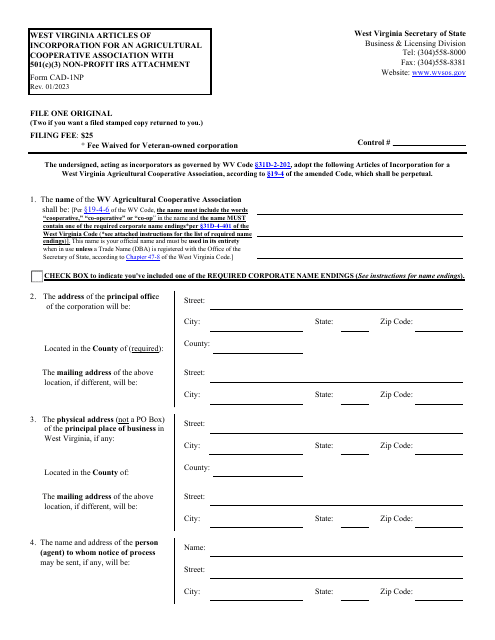

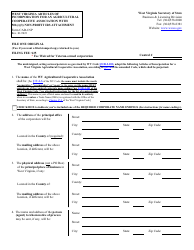

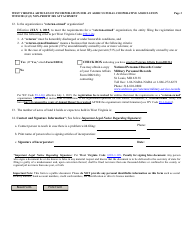

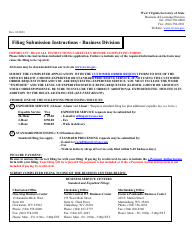

