This version of the form is not currently in use and is provided for reference only. Download this version of

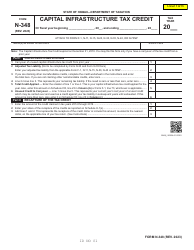

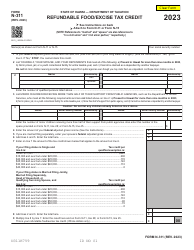

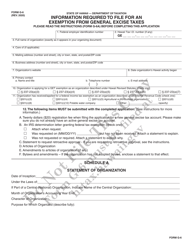

Instructions for Form N-312

for the current year.

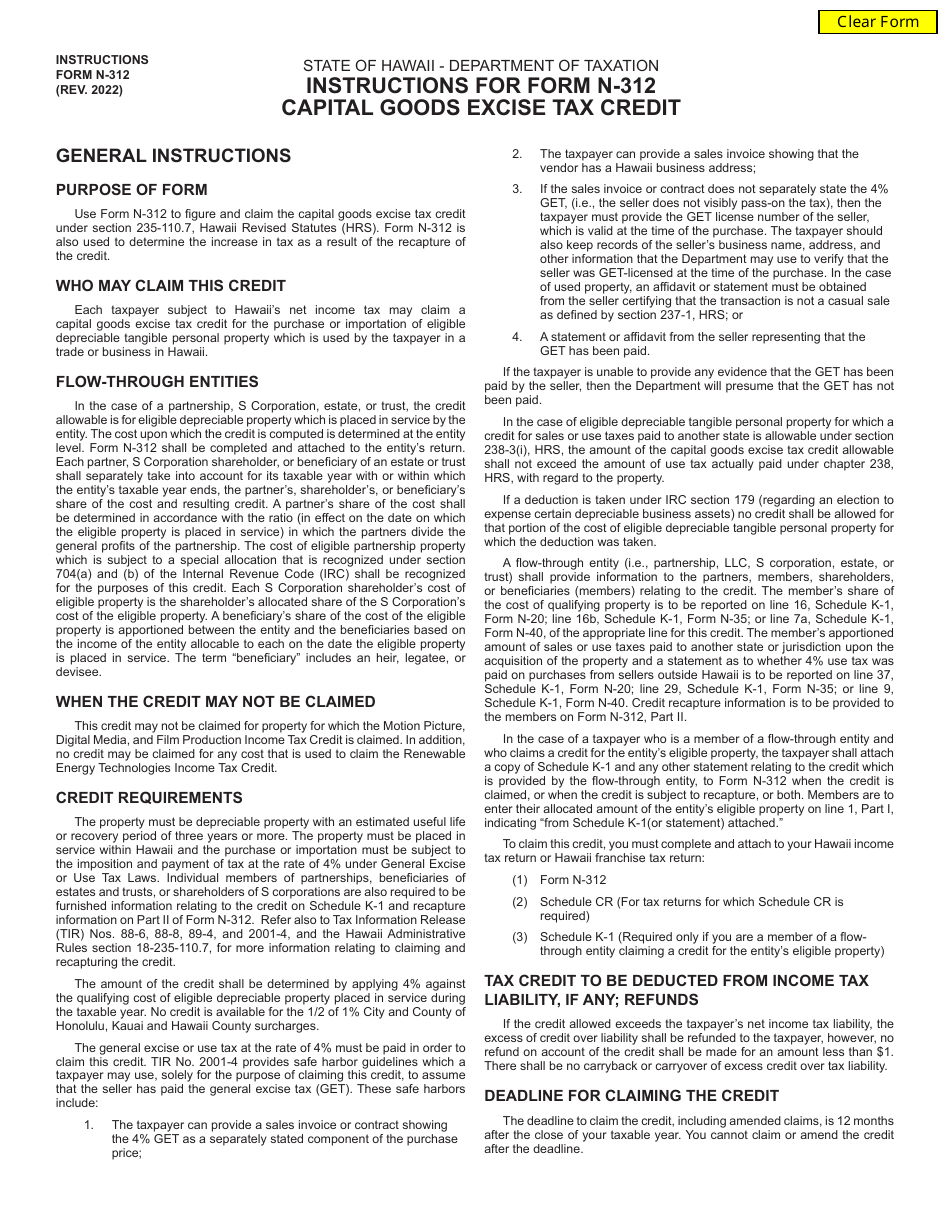

Instructions for Form N-312 Capital Goods Excise Tax Credit - Hawaii

This document contains official instructions for Form N-312 , Capital Goods Excise Tax Credit - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form N-312 is available for download through this link.

FAQ

Q: What is Form N-312?

A: Form N-312 is a tax form used to claim the Capital Goods Excise Tax Credit in Hawaii.

Q: What is the Capital Goods Excise Tax Credit?

