This version of the form is not currently in use and is provided for reference only. Download this version of

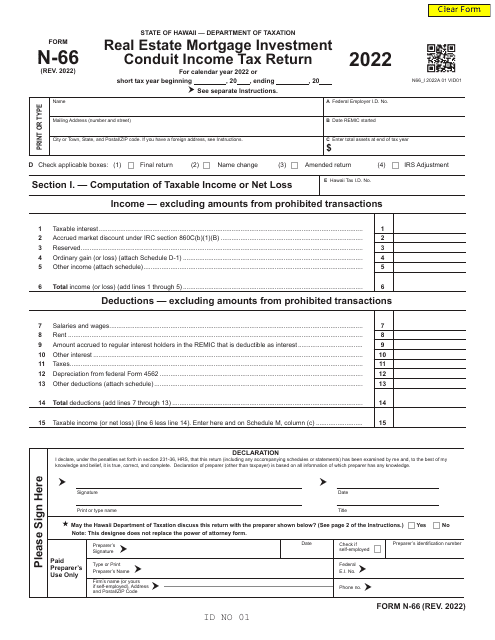

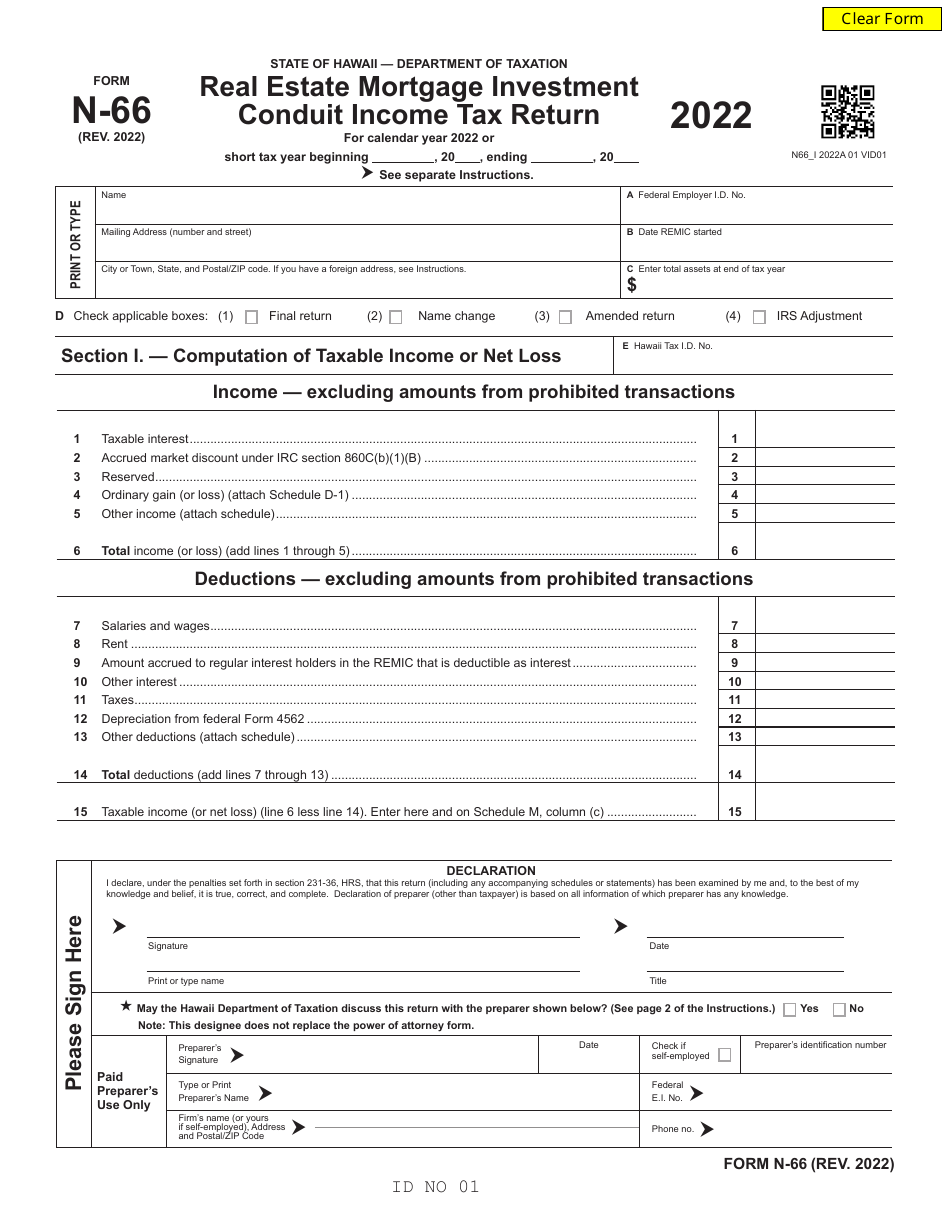

Form N-66

for the current year.

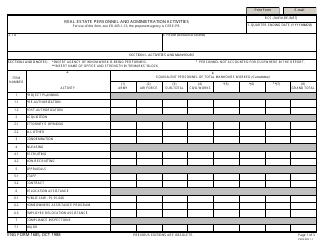

Form N-66 Real Estate Mortgage Investment Conduit Income Tax Return - Hawaii

What Is Form N-66?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-66?

A: Form N-66 is the Real Estate Mortgage Investment Conduit Income Tax Return specific to Hawaii.

Q: Who needs to file Form N-66?

A: Real Estate Mortgage Investment Conduits (REMICs) in Hawaii are required to file Form N-66.

Q: What is a Real Estate Mortgage Investment Conduit?

A: A Real Estate Mortgage Investment Conduit (REMIC) is an entity that holds a pool of mortgages and issues multiple classes of mortgage-backed securities.

Q: What is the purpose of Form N-66?

A: The purpose of Form N-66 is to report the income, deductions, and tax liability of a REMIC in Hawaii.

Q: What are the due dates for filing Form N-66?

A: The due date for filing Form N-66 is the 20th day of the 4th month following the end of the REMIC's tax year.

Q: Are there any penalties for late filing of Form N-66?

A: Yes, there are penalties for late filing of Form N-66. The penalty is 5% of the unpaid tax for each month or part of a month that the return is late, up to a maximum of 25%.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-66 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.