This version of the form is not currently in use and is provided for reference only. Download this version of

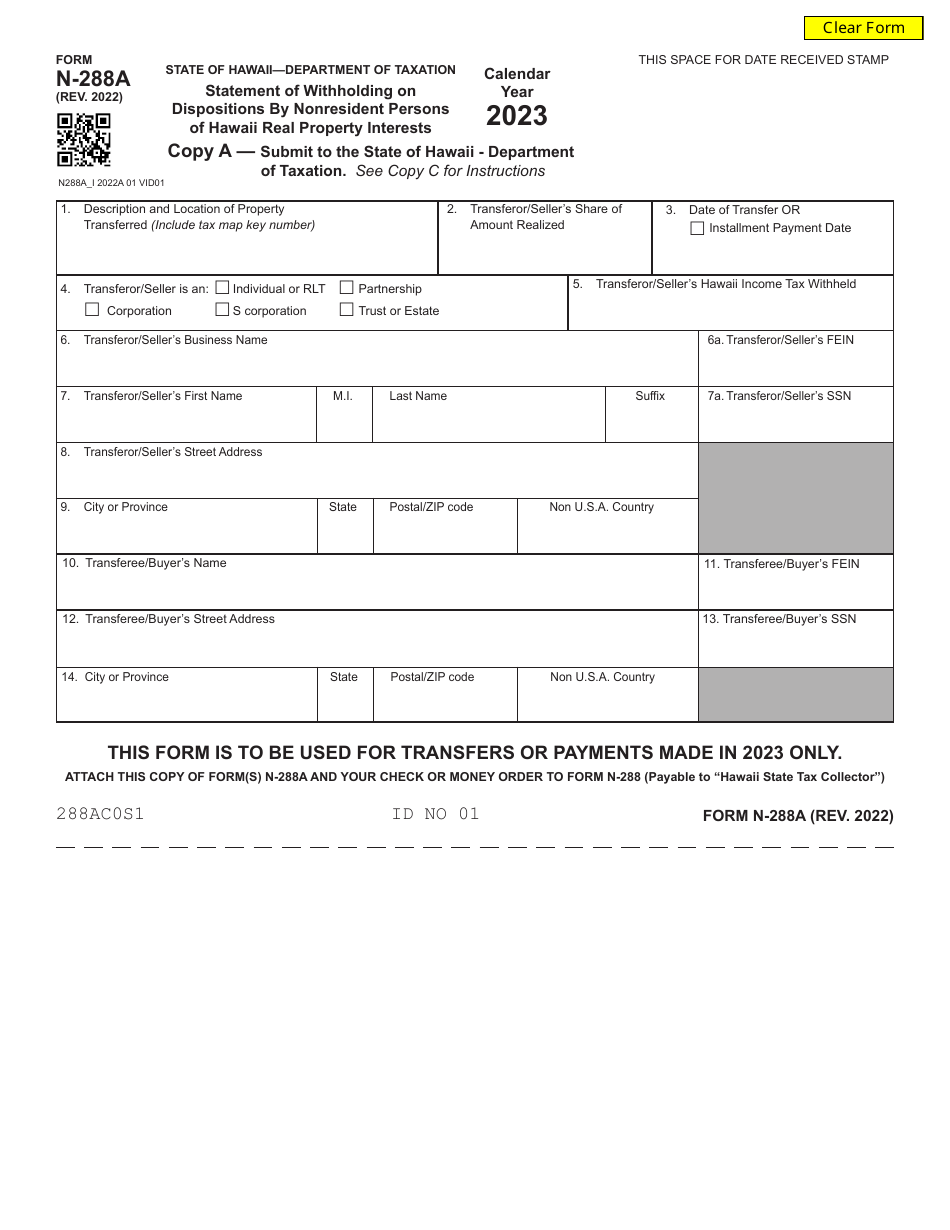

Form N-288A

for the current year.

