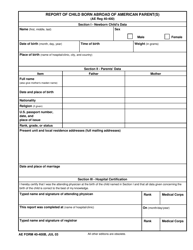

This version of the form is not currently in use and is provided for reference only. Download this version of

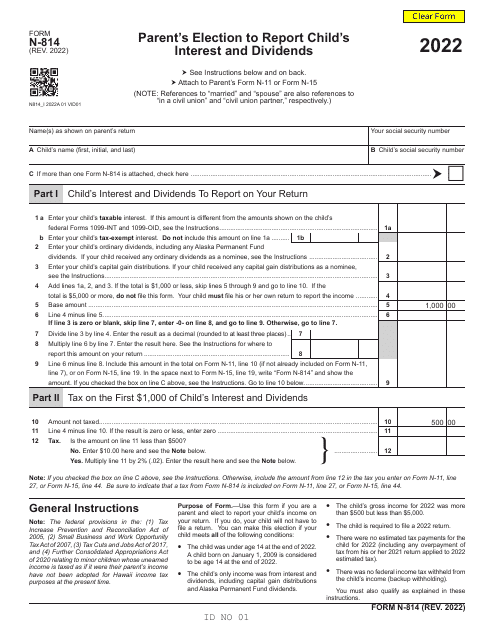

Form N-814

for the current year.

Form N-814 Parent's Election to Report Child's Interest and Dividends - Hawaii

What Is Form N-814?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-814?

