This version of the form is not currently in use and is provided for reference only. Download this version of

Form IA100B (41-156)

for the current year.

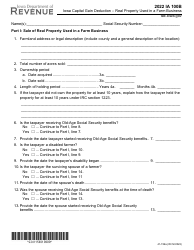

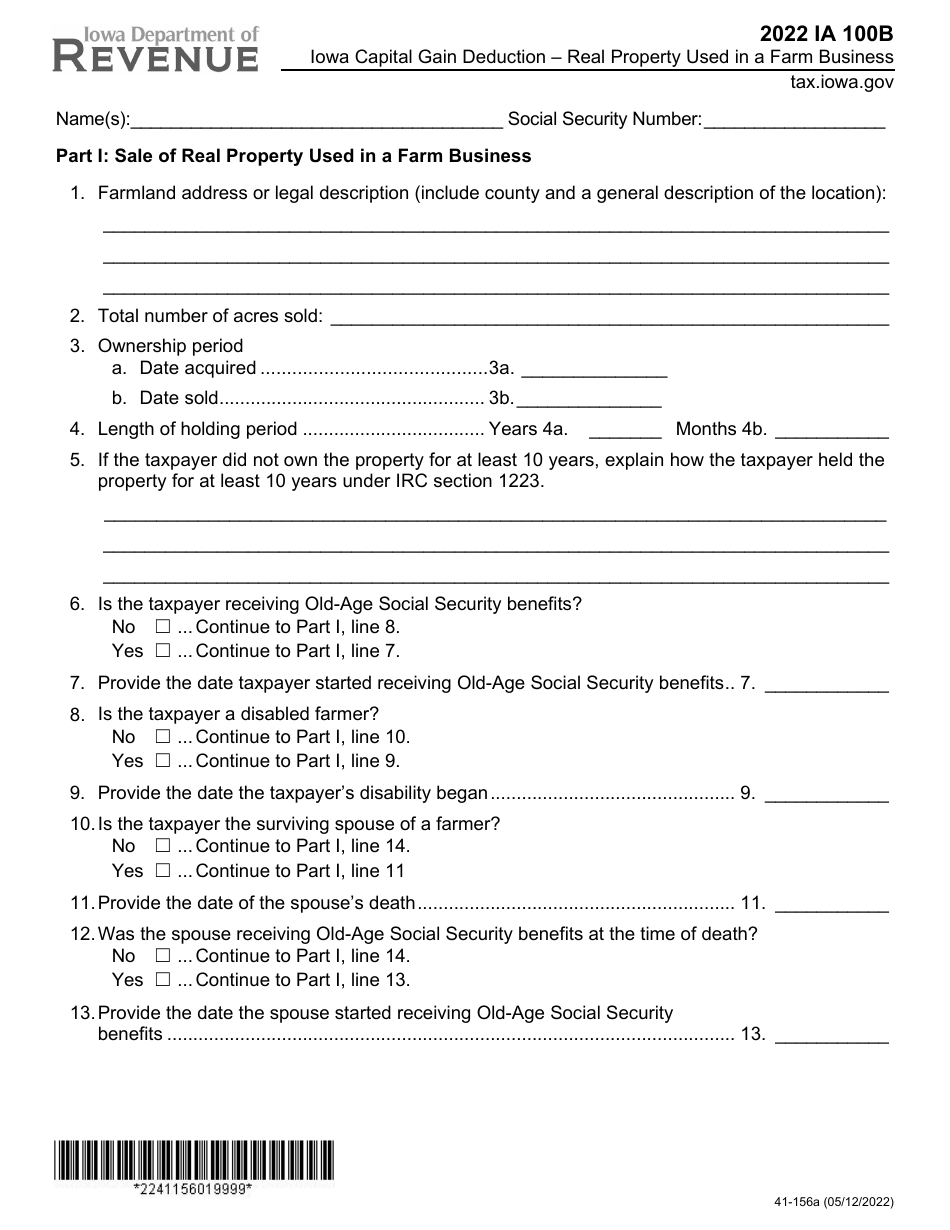

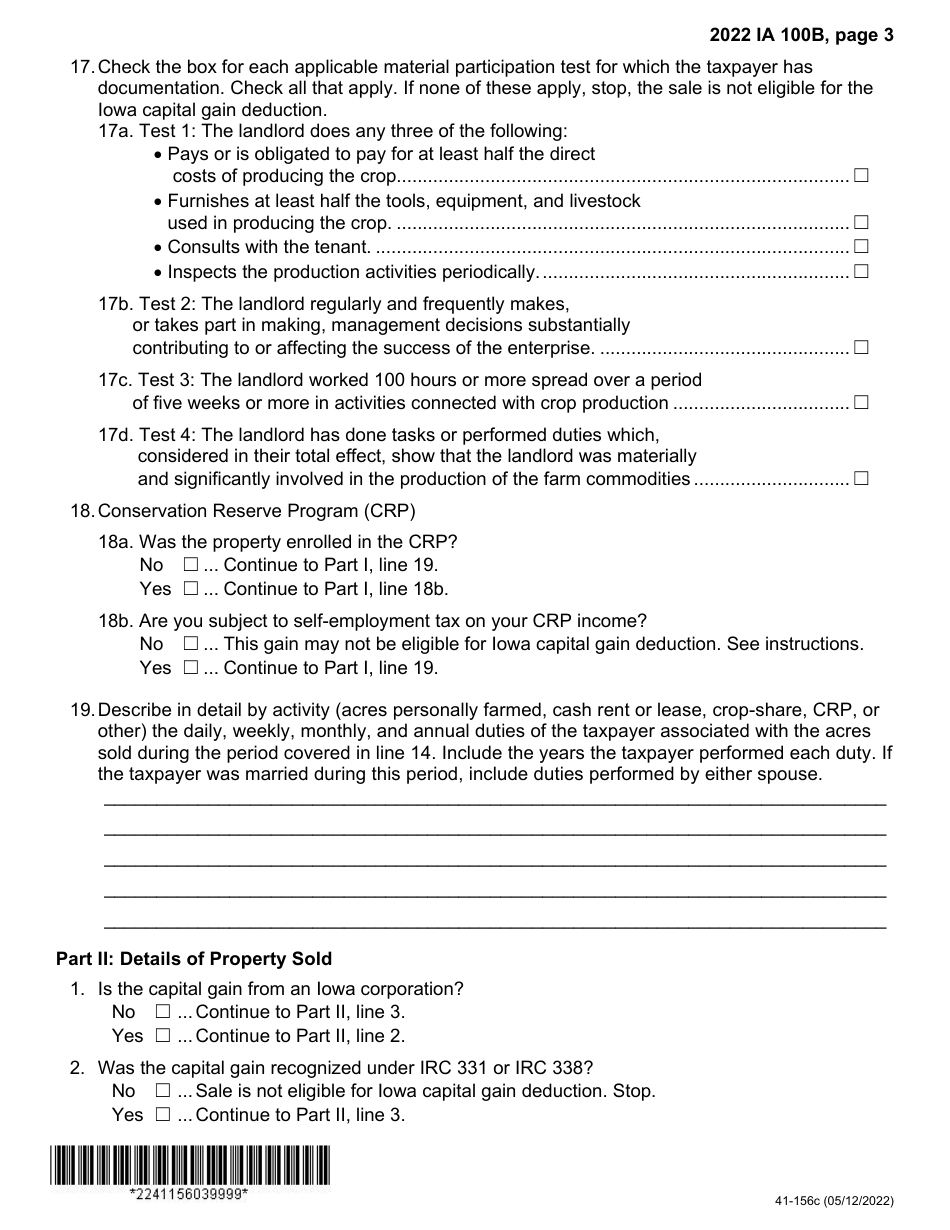

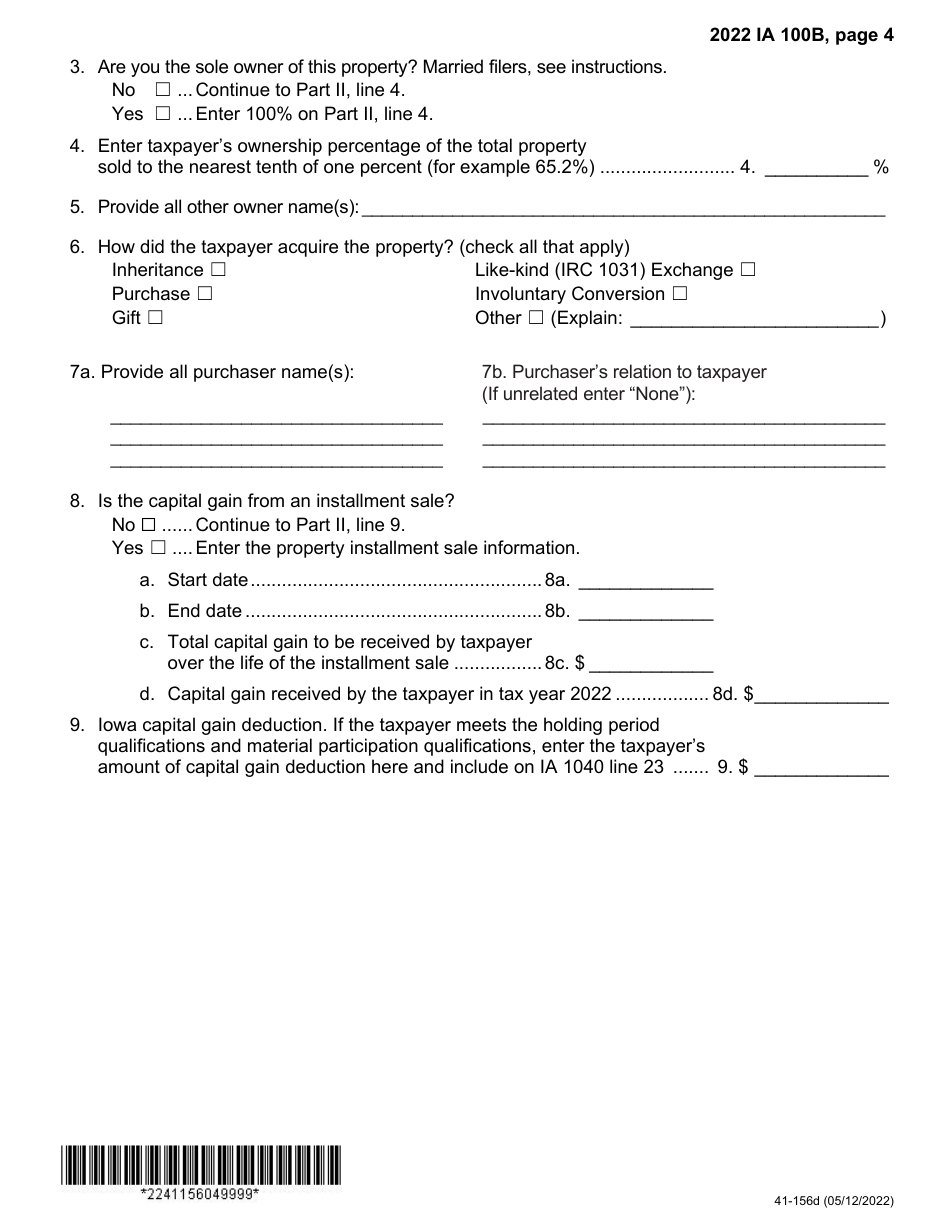

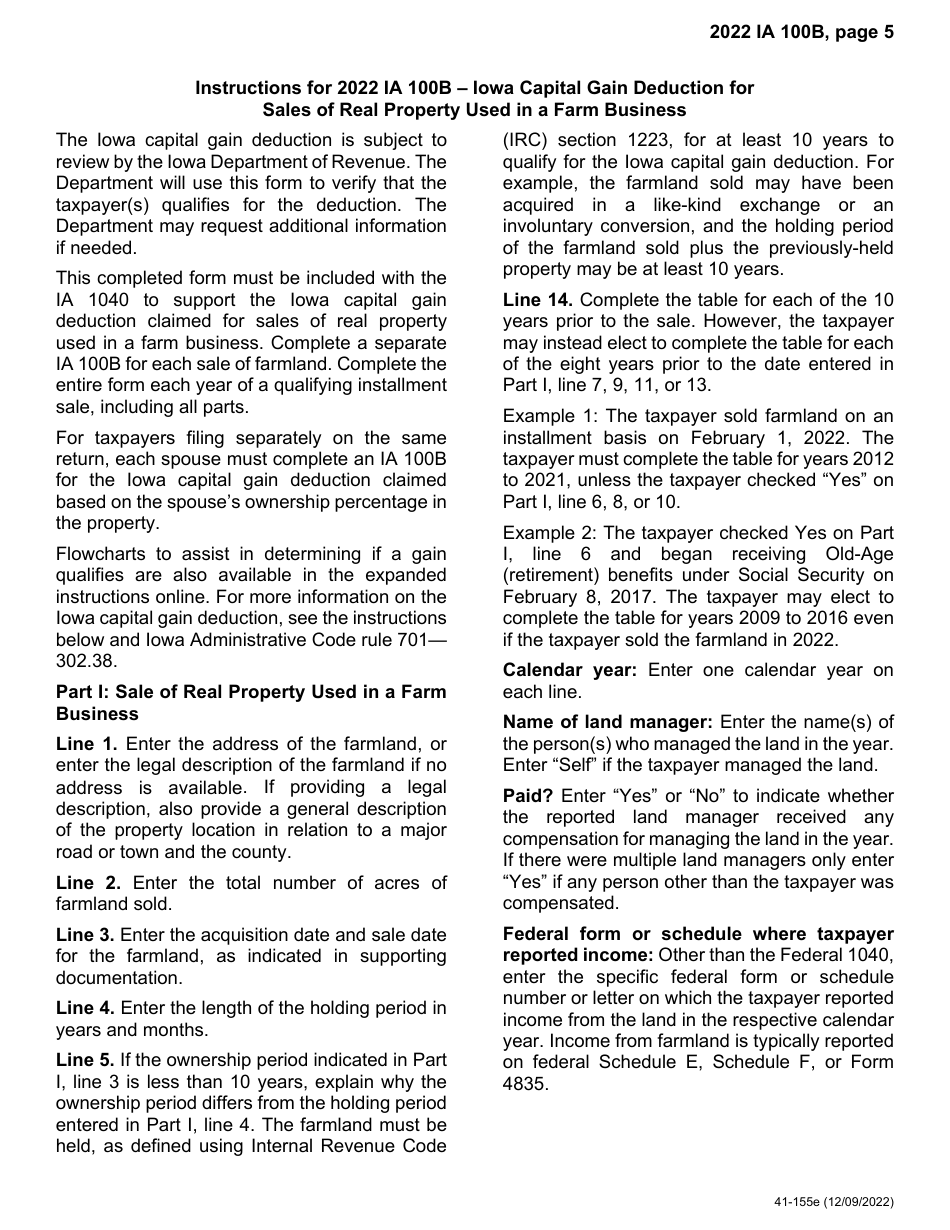

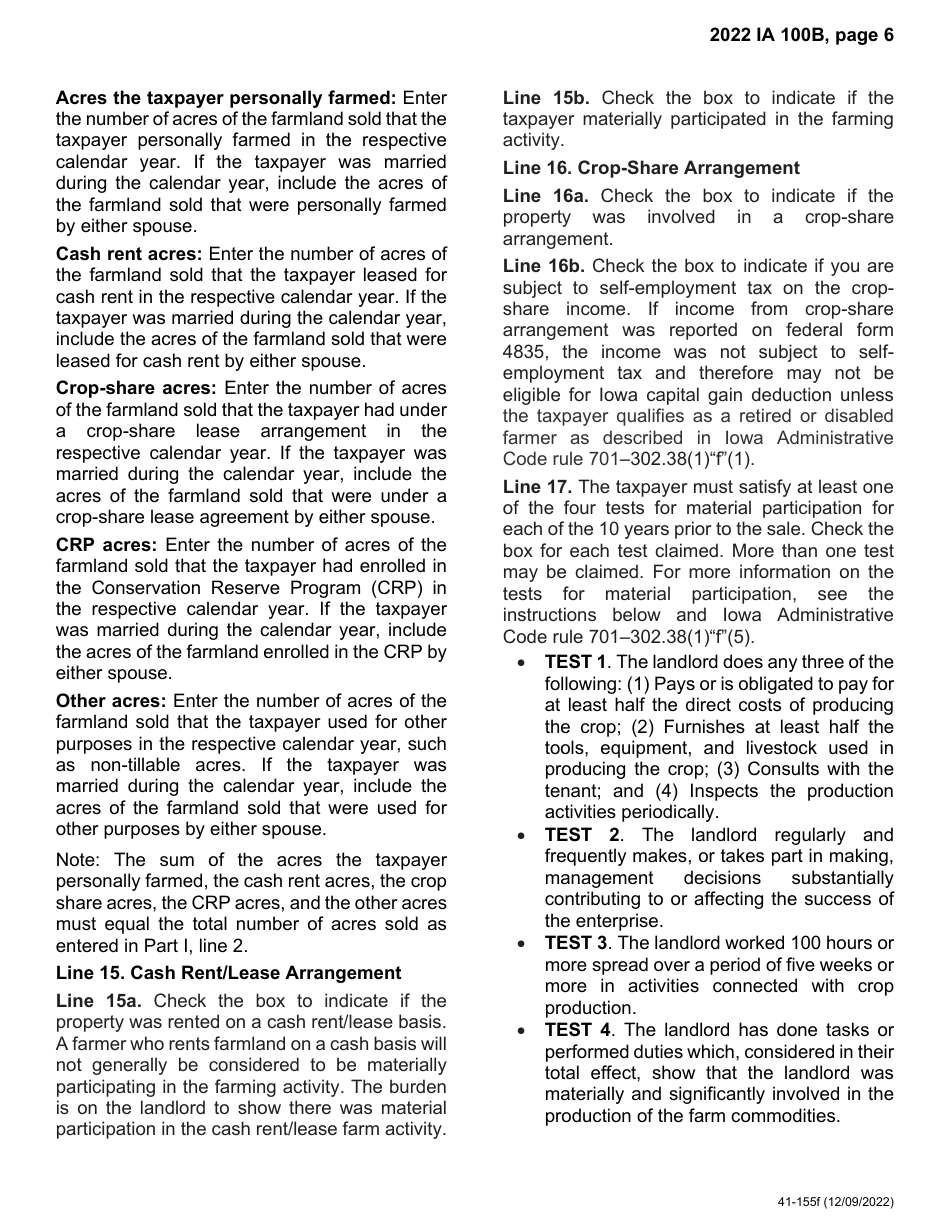

Form IA100B (41-156) Iowa Capital Gain Deduction - Real Property Used in a Farm Business - Iowa

