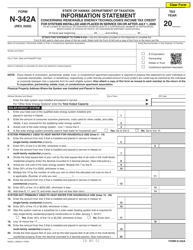

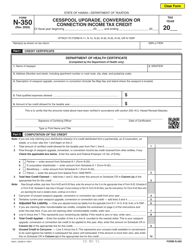

This version of the form is not currently in use and is provided for reference only. Download this version of

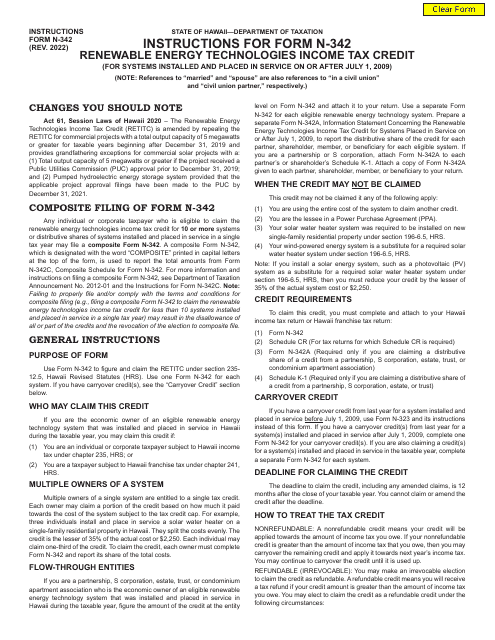

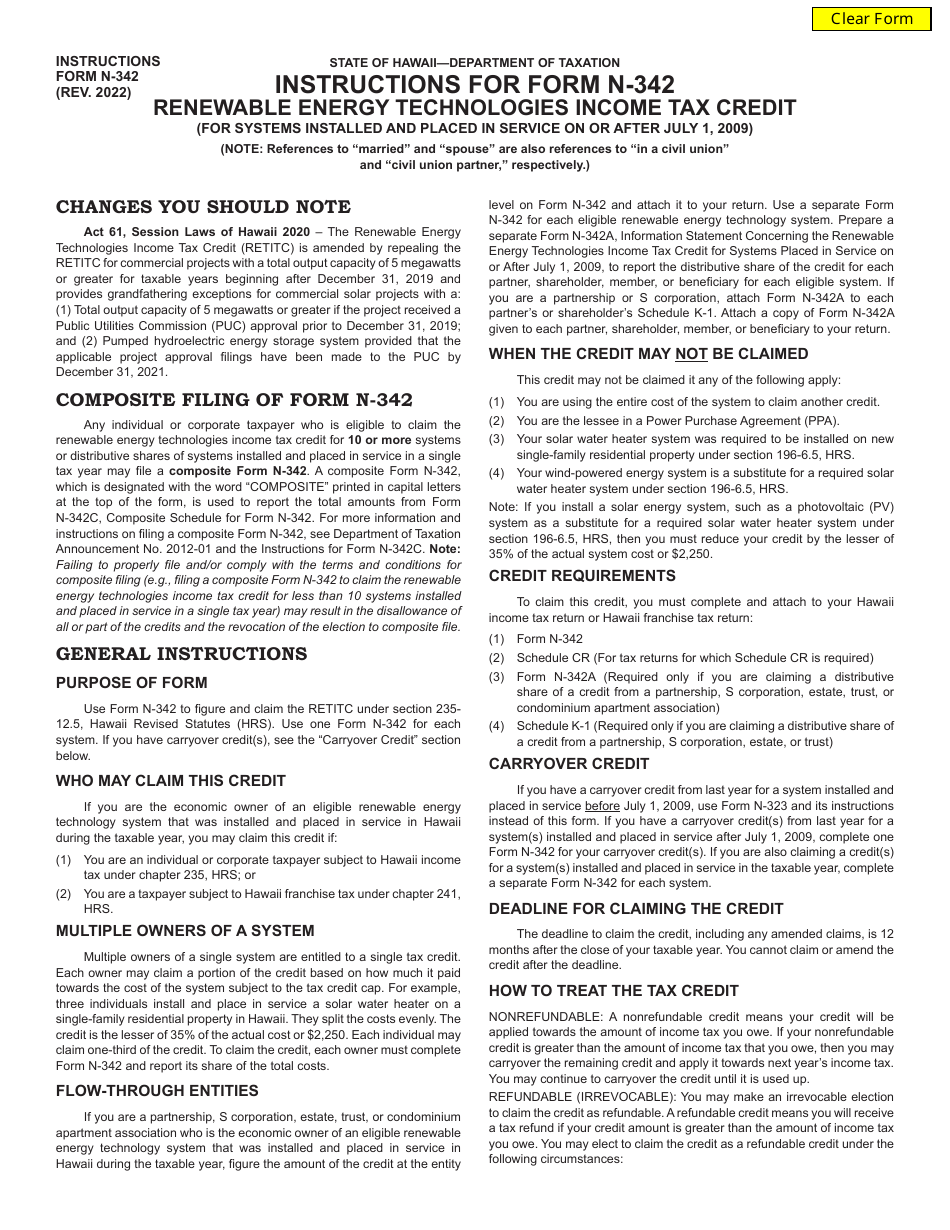

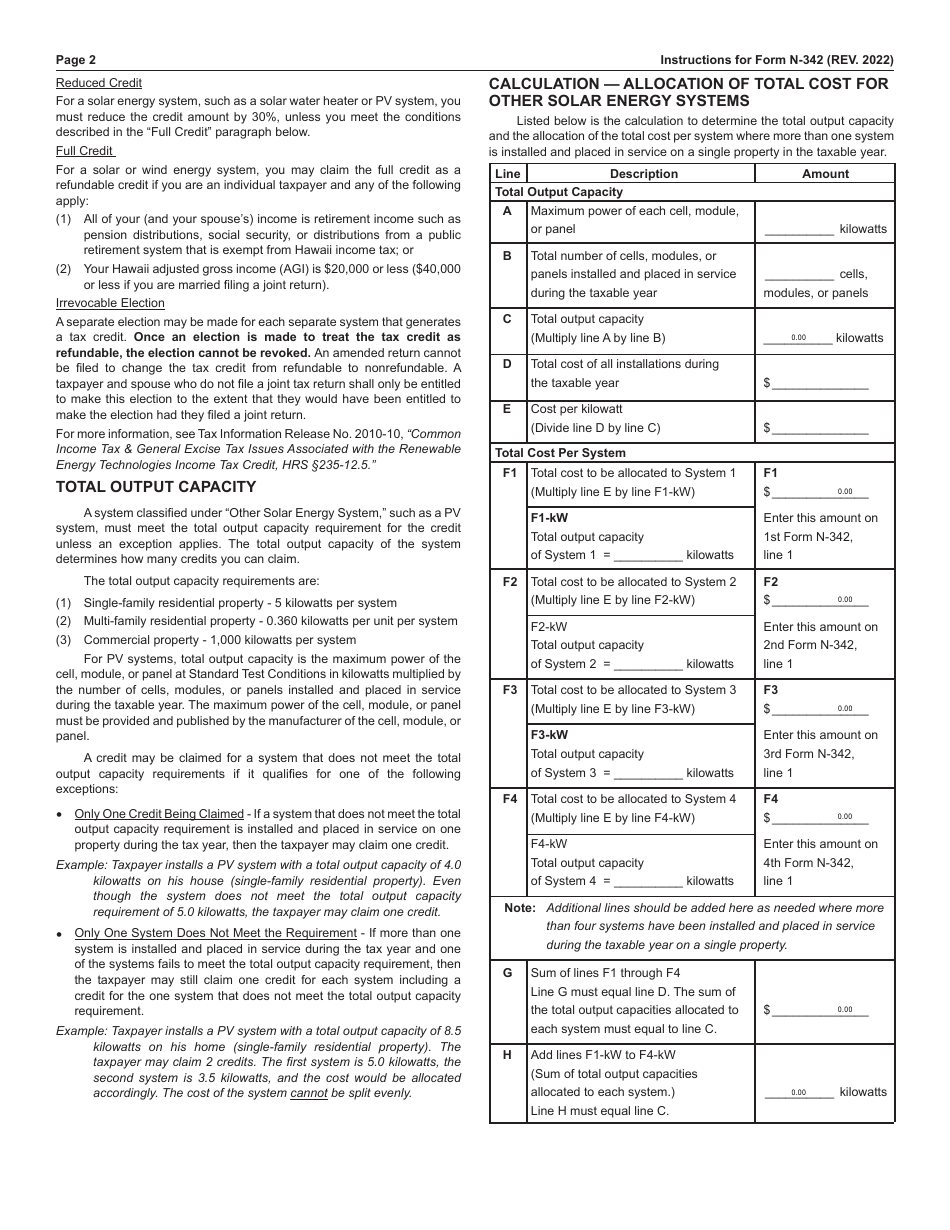

Instructions for Form N-342

for the current year.

