This version of the form is not currently in use and is provided for reference only. Download this version of

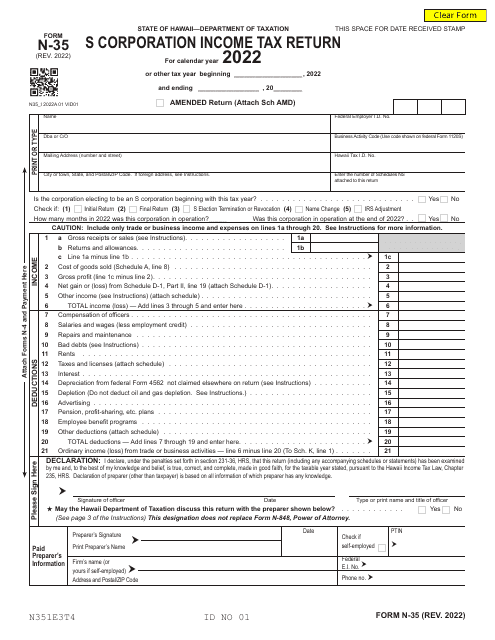

Form N-35

for the current year.

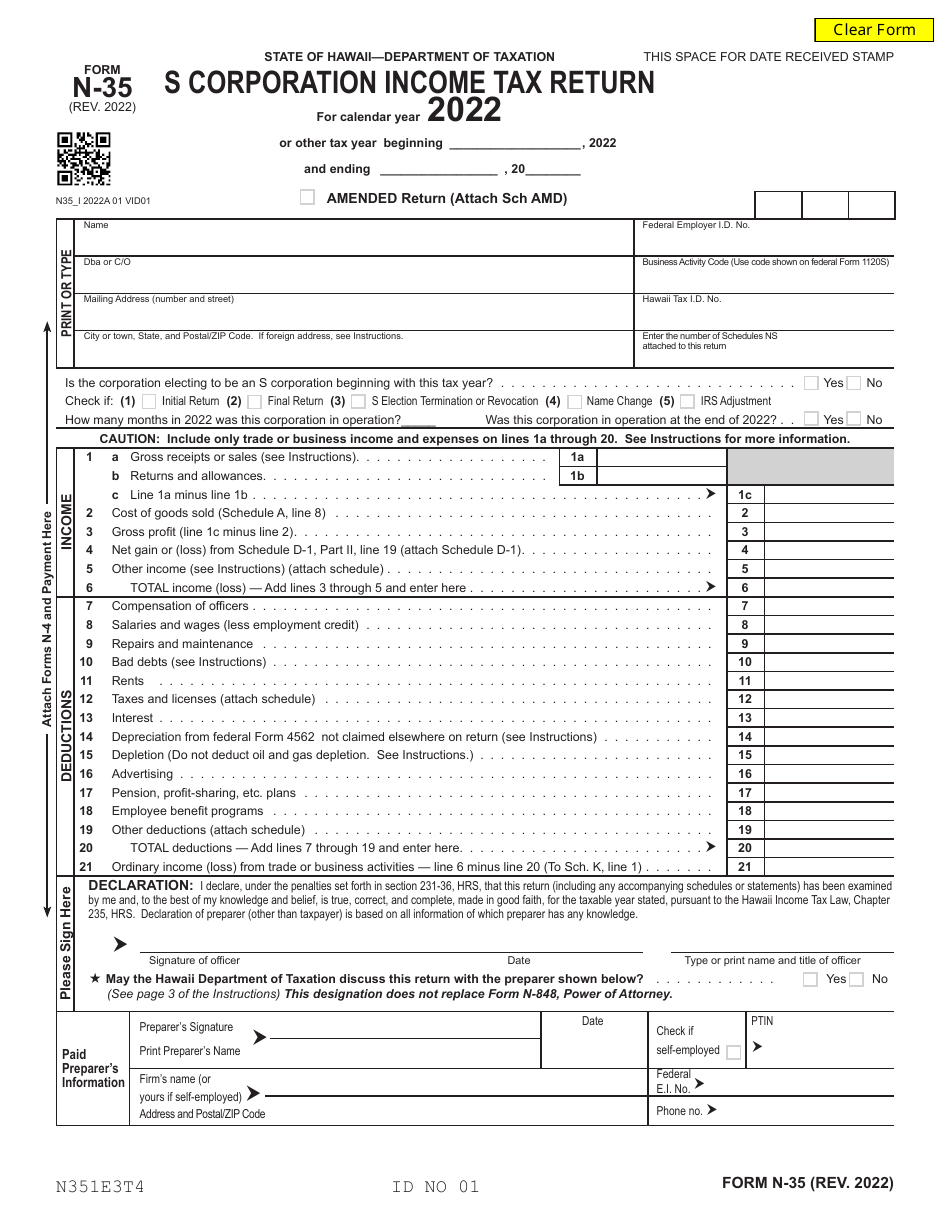

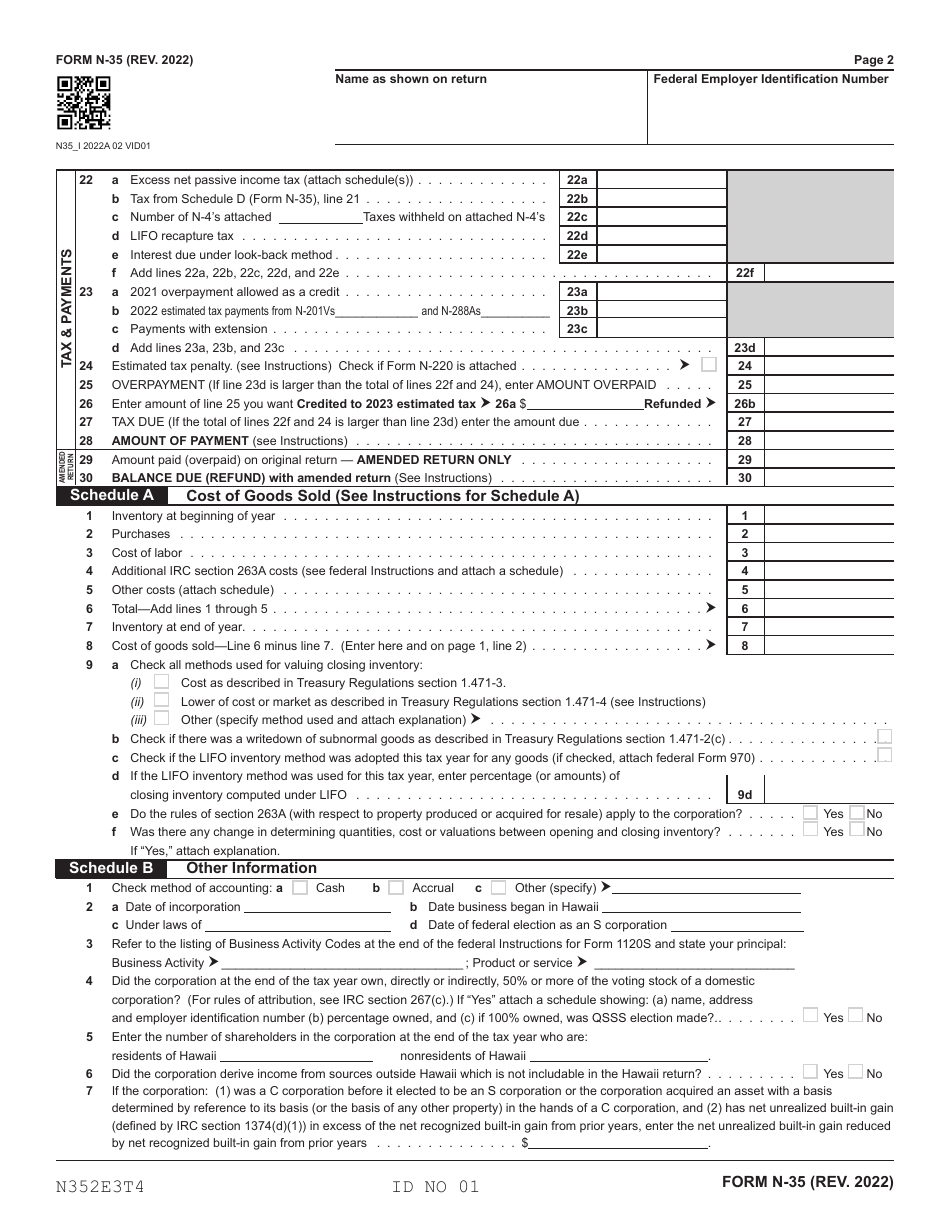

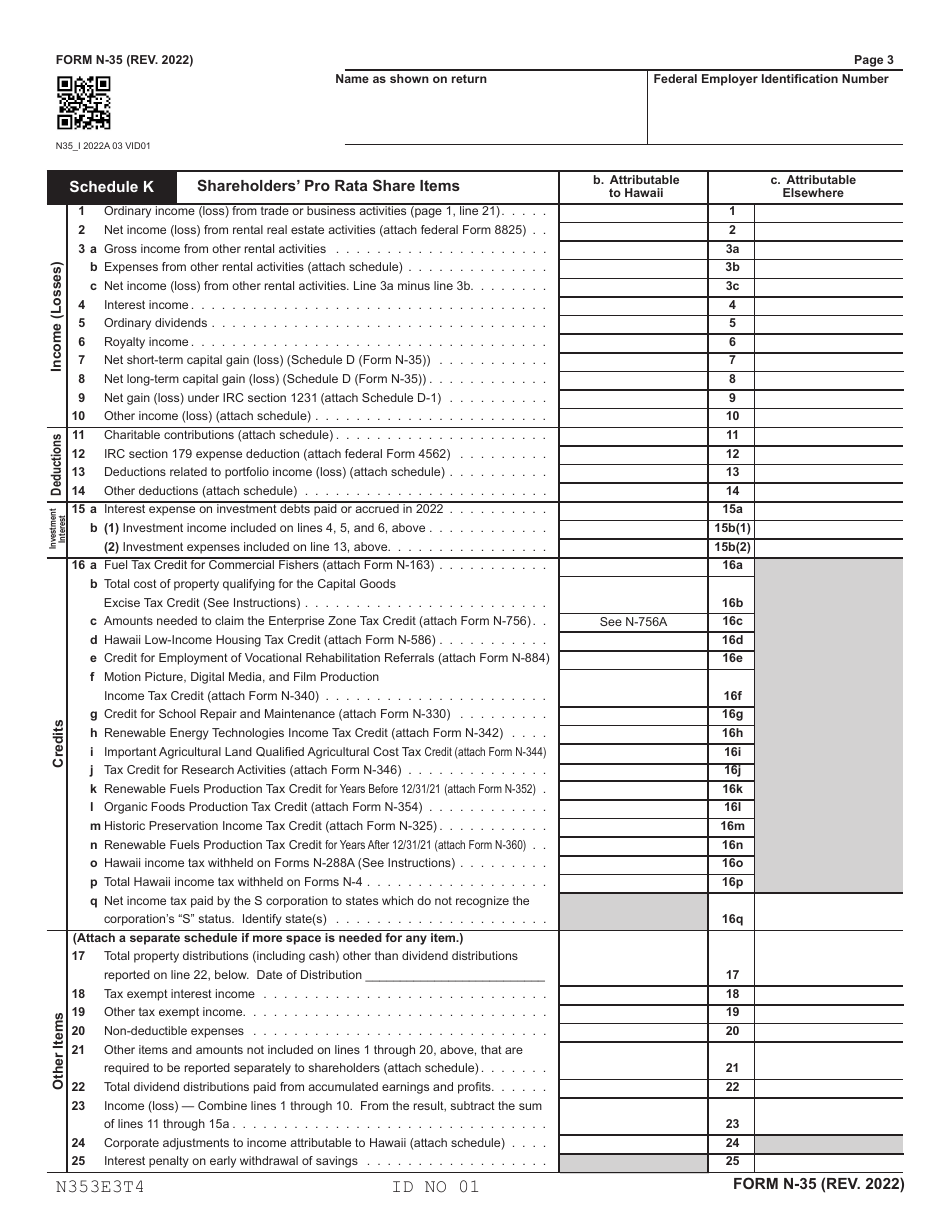

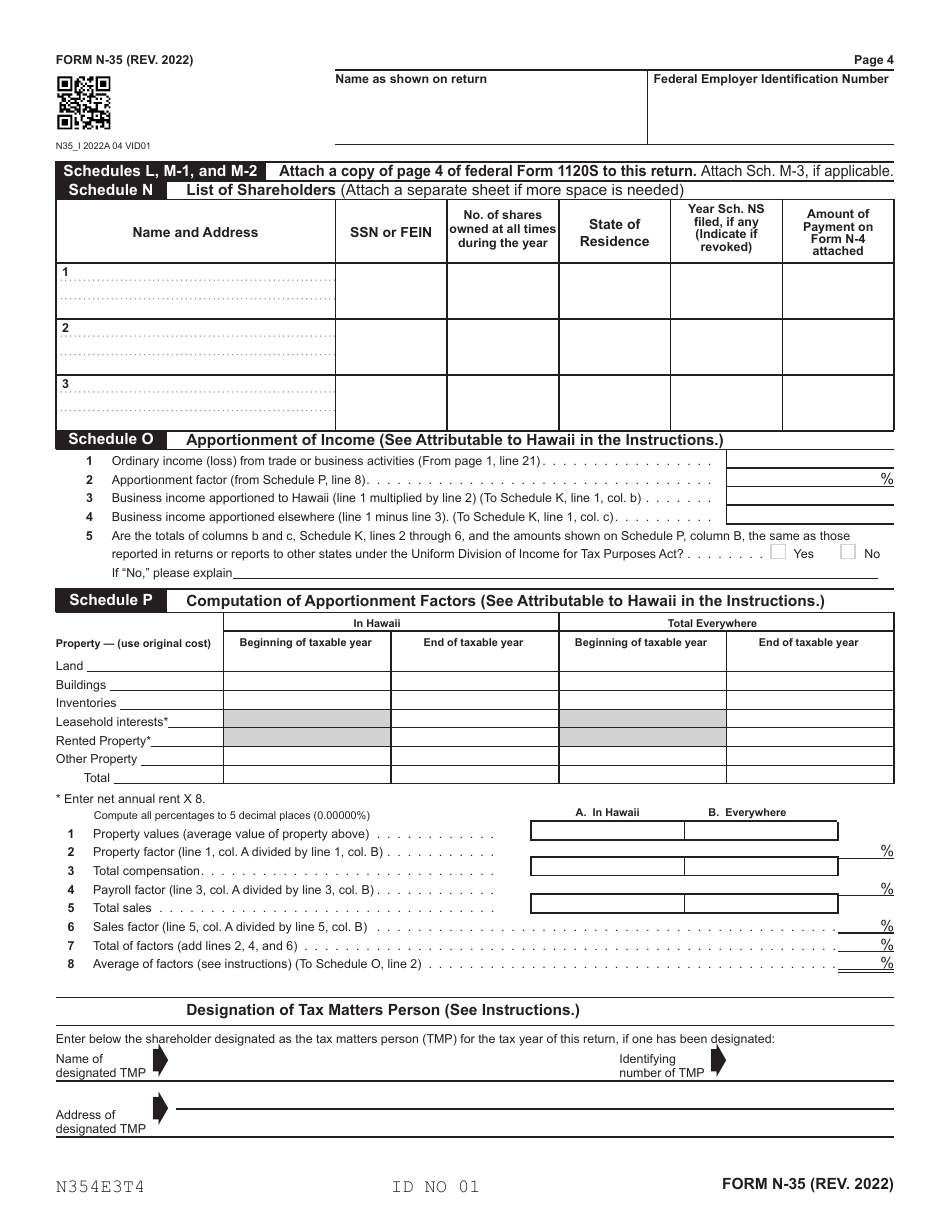

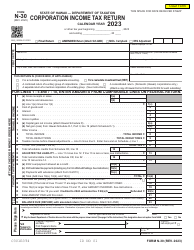

Form N-35 S Corporation Income Tax Return - Hawaii

What Is Form N-35?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-35?

