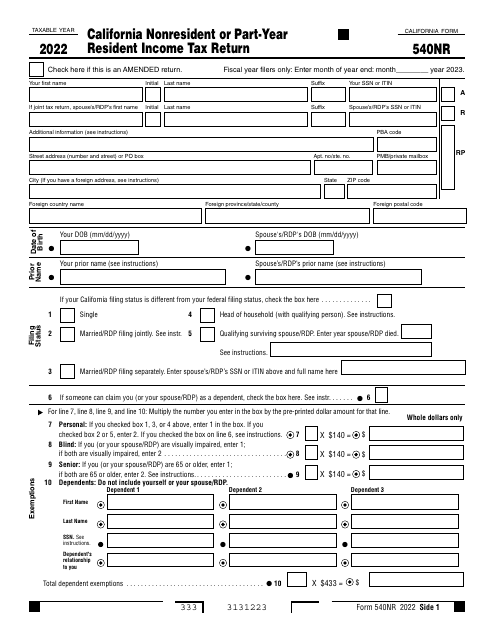

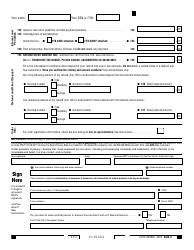

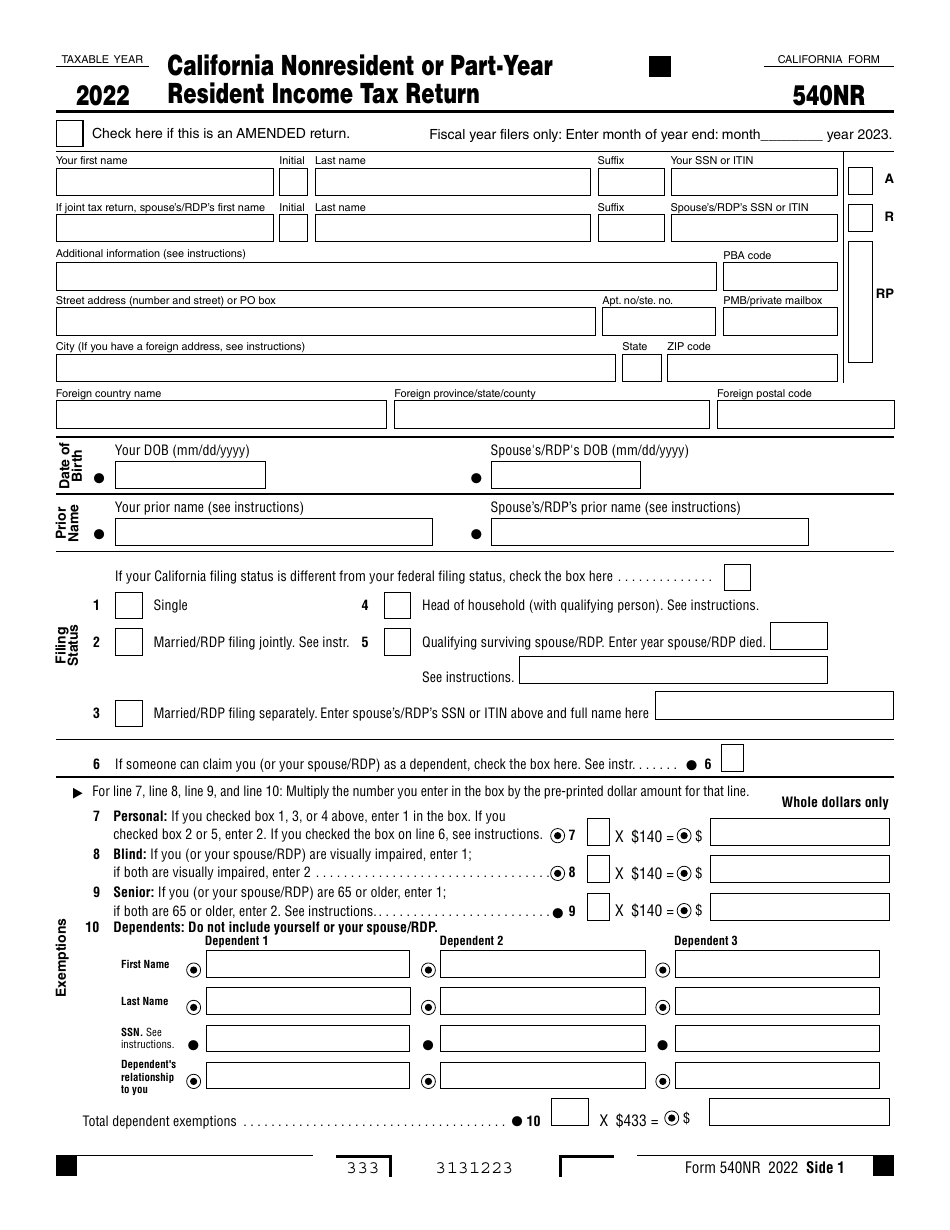

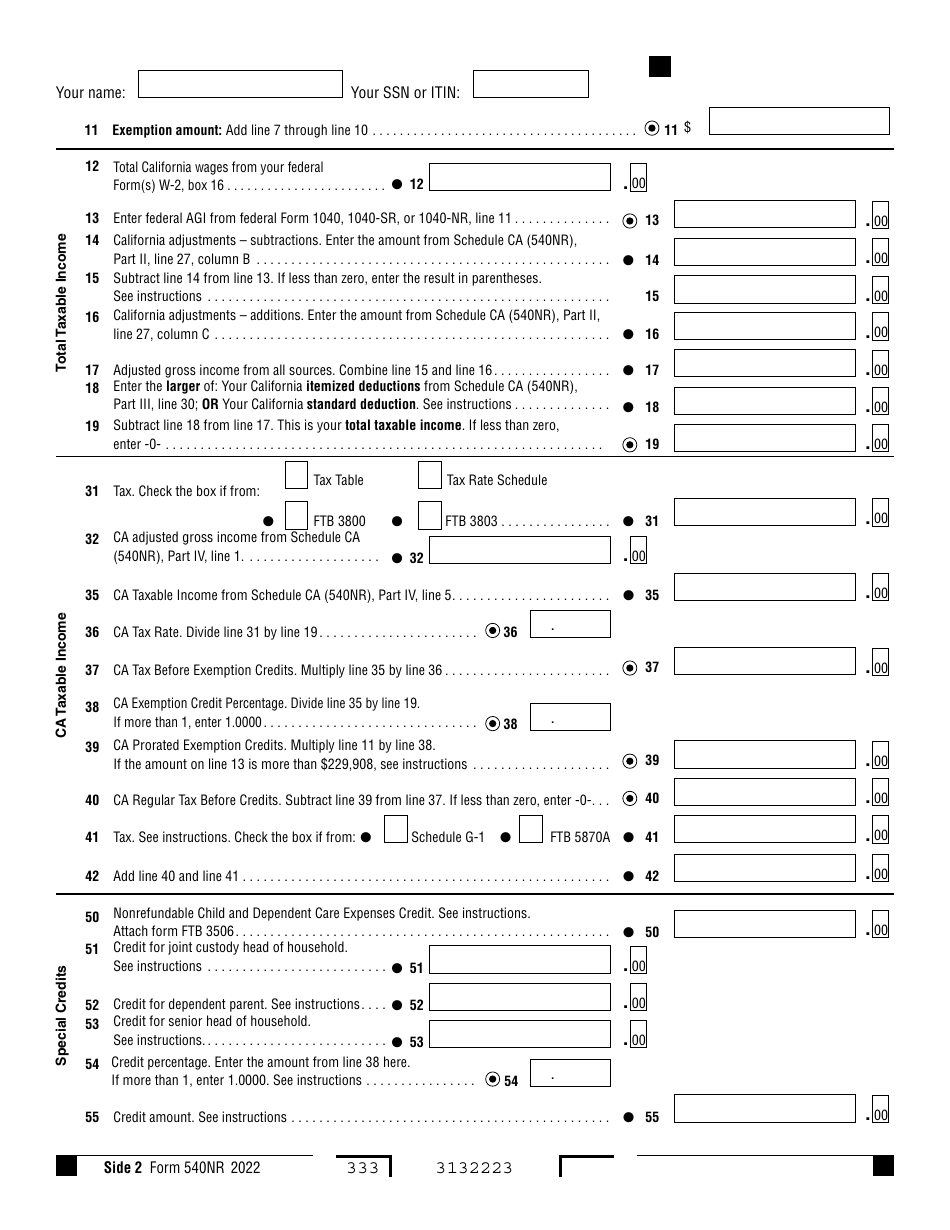

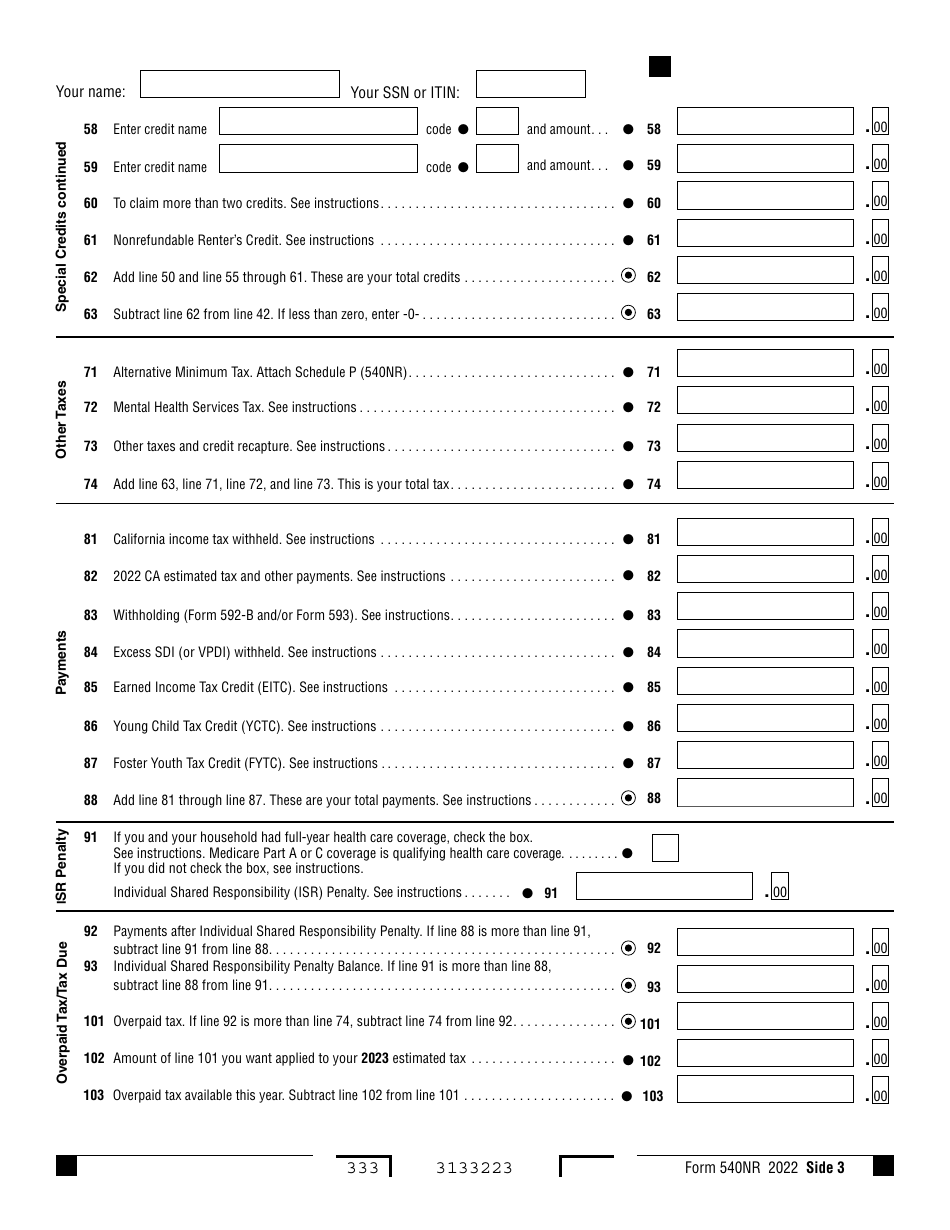

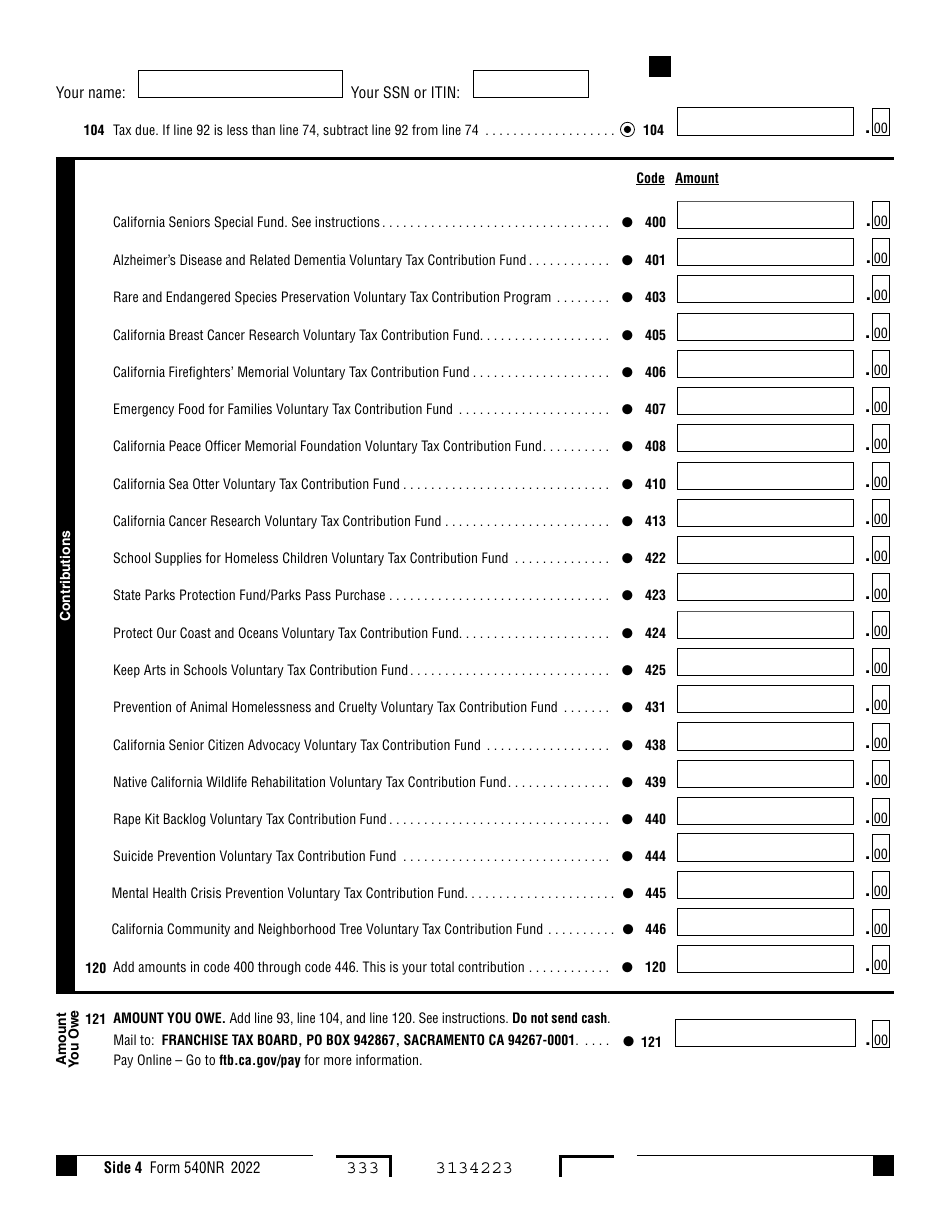

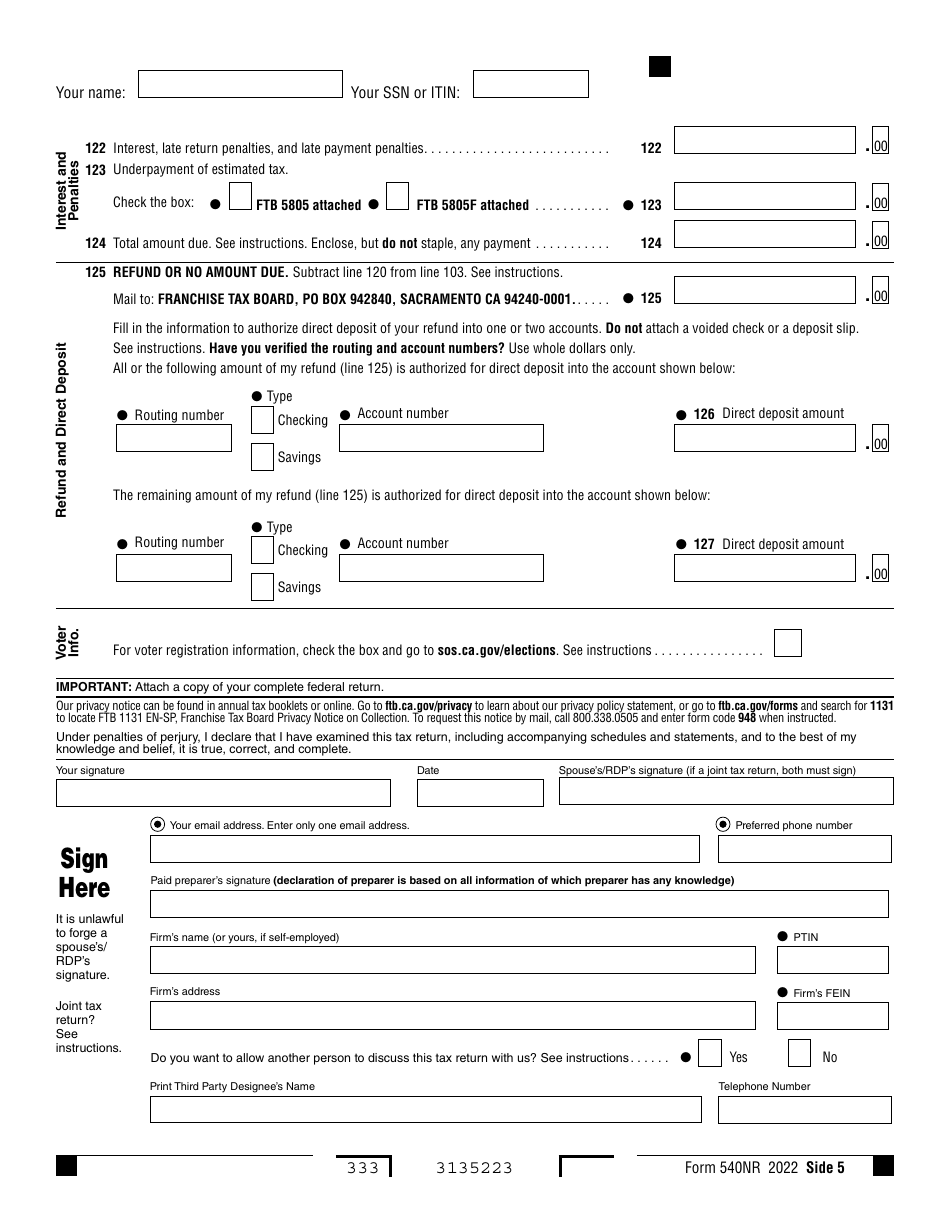

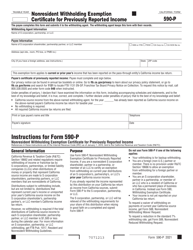

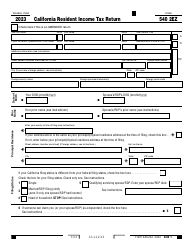

Form 540NR California Nonresident or Part-Year Resident Income Tax Return - California

