This version of the form is not currently in use and is provided for reference only. Download this version of

Form N-210

for the current year.

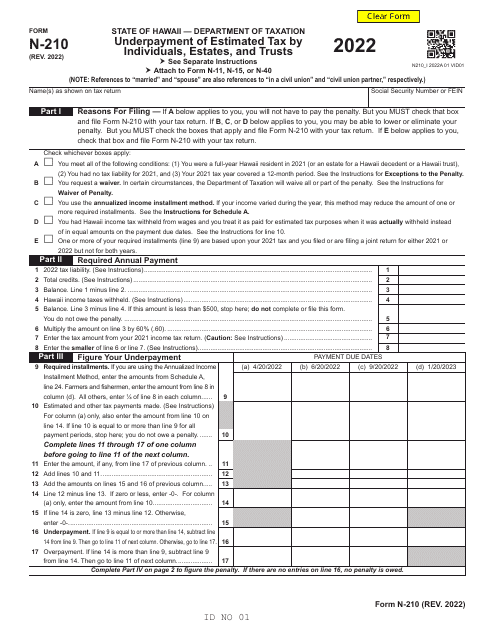

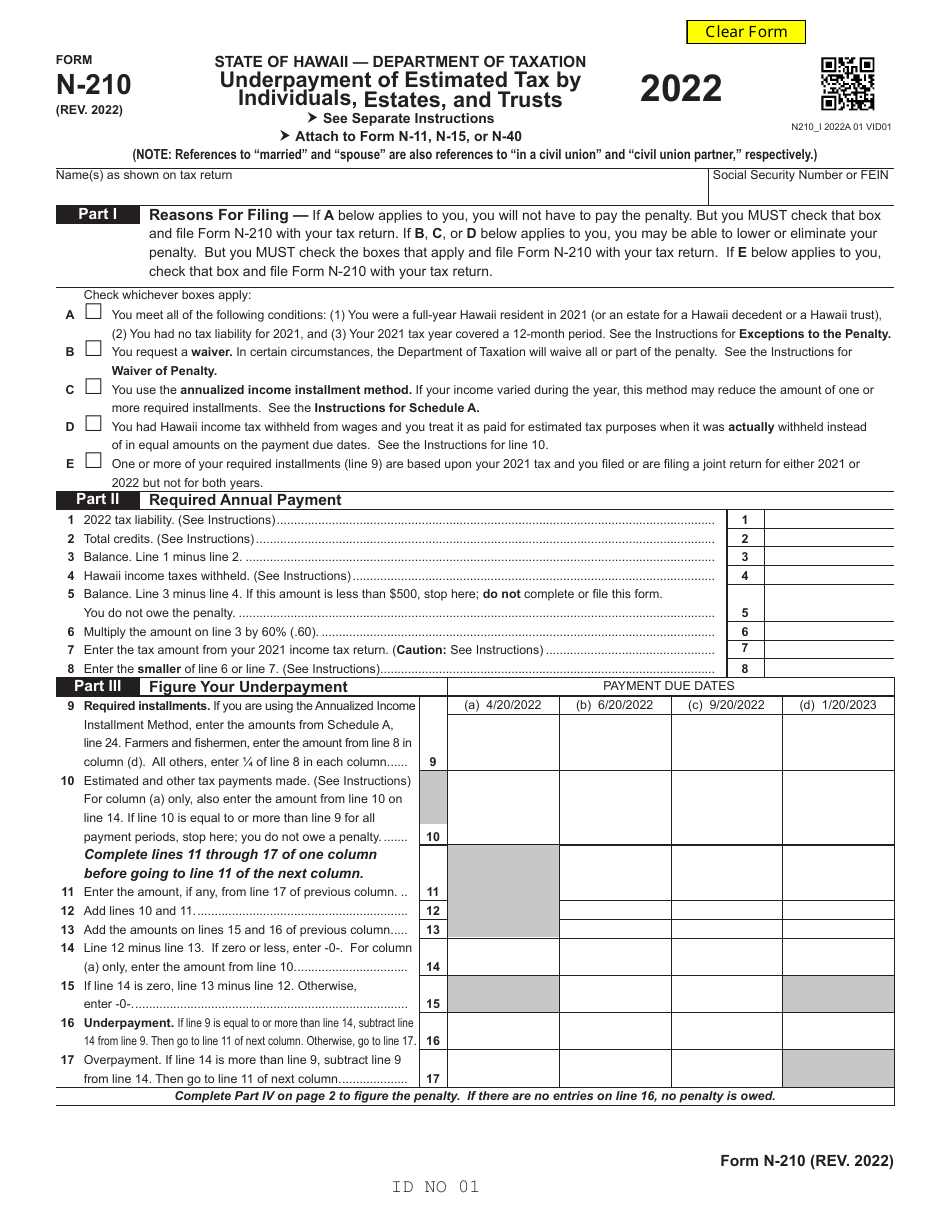

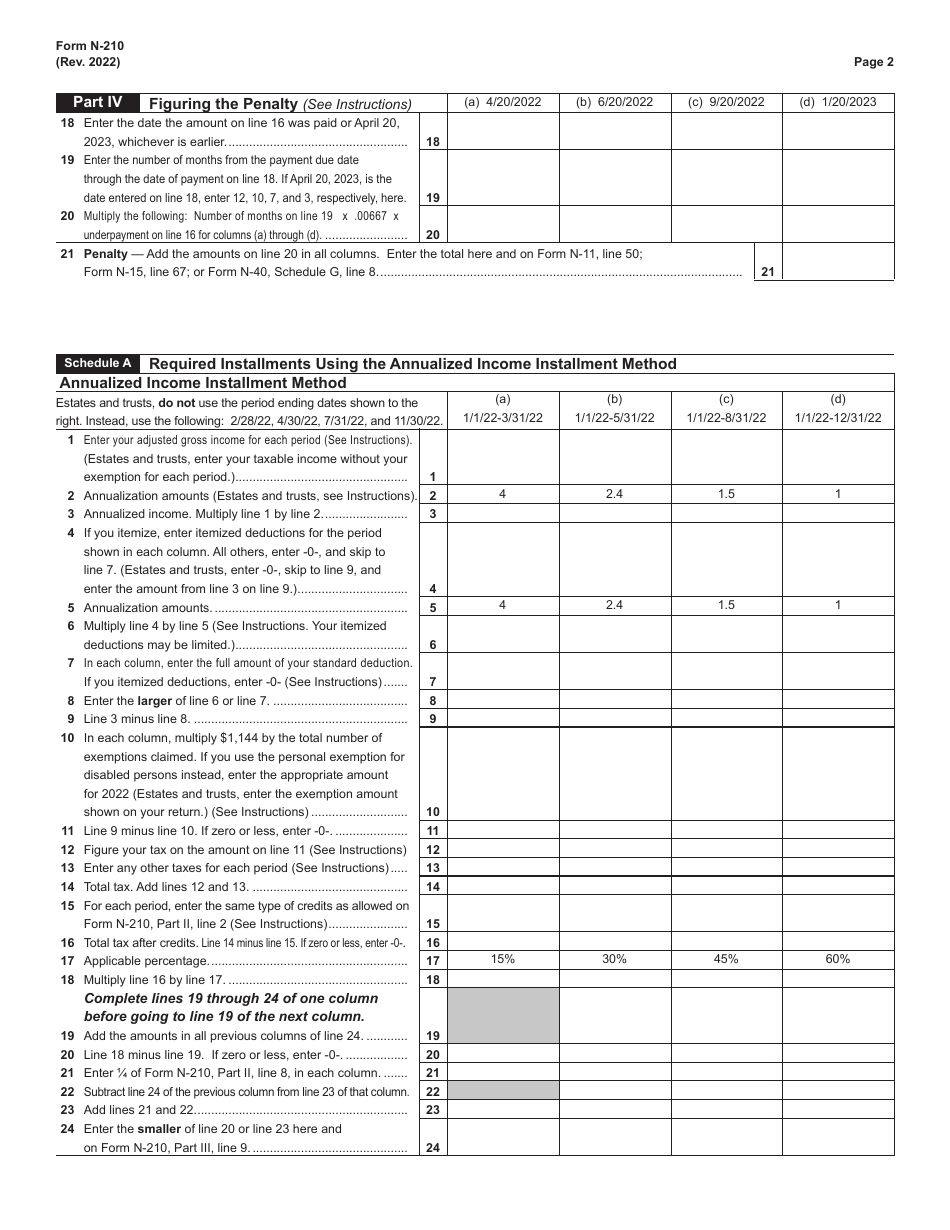

Form N-210 Underpayment of Estimated Tax by Individuals, Estates, and Trusts - Hawaii

What Is Form N-210?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-210?

A: Form N-210 is used by Individuals, Estates, and Trusts in Hawaii to calculate any underpayment of estimated tax.

Q: Who should file Form N-210?

A: Individuals, Estates, and Trusts in Hawaii who have underpaid their estimated tax should file Form N-210.

Q: What is the purpose of Form N-210?

A: The purpose of Form N-210 is to calculate any underpayment of estimated tax and determine if a penalty is owed.

Q: How do I fill out Form N-210?

A: You will need to provide your personal information, calculate your underpayment amount, and determine if you owe a penalty.

Q: When is Form N-210 due?

A: Form N-210 is due on April 15th of the following year.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-210 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.