This version of the form is not currently in use and is provided for reference only. Download this version of

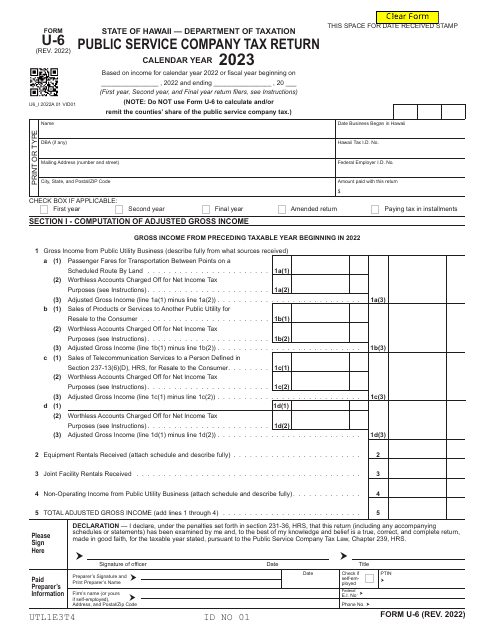

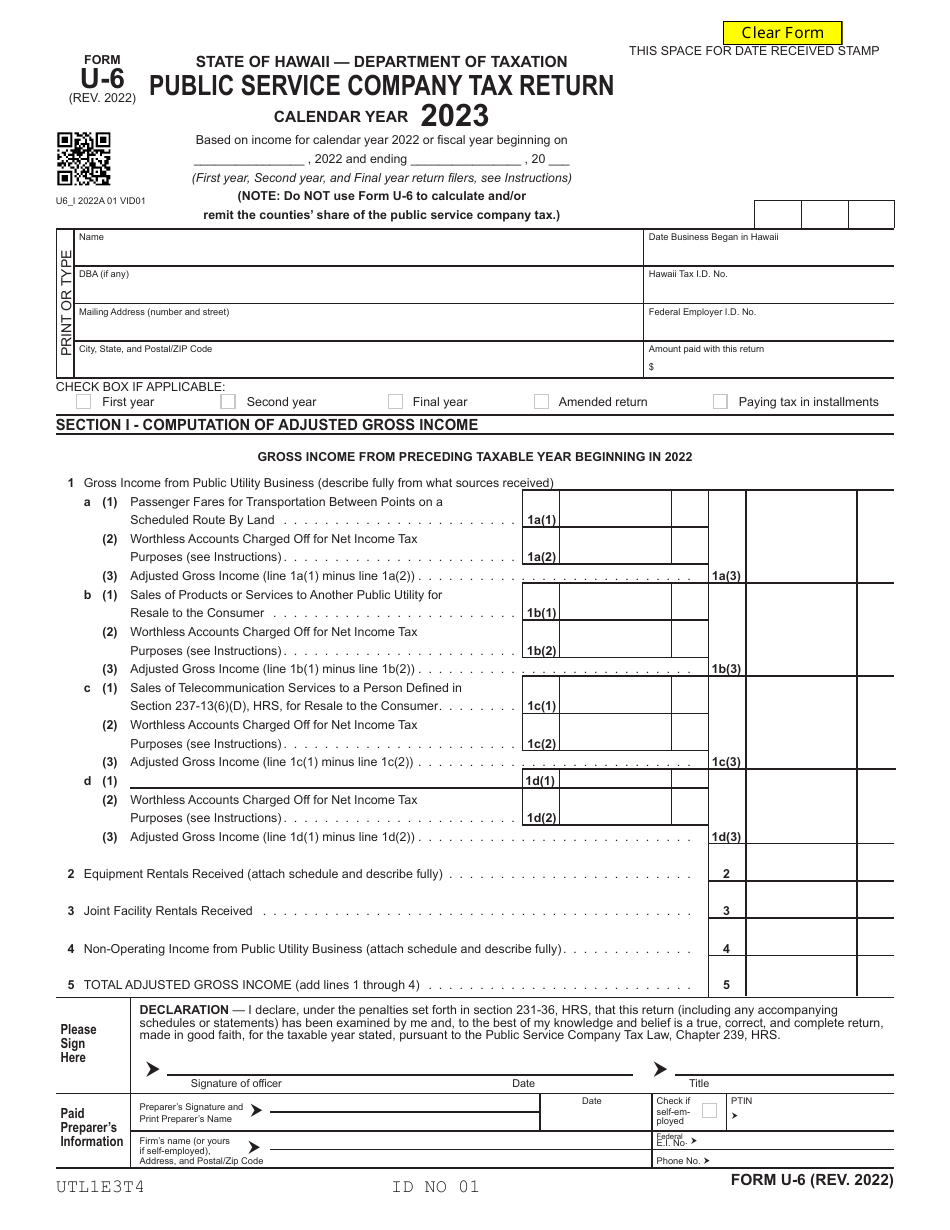

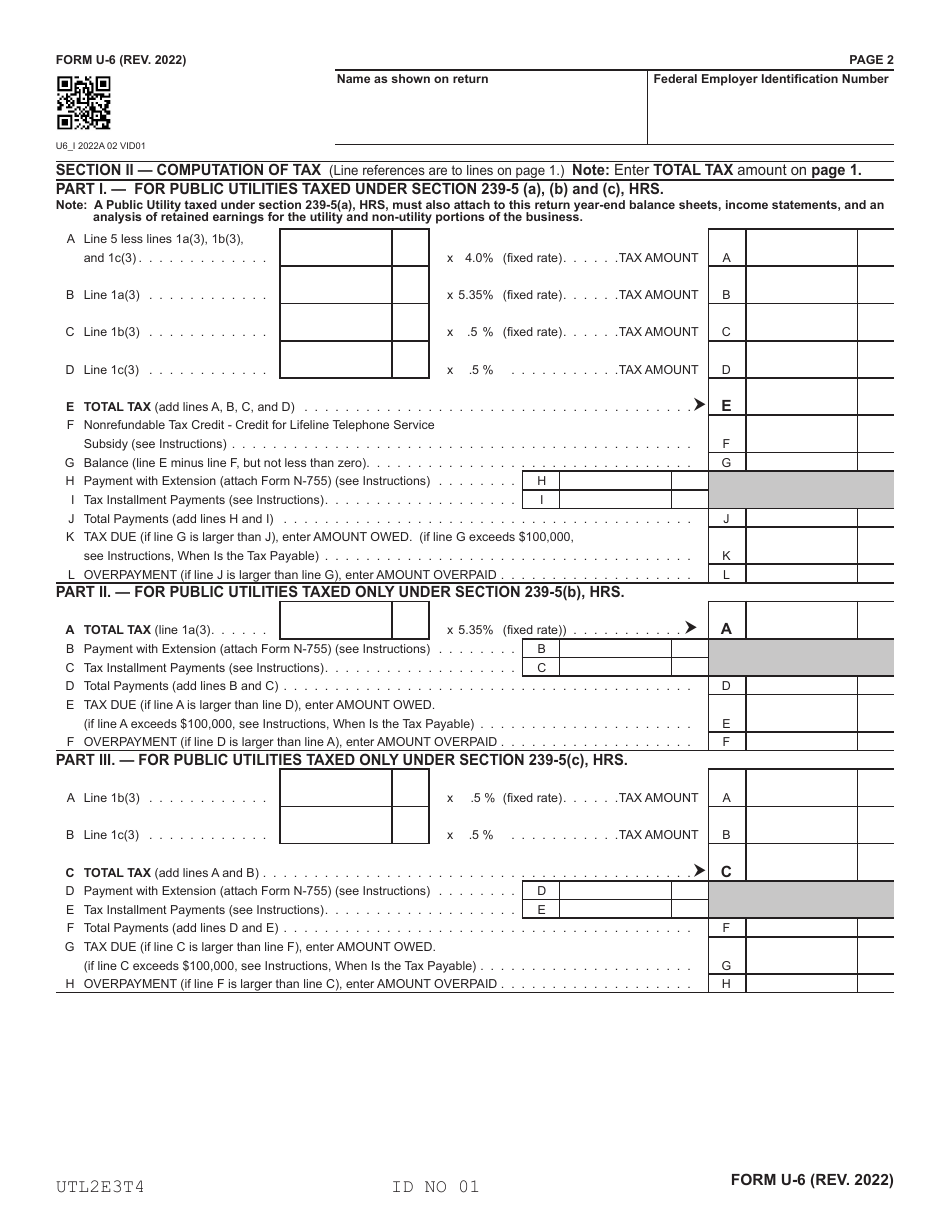

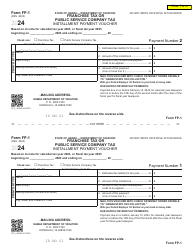

Form U-6

for the current year.

Form U-6 Public Service Company Tax Return - Hawaii

What Is Form U-6?

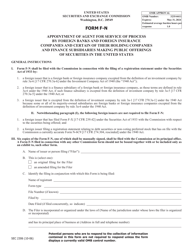

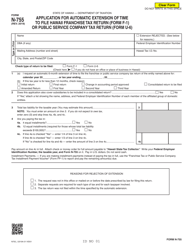

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form U-6?

A: Form U-6 is the Public Service Company Tax Return for Hawaii.

Q: Who needs to file Form U-6?

A: Public service companies in Hawaii are required to file Form U-6.

Q: What is a public service company?

A: A public service company is a business that provides essential services like electricity, water, or telecommunications.

Q: What is the purpose of Form U-6?

A: Form U-6 is used to report and calculate the tax liability of public service companies in Hawaii.

Q: When is the deadline to file Form U-6?

A: The deadline to file Form U-6 is determined by the Hawaii Department of Taxation and may vary each year.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing of Form U-6. It is important to submit the form on time to avoid penalties.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form U-6 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.