This version of the form is not currently in use and is provided for reference only. Download this version of

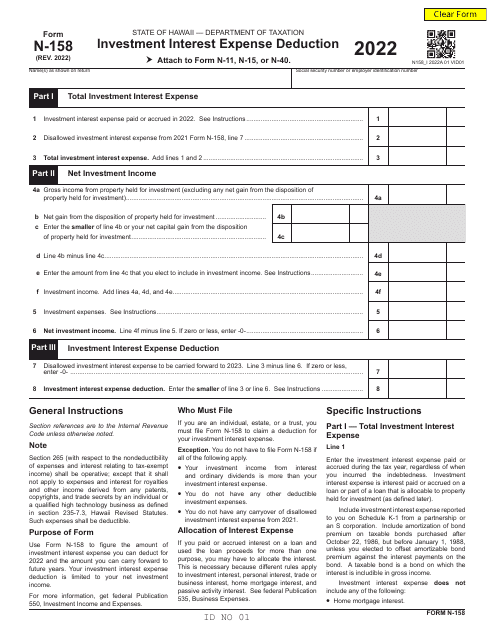

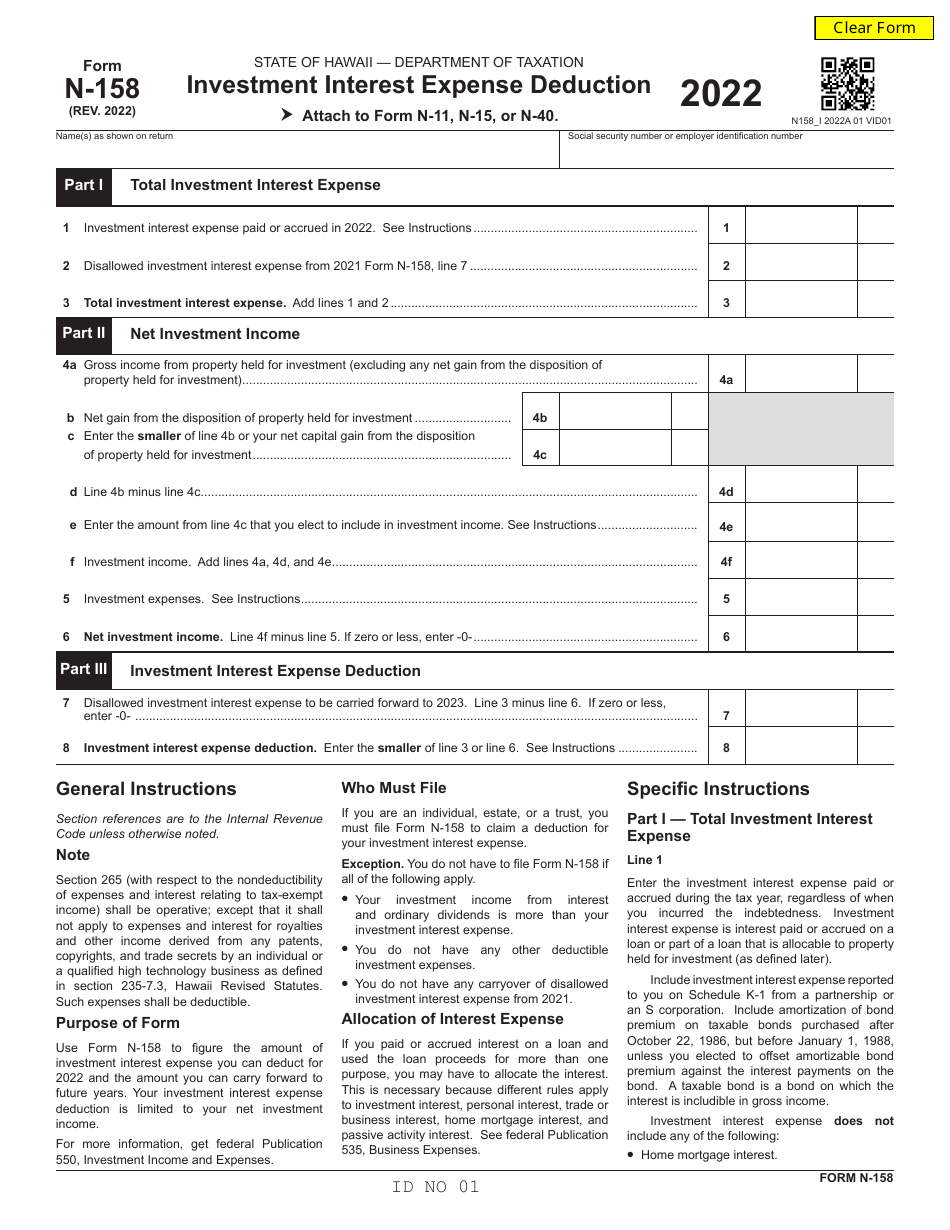

Form N-158

for the current year.

Form N-158 Investment Interest Expense Deduction - Hawaii

What Is Form N-158?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-158?

A: Form N-158 is a tax form used in the state of Hawaii to claim the Investment Interest Expense Deduction.

Q: What is the Investment Interest Expense Deduction?

A: The Investment Interest Expense Deduction is a tax deduction that allows taxpayers to deduct the interest expenses incurred from investment activities.

Q: Who can use Form N-158?

A: Form N-158 is specifically used by residents of Hawaii who are eligible for the Investment Interest Expense Deduction.

Q: How do I qualify for the Investment Interest Expense Deduction?

A: To qualify for the Investment Interest Expense Deduction, you must have incurred interest expenses from investment activities, such as borrowing money to purchase stocks, bonds, or other investment assets.

Q: What information is required on Form N-158?

A: Form N-158 requires you to provide detailed information about your investment activities, such as the types of investments made, the amount of investment interest paid, and other related expenses.

Q: When is the deadline to file Form N-158?

A: The deadline to file Form N-158 is typically the same as the deadline for filing your Hawaii state income tax return, which is usually April 20th.

Q: Can I e-file Form N-158?

A: Currently, the Hawaii Department of Taxation does not offer e-filing for Form N-158. It must be filed by mail or in person.

Q: Is there any fee to file Form N-158?

A: No, there is no fee to file Form N-158.

Q: What should I do if I need help with Form N-158?

A: If you need assistance with Form N-158 or have any questions about the Investment Interest Expense Deduction, it is recommended to consult with a tax professional or contact the Hawaii Department of Taxation.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-158 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.