This version of the form is not currently in use and is provided for reference only. Download this version of

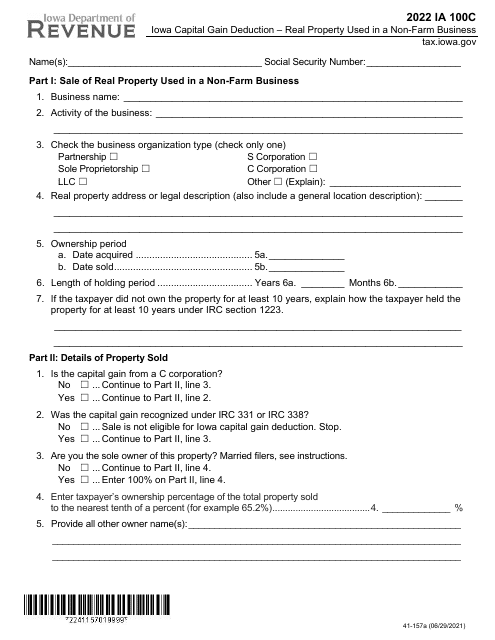

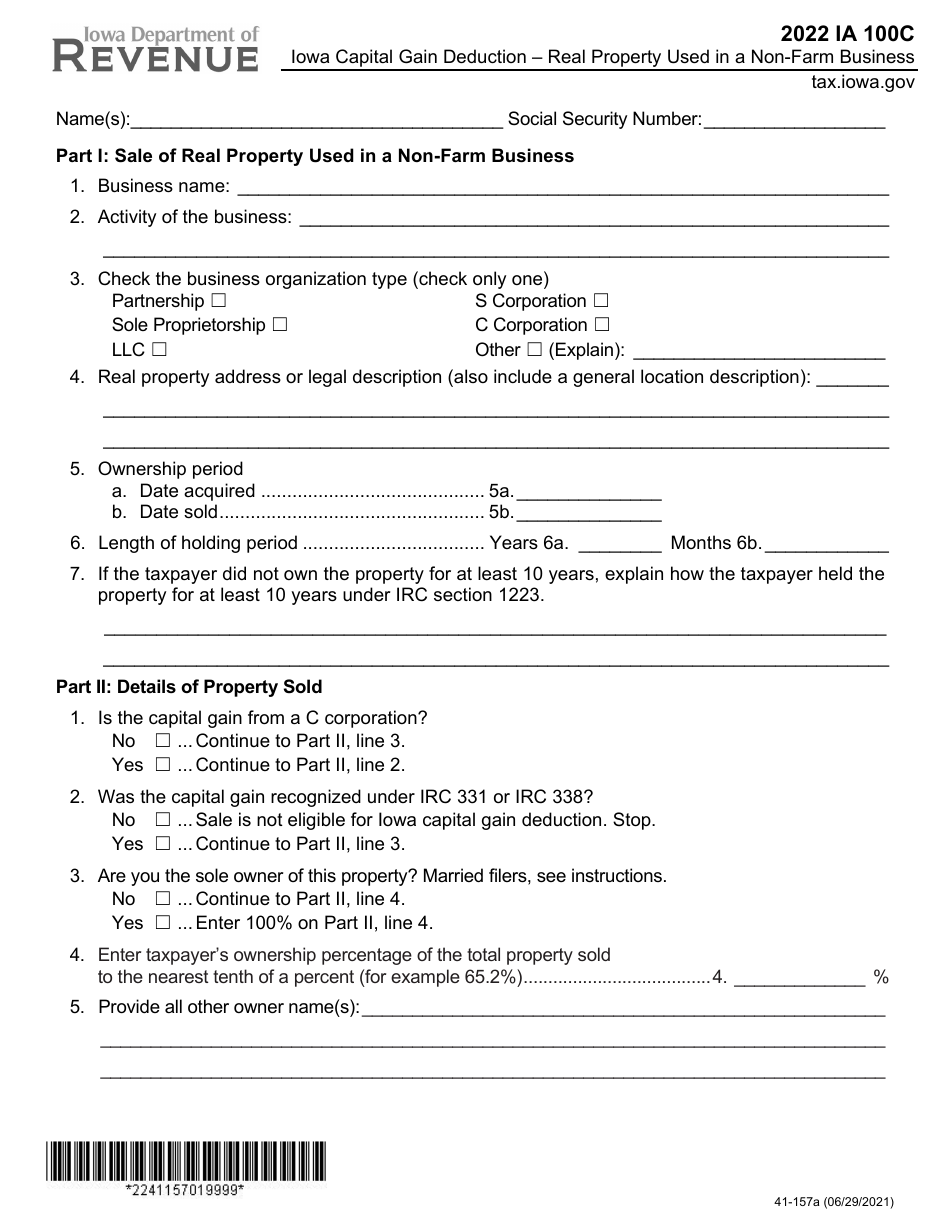

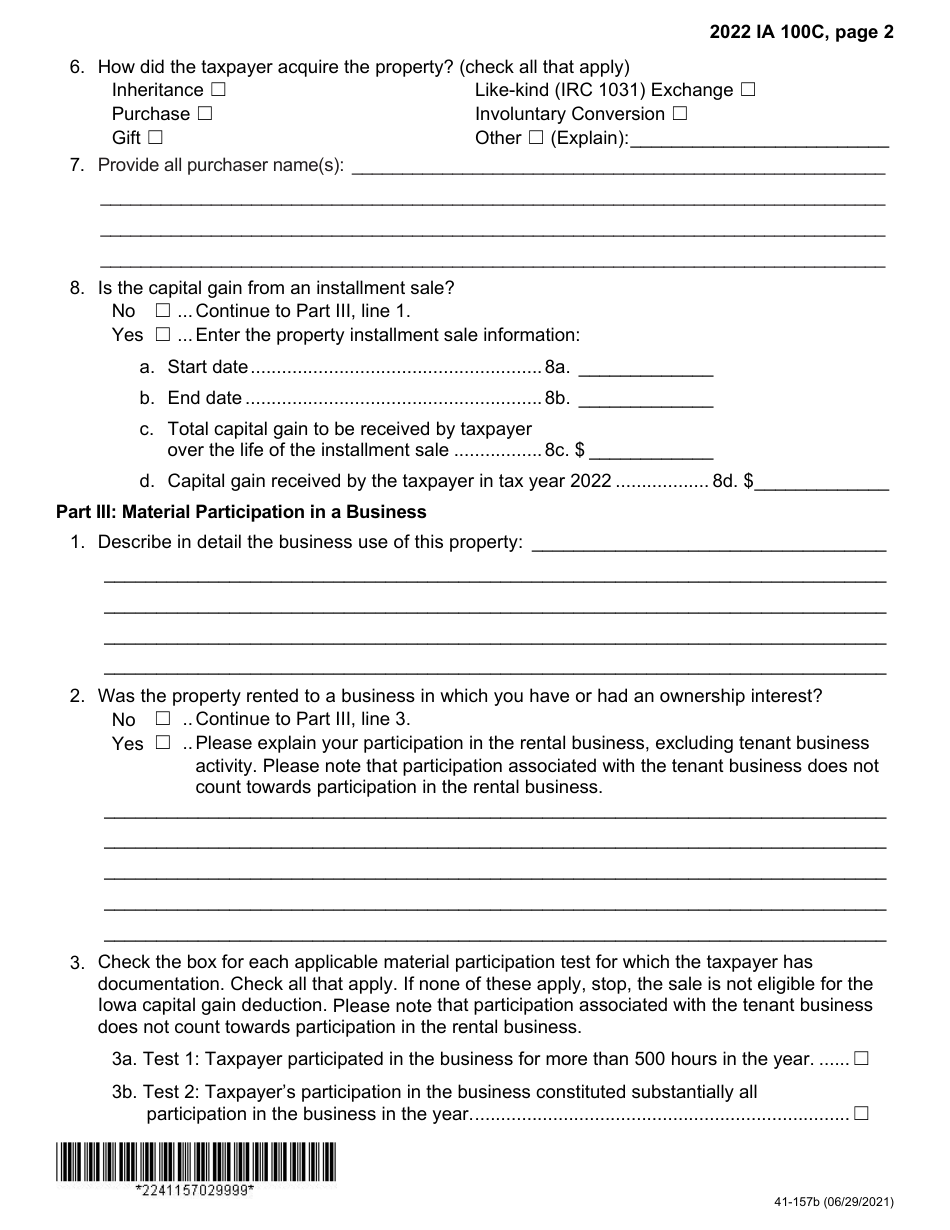

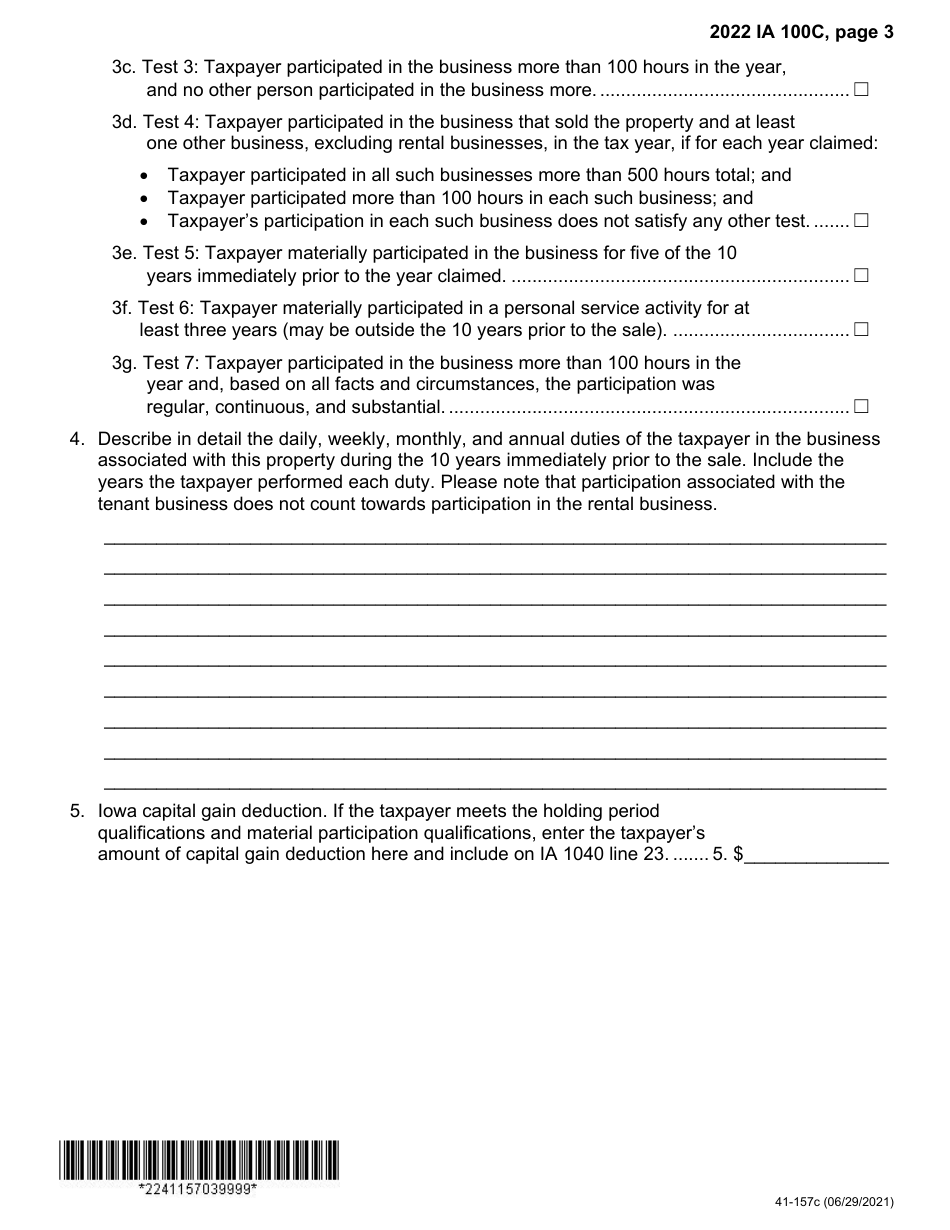

Form IA100C (41-157)

for the current year.

Form IA100C (41-157) Iowa Capital Gain Deduction - Real Property Used in a Non-farm Business - Iowa

What Is Form IA100C (41-157)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA100C?

A: Form IA100C is a tax form used in Iowa to claim the Capital Gain Deduction for Real Property Used in a Non-farm Business.

Q: What is the Capital Gain Deduction?

A: The Capital Gain Deduction allows taxpayers to reduce the amount of taxable income from the sale of real property used in a non-farm business.