What Is Form 540NR?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 540NR?

A: Form 540NR is the California Nonresident or Part-Year Resident Income Tax Return.

Q: Who should file Form 540NR?

A: Form 540NR should be filed by individuals who are nonresidents of California or part-year residents with income from California sources.

Q: What is the purpose of Form 540NR?

A: The purpose of Form 540NR is to report and calculate the income tax liability for nonresidents or part-year residents of California.

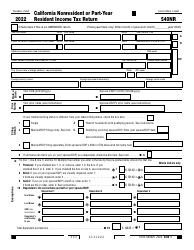

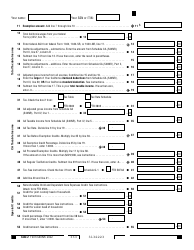

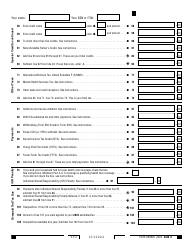

Q: What information is required on Form 540NR?

A: Form 540NR requires information about the taxpayer's income, deductions, exemptions, and credits.

Q: When is the deadline to file Form 540NR?

A: The deadline to file Form 540NR is generally on or before April 15th, following the end of the tax year.

Q: Are there any extensions available for filing Form 540NR?

A: Yes, individuals can request an extension to file Form 540NR, which will typically provide an additional six months.

Q: Is Form 540NR only for California residents?

A: No, Form 540NR is specifically for nonresidents of California or part-year residents with income from California sources.

Q: Can Form 540NR be filed electronically?

A: Yes, Form 540NR can be filed electronically using the California Franchise Tax Board's e-file system or through approved tax software.

Q: What if I made a mistake on my Form 540NR?

A: If you made a mistake on your Form 540NR, you can file an amended return using Form 540X to correct the error.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 540NR by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.