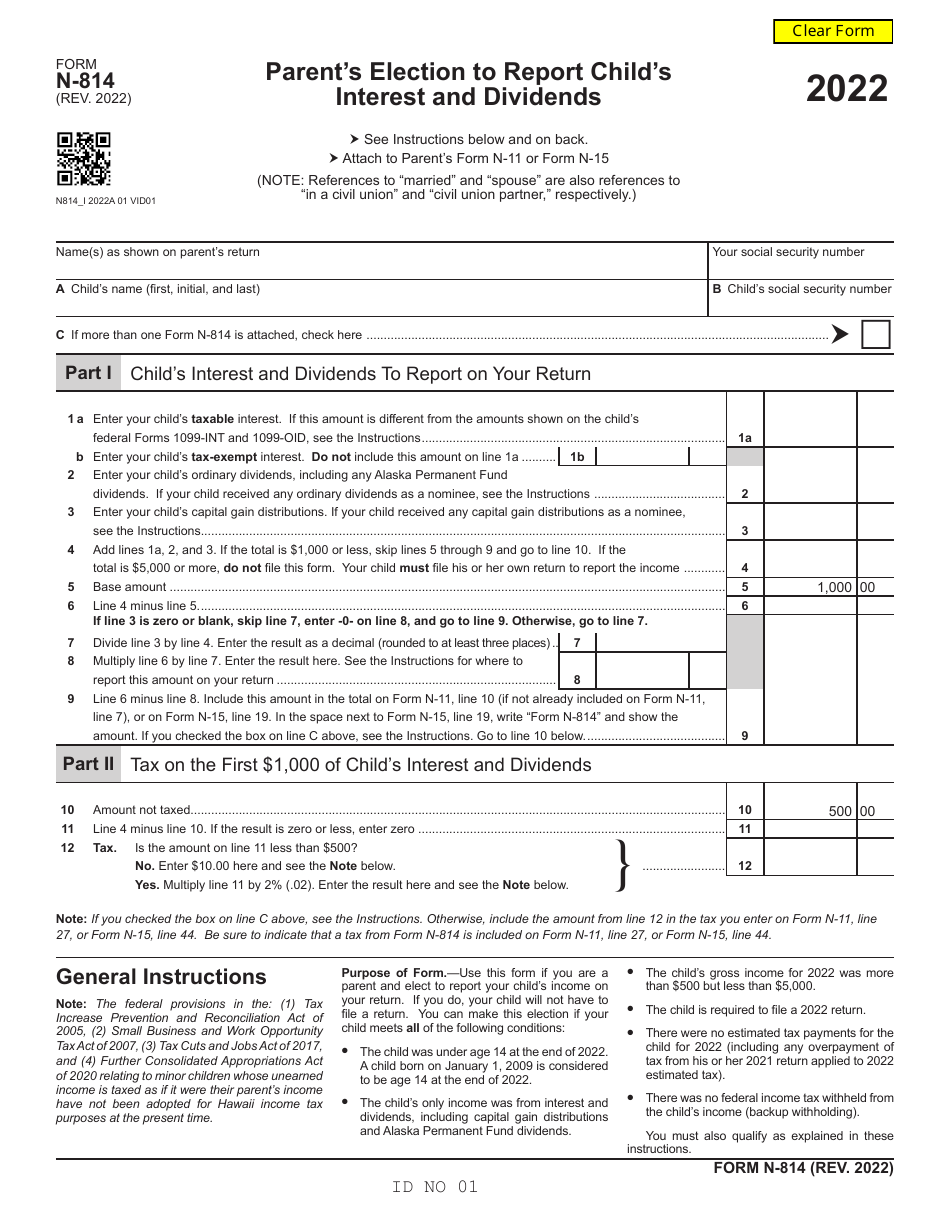

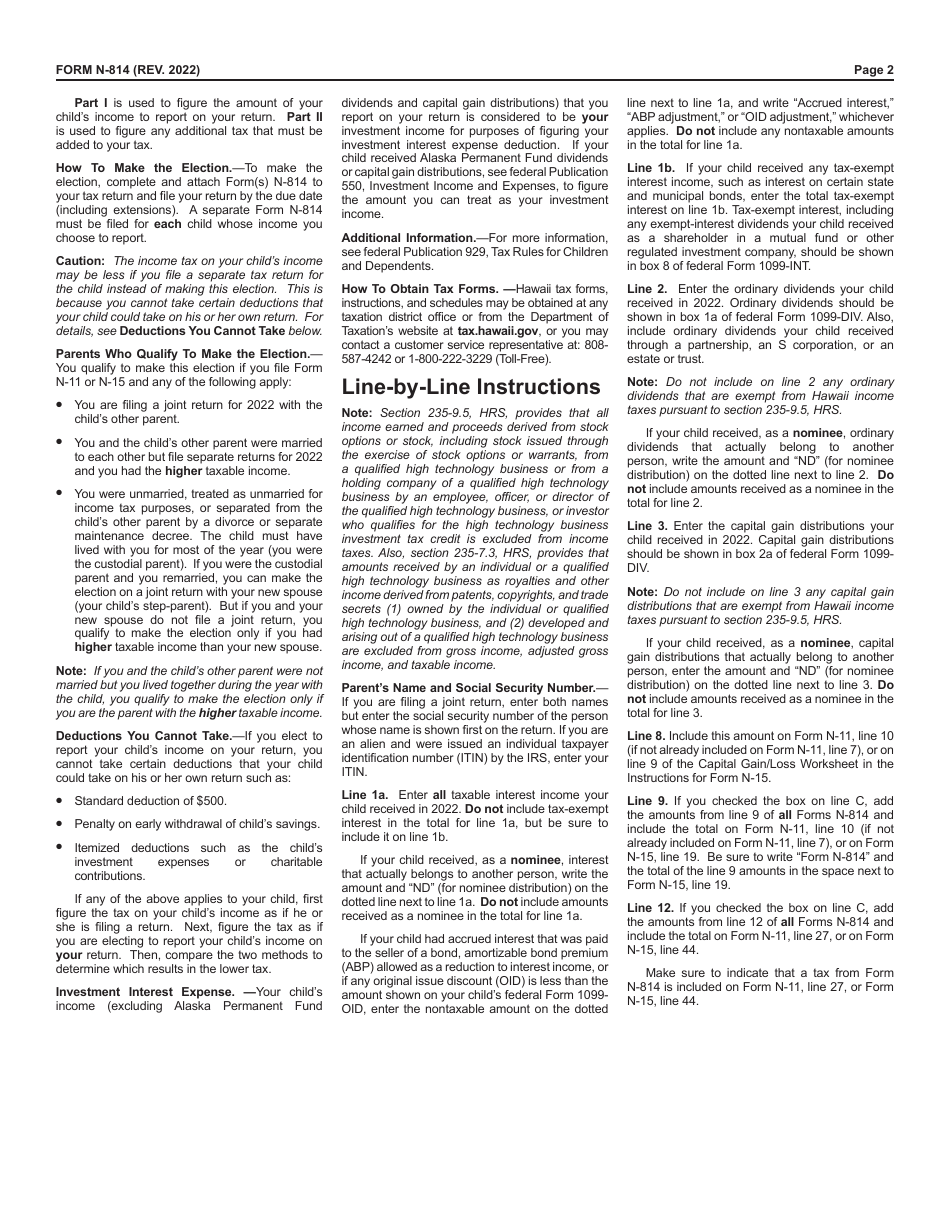

A: Form N-814 is a document used by parents in Hawaii to report their child's interest and dividends on their income tax return.

Q: Who should file Form N-814?

A: Parents in Hawaii should file Form N-814 if they want to report their child's interest and dividends on their own income tax return.

Q: What is the purpose of filing Form N-814?

A: The purpose of filing Form N-814 is to allow parents in Hawaii to include their child's interest and dividends on their own income tax return, instead of the child filing a separate return.

Q: When is Form N-814 due?

A: Form N-814 is due on the same date as your income tax return, which is typically April 20th in Hawaii.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-814 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.