Q: What is considered real property used in a non-farm business?

A: Real property used in a non-farm business refers to land, buildings, or structures that are used in a business other than farming.

Q: Who is eligible for the Capital Gain Deduction?

A: Individuals or businesses who sold real property used in a non-farm business in Iowa may be eligible for the Capital Gain Deduction.

Q: How can I claim the Capital Gain Deduction?

A: To claim the Capital Gain Deduction, you need to fill out Form IA100C and attach it to your Iowa state tax return.

Q: Is there a deadline to file Form IA100C?

A: Yes, Form IA100C must be filed by the deadline for your Iowa state tax return, which is usually April 30th.

Q: Are there any limitations or restrictions for the Capital Gain Deduction?

A: Yes, there are limitations and restrictions for the Capital Gain Deduction. It is recommended to consult the instructions for Form IA100C or a tax professional for more information.

Q: Can I claim the Capital Gain Deduction if the property was used for farming?

A: No, the Capital Gain Deduction is specifically for real property used in a non-farm business in Iowa. For property used for farming, there may be other deductions or exemptions available.

Q: What should I do if I have more questions about Form IA100C?

A: If you have more questions about Form IA100C or the Capital Gain Deduction, it is best to contact the Iowa Department of Revenue or consult a tax professional.

Form Details:

- Released on December 9, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA100C (41-157) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.