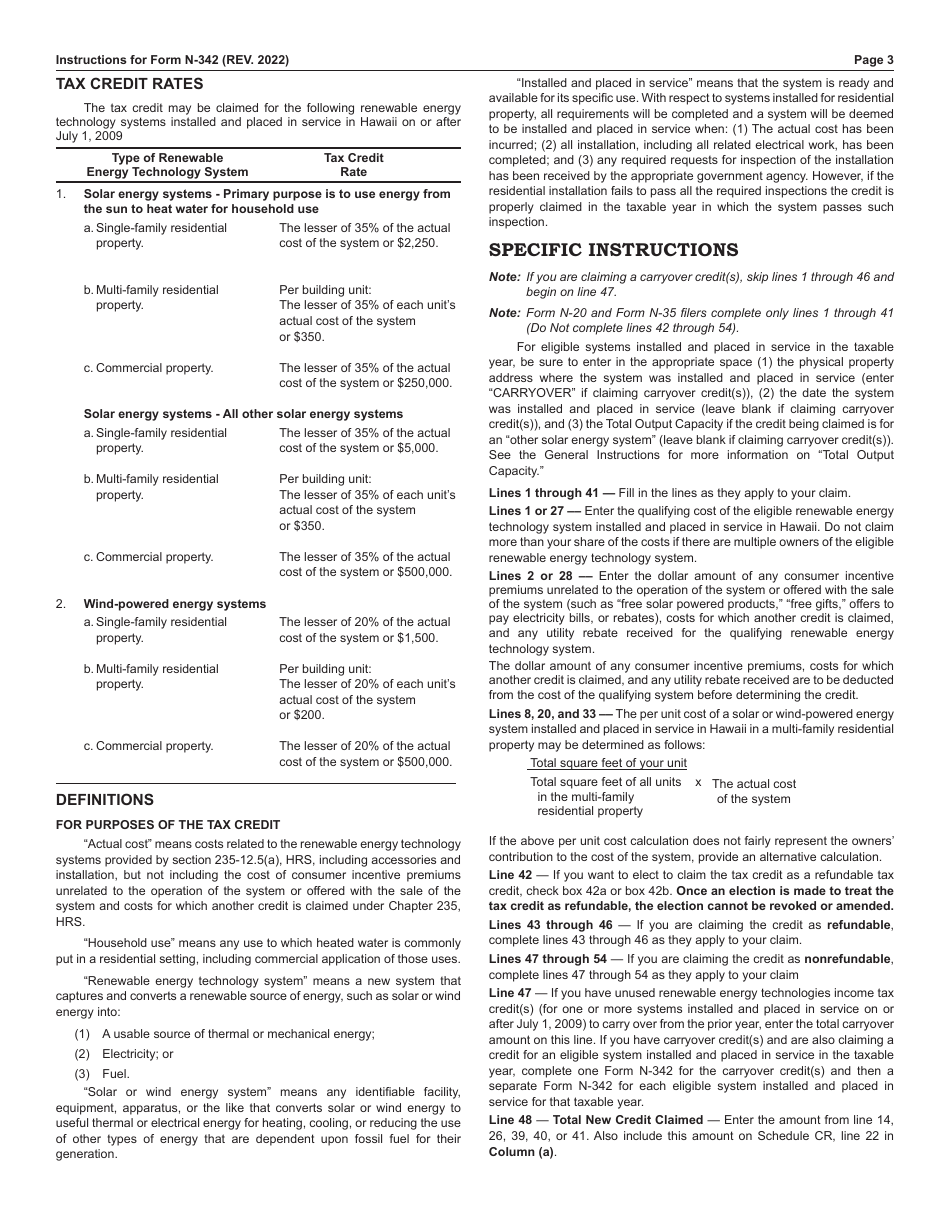

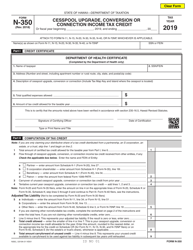

Instructions for Form N-342 Renewable Energy Technologies Income Tax Credit (For Systems Installed and Placed in Service on or After July 1, 2009) - Hawaii

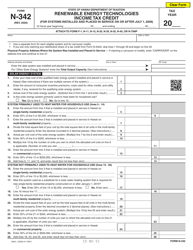

This document contains official instructions for Form N-342 , Renewable Energy Technologies Income Tax Credit (For Systems Installed and Placed in Service on or After July 1, 2009) - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form N-342 is available for download through this link.

FAQ

Q: What is Form N-342?

A: Form N-342 is a tax form used to claim the Renewable Energy Technologies Income Tax Credit in Hawaii.

Q: What is the Renewable Energy Technologies Income Tax Credit?

A: The Renewable Energy Technologies Income Tax Credit is a tax incentive provided by the state of Hawaii for installing and using renewable energy systems.

Q: When can I use Form N-342?

A: You can use Form N-342 if you installed and placed a renewable energy system in service in Hawaii on or after July 1, 2009.

Q: What is the purpose of the tax credit?

