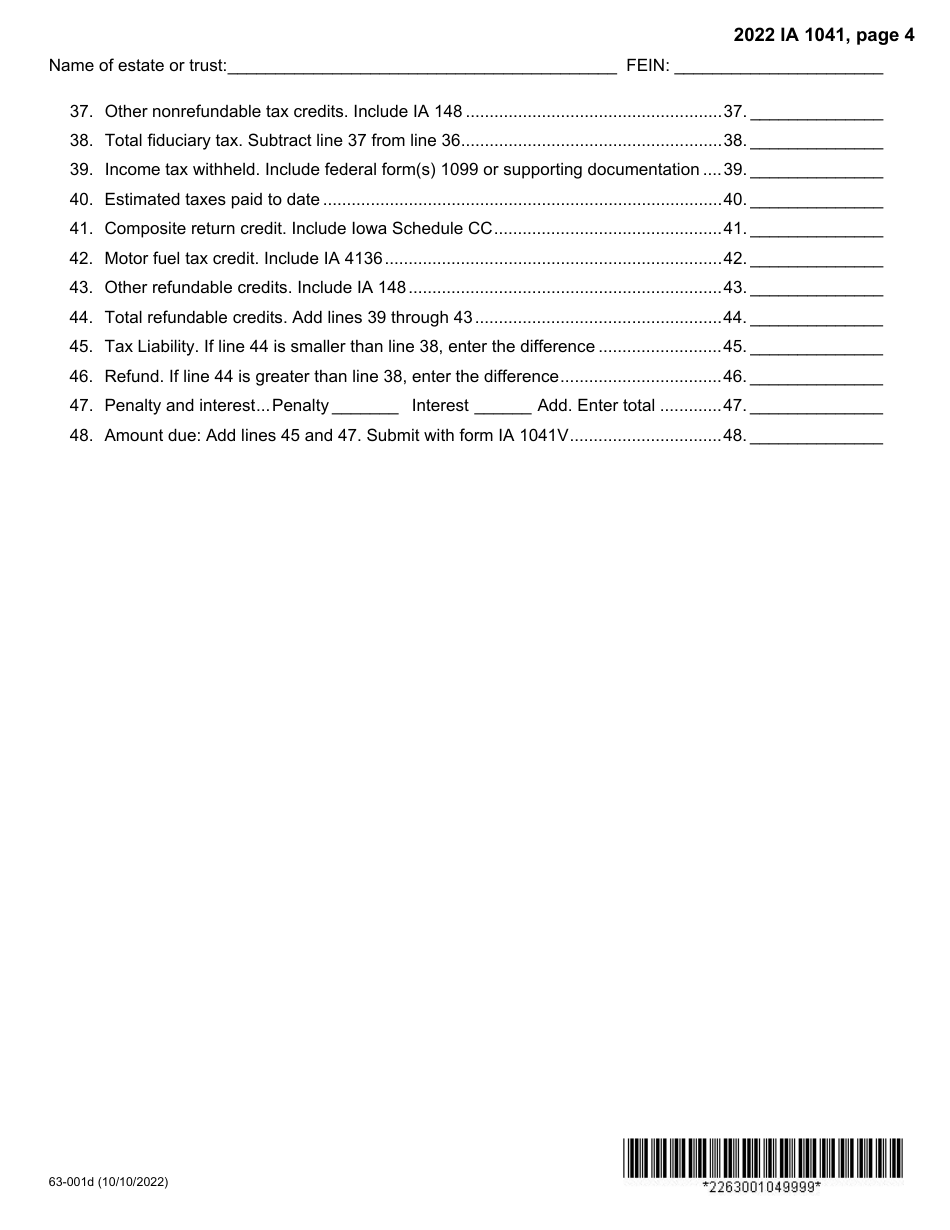

Q: What is the purpose of Form IA1041?

A: The purpose of Form IA1041 is to report the income, deductions, credits, and tax liability of an estate or trust in Iowa.

Q: When is Form IA1041 due?

A: Form IA1041 is due on or before April 30th of the following year.

Q: Can Form IA1041 be filed electronically?

A: Yes, Form IA1041 can be filed electronically.

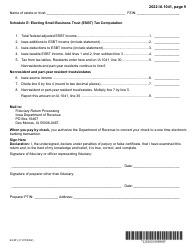

Q: Are there any penalties for late filing of Form IA1041?

A: Yes, there are penalties for late filing of Form IA1041. It is important to file the return on time to avoid penalties.

Q: What should I include with Form IA1041?

A: You should include all necessary schedules, forms, and supporting documentation with Form IA1041.

Q: Can I get an extension to file Form IA1041?

A: Yes, you can request an extension to file Form IA1041. The extension must be requested before the original due date of the return.

Q: Is there a separate form for Iowa estate taxes?

A: No, there is no separate form for Iowa estate taxes. Estate taxes are reported on Form IA1041.

Form Details:

- Released on October 10, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA1041 (63-001) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.