What Is Form IA100B (41-156)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA100B (41-156)?

A: Form IA100B (41-156) is related to the Iowa Capital Gain Deduction for real property used in a farm business in Iowa.

Q: What is the Iowa Capital Gain Deduction?

A: The Iowa Capital Gain Deduction is a tax benefit that allows eligible individuals to exclude a portion of their capital gains from the sale of real property used in a farm business in Iowa.

Q: Who is eligible for the Iowa Capital Gain Deduction?

A: Individuals who meet certain criteria, such as being a resident of Iowa and having owned and used the property in a farm business for a specific period of time, may be eligible for the Iowa Capital Gain Deduction.

Q: What is the purpose of Form IA100B?

A: Form IA100B is used to claim the Iowa Capital Gain Deduction for real property used in a farm business in Iowa.

Q: Is the Iowa Capital Gain Deduction limited to specific types of real property?

A: Yes, the Iowa Capital Gain Deduction is limited to qualified real property used in a farm business, such as agricultural land and buildings.

Q: Are there any restrictions or limitations for claiming the Iowa Capital Gain Deduction?

A: Yes, there are certain restrictions and limitations that apply to claiming the Iowa Capital Gain Deduction, including the requirement to meet specific ownership and use criteria.

Q: When should I file Form IA100B?

A: Form IA100B should be filed with your Iowa state tax return for the year in which you are claiming the Iowa Capital Gain Deduction.

Q: What documentation do I need to submit with Form IA100B?

A: You may need to submit documentation that supports your claim for the Iowa Capital Gain Deduction, such as purchase and sale agreements, records of property use, and other relevant records.

Q: Can I claim the Iowa Capital Gain Deduction if the property was used for non-farm purposes at any time?

A: No, the Iowa Capital Gain Deduction is only available for real property used exclusively in a farm business in Iowa.

Form Details:

- Released on December 9, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA100B (41-156) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.