This version of the form is not currently in use and is provided for reference only. Download this version of

Form IA100E (41-159)

for the current year.

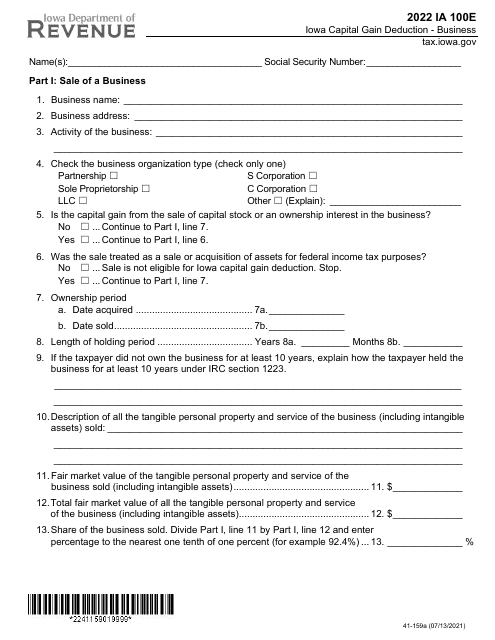

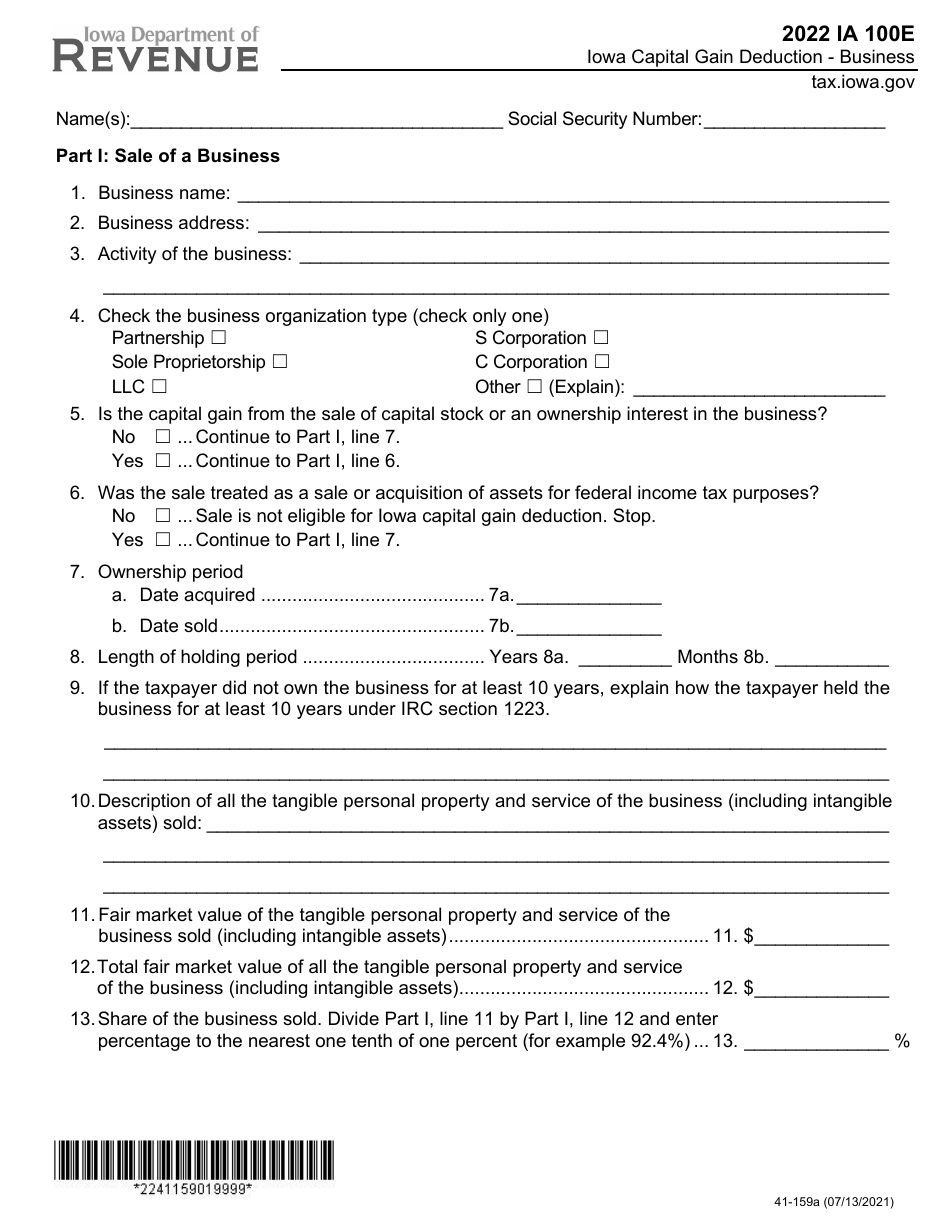

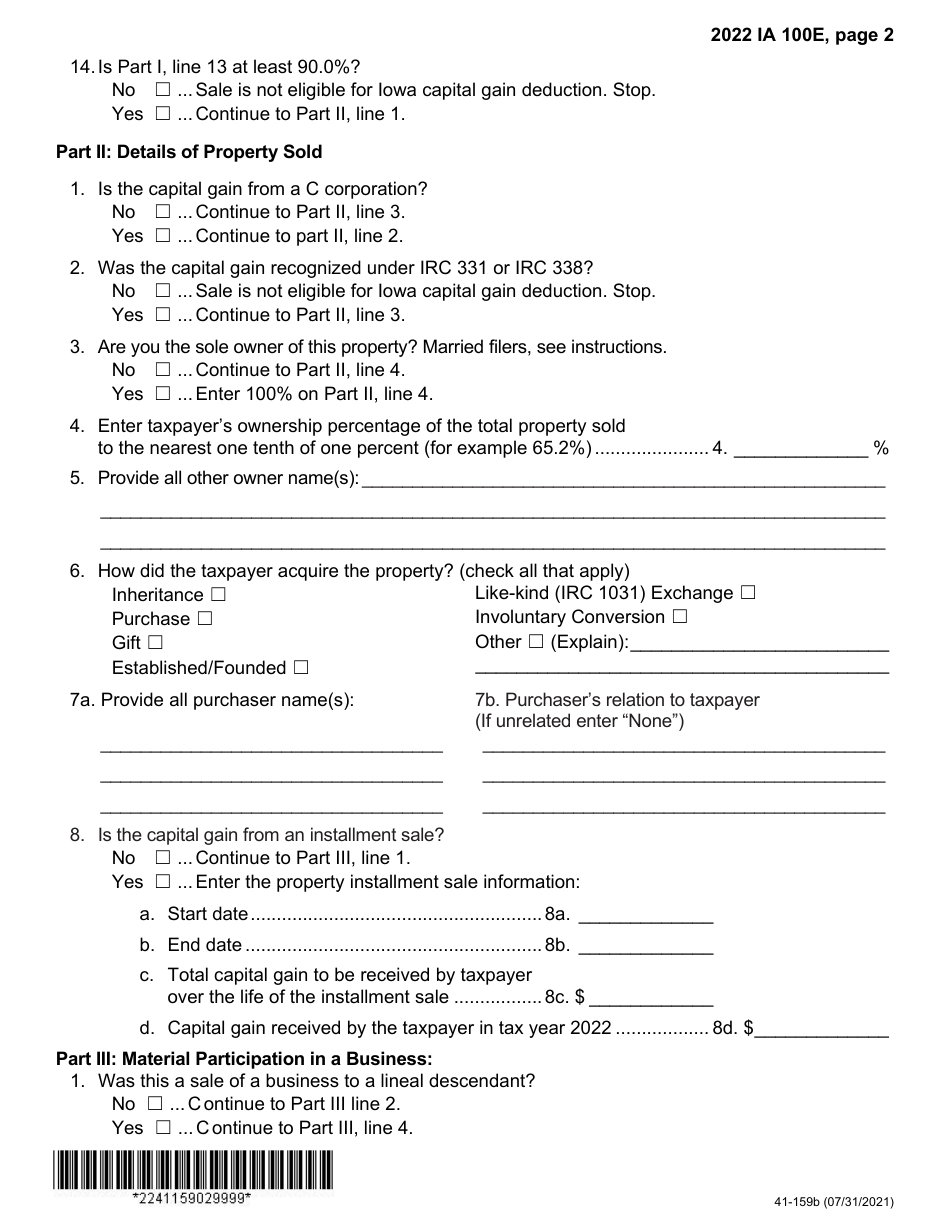

