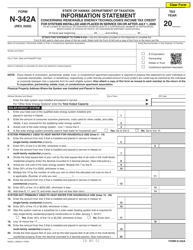

This version of the form is not currently in use and is provided for reference only. Download this version of

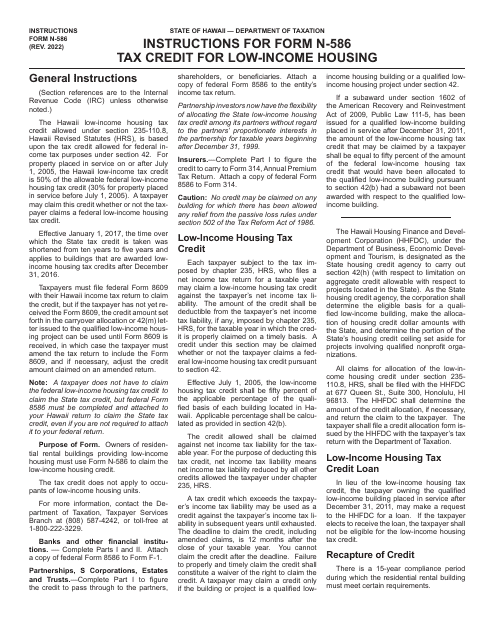

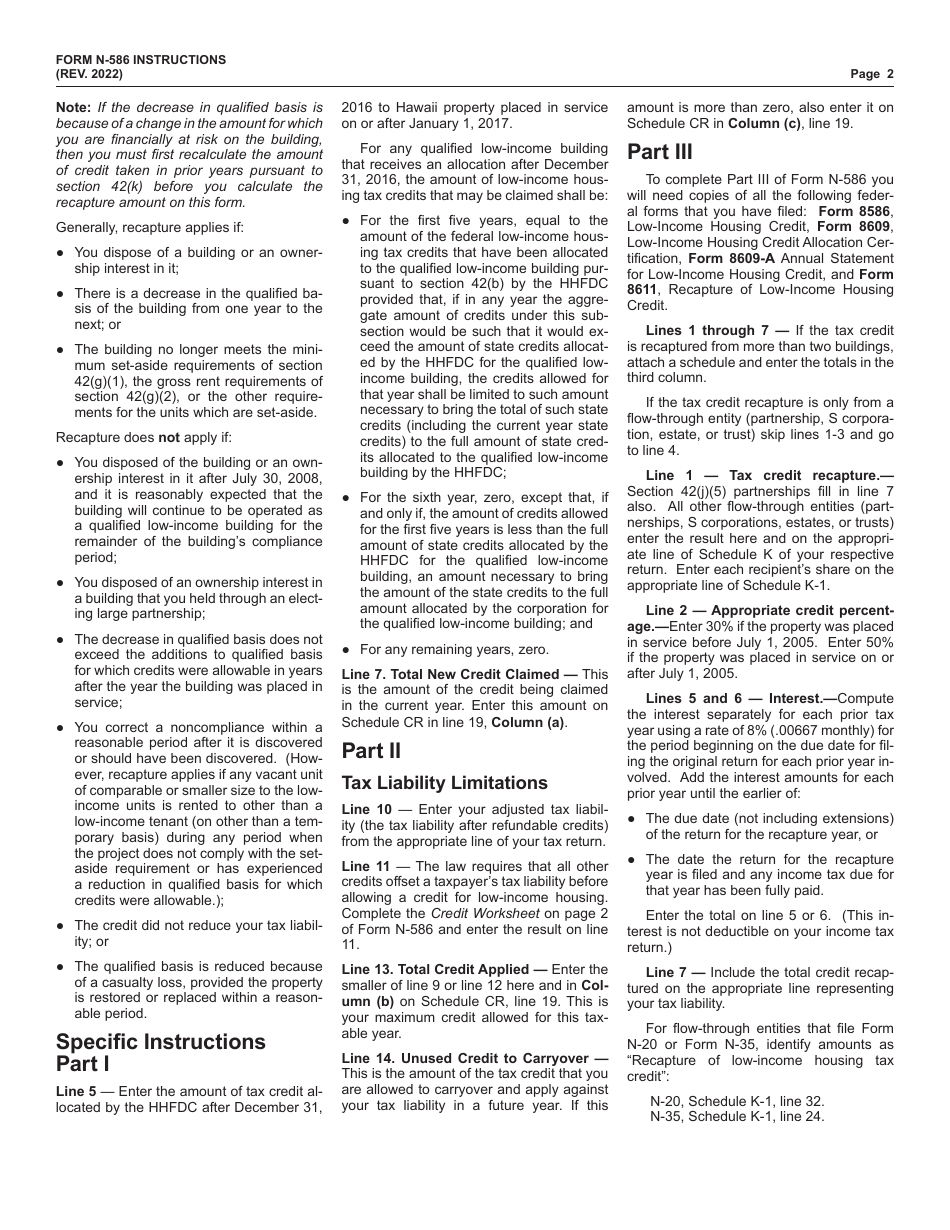

Instructions for Form N-586

for the current year.

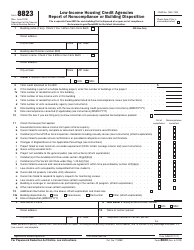

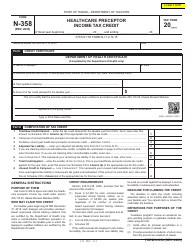

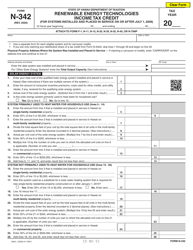

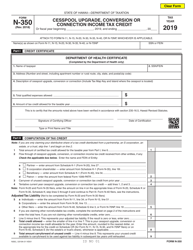

Instructions for Form N-586 Tax Credit for Low-Income Housing - Hawaii

This document contains official instructions for Form N-586 , Tax Credit for Low-Income Housing - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form N-586 is available for download through this link.

FAQ

Q: What is Form N-586?

A: Form N-586 is a tax form used by individuals in Hawaii to claim the Low-Income Housing Tax Credit.

Q: Who can use Form N-586?

A: Form N-586 can be used by individuals in Hawaii who meet the eligibility requirements for the Low-Income Housing Tax Credit.

Q: What is the Low-Income Housing Tax Credit?

A: The Low-Income Housing Tax Credit is a tax credit available to individuals who invest in low-income housing projects.

Q: How do I qualify for the Low-Income Housing Tax Credit?

A: To qualify for the Low-Income Housing Tax Credit, you must meet certain income and residency requirements set by the state of Hawaii.

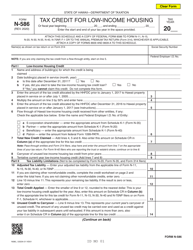

Q: What information do I need to complete Form N-586?

A: To complete Form N-586, you will need information about the low-income housing project in which you invested, as well as your own personal information.

Q: When is the deadline to file Form N-586?

A: The deadline to file Form N-586 is usually April 20th of the following year.

Q: What happens after I file Form N-586?

A: After you file Form N-586, the Hawaii Department of Taxation will review your application and determine if you are eligible for the Low-Income Housing Tax Credit.

Q: Are there any other tax credits available in Hawaii?

A: Yes, Hawaii offers other tax credits such as the Solar Energy Tax Credit and the Renewable Energy Technologies Tax Credit.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.