This version of the form is not currently in use and is provided for reference only. Download this version of

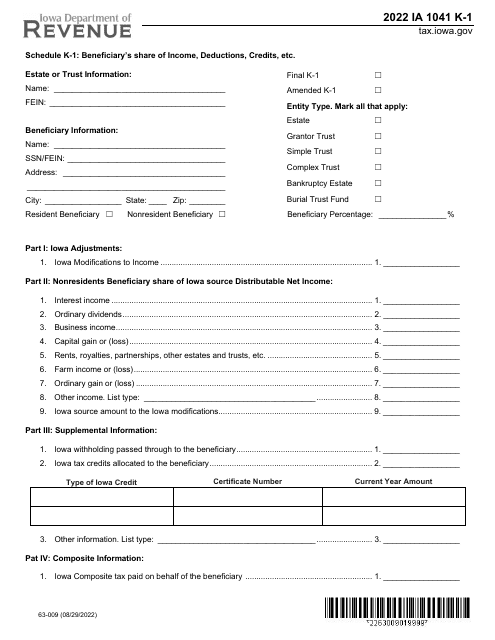

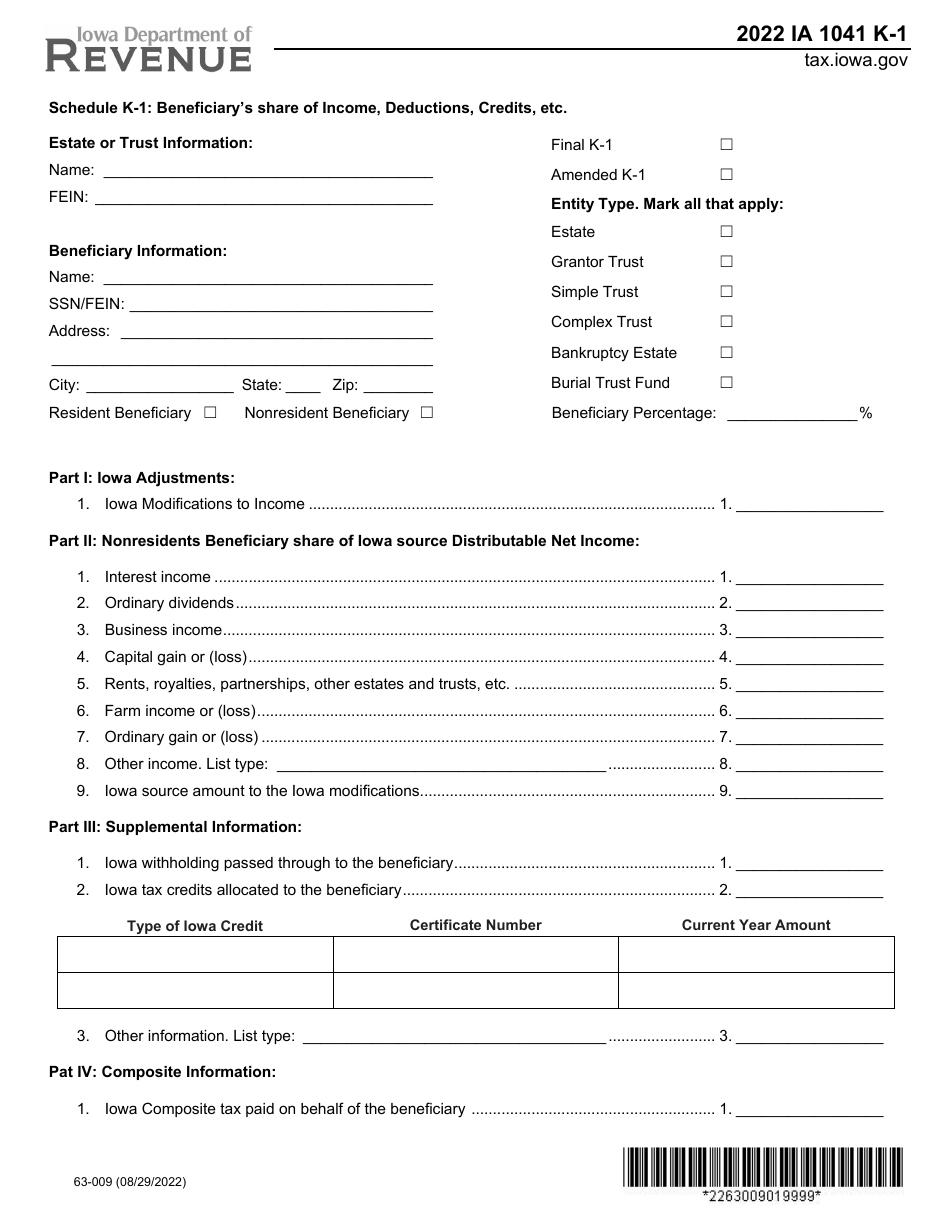

Form IA1041 (63-009) Schedule K-1

for the current year.

Form IA1041 (63-009) Schedule K-1 Beneficiary's Share of Income, Deductions, Credits, Etc - Iowa

What Is Form IA1041 (63-009) Schedule K-1?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa.The document is a supplement to Form IA1041, Iowa Fiduciary Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA1041?

A: Form IA1041 is a tax form used in Iowa for reporting a beneficiary's share of income, deductions, credits, etc.

Q: What is Schedule K-1?

A: Schedule K-1 is a section of Form IA1041 that reports a beneficiary's share of income, deductions, credits, etc.

Q: What does a beneficiary report on Schedule K-1?

A: A beneficiary reports their share of income, deductions, credits, etc. on Schedule K-1.

Q: Who uses Form IA1041?

A: Form IA1041 is used by individuals who are beneficiaries of an Iowa estate or trust.

Q: Why is Form IA1041 used?

A: Form IA1041 is used to report a beneficiary's share of income, deductions, credits, etc. from an Iowa estate or trust.

Q: Is Form IA1041 only for residents of Iowa?

A: No, Form IA1041 is used by all beneficiaries of an Iowa estate or trust, regardless of their residency status.

Form Details:

- Released on August 29, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IA1041 (63-009) Schedule K-1 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.