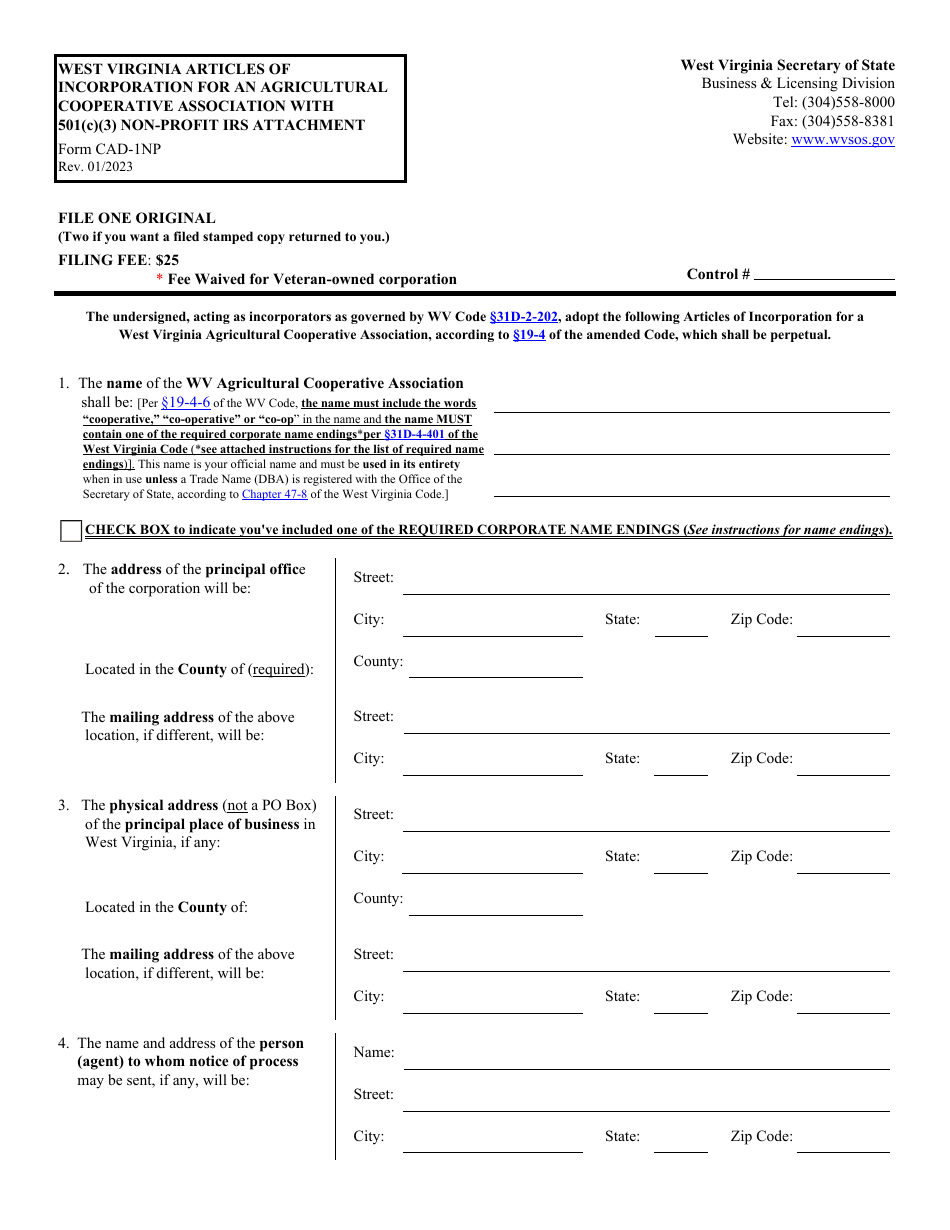

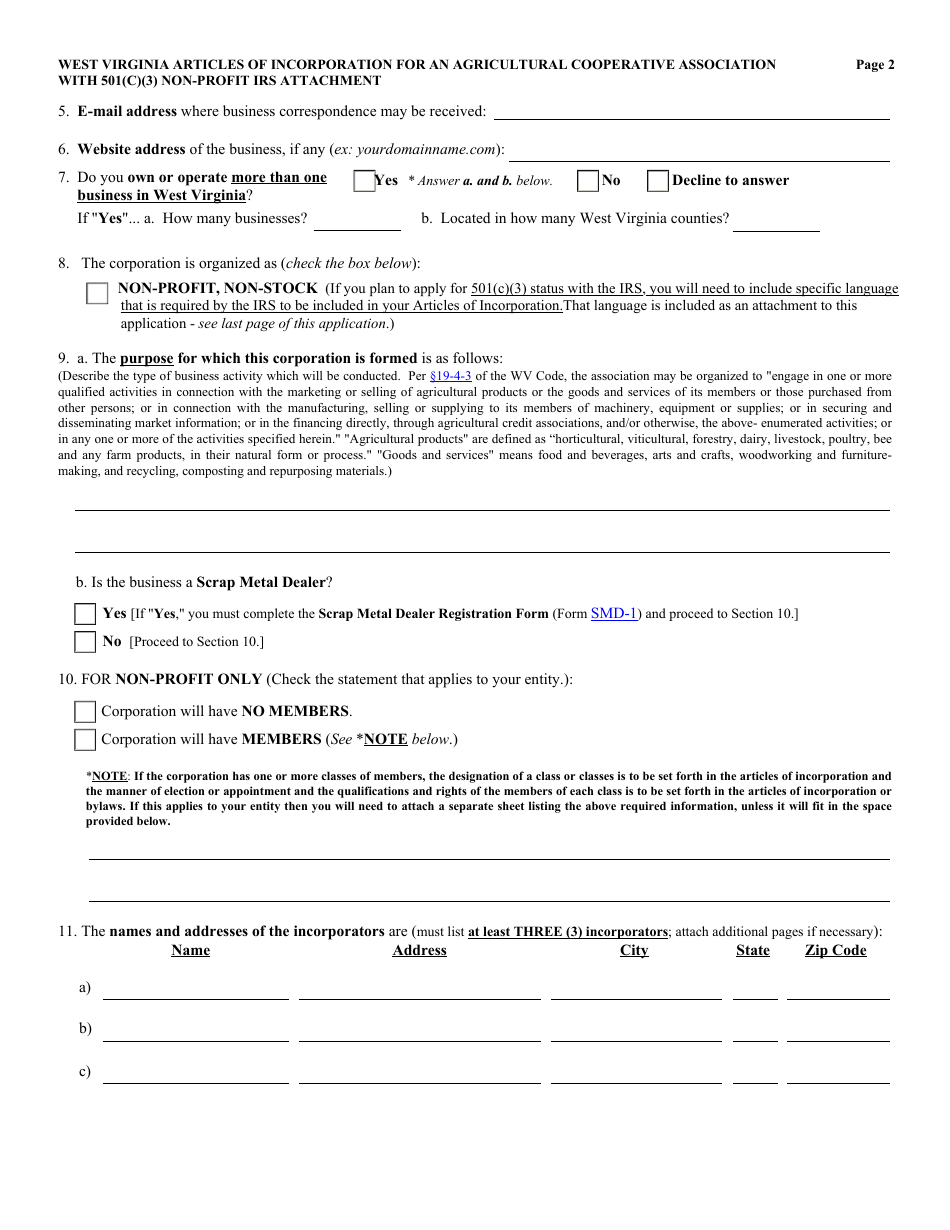

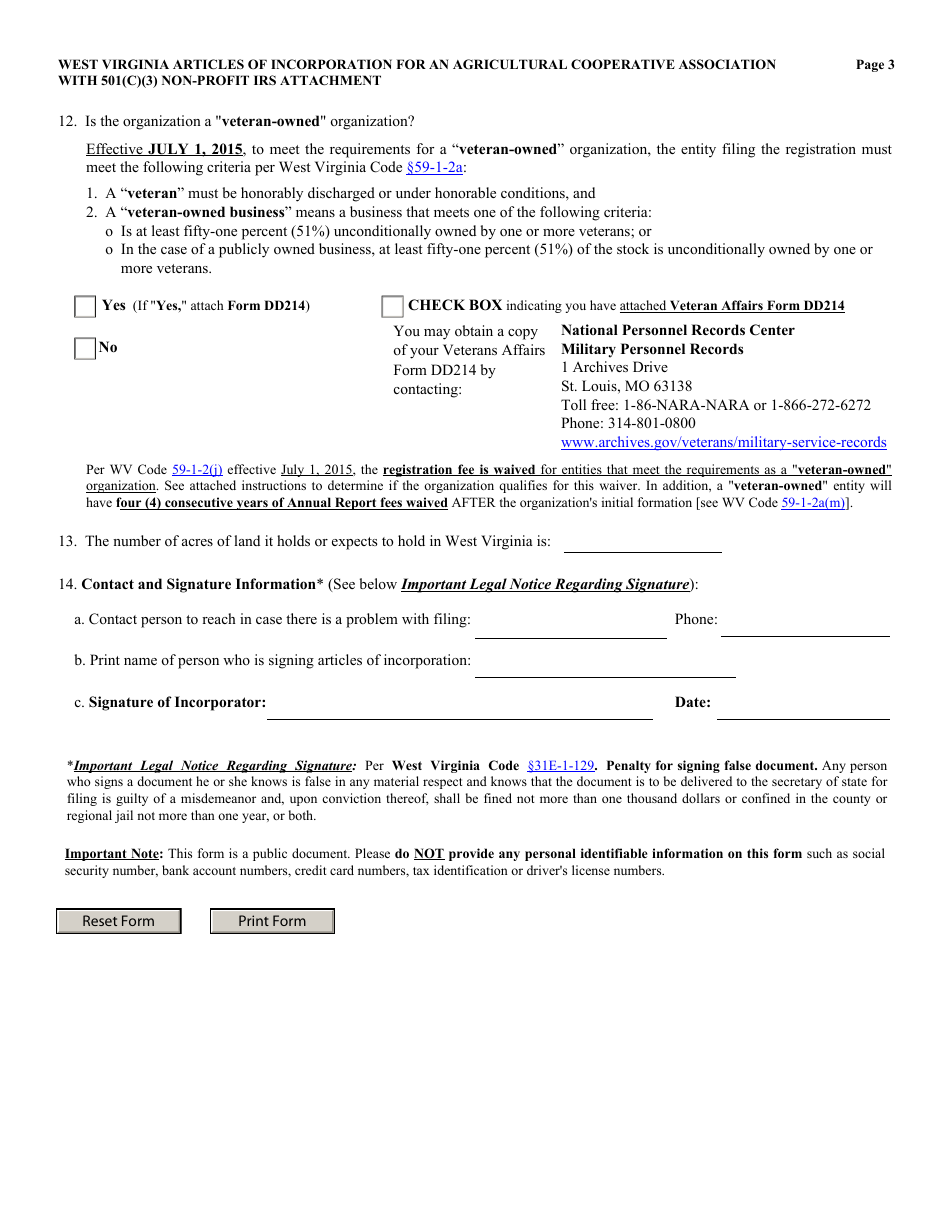

