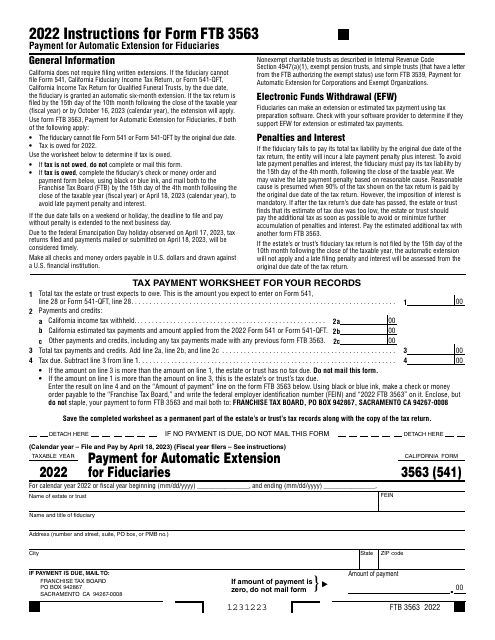

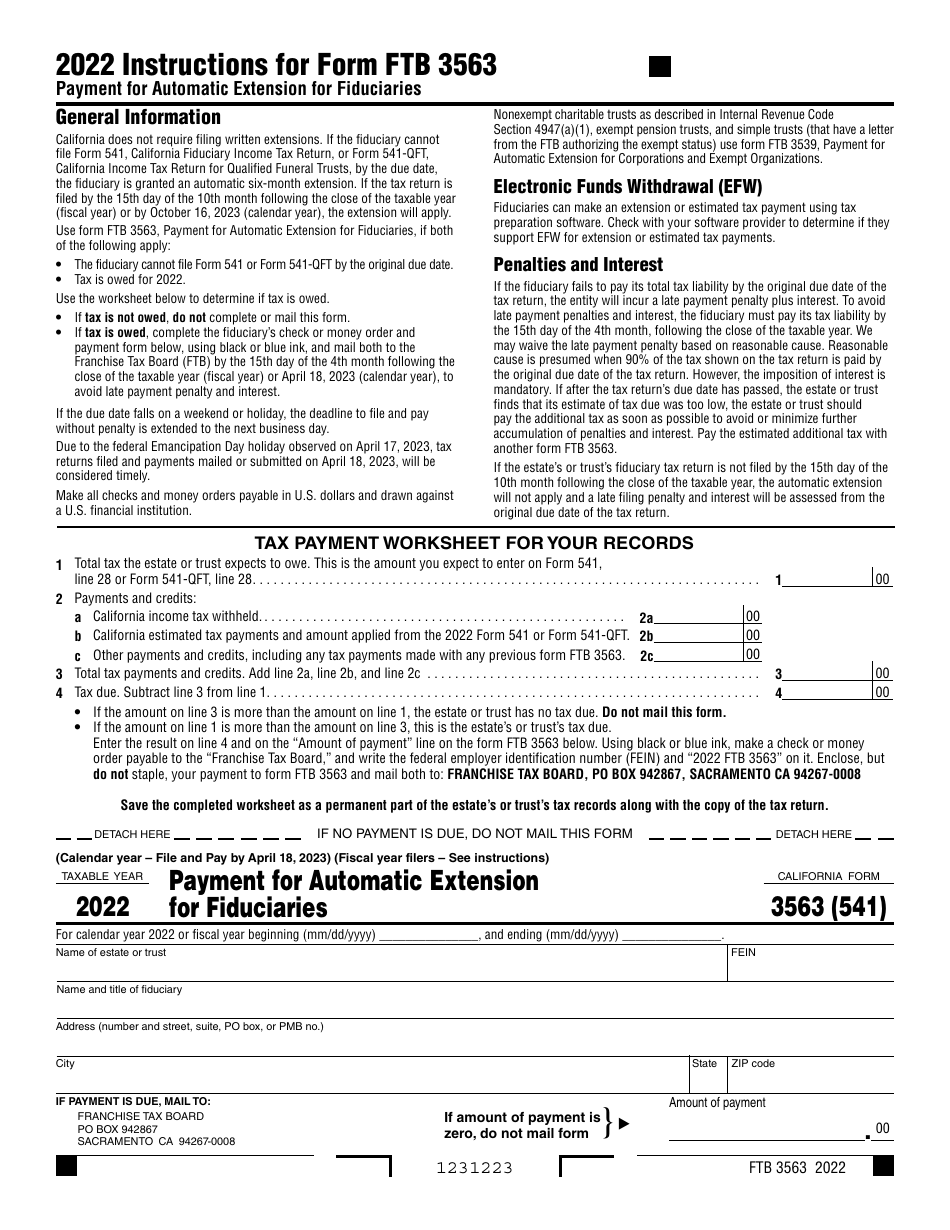

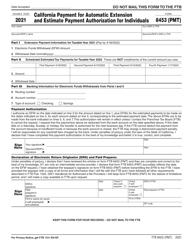

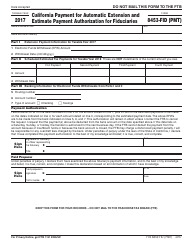

Form FTB3563 (541) Payment for Automatic Extension for Fiduciaries - California

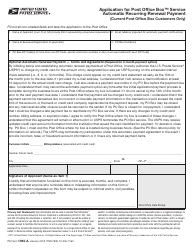

What Is Form FTB3563 (541)?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3563 (541)?

A: Form FTB3563 (541) is the California Payment for Automatic Extension for Fiduciaries.

Q: Who needs to file Form FTB3563 (541)?

A: Form FTB3563 (541) needs to be filed by fiduciaries who want to request an automatic extension for filing their California tax returns.

Q: What is the purpose of filing Form FTB3563 (541)?

A: The purpose of filing Form FTB3563 (541) is to request an automatic extension of time to file the fiduciary tax return in California.

Q: When is the deadline for filing Form FTB3563 (541)?

A: The deadline for filing Form FTB3563 (541) is the same as the deadline for filing the fiduciary tax return in California, which is generally on or before April 15th.

Q: Is there a fee for filing Form FTB3563 (541)?

A: No, there is no fee for filing Form FTB3563 (541). However, any tax due must be paid by the original due date to avoid penalties and interest.

Q: Can I e-file Form FTB3563 (541)?

A: Yes, you can e-file Form FTB3563 (541) if you are using an approved tax software or through a tax professional.

Q: What should I do after filing Form FTB3563 (541)?

A: After filing Form FTB3563 (541), make sure to pay any remaining tax due by the extended due date to avoid penalties and interest.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3563 (541) by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.