A: The Capital Goods Excise Tax Credit is a tax credit provided to businesses in Hawaii for certain qualified capital goods.

Q: Who can claim the Capital Goods Excise Tax Credit?

A: Businesses in Hawaii that have purchased or acquired qualified capital goods may be eligible to claim this tax credit.

Q: What are qualified capital goods?

A: Qualified capital goods include machinery, equipment, and other tangible personal property used in the production of goods or services.

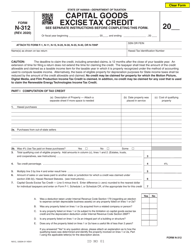

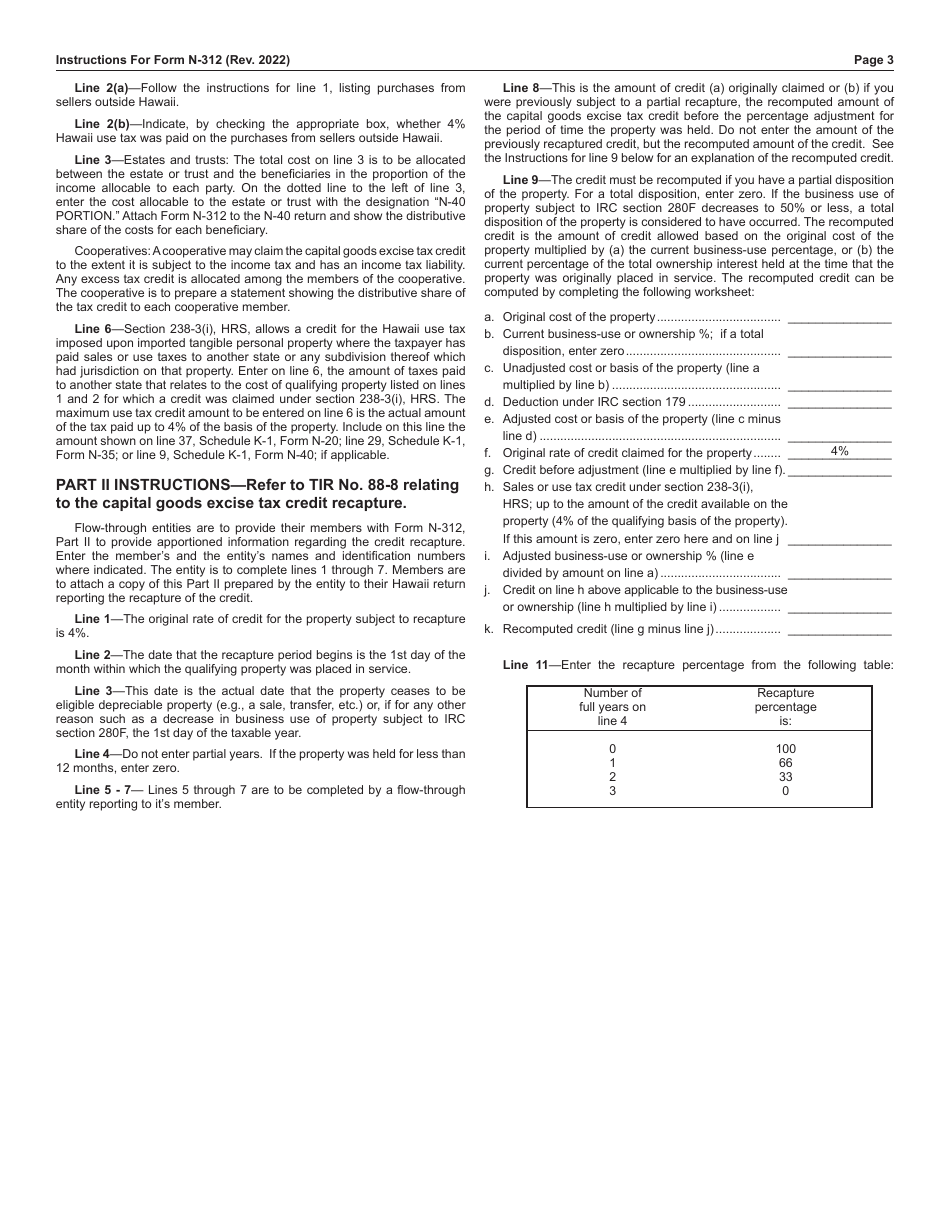

Q: How do I fill out Form N-312?

A: You will need to provide information about the qualified capital goods you purchased or acquired, including the purchase price and date of acquisition.

Q: Is there a deadline for submitting Form N-312?

A: Yes, Form N-312 must be filed by the 20th day of the 4th month following the end of the tax year in which the qualified capital goods were acquired.

Q: What if I need help with Form N-312?

A: If you need assistance with Form N-312 or have questions about the Capital Goods Excise Tax Credit, you can contact the Hawaii Department of Taxation for guidance.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.