This version of the form is not currently in use and is provided for reference only. Download this version of

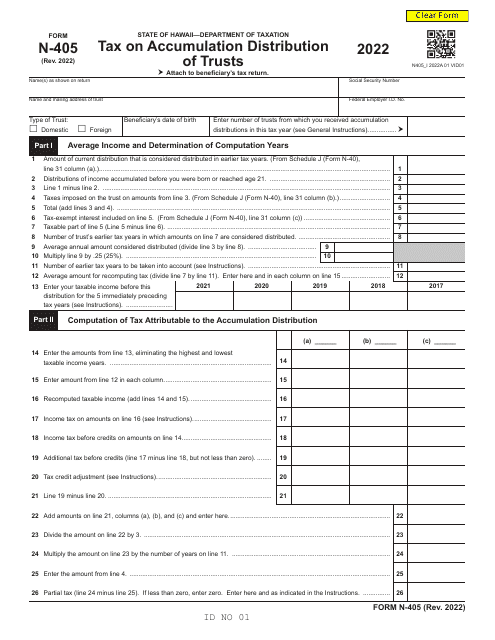

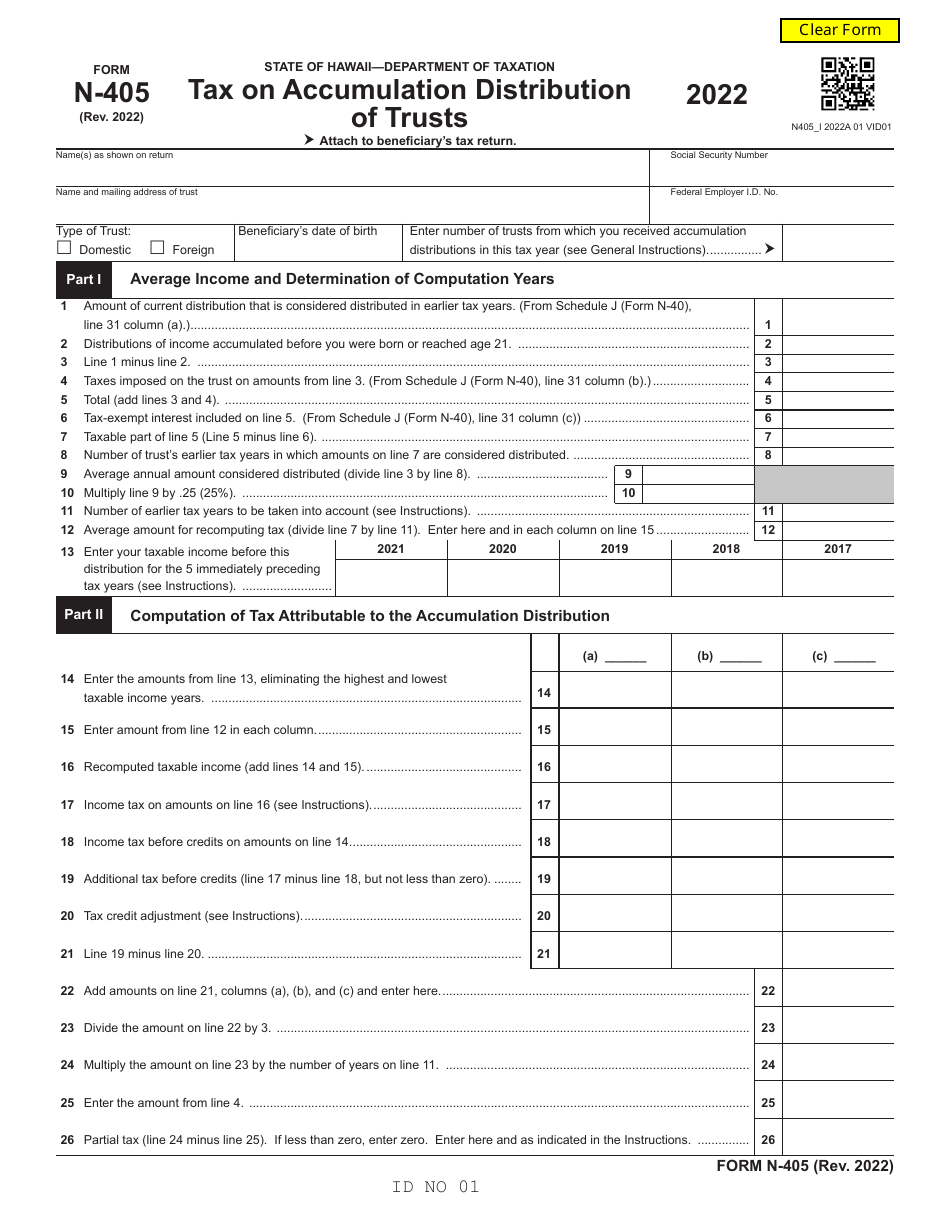

Form N-405

for the current year.

Form N-405 Tax on Accumulation Distribution of Trusts - Hawaii

What Is Form N-405?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-405?

A: Form N-405 is a tax form used in Hawaii to report the accumulation distribution of trusts.

Q: What is an accumulation distribution?

A: An accumulation distribution occurs when a trust distributes money that has been accumulated or held onto rather than distributed to beneficiaries.

Q: Who needs to file Form N-405?

A: Trusts in Hawaii that had an accumulation distribution during the tax year need to file Form N-405.

Q: When is Form N-405 due?

A: Form N-405 is due on the 20th day of the 4th month following the close of the tax year.

Q: Are there any penalties for not filing Form N-405?

A: Yes, there are penalties for not filing Form N-405, including late filing penalties and interest on any unpaid taxes.

Q: Can I e-file Form N-405?

A: As of now, Form N-405 cannot be e-filed. It must be filed by mail or in person.

Q: What information do I need to complete Form N-405?

A: To complete Form N-405, you will need information about the accumulation distribution, such as the amount distributed and the relevant tax year.

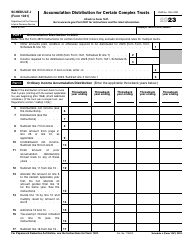

Q: Do I need to attach any documents to Form N-405?

A: Yes, you will need to attach a copy of federal Form 4970 to Form N-405.

Q: Can I request an extension to file Form N-405?

A: Yes, you can request an extension to file Form N-405 by filing Form N-101A with the Hawaii Department of Taxation.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-405 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.