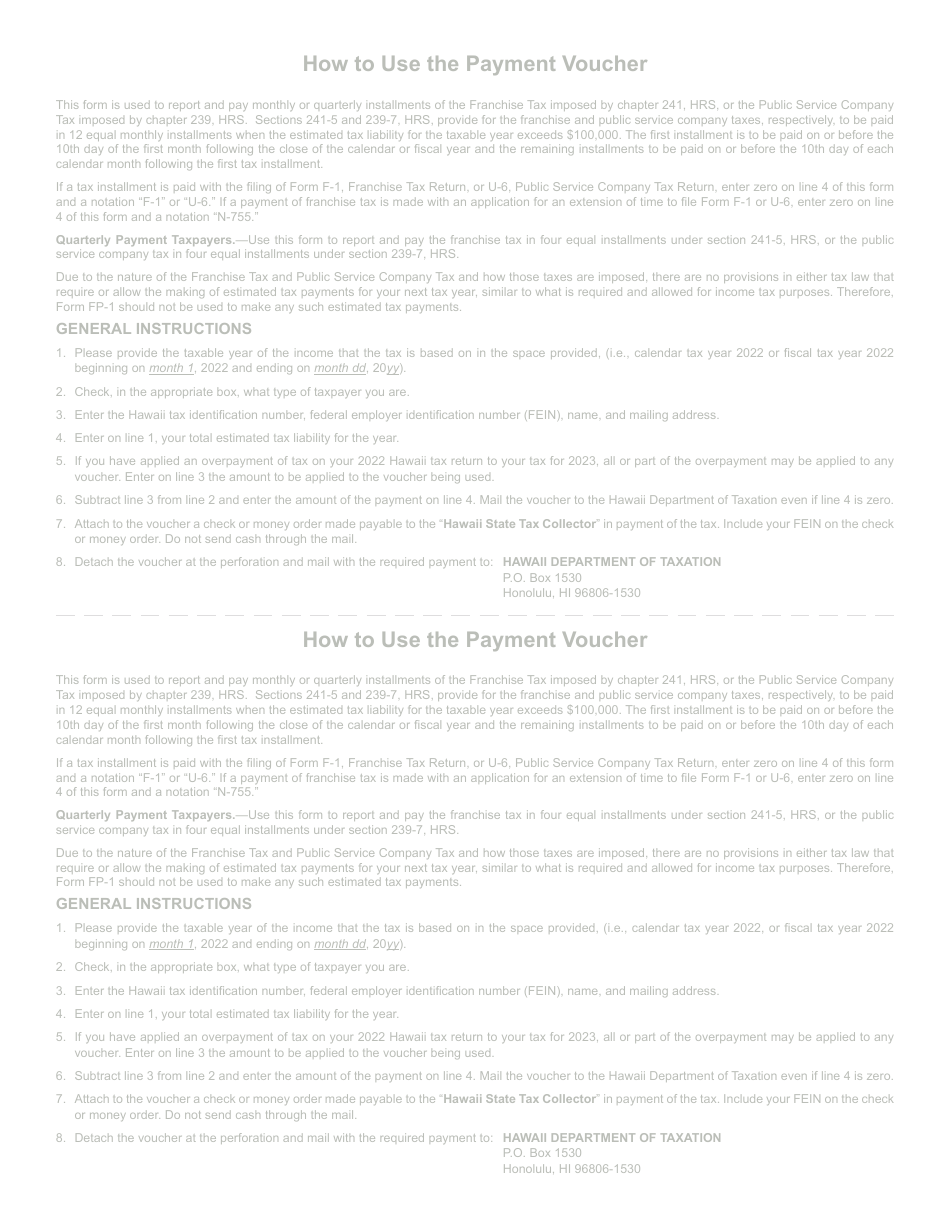

This version of the form is not currently in use and is provided for reference only. Download this version of

