This version of the form is not currently in use and is provided for reference only. Download this version of

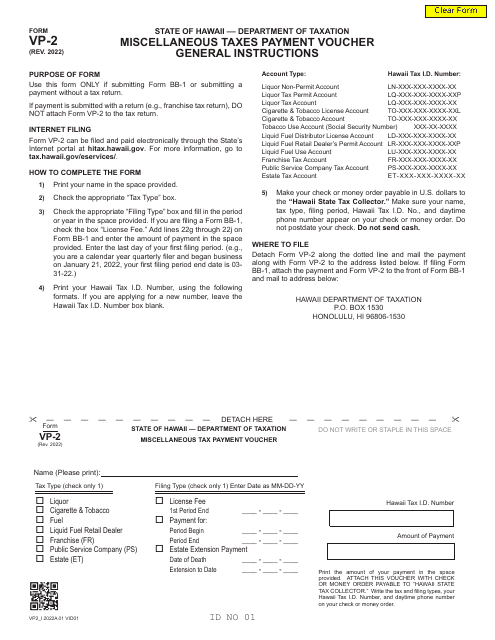

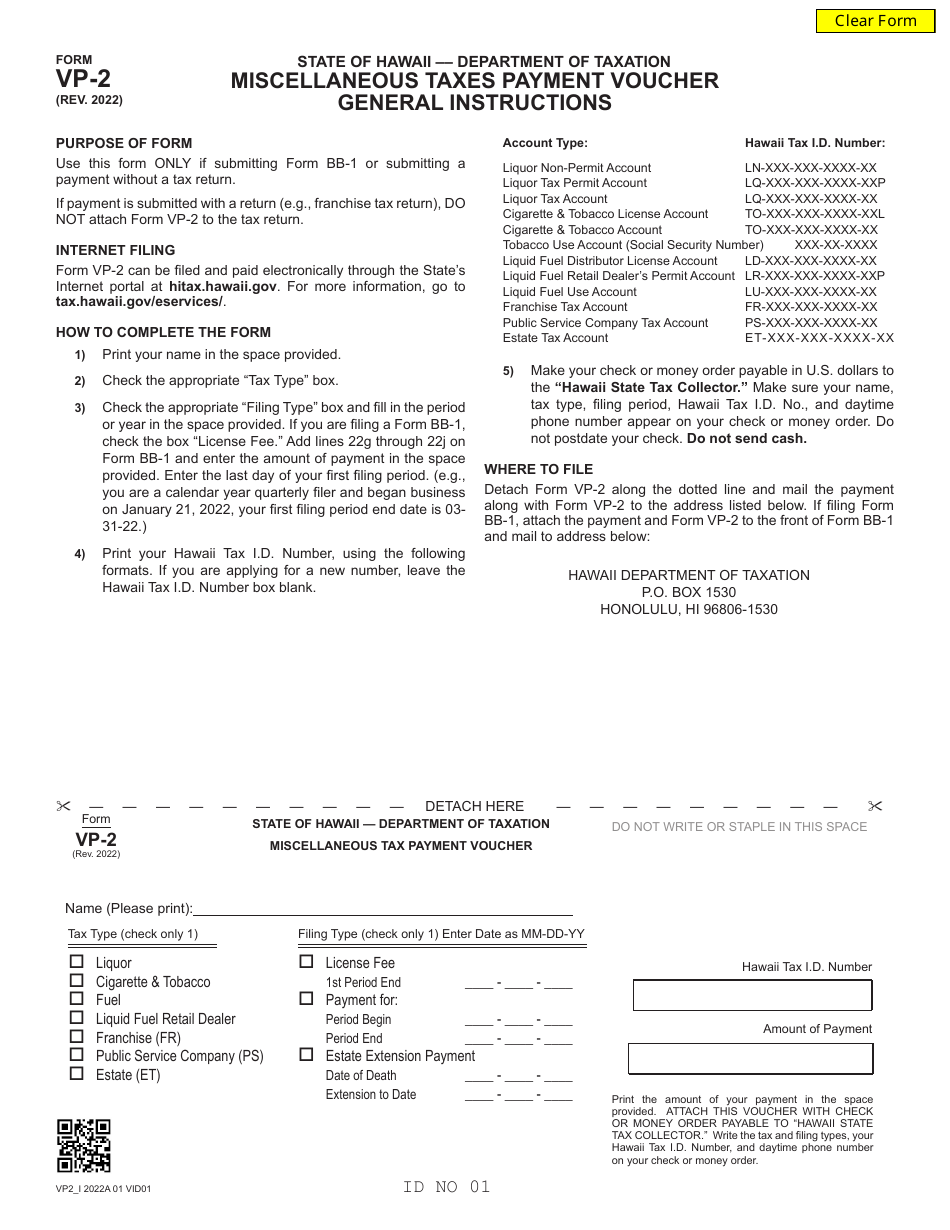

Form VP-2

for the current year.

Form VP-2 Miscellaneous Tax Payment Voucher - Hawaii

What Is Form VP-2?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form VP-2?

A: Form VP-2 is a Miscellaneous Tax Payment Voucher used in Hawaii.

Q: What is the purpose of Form VP-2?

A: Form VP-2 is used to make miscellaneous tax payments to the state of Hawaii.

Q: Who needs to file Form VP-2?

A: Anyone who needs to make a miscellaneous tax payment to the state of Hawaii needs to file Form VP-2.

Q: What types of taxes can be paid with Form VP-2?

A: Form VP-2 can be used to pay various types of taxes, such as individual income tax, corporate income tax, and general excise tax.

Q: When is Form VP-2 due?

A: The due date for Form VP-2 varies depending on the type of tax being paid. It is important to check the instructions for the specific tax to determine the deadline.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VP-2 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.