This version of the form is not currently in use and is provided for reference only. Download this version of

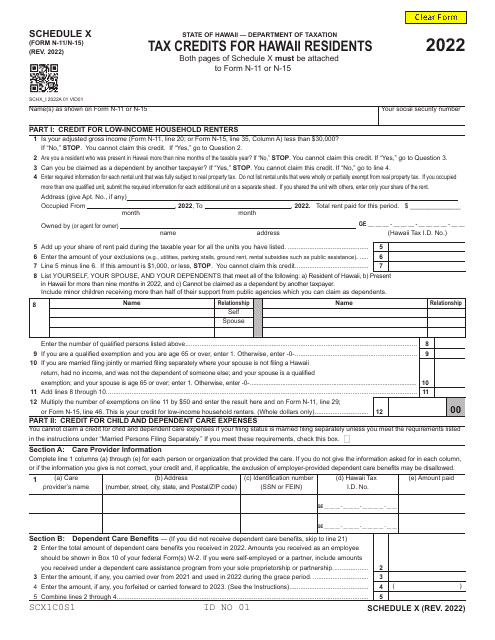

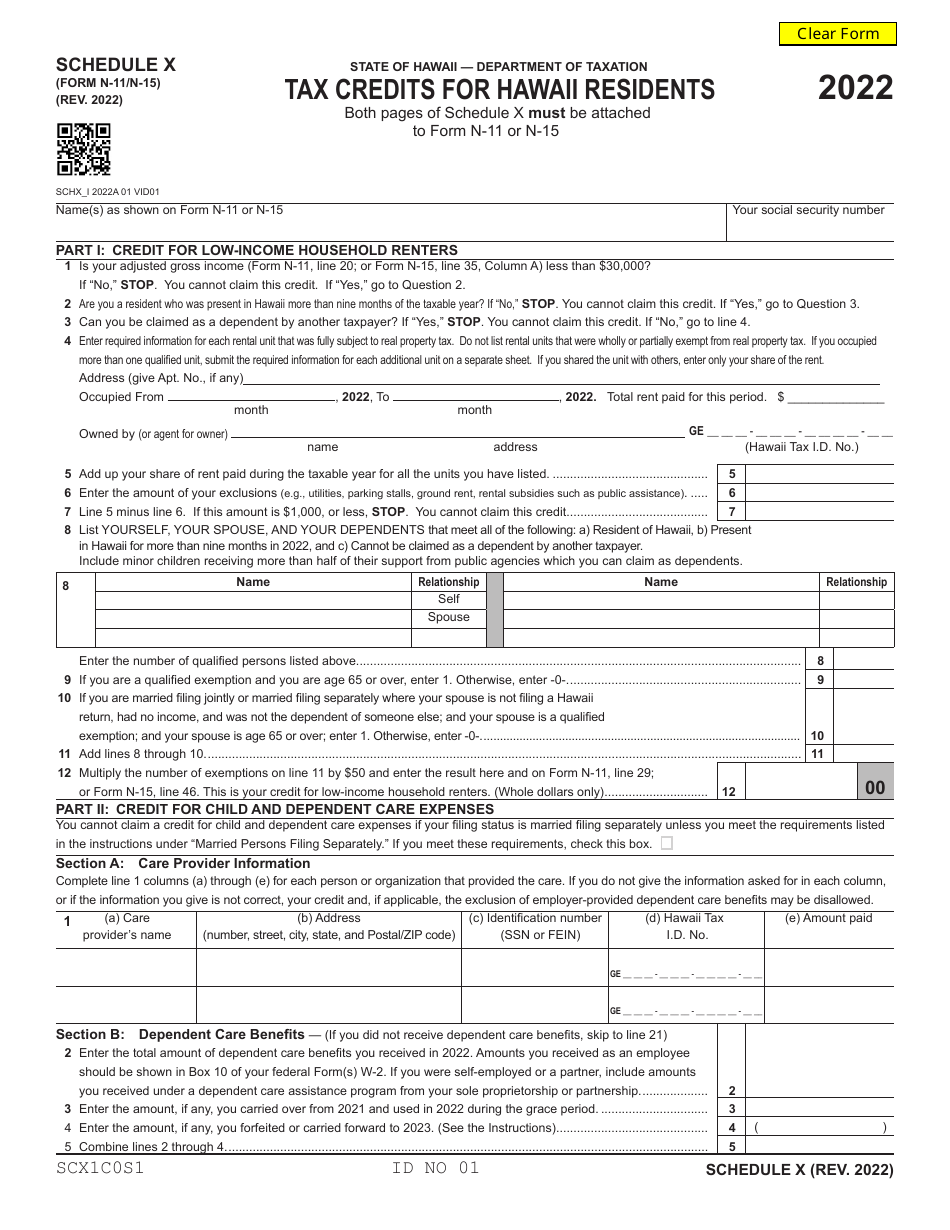

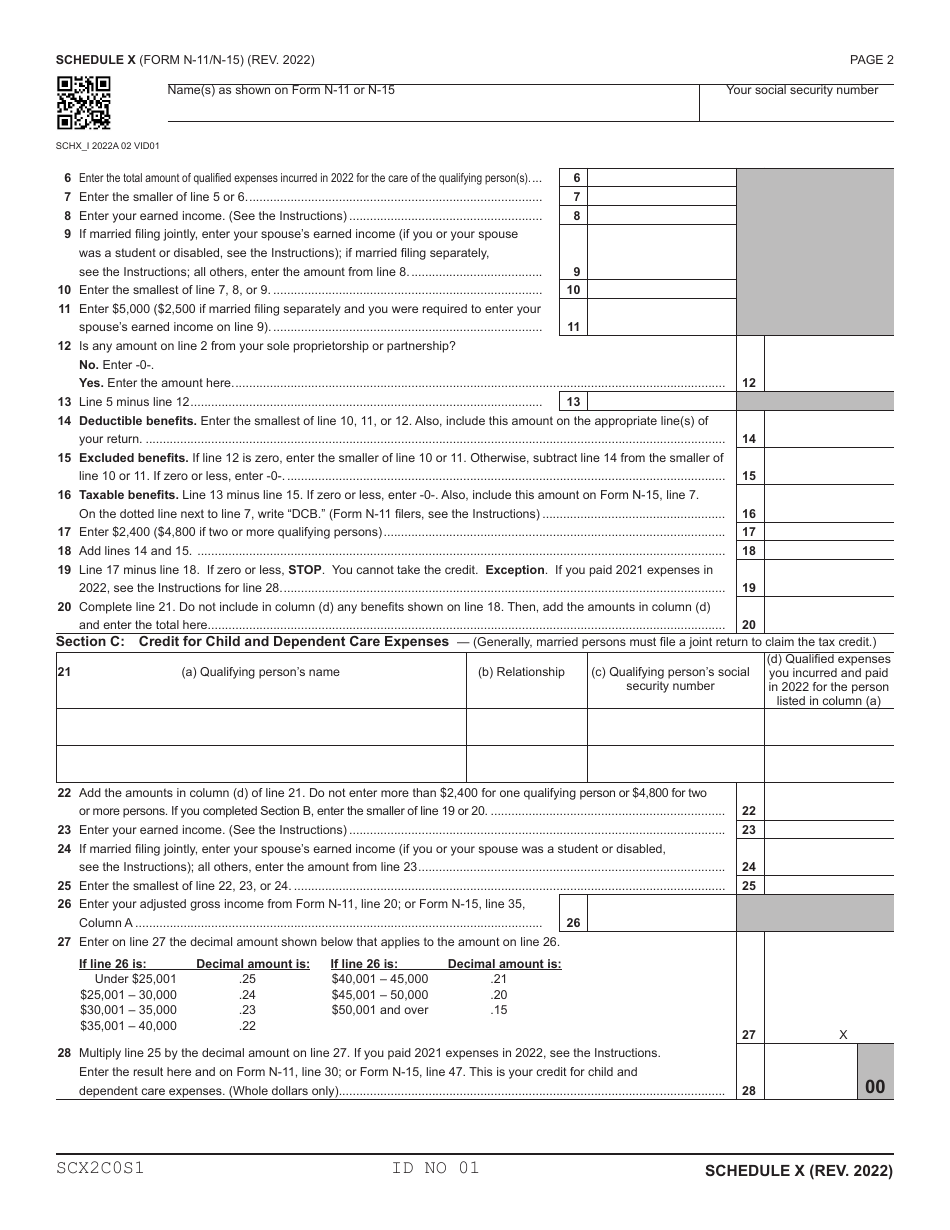

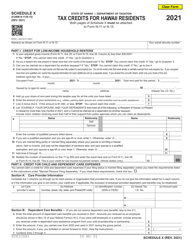

Form N-11 (N-15) Schedule X

for the current year.

Form N-11 (N-15) Schedule X Tax Credits for Hawaii Residents - Hawaii

What Is Form N-11 (N-15) Schedule X?

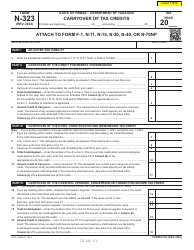

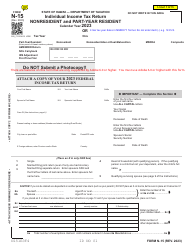

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii.The document is a supplement to Form N-15, Individual Income Tax Return - Nonresident and Part-Year Resident. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-11 (N-15) Schedule X?

A: Form N-11 (N-15) Schedule X is a tax form specifically for Hawaii residents.

Q: What is a tax credit?

A: A tax credit is a reduction in the amount of tax owed.

Q: What are the tax credits available for Hawaii residents?

A: The tax credits available for Hawaii residents can be found on Form N-11 (N-15) Schedule X.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-11 (N-15) Schedule X by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.