This version of the form is not currently in use and is provided for reference only. Download this version of

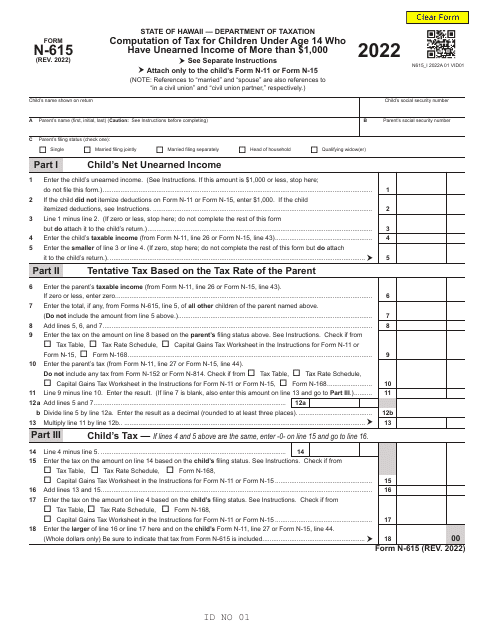

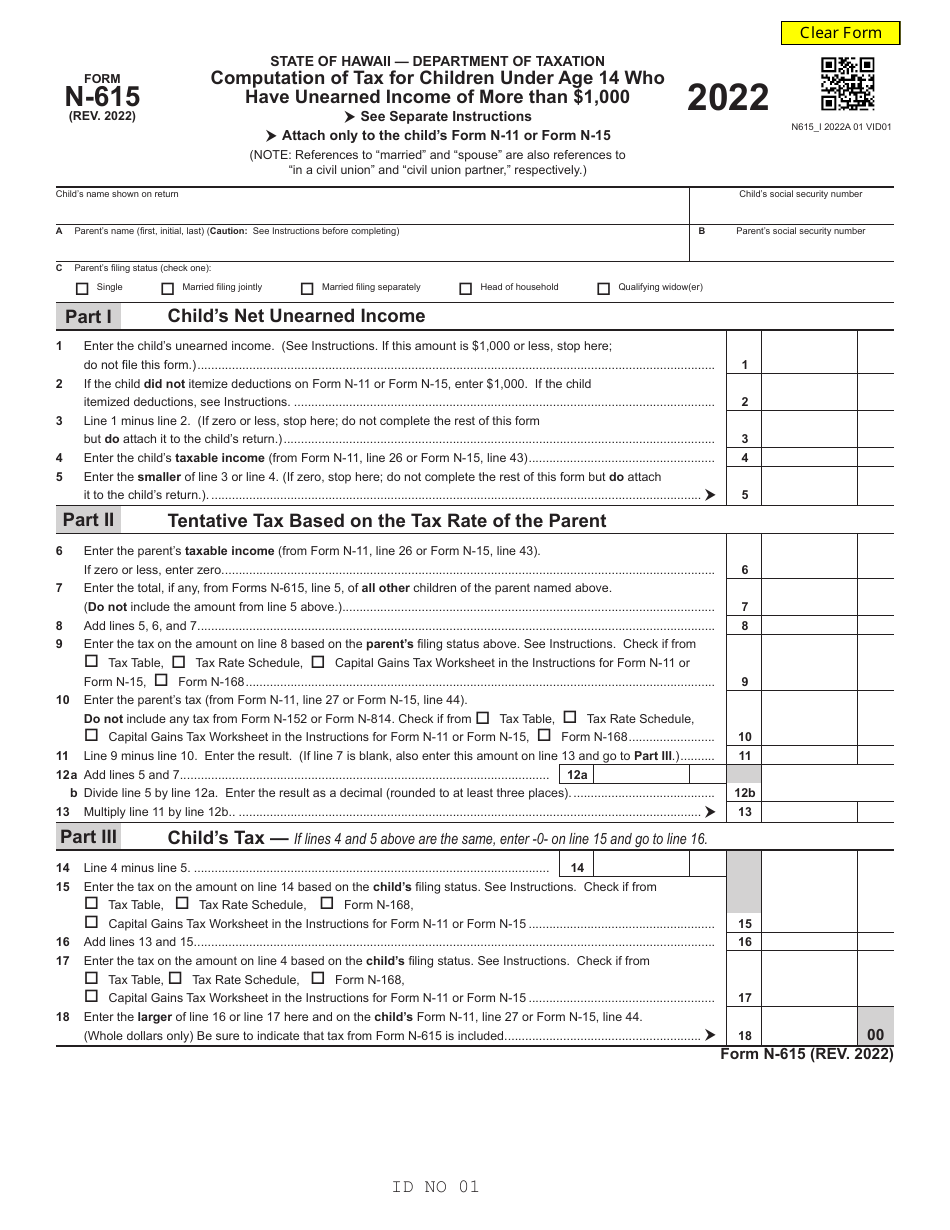

Form N-615

for the current year.

Form N-615 Computation of Tax for Children Under Age 14 Who Have Unearned Income of More Than $1,000 - Hawaii

What Is Form N-615?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-615?

A: Form N-615 is used to compute the tax for children under age 14 who have unearned income of more than $1,000 in Hawaii.

Q: Who needs to fill out Form N-615?

A: Children under age 14 who have unearned income of more than $1,000 in Hawaii need to fill out Form N-615.

Q: What is considered unearned income?

A: Unearned income includes dividends, interest, and capital gains from investments.

Q: How is the tax computed for children under age 14 with unearned income?

A: The tax is computed based on the child's unearned income and the applicable tax rates for Hawaii.

Q: Is there a threshold for when Form N-615 needs to be filled out?

A: Yes, Form N-615 needs to be filled out if the child has unearned income of more than $1,000.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-615 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.