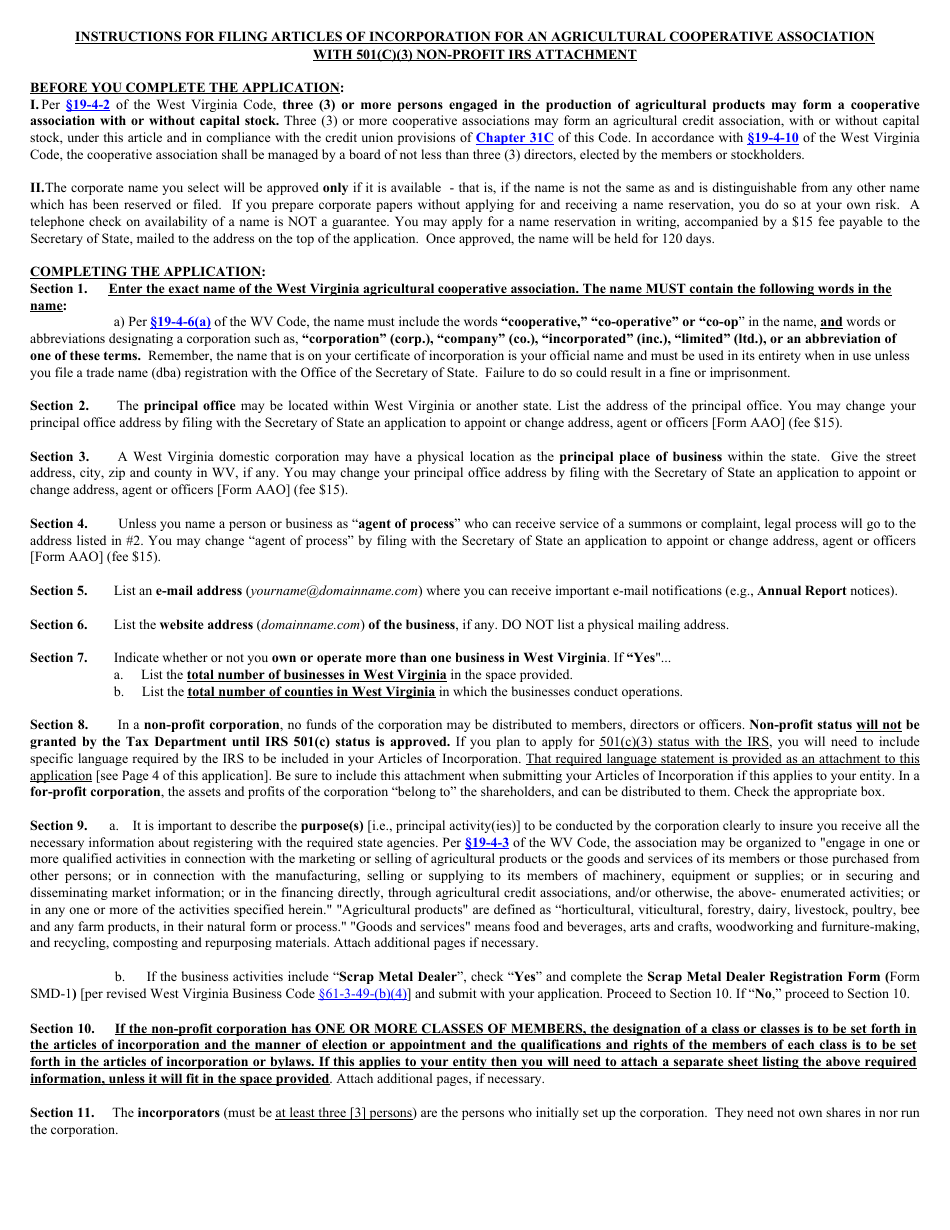

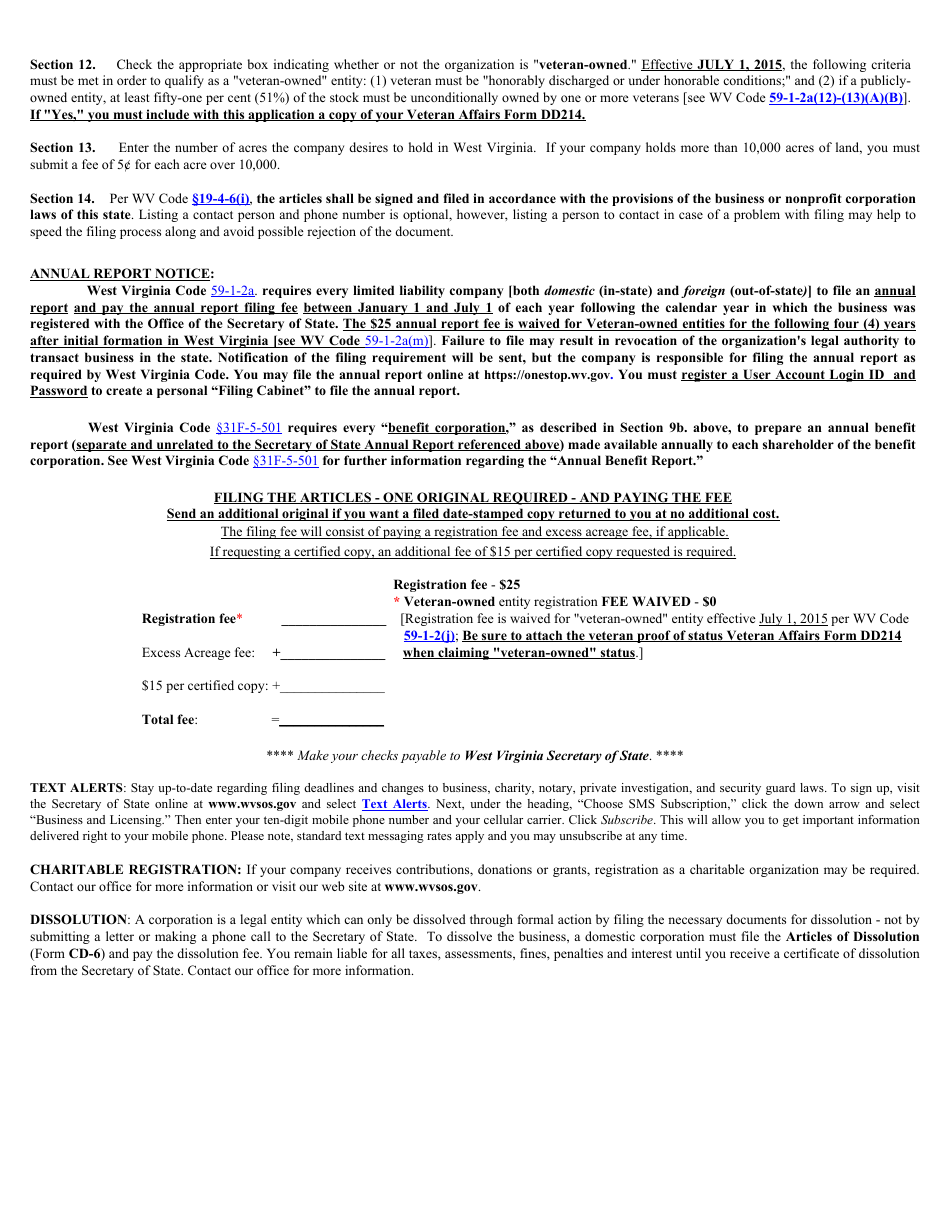

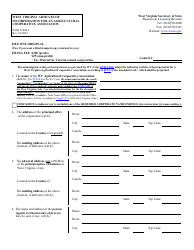

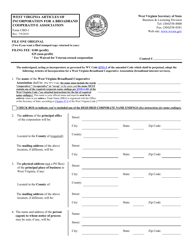

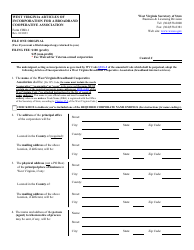

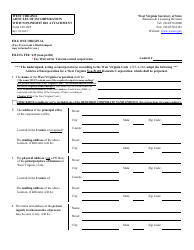

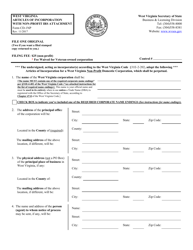

Form CAD-1NP West Virginia Articles of Incorporation for an Agricultural Cooperative Association With 501(C)(3) Non-profit IRS Attachment - West Virginia

What Is Form CAD-1NP?