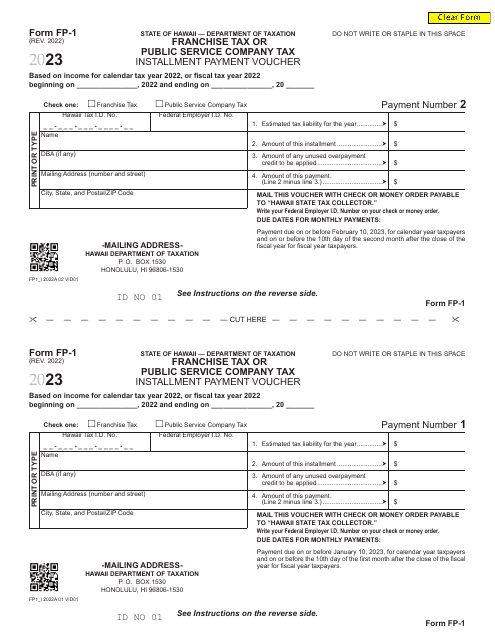

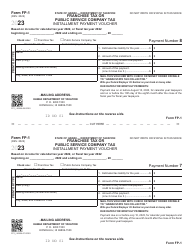

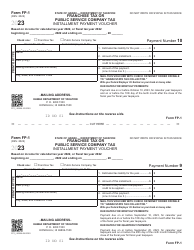

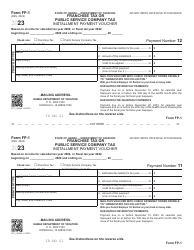