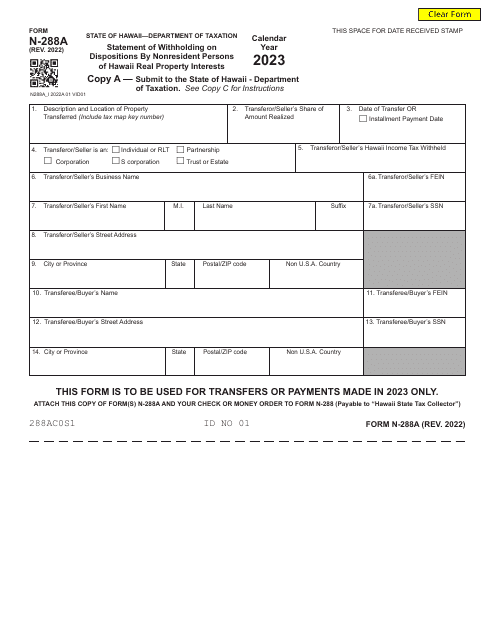

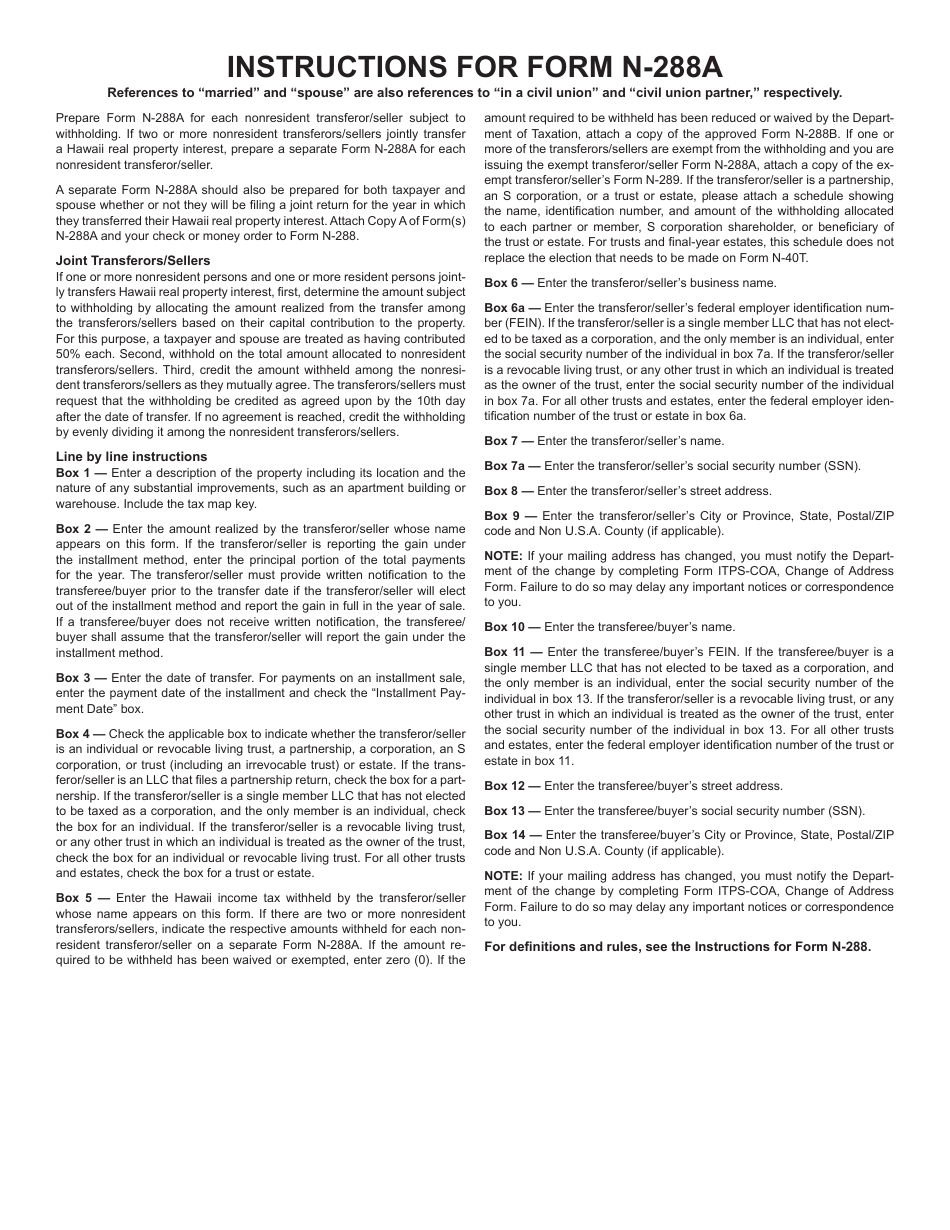

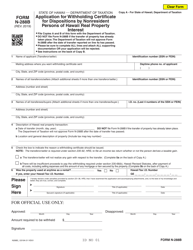

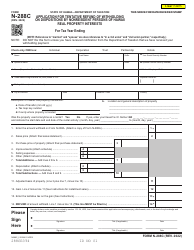

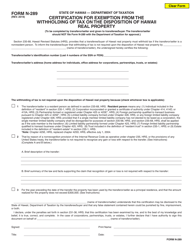

Form N-288A Statement of Withholding on Dispositions by Nonresident Persons of Hawaii Real Property Interests - Hawaii

What Is Form N-288A?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-288A?

