This version of the form is not currently in use and is provided for reference only. Download this version of

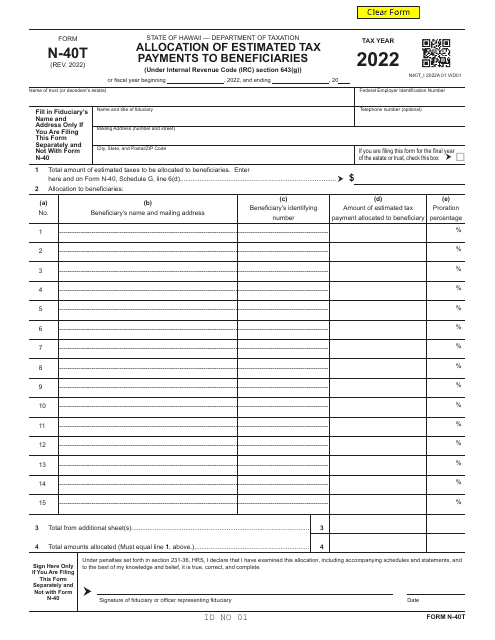

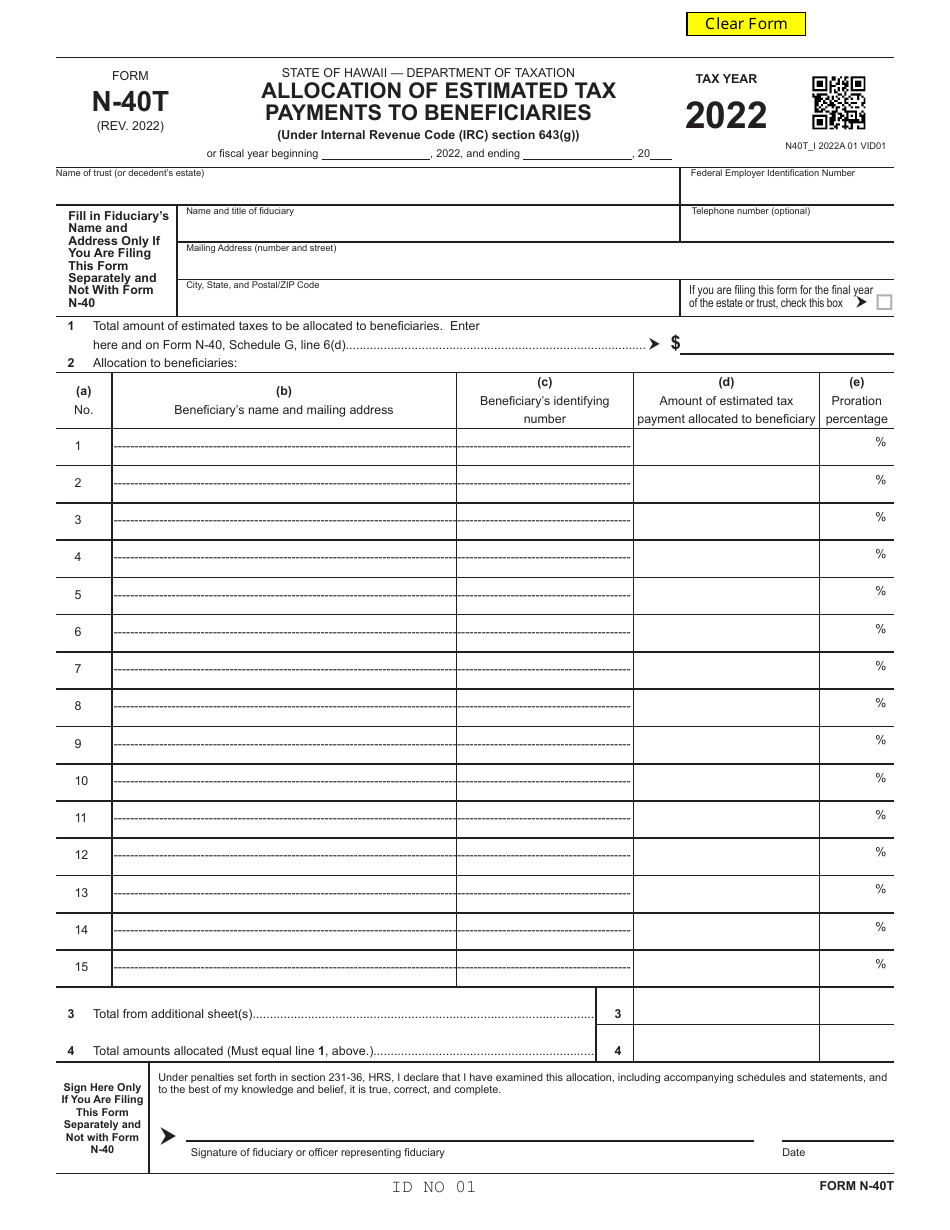

Form N-40T

for the current year.

Form N-40T Allocation of Estimated Tax Payments to Beneficiaries - Hawaii

What Is Form N-40T?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-40T?

A: Form N-40T is the Allocation of Estimated Tax Payments to Beneficiaries form specific to Hawaii.

Q: Who should file Form N-40T?

A: This form should be filed by fiduciaries of estates and trusts in Hawaii.

Q: What is the purpose of Form N-40T?

A: The purpose of Form N-40T is to allocate estimated tax payments among the beneficiaries of an estate or trust.

Q: When is Form N-40T due?

A: Form N-40T is due on or before the 15th day of the 4th month following the close of the taxable year.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-40T by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.