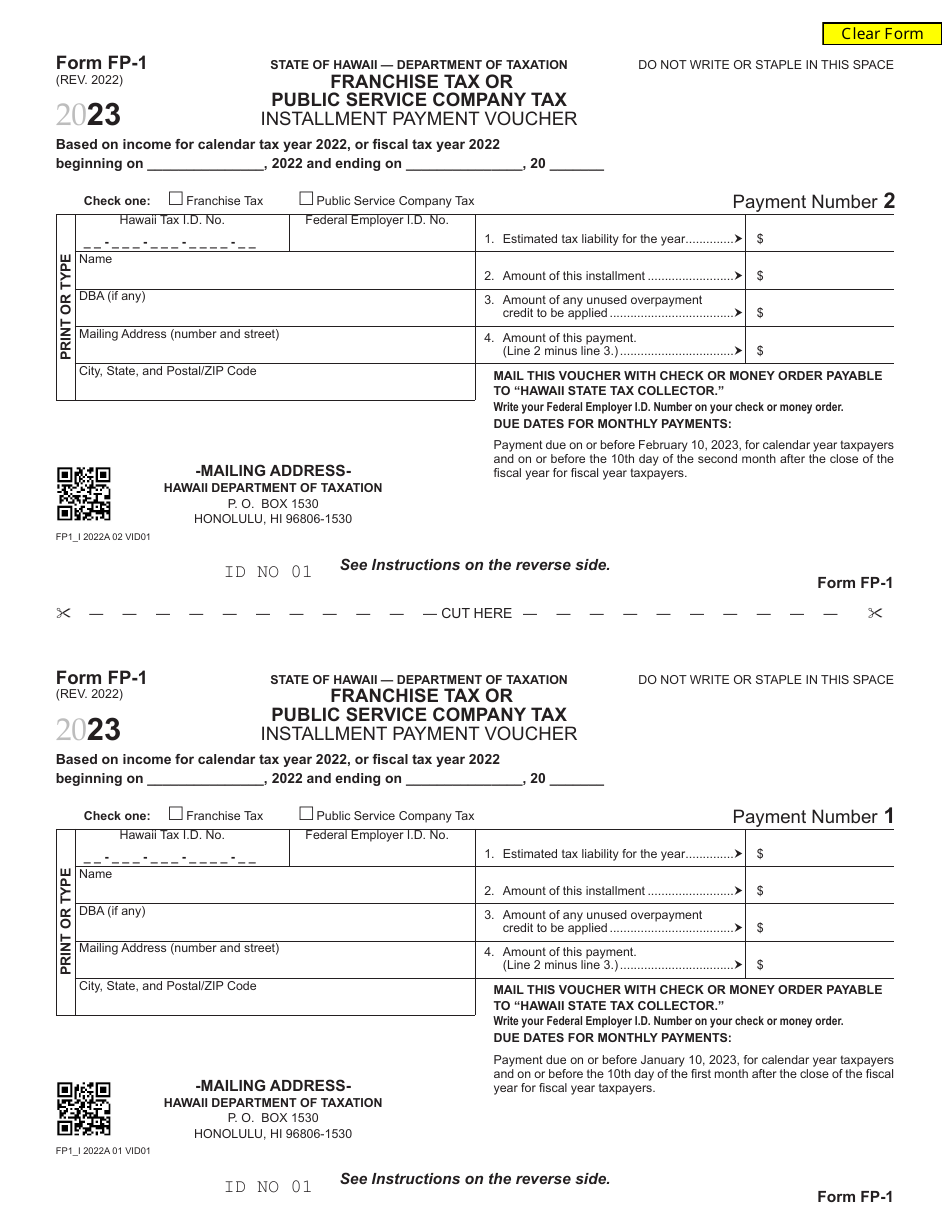

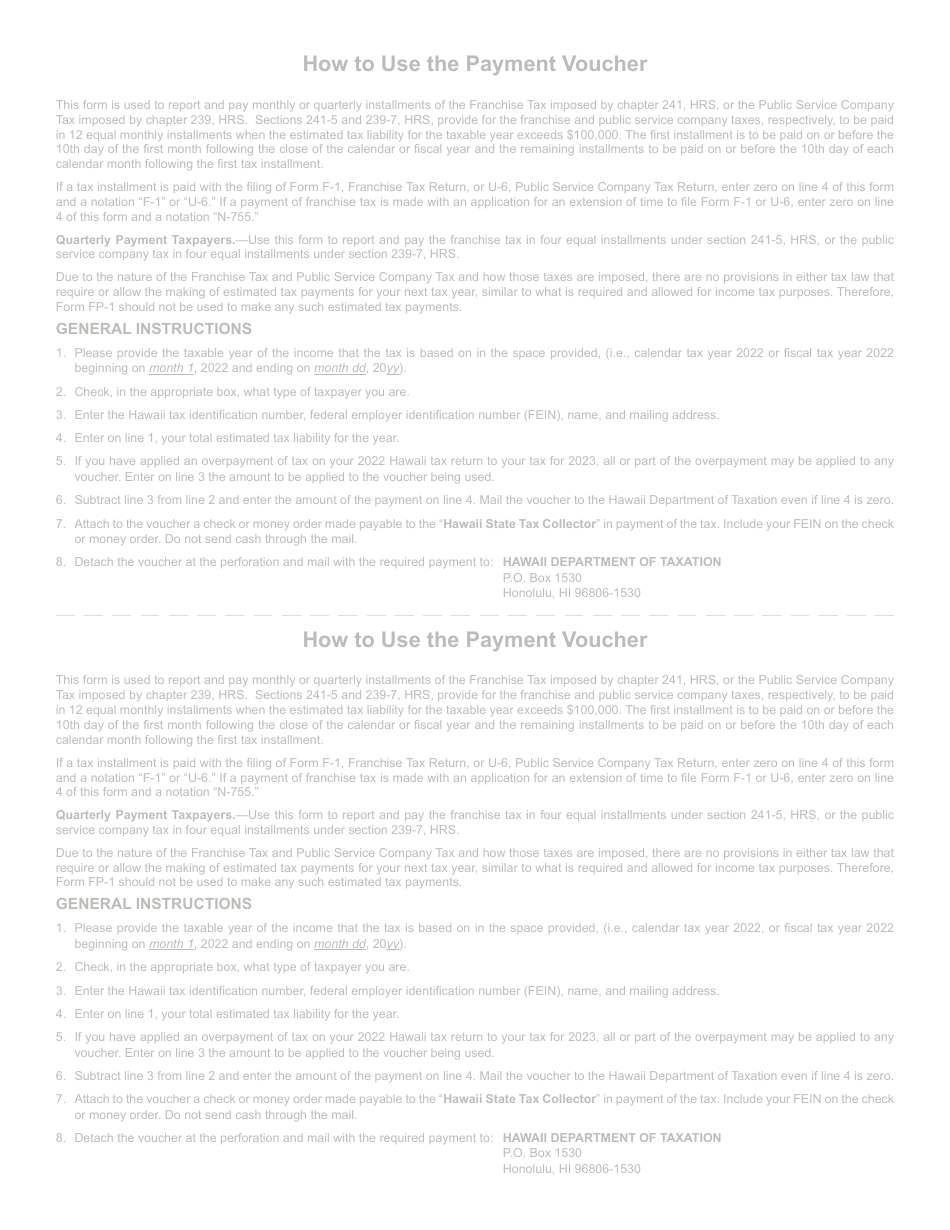

