This version of the form is not currently in use and is provided for reference only. Download this version of

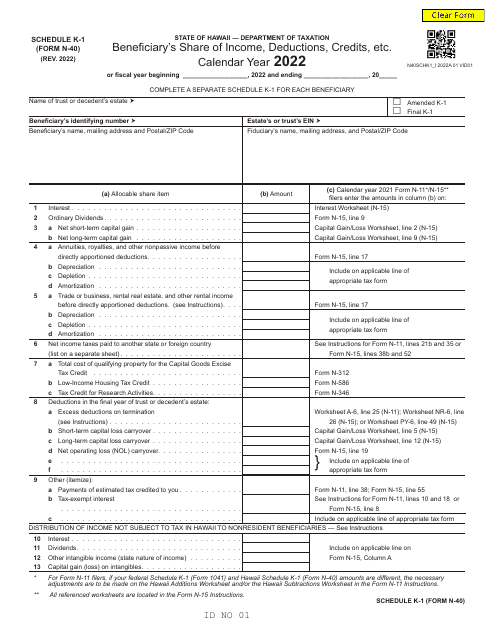

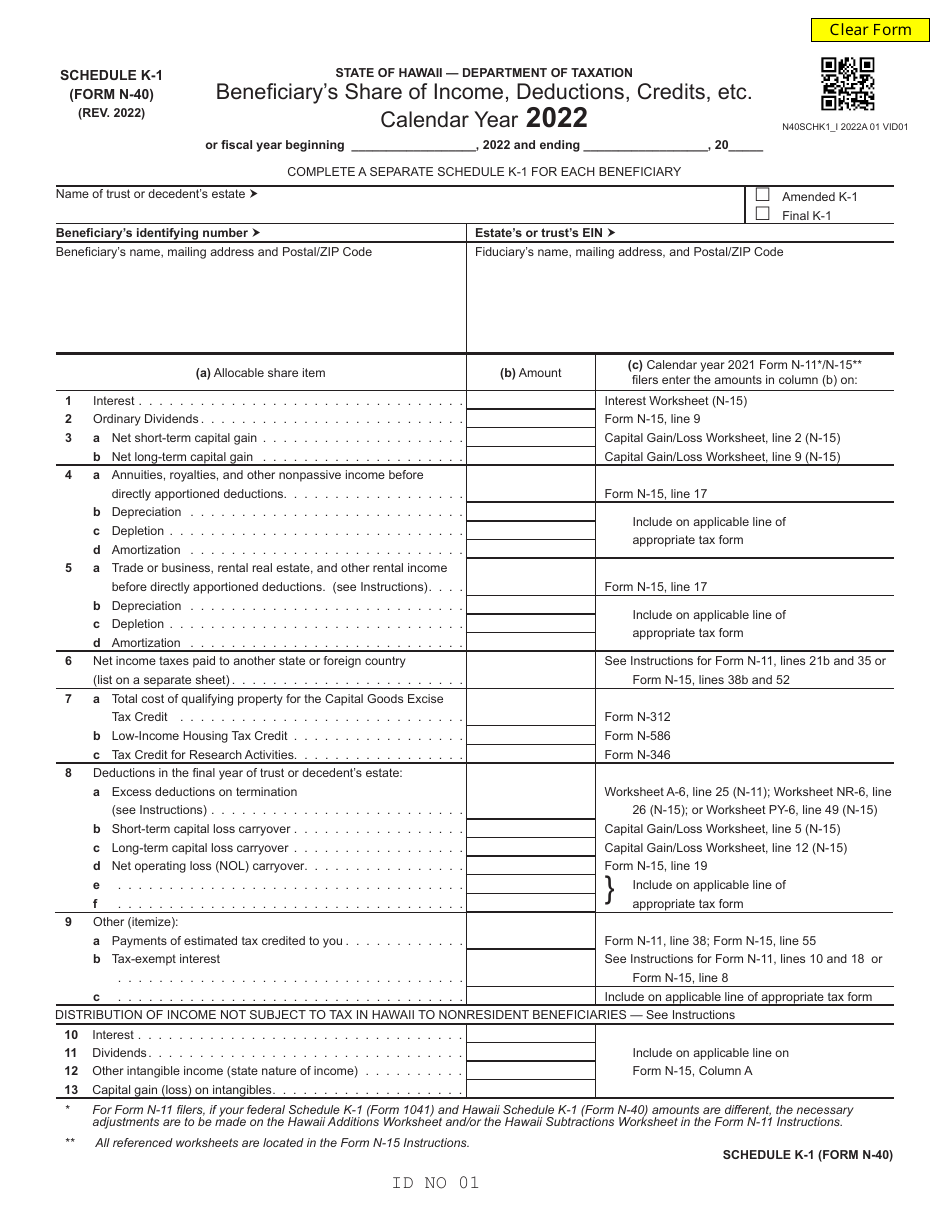

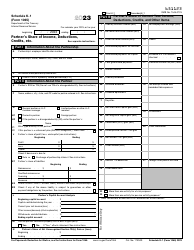

Form N-40 Schedule K-1

for the current year.

Form N-40 Schedule K-1 Beneficiary's Share of Income, Deductions, Credits, Etc. - Hawaii

What Is Form N-40 Schedule K-1?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii.The document is a supplement to Form N-40, Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-40 Schedule K-1?

A: Form N-40 Schedule K-1 is a form used by beneficiaries in Hawaii to report their share of income, deductions, credits, etc.

Q: Who needs to fill out Form N-40 Schedule K-1?

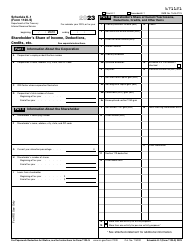

A: Beneficiaries in Hawaii who have received income, deductions, credits, etc. from a trust or estate need to fill out Form N-40 Schedule K-1.

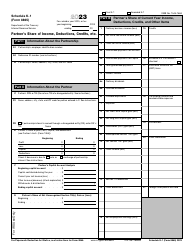

Q: What information is needed for Form N-40 Schedule K-1?

A: You will need the trust or estate's EIN, your share of income, deductions, credits, etc., and any other information required by the form.

Q: When is the deadline to file Form N-40 Schedule K-1?

A: The deadline to file Form N-40 Schedule K-1 is the same as the deadline for filing your Hawaii tax return.

Q: Do I need to include Form N-40 Schedule K-1 with my tax return?

A: Yes, you need to include Form N-40 Schedule K-1 with your Hawaii tax return.

Q: What happens if I don't file Form N-40 Schedule K-1?

A: If you don't file Form N-40 Schedule K-1, you may not accurately report your income, deductions, credits, etc. from a trust or estate, which could result in penalties or fines.

Q: Can I e-file Form N-40 Schedule K-1?

A: No, currently e-filing is not available for Form N-40 Schedule K-1. You must submit a paper copy.

Q: Can I amend Form N-40 Schedule K-1?

A: Yes, if you need to make changes to your original Form N-40 Schedule K-1, you can file an amended form with the Hawaii Department of Taxation.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-40 Schedule K-1 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.