This version of the form is not currently in use and is provided for reference only. Download this version of

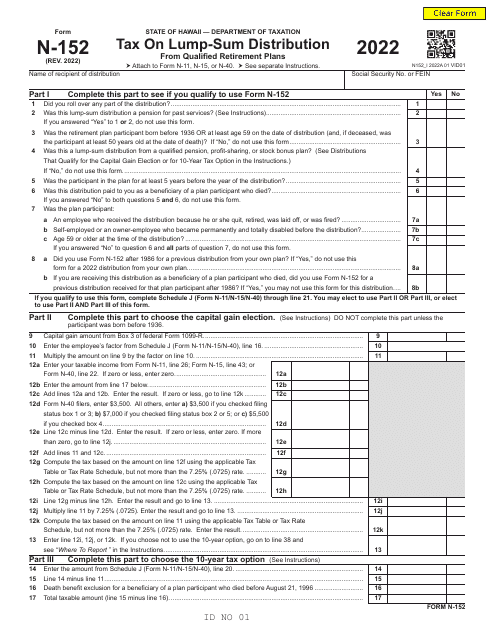

Form N-152

for the current year.

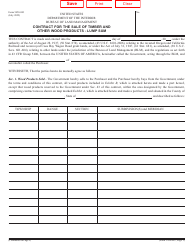

Form N-152 Tax on Lump-Sum Distribution - Hawaii

What Is Form N-152?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-152?

A: Form N-152 is a tax form used to report the tax on lump-sum distributions in Hawaii.

Q: What is a lump-sum distribution?

A: A lump-sum distribution is a one-time payment of a taxpayer's entire balance in a qualified retirement plan.

Q: Who needs to file Form N-152?

A: Residents of Hawaii who receive a lump-sum distribution from a qualified retirement plan need to file Form N-152.