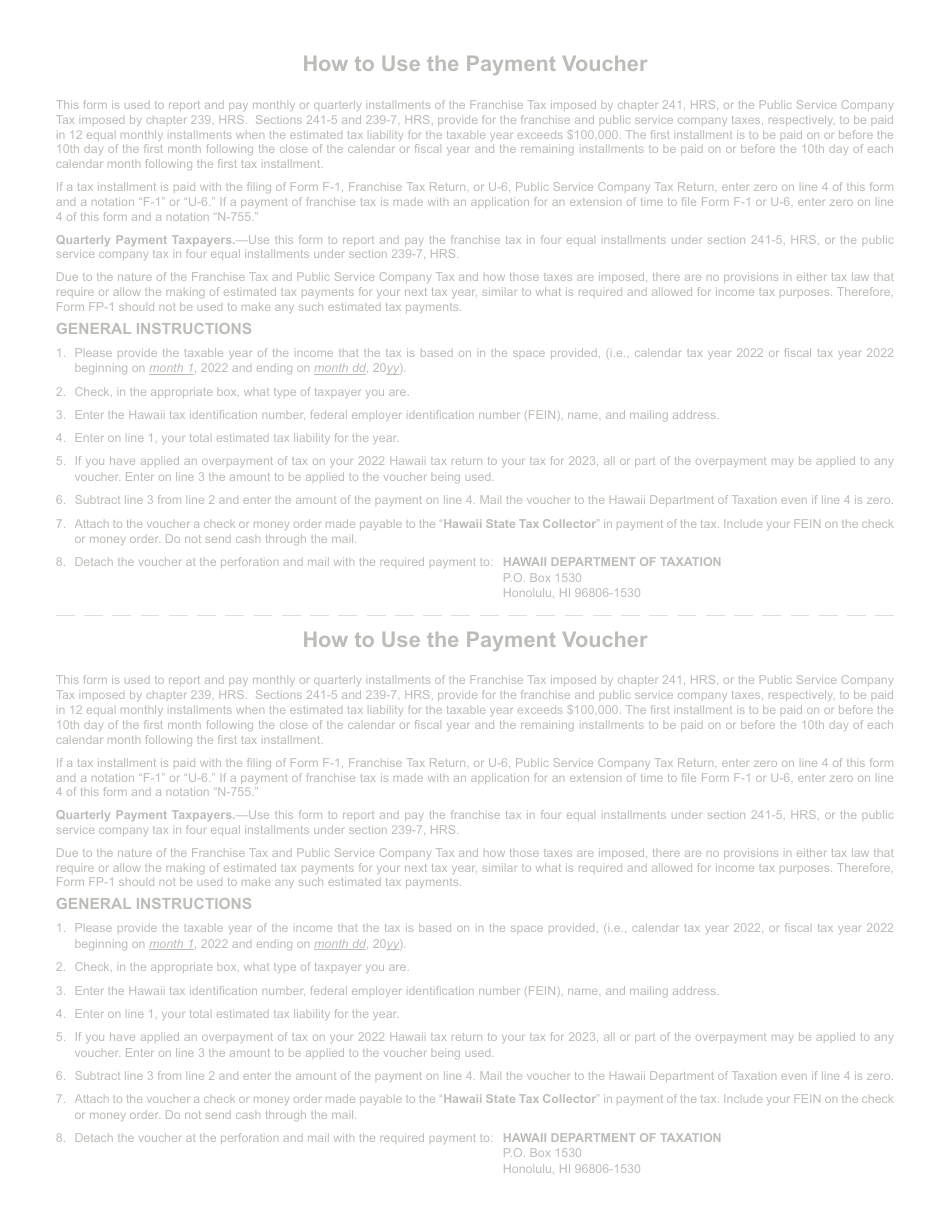

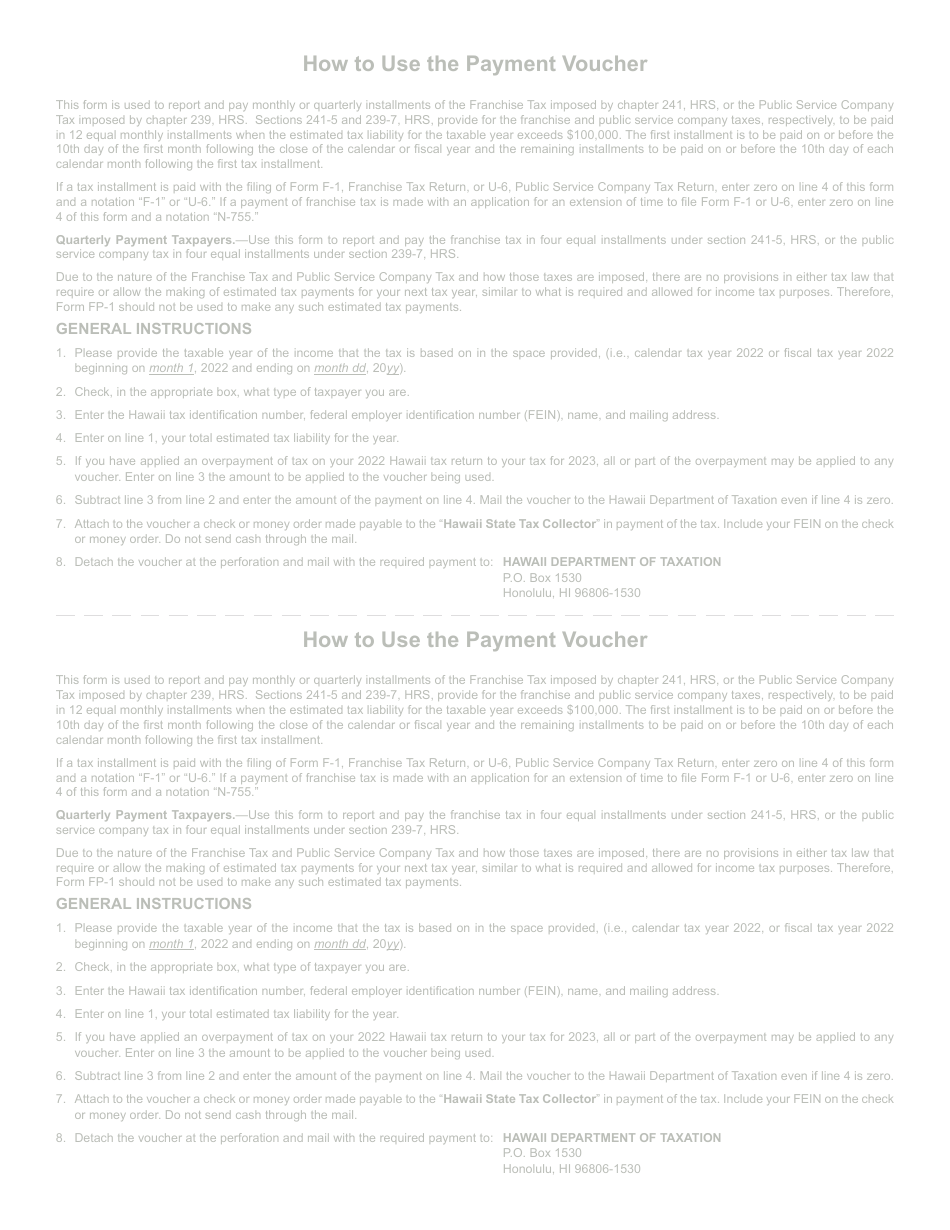