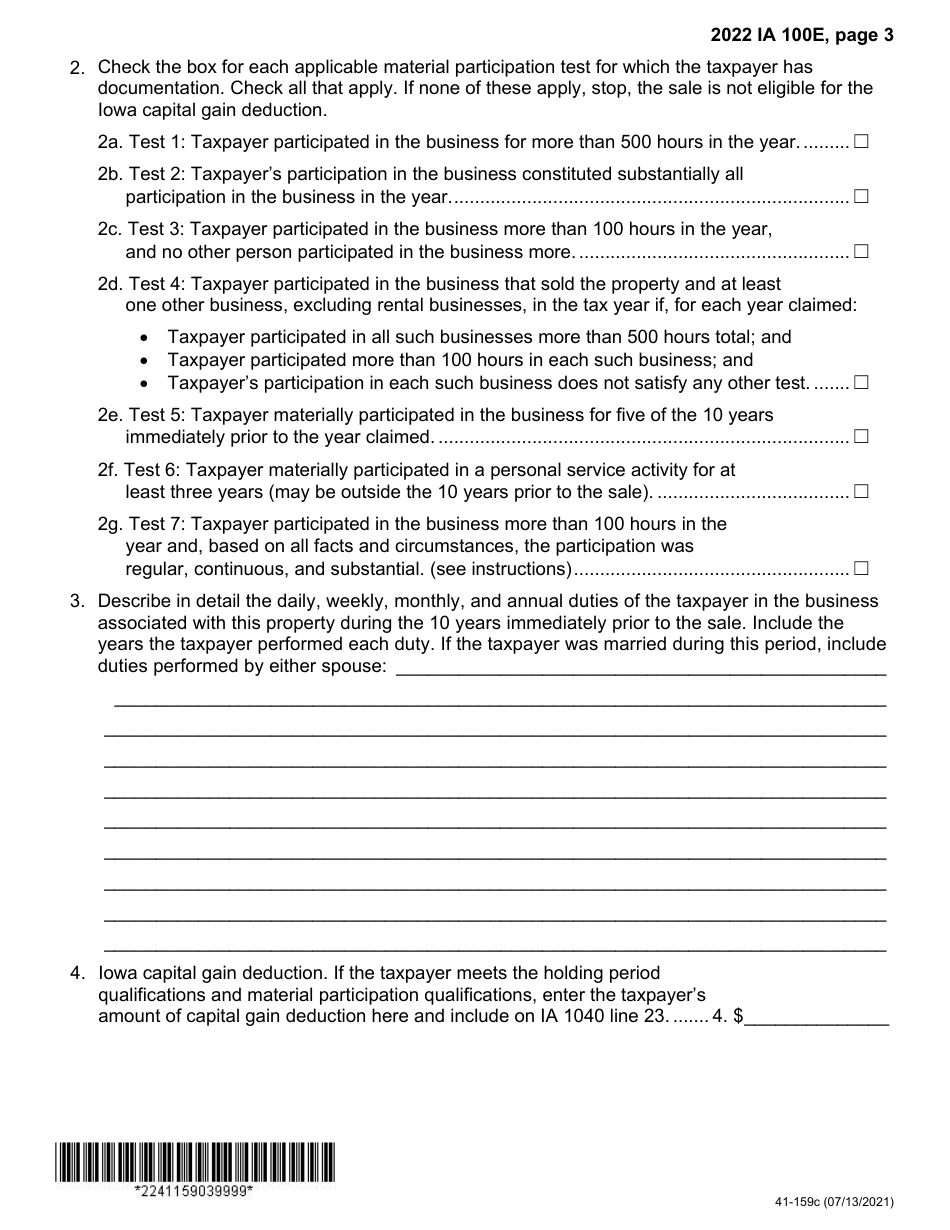

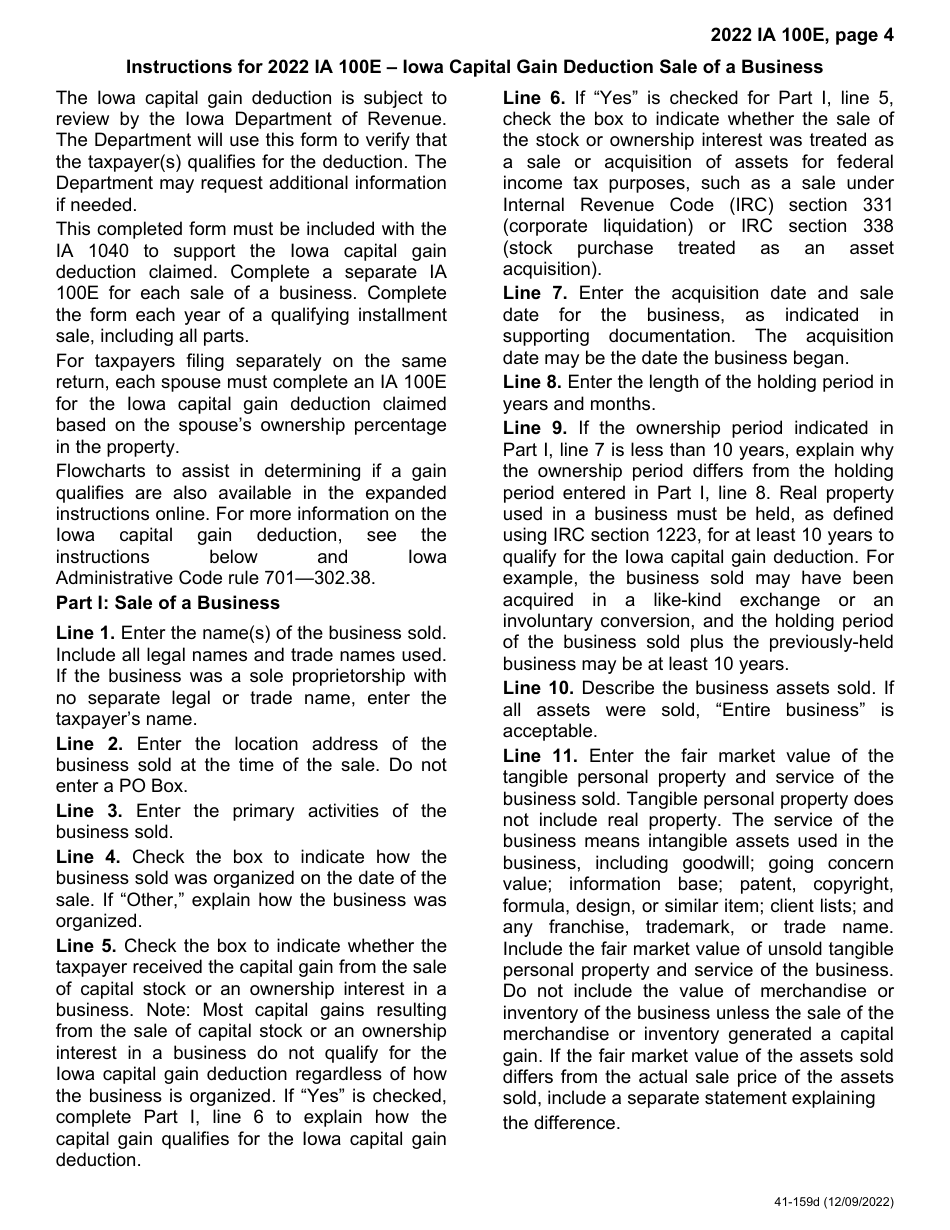

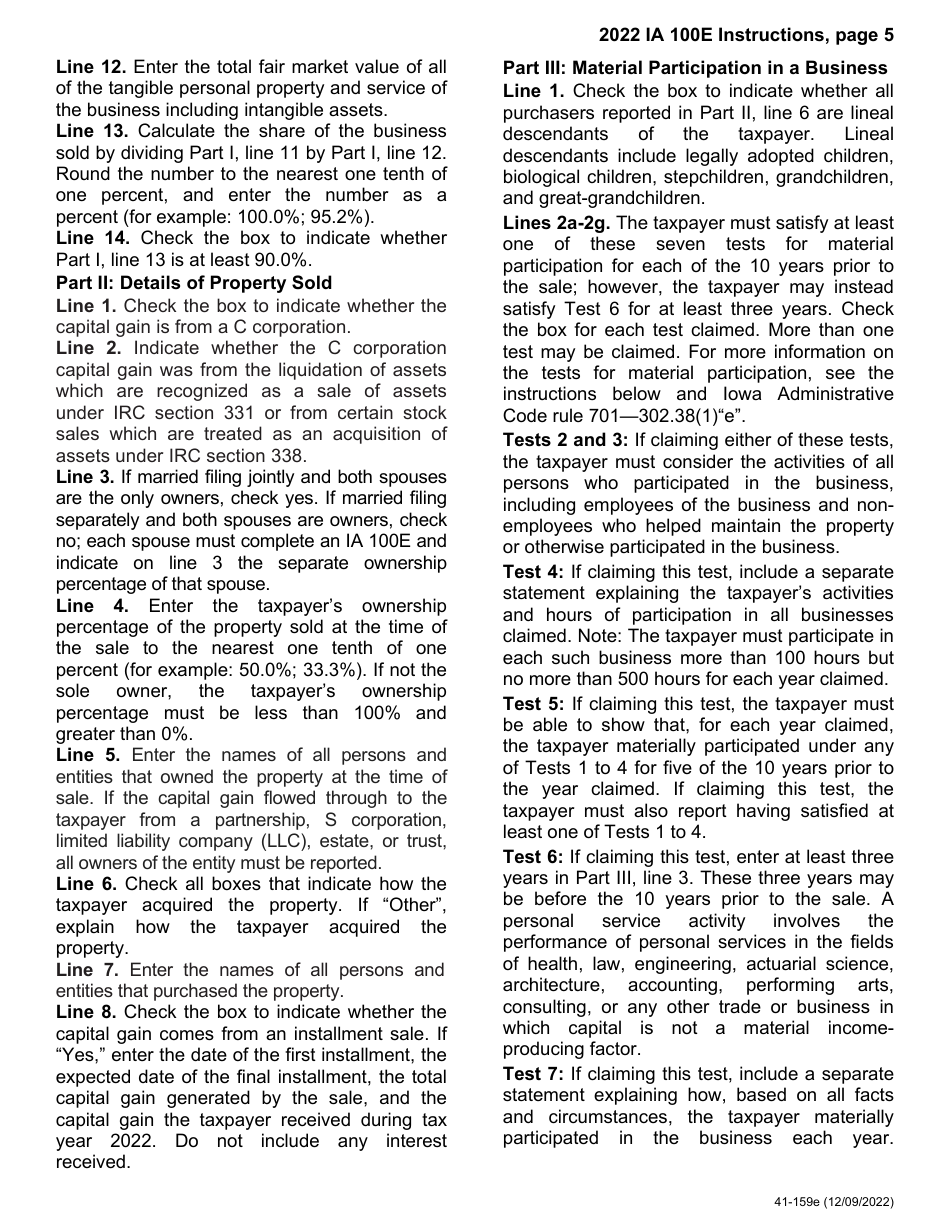

Form IA100E (41-159) Iowa Capital Gain Deduction - Business - Iowa

What Is Form IA100E (41-159)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA100E (41-159)?

A: Form IA100E (41-159) is a tax form used in Iowa to claim the Capital Gain Deduction for business owners.

Q: What is the Iowa Capital Gain Deduction?

A: The Iowa Capital Gain Deduction is a tax benefit that allows qualifying business owners in Iowa to exclude a portion of their capital gains from their taxable income.

Q: Who can claim the Iowa Capital Gain Deduction?

A: Business owners in Iowa who meet certain criteria can claim the Iowa Capital Gain Deduction. These criteria include being a resident of Iowa and meeting specific ownership and investment requirements.

Q: What is the purpose of Form IA100E (41-159)?

A: The purpose of Form IA100E (41-159) is to calculate and claim the Iowa Capital Gain Deduction for eligible business owners.

Form Details:

- Released on July 13, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA100E (41-159) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.