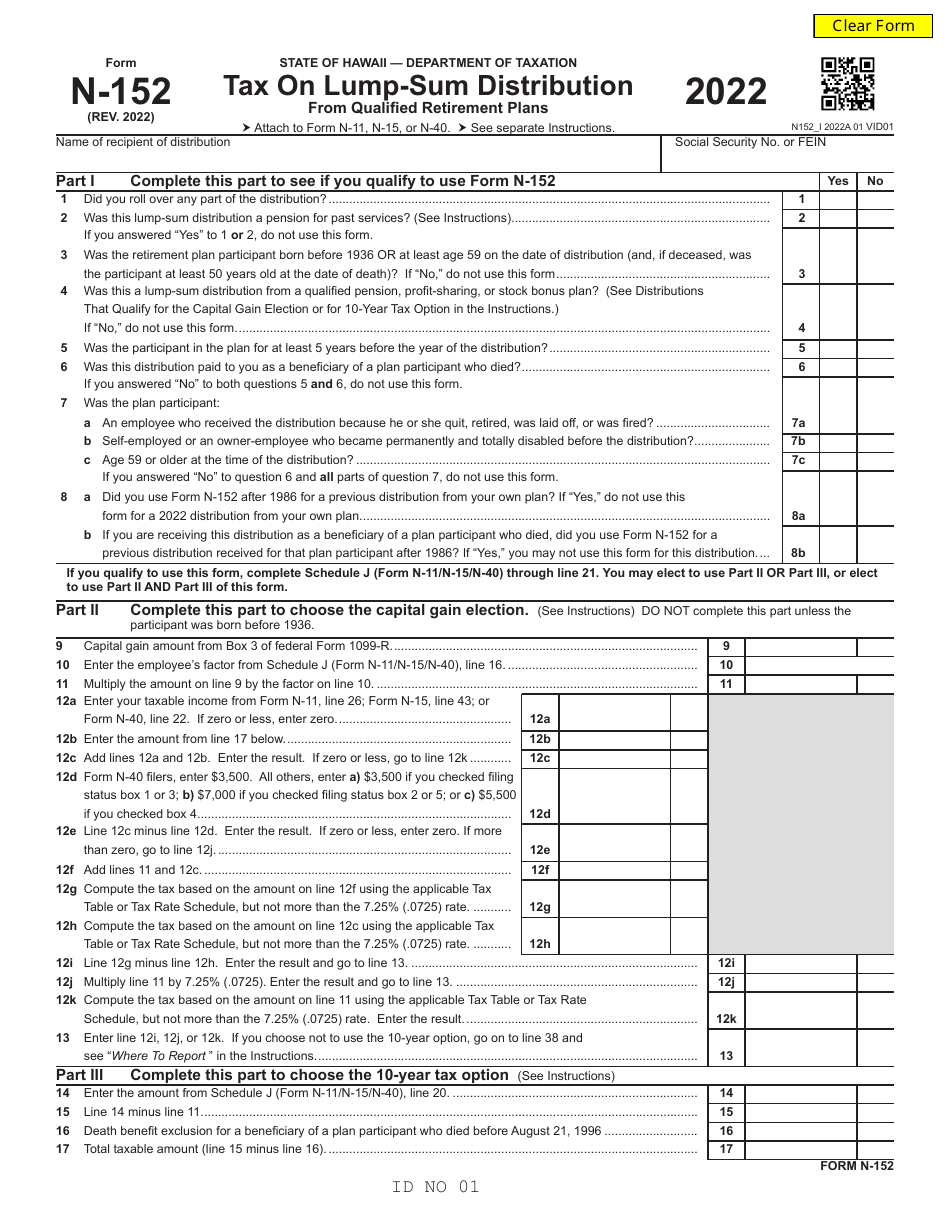

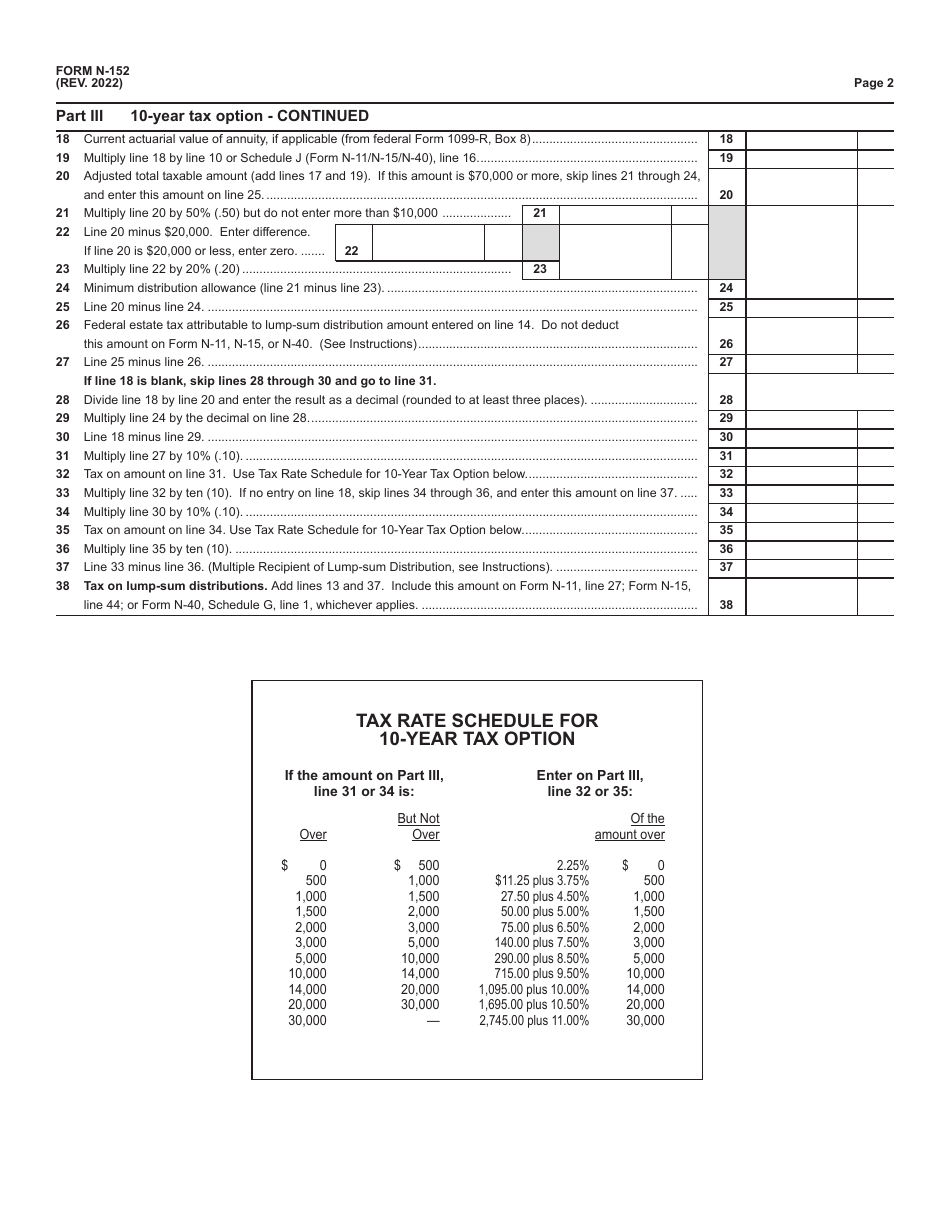

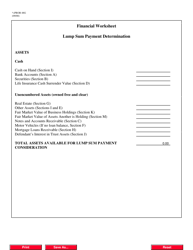

Q: How do I calculate the tax on a lump-sum distribution?

A: The tax on a lump-sum distribution is calculated using the lump-sum distribution tax worksheet provided with Form N-152.

Q: Are there any exemption or credit for the lump-sum distribution tax?

A: No, there are no exemptions or credits available for the lump-sum distribution tax in Hawaii.

Q: When is the deadline to file Form N-152?

A: Form N-152 is due on April 20th of the following year after the year in which the lump-sum distribution was received.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-152 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.