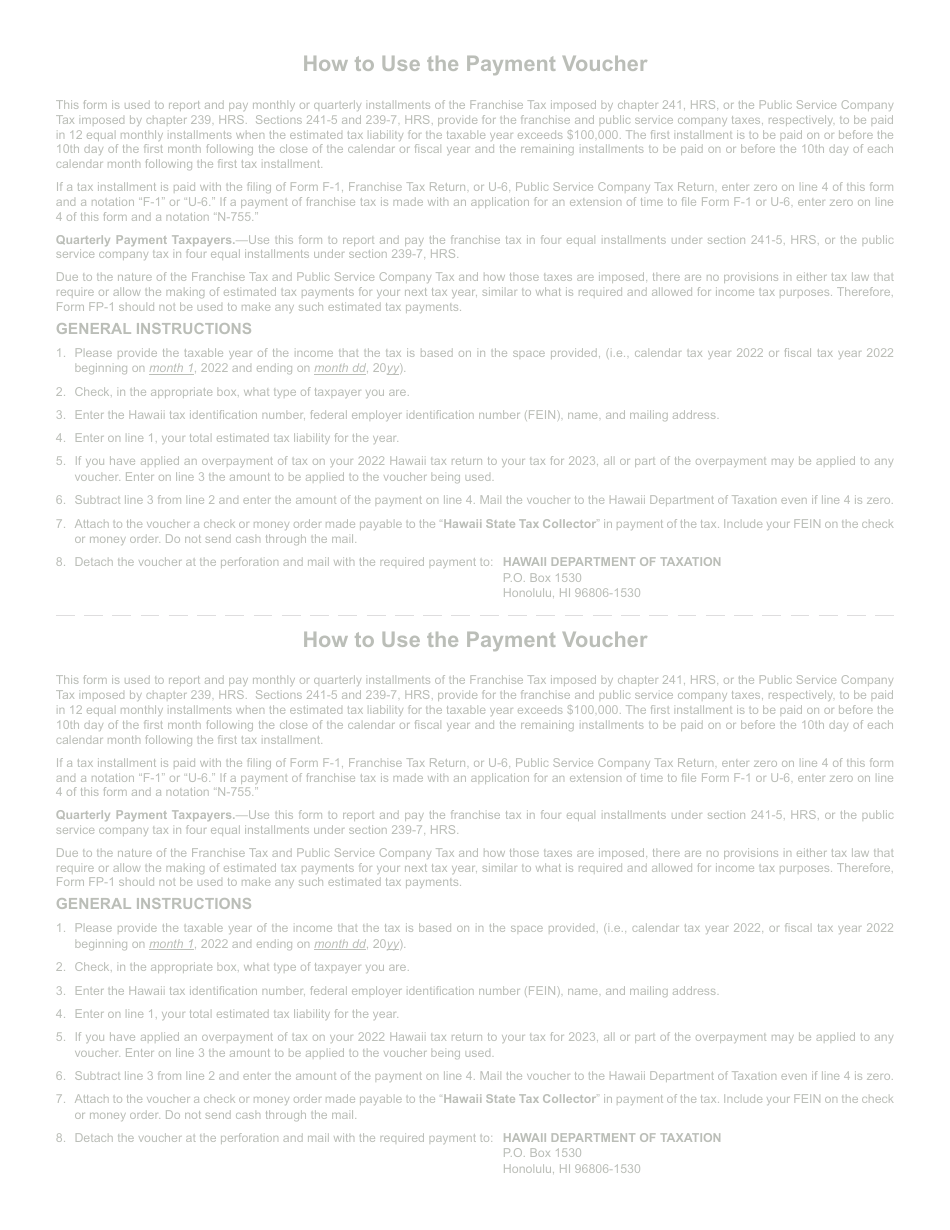

Form FP-1

for the current year.

