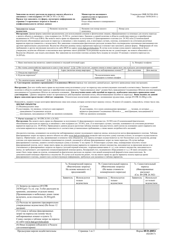

This version of the form is not currently in use and is provided for reference only. Download this version of

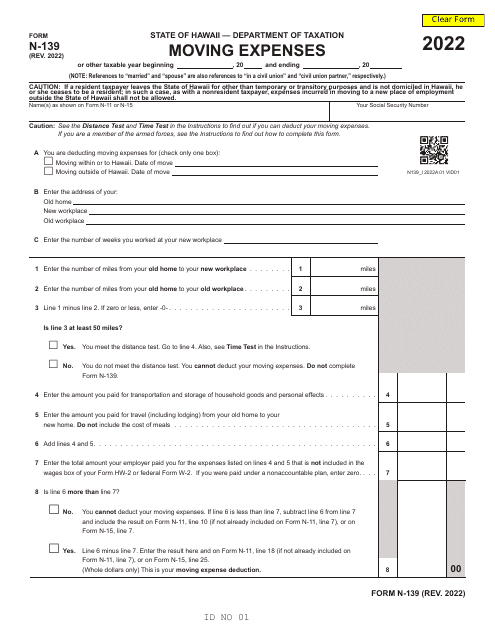

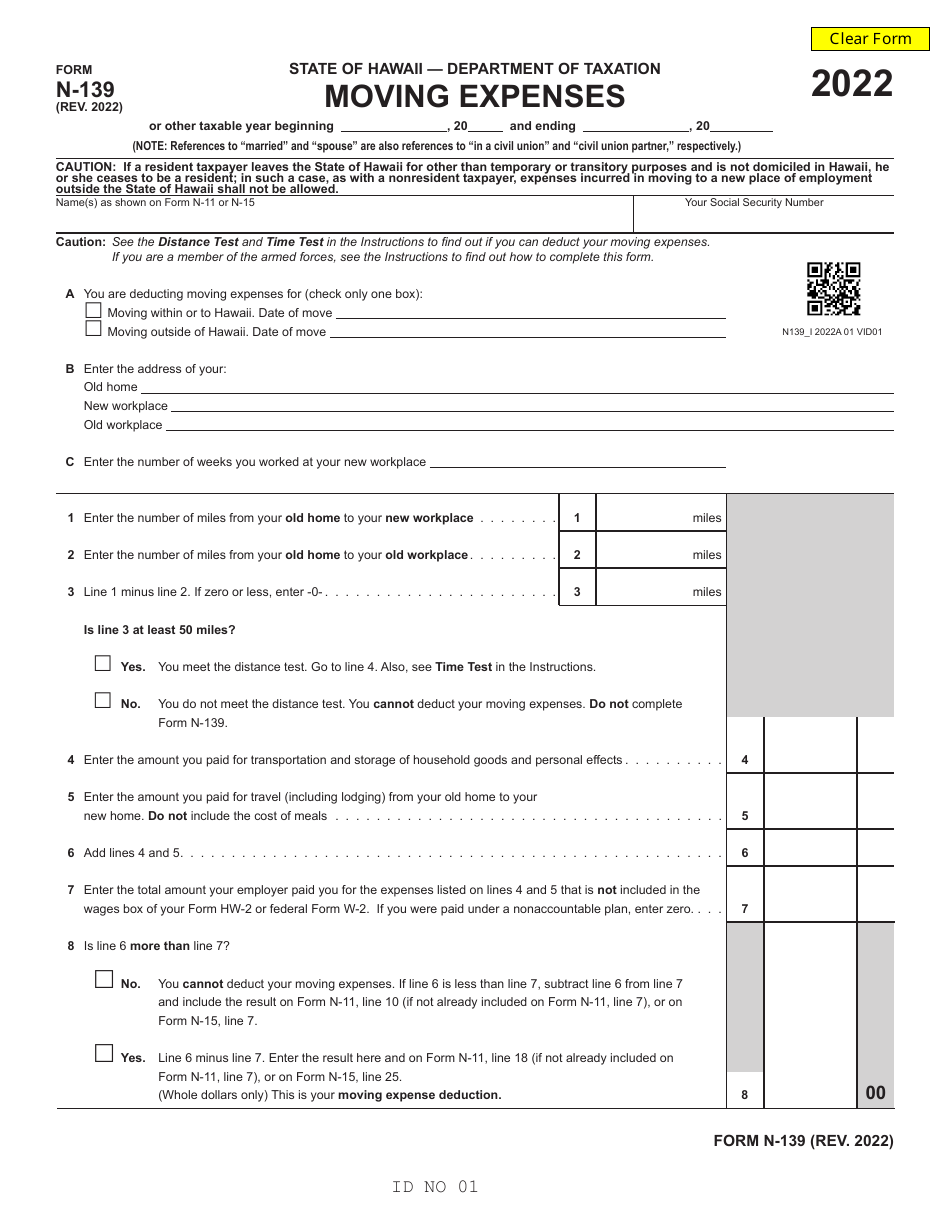

Form N-139

for the current year.

Form N-139 Moving Expenses - Hawaii

What Is Form N-139?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-139?