A: The purpose of the tax credit is to encourage the use of renewable energy technologies and reduce dependence on fossil fuels in Hawaii.

Q: What are the eligible renewable energy technologies?

A: Eligible renewable energy technologies include solar energy systems, wind energy systems, hydroelectric power systems, and biomass systems.

Q: How much is the tax credit?

A: The tax credit amount depends on the type of renewable energy system installed and the capacity of the system. The credit can be up to 35% of the system cost.

Q: How do I claim the tax credit?

A: To claim the tax credit, you need to complete and file Form N-342 with your annual tax return. You should keep records and receipts of the system installation as supporting documentation.

Q: Is there a deadline to file Form N-342?

A: Yes, Form N-342 must be filed by December 31st of the year following the year in which the system was placed in service.

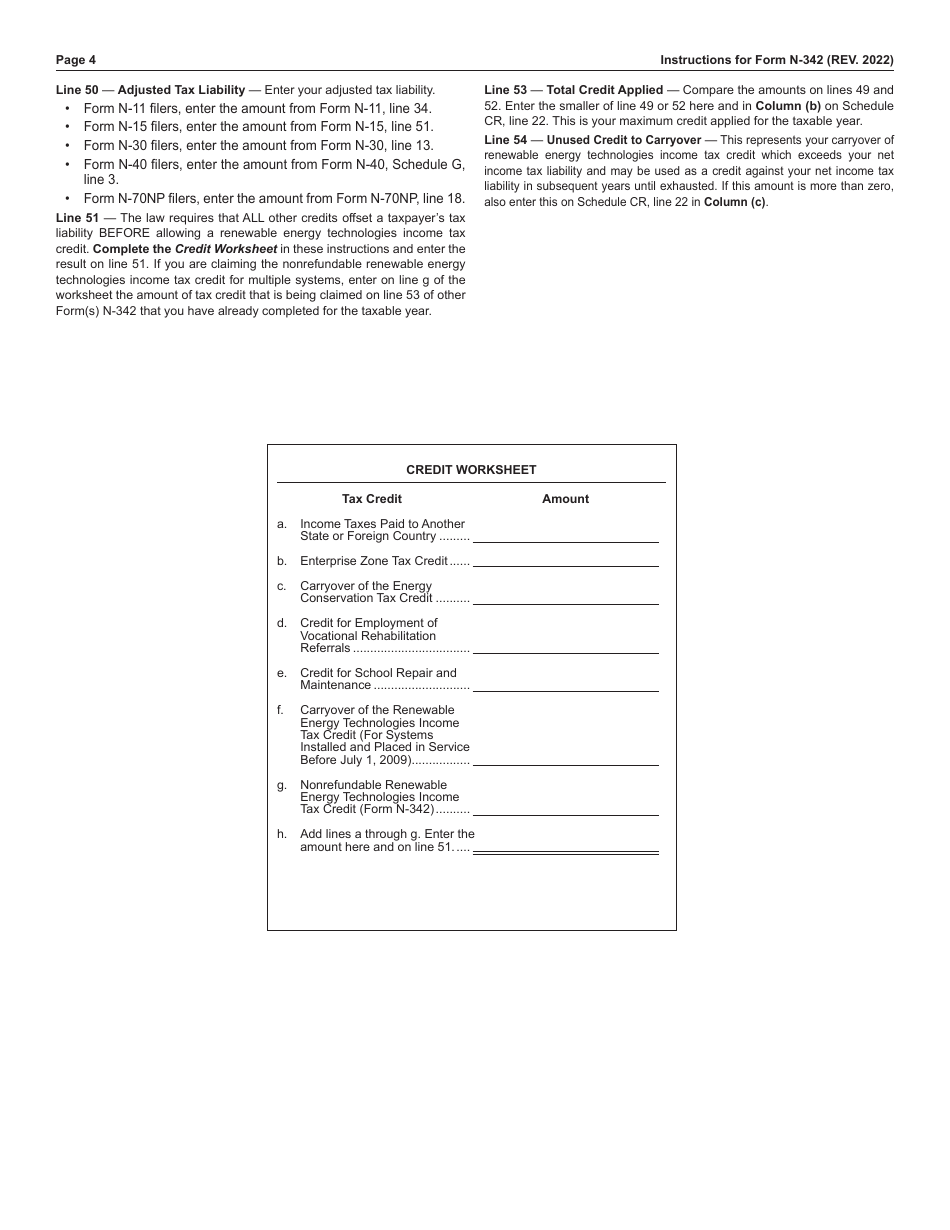

Q: Can I carry forward any unused tax credit?

A: Yes, if the tax credit exceeds your tax liability for the year, you can carry forward the unused credit for up to 5 years.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.