This version of the form is not currently in use and is provided for reference only. Download this version of

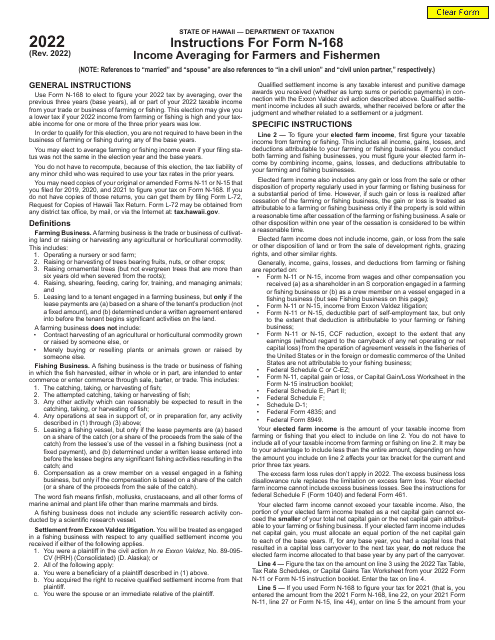

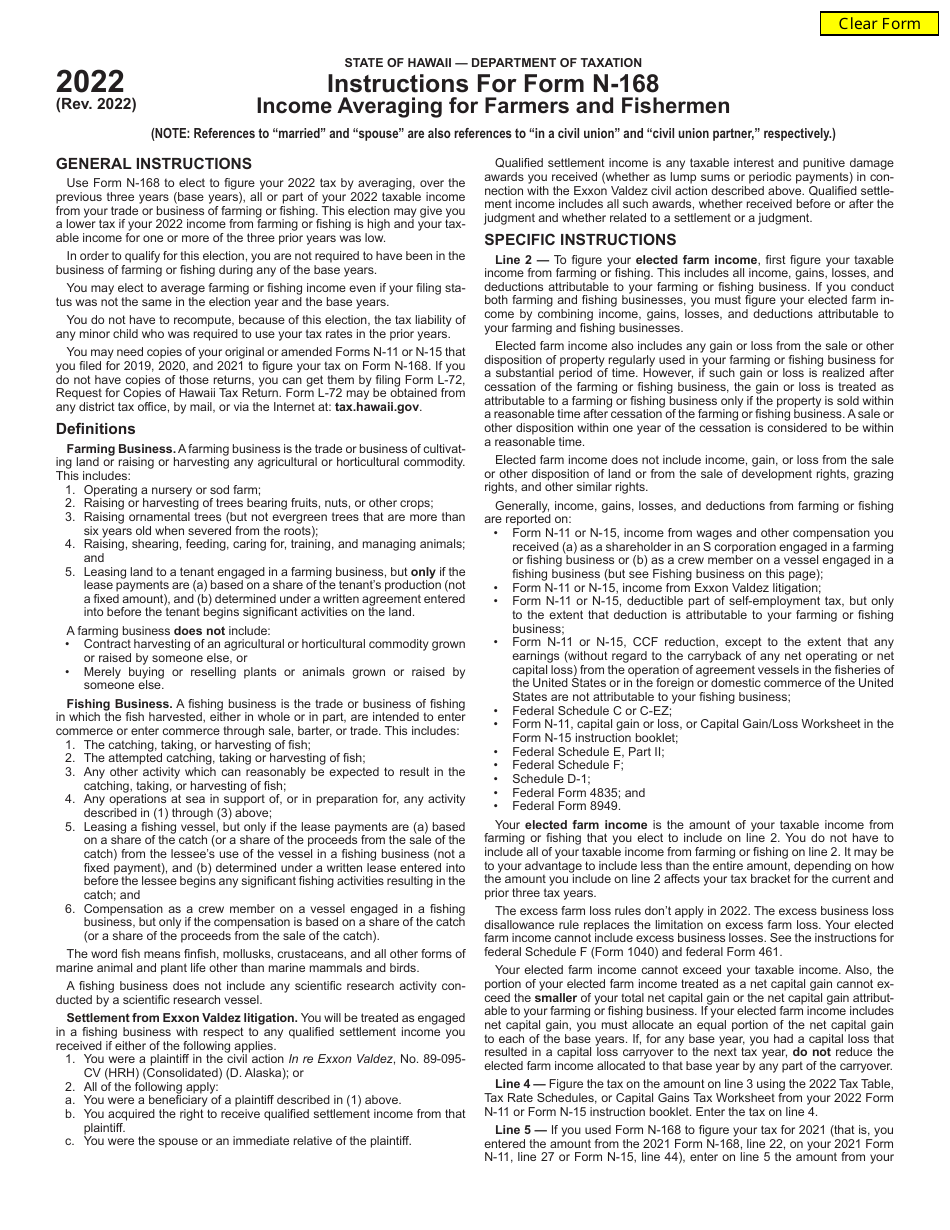

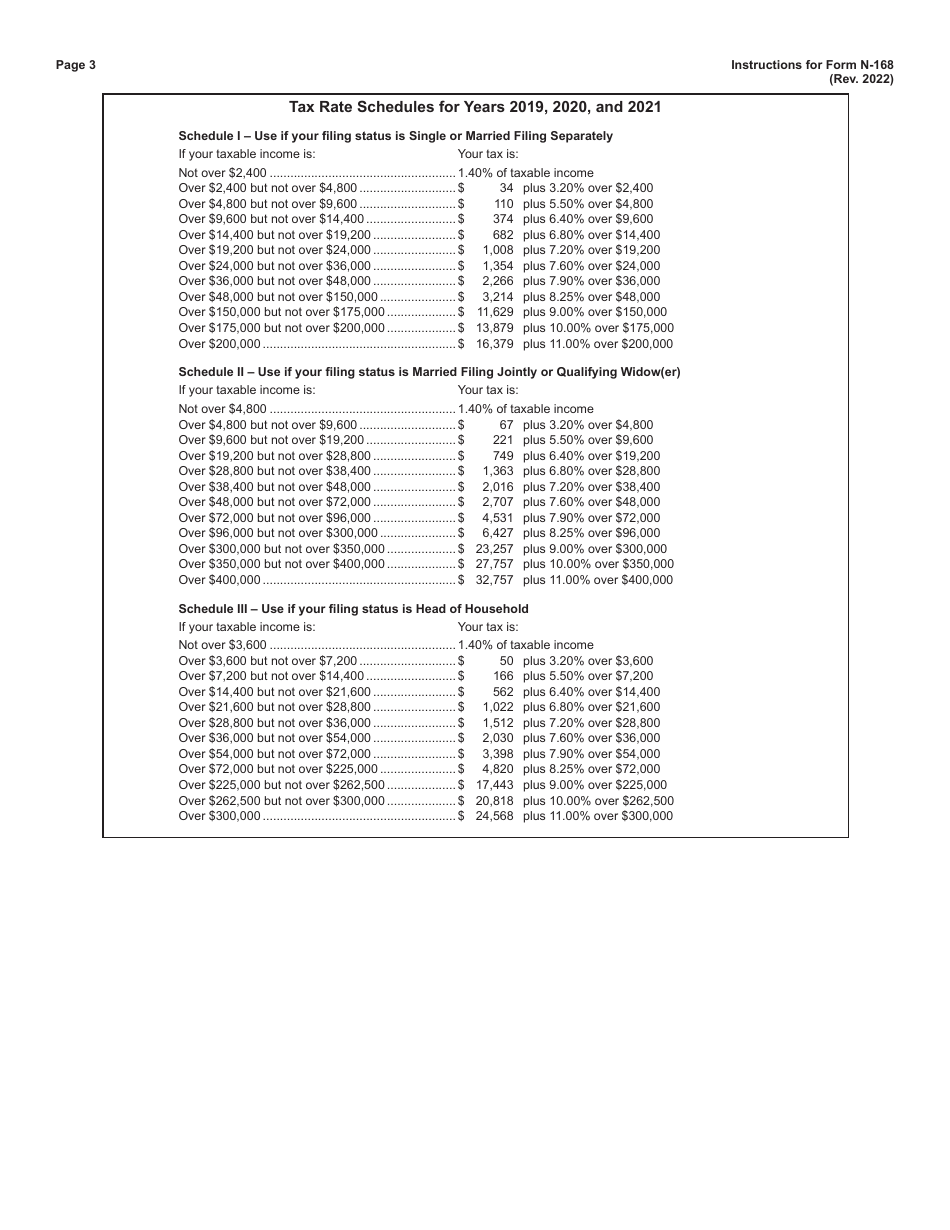

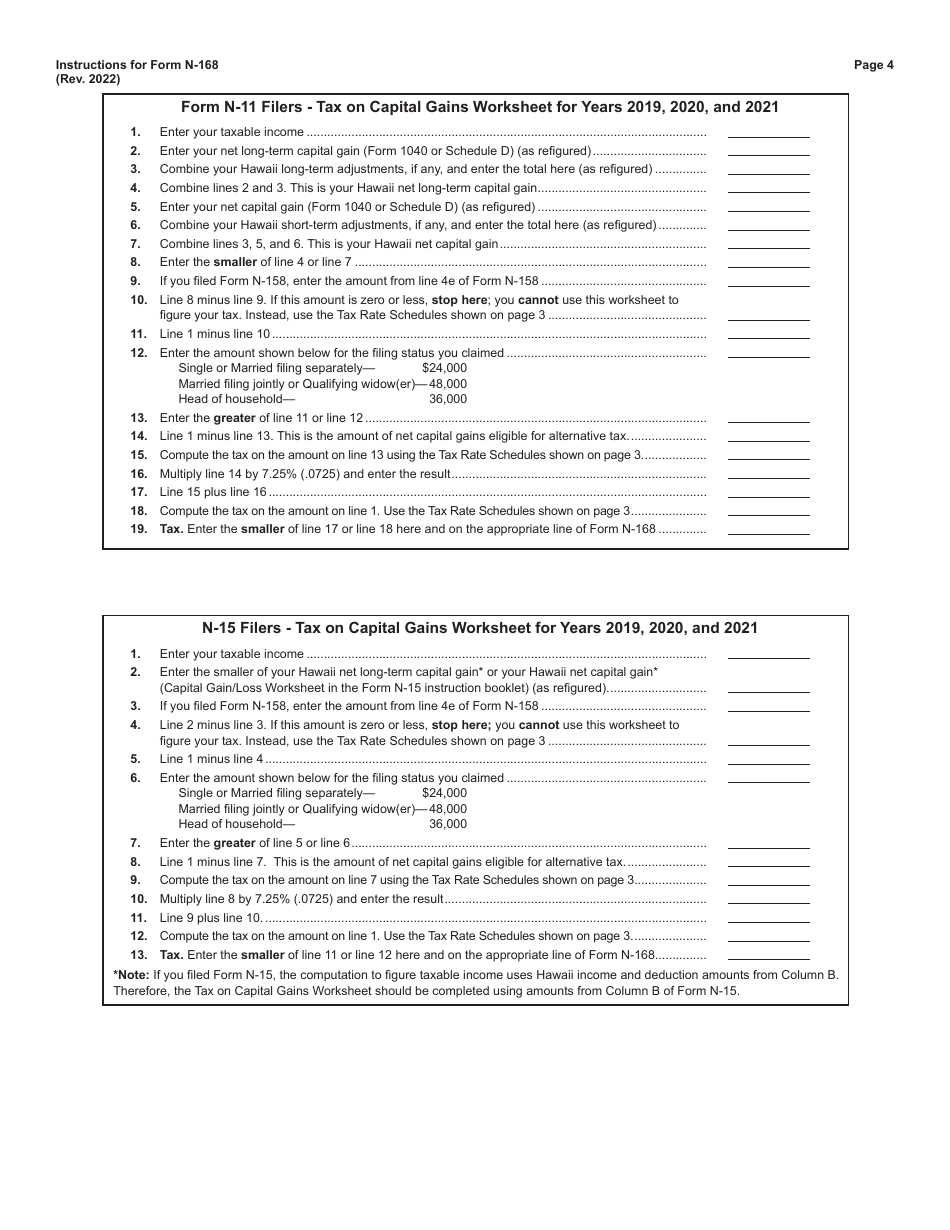

Instructions for Form N-168

for the current year.

Instructions for Form N-168 Income Averaging for Farmers and Fishermen - Hawaii

This document contains official instructions for Form N-168 , Income Averaging for Farmers and Fishermen - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form N-168 is available for download through this link.

FAQ

Q: What is Form N-168?

A: Form N-168 is a form used for income averaging for farmers and fishermen in Hawaii.

Q: Who can use Form N-168?

A: Farmers and fishermen in Hawaii can use Form N-168.

Q: What is income averaging?

A: Income averaging allows farmers and fishermen to reduce their tax burden by averaging their income over a specified period.

Q: How does income averaging work?

A: Income averaging allows farmers and fishermen to calculate their tax liability based on the average income from the past three years.

Q: Is income averaging available in all states?

A: No, income averaging is specific to farmers and fishermen in Hawaii.

Q: Are there any requirements to use Form N-168?

A: Yes, you must meet certain eligibility criteria to qualify for income averaging using Form N-168.

Q: Can I use income averaging for any other professions?

A: No, income averaging is only available for farmers and fishermen in Hawaii.

Q: Can income averaging lower my tax liability?

A: Yes, income averaging can help reduce your tax burden by spreading out your income over multiple years.

Q: Are there any limitations or restrictions on income averaging?

A: Yes, there are certain restrictions and limitations to using income averaging, which are outlined in the instructions for Form N-168.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.