A: Form N-35 is the S Corporation Income Tax Return for the state of Hawaii.

Q: Who should file Form N-35?

A: S corporations operating in Hawaii should file Form N-35.

Q: What is the purpose of Form N-35?

A: Form N-35 is used to report the income, deductions, and credits of an S corporation.

Q: When is Form N-35 due?

A: Form N-35 is due on the 20th day of the 4th month following the close of the tax year.

Q: Are there any extensions available for filing Form N-35?

A: Yes, an extension of time to file Form N-35 can be requested.

Q: How can I request an extension for Form N-35?

A: You can request an extension by filing Form N-301, Application for Automatic Extension of Time to File Hawaii Corporation Income Tax Return.

Q: Is Form N-35 the only form that needs to be filed for S corporations in Hawaii?

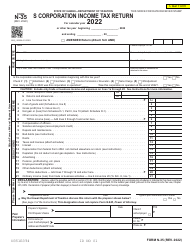

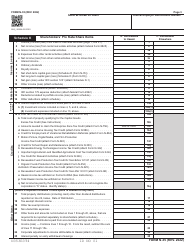

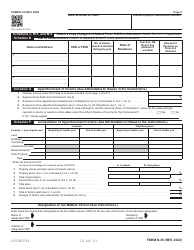

A: No, there are additional schedules and forms that may need to be filed depending on the circumstances.

Q: Can Form N-35 be filed electronically?

A: Yes, Form N-35 can be filed electronically.

Q: Are there any fees associated with filing Form N-35?

A: Yes, there is a fee for filing Form N-35. The fee amount may vary and should be checked with the Hawaii Department of Taxation.

Q: What if I make a mistake on my Form N-35?

A: If you make a mistake on your Form N-35, you may need to file an amended return using Form N-35X.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-35 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.