This version of the form is not currently in use and is provided for reference only. Download this version of

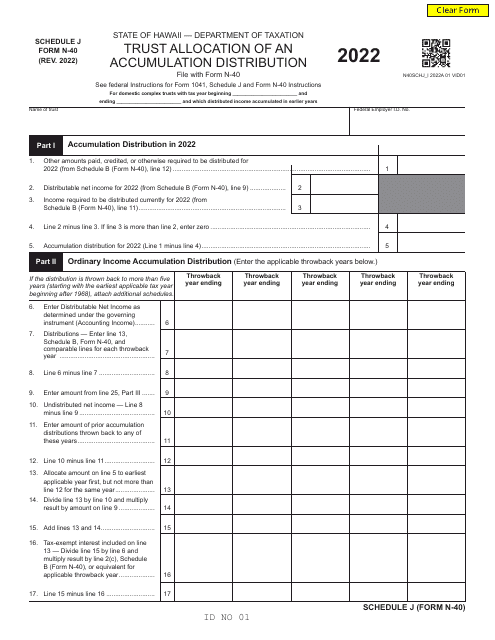

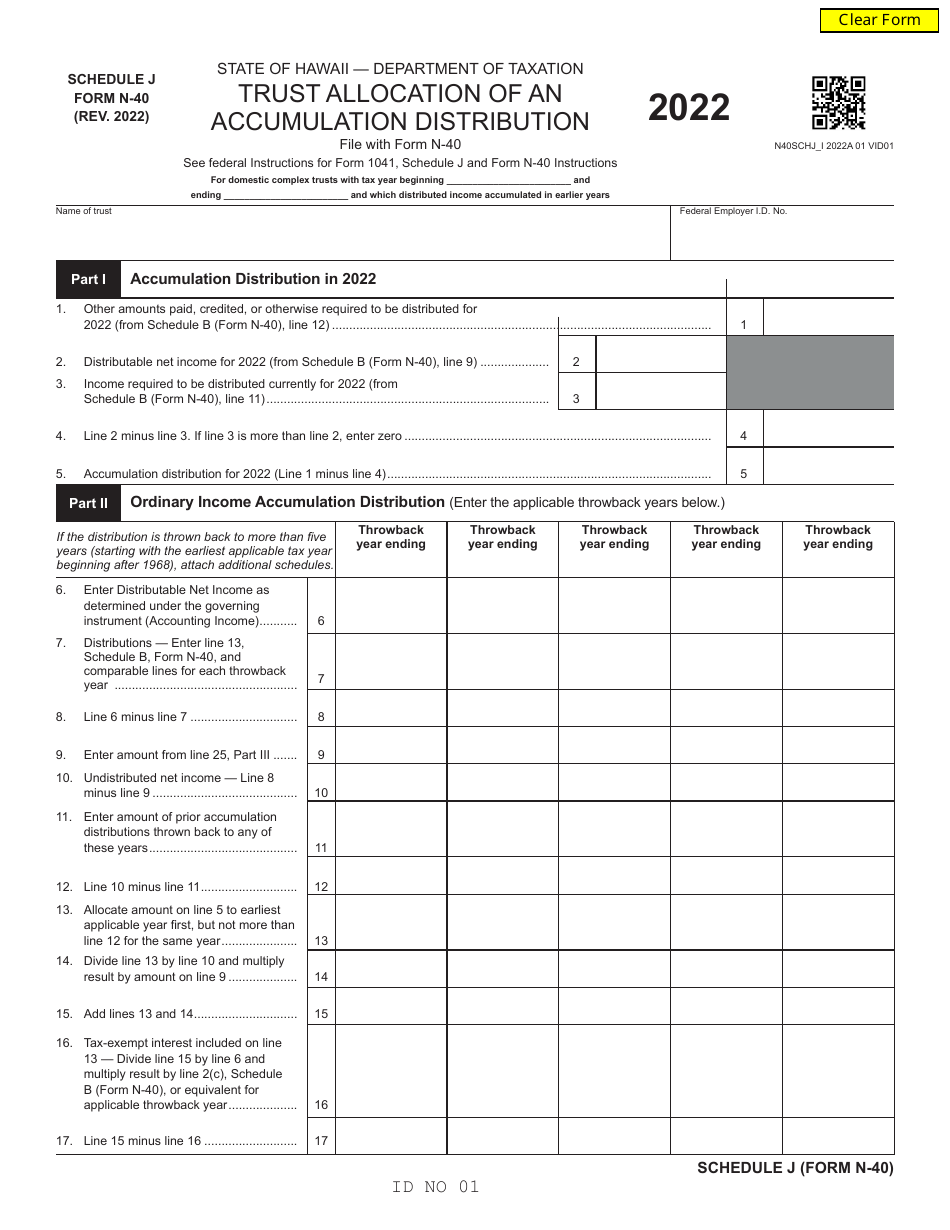

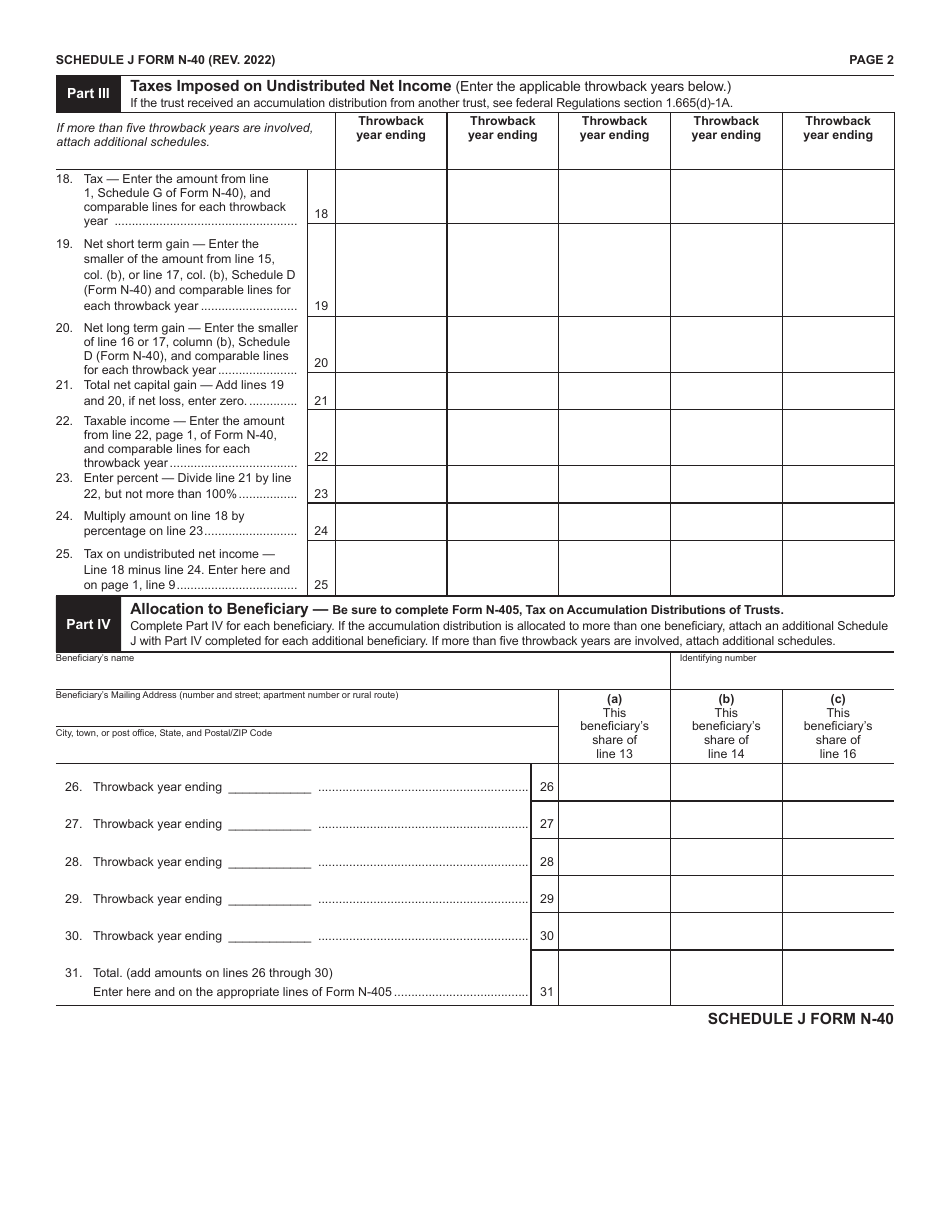

Form N-40 Schedule J

for the current year.

Form N-40 Schedule J Trust Allocation of an Accumulation Distribution - Hawaii

What Is Form N-40 Schedule J?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii.The document is a supplement to Form N-40, Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-40 Schedule J?

A: Form N-40 Schedule J is a tax form used in the state of Hawaii to report the allocation of an accumulation distribution from a trust.

Q: What is an accumulation distribution?

A: An accumulation distribution refers to income that has been accumulated by a trust and is distributed to beneficiaries.

Q: Who needs to file Form N-40 Schedule J?

A: Individuals who are residents of Hawaii and received an accumulation distribution from a trust need to file Form N-40 Schedule J.

Q: What information is required on Form N-40 Schedule J?

A: Form N-40 Schedule J requires information about the trust, the beneficiaries, and the allocation of the accumulation distribution.

Q: When is the deadline to file Form N-40 Schedule J?

A: The deadline to file Form N-40 Schedule J is the same as the deadline for filing your Hawaii state income tax return, which is typically April 20th.

Q: What happens if I don't file Form N-40 Schedule J?

A: If you are required to file Form N-40 Schedule J and fail to do so, you may face penalties and interest on any tax owed.

Q: Can I e-file Form N-40 Schedule J?

A: Yes, you can e-file Form N-40 Schedule J if you are filing your Hawaii state income tax return electronically.

Q: Can I file Form N-40 Schedule J separately from my Hawaii state income tax return?

A: No, Form N-40 Schedule J must be filed along with your Hawaii state income tax return.

Q: Are there any exceptions to filing Form N-40 Schedule J?

A: There may be exceptions to filing Form N-40 Schedule J depending on your specific circumstances. It is best to consult with a tax professional or the Hawaii Department of Taxation for guidance.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-40 Schedule J by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.