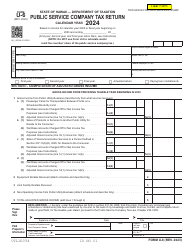

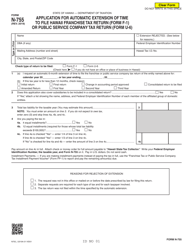

Form FP-1 Franchise Tax or Public Service Company Tax - Hawaii

What Is Form FP-1?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

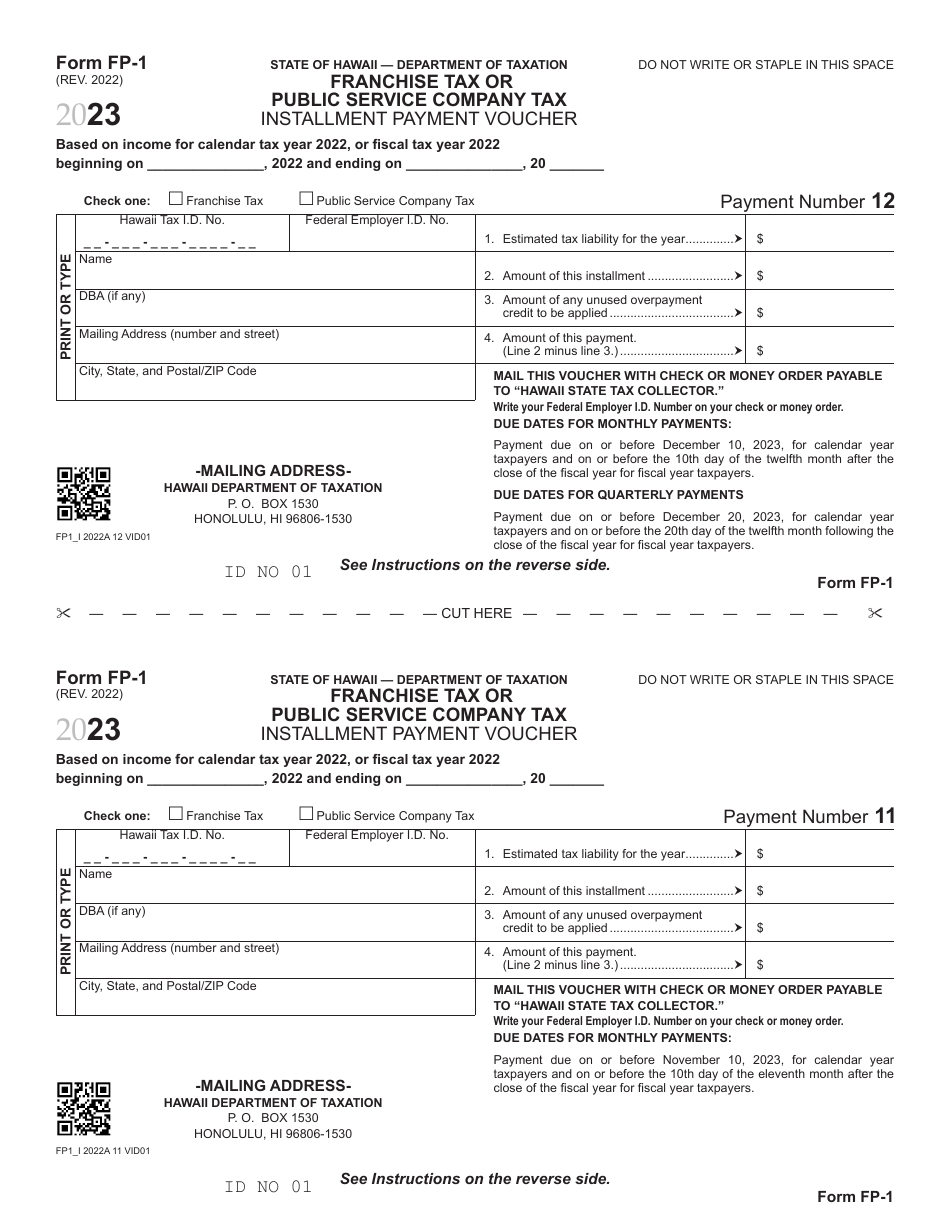

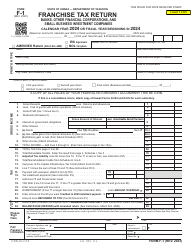

Q: What is Form FP-1?

A: Form FP-1 is the form used in Hawaii to report Franchise Tax or Public Service Company Tax.

Q: What is Franchise Tax?

A: Franchise Tax is a tax imposed on a business entity for the privilege of operating in Hawaii.

Q: What is Public Service Company Tax?

A: Public Service Company Tax is a tax imposed on public service companies operating in Hawaii.

Q: Who needs to file Form FP-1?

A: Business entities subject to Franchise Tax or Public Service Company Tax in Hawaii need to file Form FP-1.

Q: What information is required on Form FP-1?

A: Form FP-1 requires information such as business entity details, income information, and tax calculations.

Q: When is Form FP-1 due?

A: Form FP-1 is due on or before the 20th day of the fourth month following the close of the taxable year.

Q: Is there a fee for filing Form FP-1?

A: Yes, there is a fee for filing Form FP-1. The fee amount varies depending on the amount of tax due.

Q: Are there any penalties for late filing of Form FP-1?

A: Yes, there are penalties for late filing of Form FP-1. It is important to file the form on time to avoid penalties.

Q: What should I do if I have questions or need assistance with Form FP-1?

A: If you have questions or need assistance with Form FP-1, you can contact the Hawaii Department of Taxation for guidance.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FP-1 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.