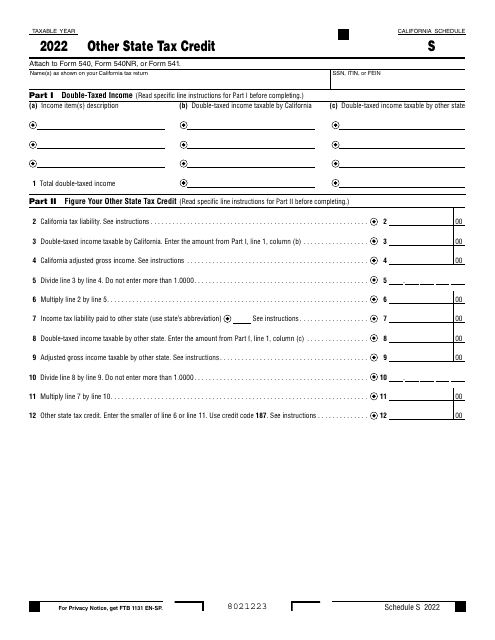

Form 540 Schedule S Other State Tax Credit - California

What Is Form 540 Schedule S?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California.The document is a supplement to Form 540, California Resident Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 540 Schedule S?

A: Form 540 Schedule S is a tax form used by California residents to claim the Other StateTax Credit.

Q: What does the Other State Tax Credit refer to?

A: The Other State Tax Credit refers to the credit given to California residents for income taxes paid to another state.

Q: Who is eligible to use Form 540 Schedule S?

A: California residents who have paid income taxes to another state are eligible to use Form 540 Schedule S.

Q: Why would someone need to claim the Other State Tax Credit?

A: Someone would need to claim the Other State Tax Credit to avoid being taxed twice on the same income by both California and another state.

Q: Are there any limitations or restrictions to claiming the Other State Tax Credit?

A: Yes, there are limitations and restrictions to claiming the Other State Tax Credit. The amount of credit you can claim is generally limited to the lesser of the amount of tax you paid to the other state or the amount of California tax on the same income. Additionally, certain types of income may not qualify for the credit.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 540 Schedule S by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.