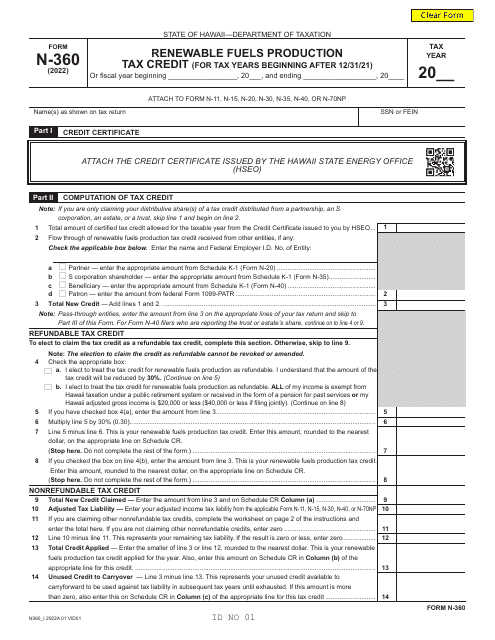

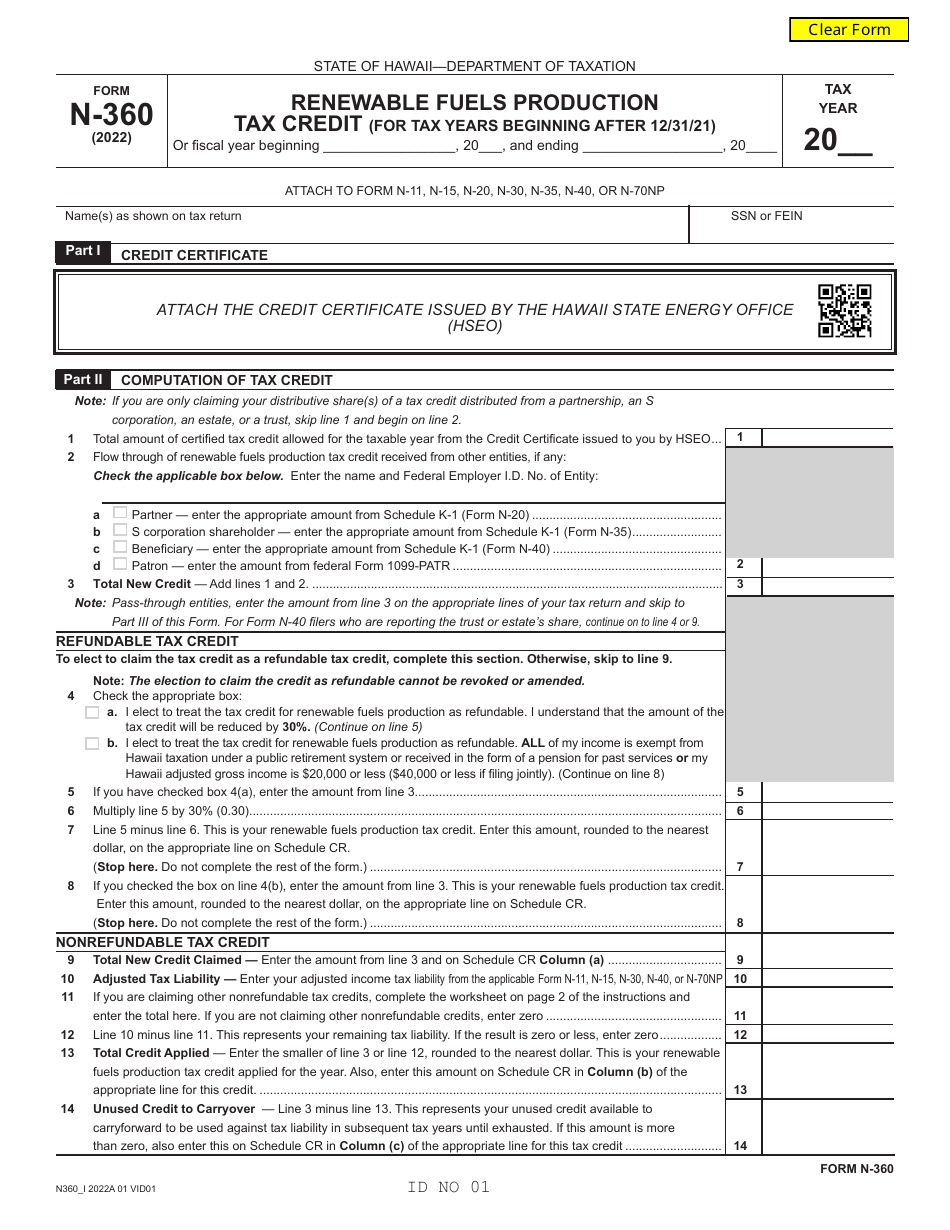

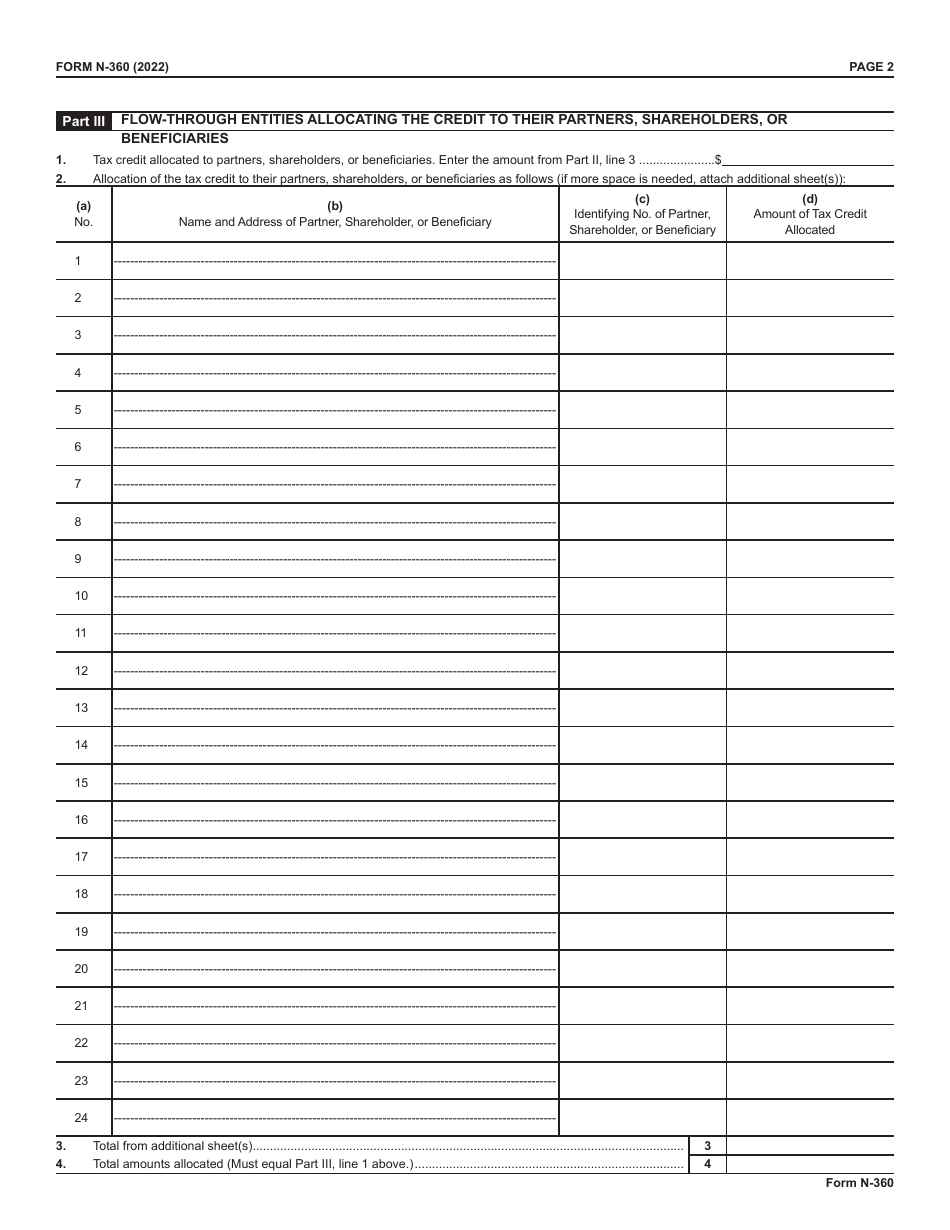

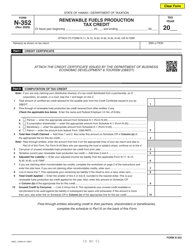

Form N-360 Renewable Fuels Production Tax Credit (For Tax Years Beginning After 12 / 31 / 21) - Hawaii

What Is Form N-360?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-360?

A: Form N-360 is used to claim the Renewable Fuels Production Tax Credit for tax years beginning after 12/31/21.

Q: What is the Renewable Fuels Production Tax Credit?

A: The Renewable Fuels Production Tax Credit is a tax credit for eligible businesses engaged in the production of renewable fuels.

Q: Who is eligible to claim the tax credit?

A: Eligible businesses engaged in the production of renewable fuels are eligible to claim the tax credit.

Q: When can the tax credit be claimed?

A: The tax credit can be claimed for tax years beginning after 12/31/21.

Q: Can individuals claim this tax credit?

A: No, the tax credit is only available for businesses engaged in renewable fuels production.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-360 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.