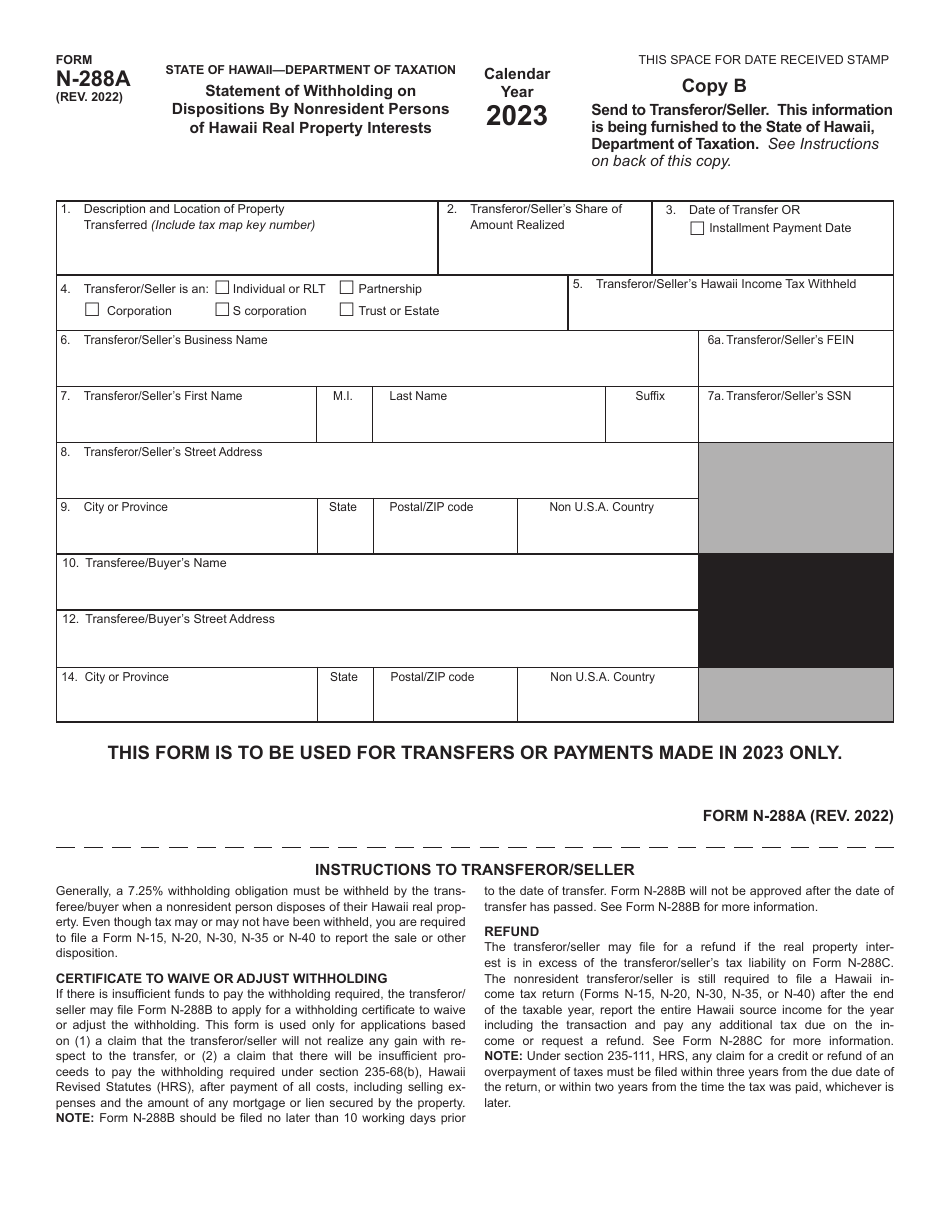

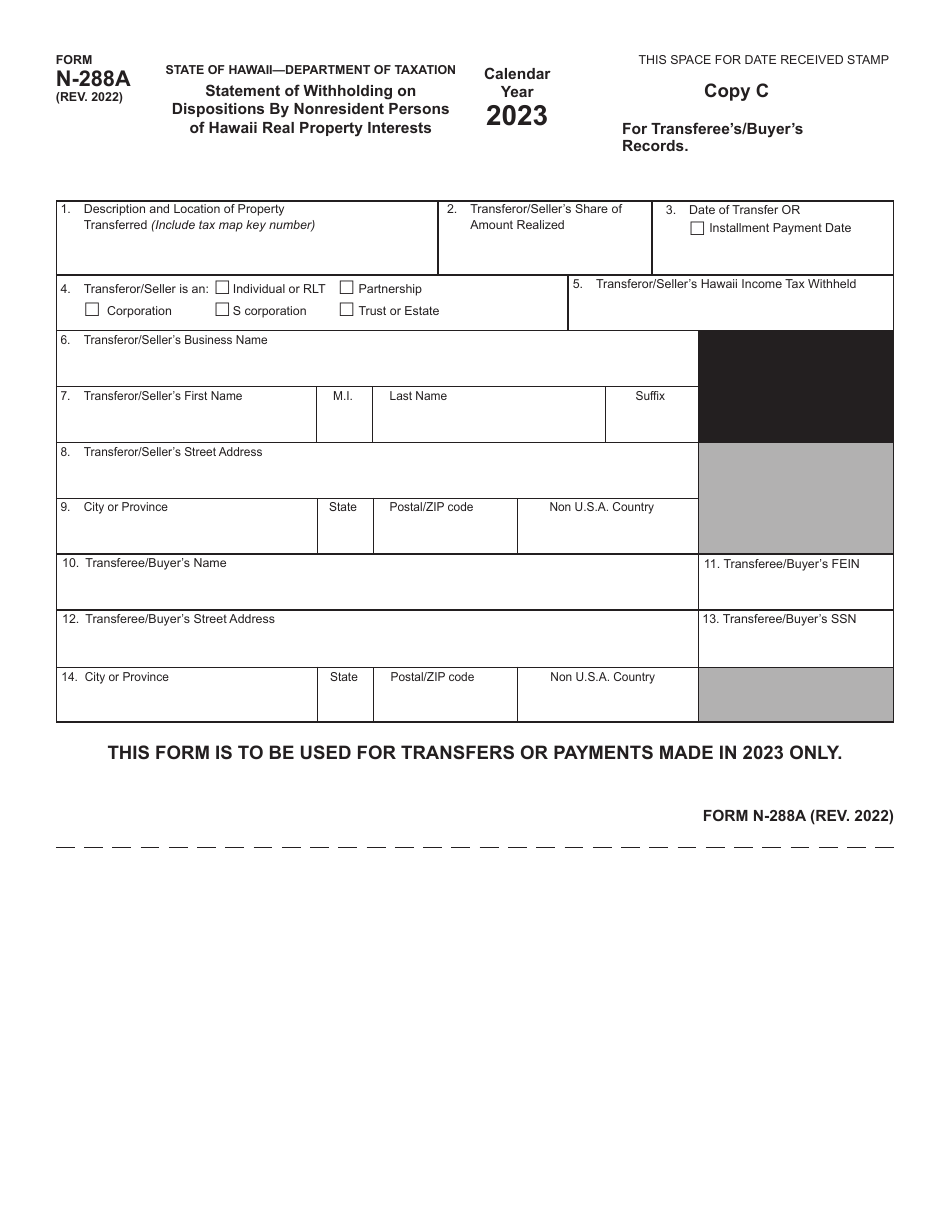

A: Form N-288A is the Statement of Withholding on Dispositions by Nonresident Persons of Hawaii Real Property Interests.

Q: Who needs to file Form N-288A?

A: Nonresident persons who dispose of Hawaii real property interests need to file Form N-288A.

Q: What is the purpose of Form N-288A?

A: Form N-288A is used to report and withhold taxes on the sale or transfer of Hawaii real property by nonresidents.

Q: What information is required on Form N-288A?

A: Form N-288A requires information such as the seller's name, address, and taxpayer identification number, details of the property, and the amount of withholding.

Q: Are there any exceptions to filing Form N-288A?

A: Yes, there are certain exemptions and exclusions that may apply. Consult the instructions for Form N-288A or contact the Hawaii Department of Taxation for more information.

Q: When is Form N-288A due?

A: Form N-288A is generally due within 10 days after the date of transfer of the real property or the closing of the transaction, whichever occurs later.

Q: Can Form N-288A be filed electronically?

A: No, at the time of writing this, Form N-288A cannot be filed electronically. It must be submitted by mail or in person.

Q: What are the consequences of not filing Form N-288A?

A: Failure to file Form N-288A or withholding the required amount may result in penalties, interest, and other enforcement actions by the Hawaii Department of Taxation.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-288A by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.