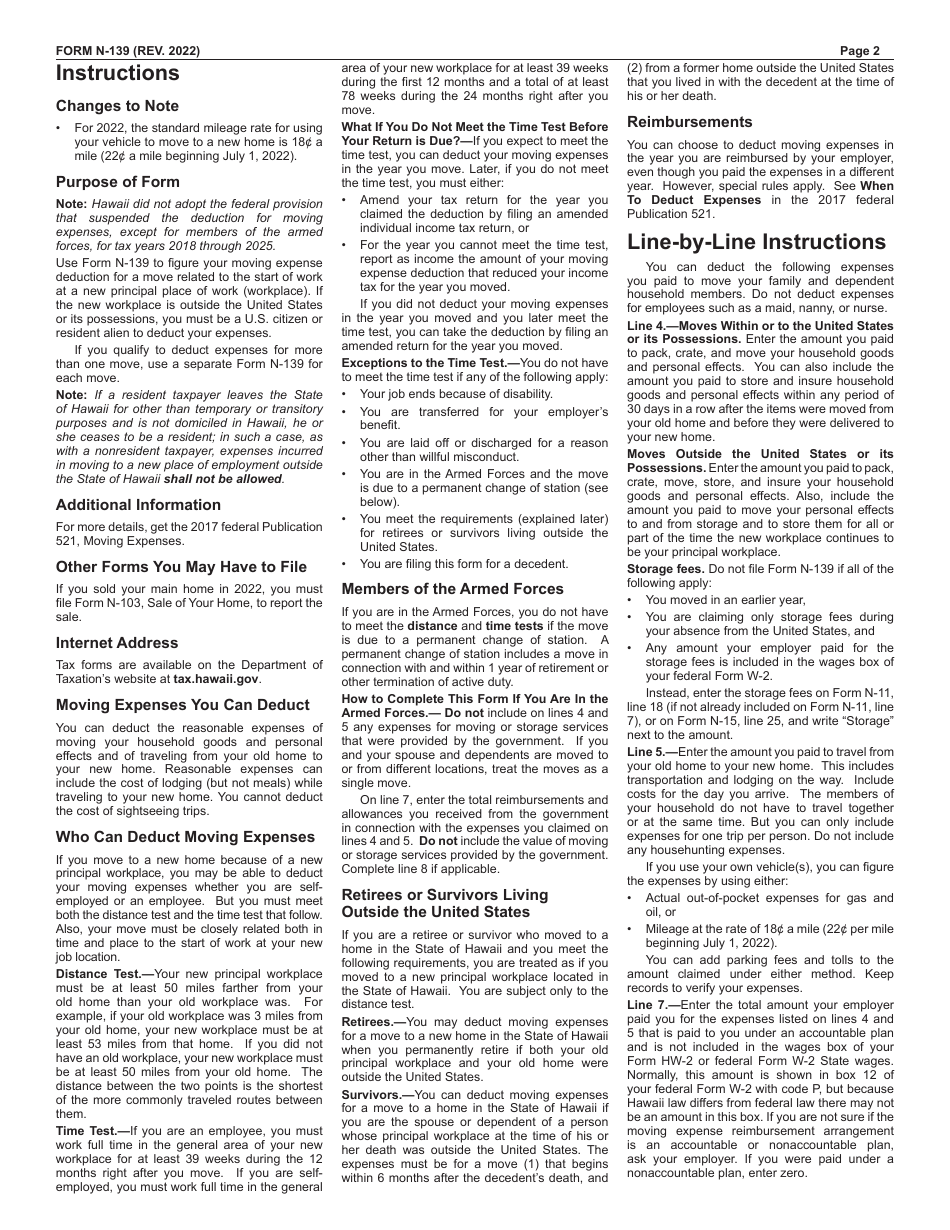

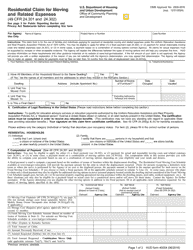

A: Form N-139 is used to report moving expenses for individuals who have relocated to or from Hawaii.

Q: Who needs to file Form N-139?

A: Individuals who have moved to or from Hawaii and have incurred moving expenses may need to file Form N-139.

Q: What are moving expenses?

A: Moving expenses refer to the costs associated with relocating to a new home, such as transportation, lodging, and packing and shipping of personal belongings.

Q: What information is required to complete Form N-139?

A: To complete Form N-139, you will need to provide your personal information, details about your move, and a breakdown of your moving expenses.

Q: When is the deadline for filing Form N-139?

A: The deadline for filing Form N-139 is typically April 20th of the year following the tax year in which the move took place.

Q: Do I need to file Form N-139 if I didn't have any moving expenses?

A: If you did not incur any moving expenses, you may not need to file Form N-139. However, it is always a good idea to consult with a tax professional or the Hawaii Department of Taxation to confirm.

Q: Can I claim moving expenses on my federal tax return?

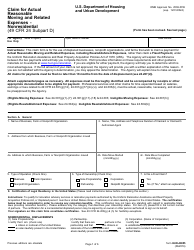

A: As of 2018, the ability to claim a deduction for moving expenses on your federal tax return is generally only available to members of the military.

Q: Are moving expenses deductible on my state tax return?

A: Moving expenses may be deductible on your state tax return, depending on the laws of your specific state. In the case of Hawaii, you can use Form N-139 to report and potentially claim a deduction for eligible moving expenses.

Q: Is there a limit to the amount of moving expenses that can be deducted?

A: Yes, there may be limits to the amount of moving expenses that can be deducted, both at the federal and state level. It is recommended to consult with a tax professional or the Hawaii Department of Taxation for specific guidance.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-139 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.