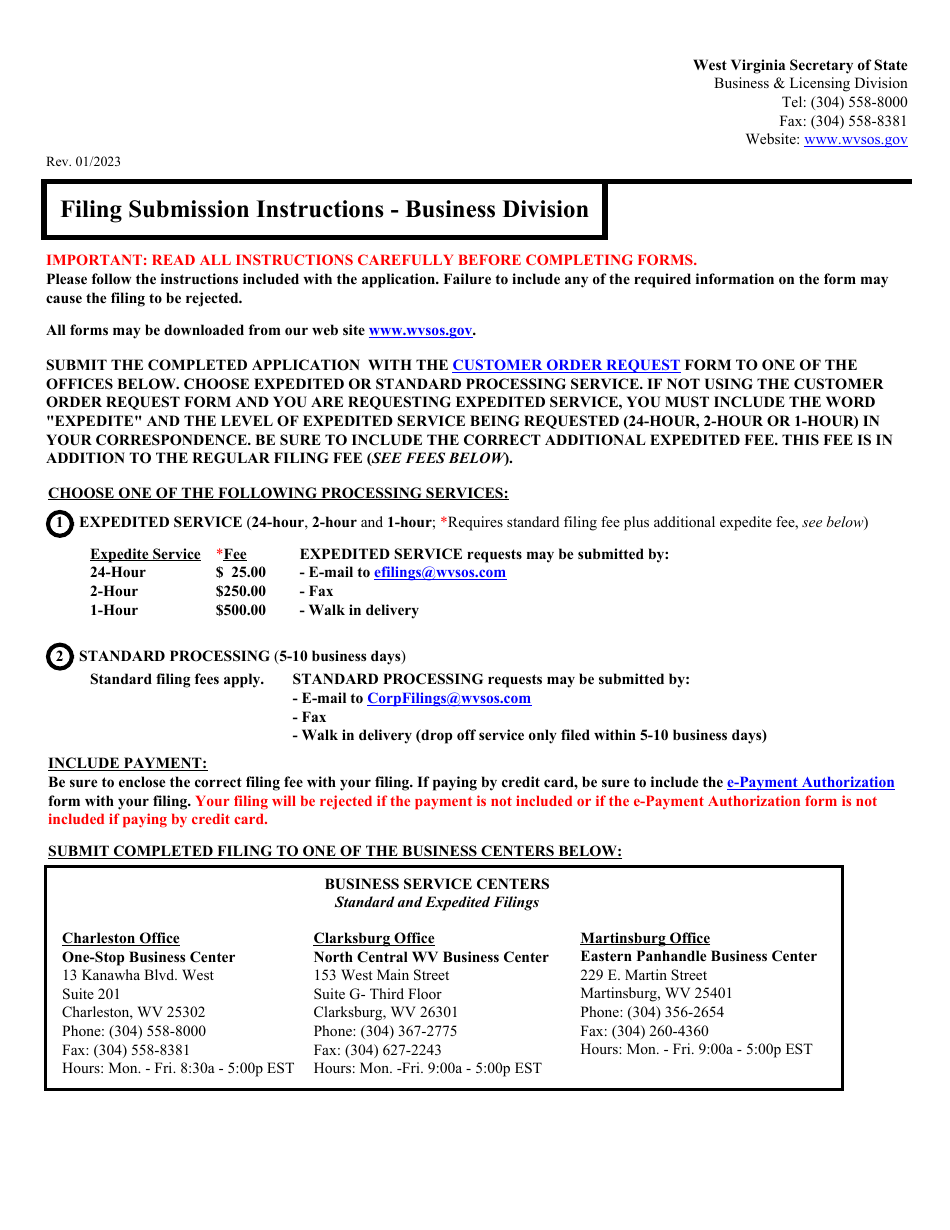

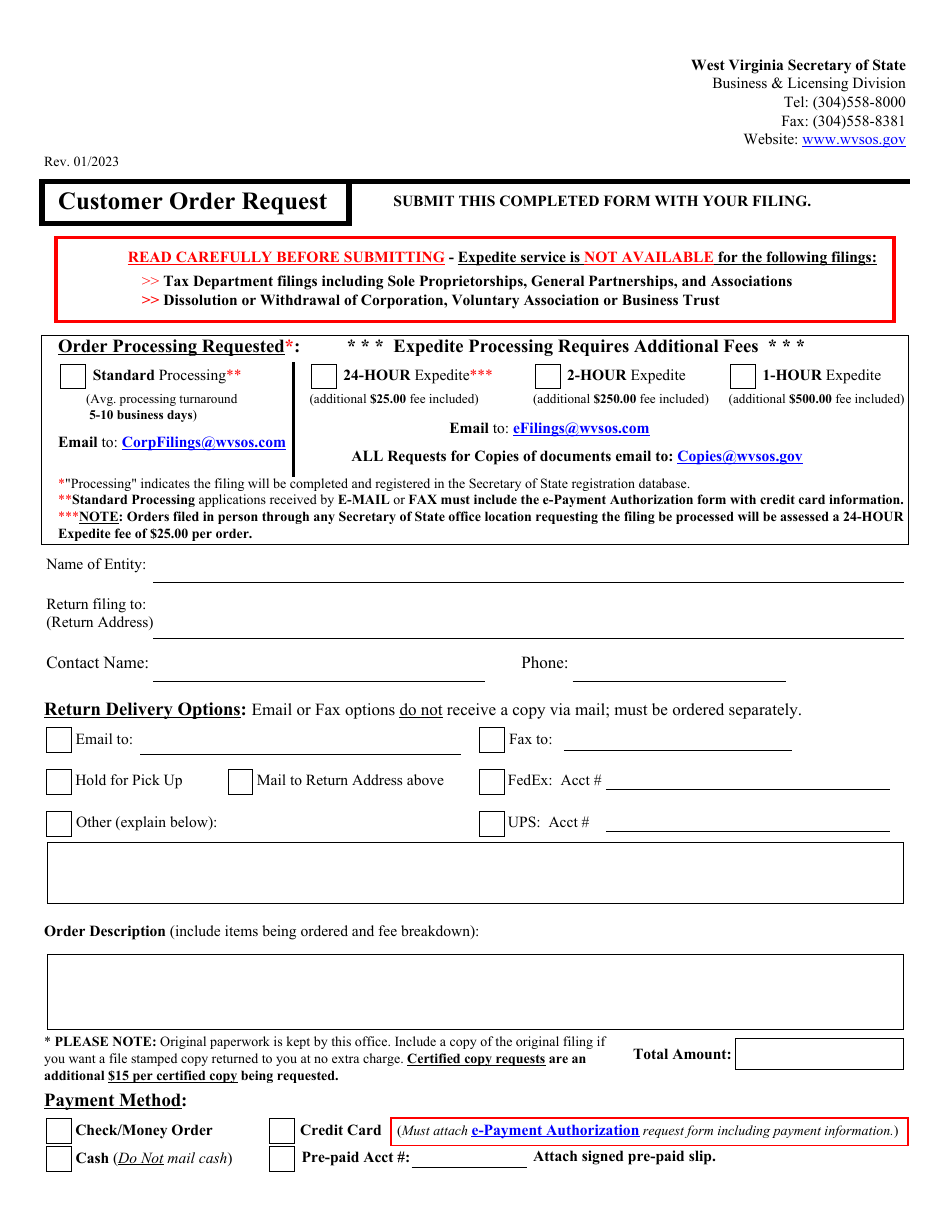

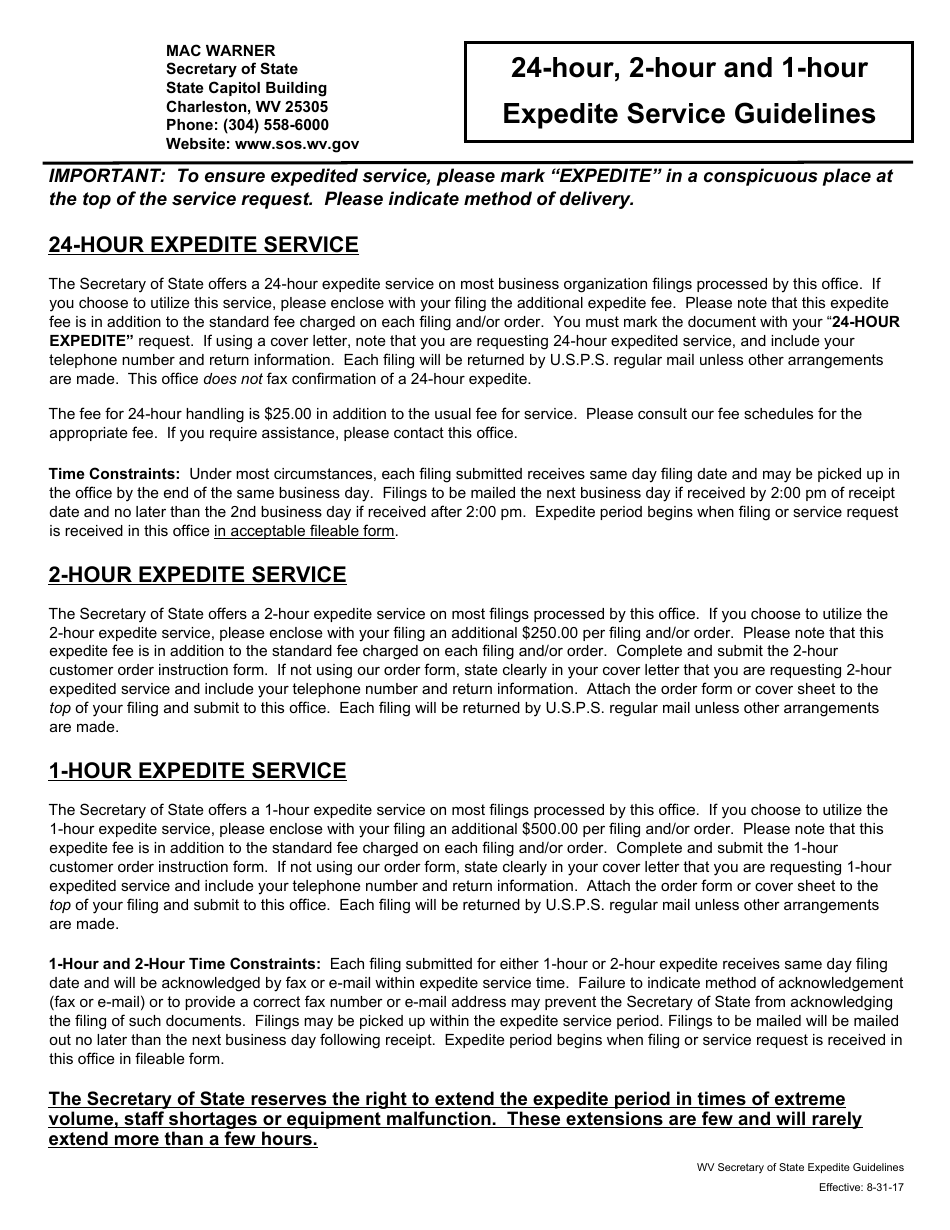

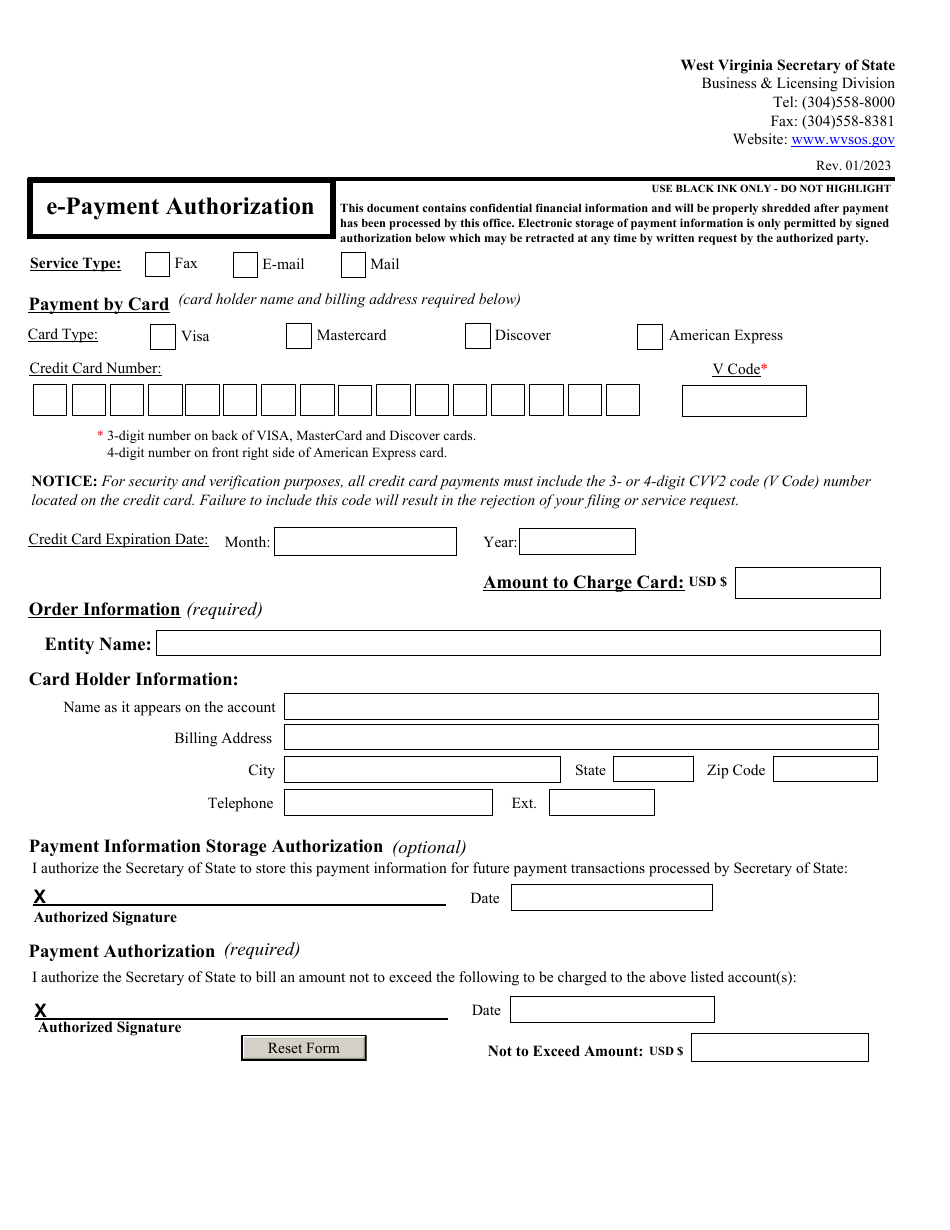

This is a legal form that was released by the West Virginia Secretary of State - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CAD-1NP?

A: Form CAD-1NP is the West Virginia Articles of Incorporation for an Agricultural Cooperative Association with 501(c)(3) non-profit IRS attachment.

Q: What is an Agricultural Cooperative Association?

A: An Agricultural Cooperative Association is a type of cooperative where farmers and agricultural producers come together to collectively market and sell their products, purchase supplies, and share resources.

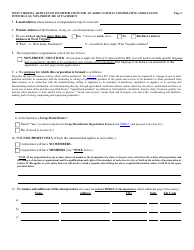

Q: What is a 501(c)(3) non-profit IRS attachment?

A: A 501(c)(3) non-profit IRS attachment is a document that outlines the organization's tax-exempt status under section 501(c)(3) of the Internal Revenue Code.

Q: Who needs to file Form CAD-1NP?

A: Form CAD-1NP is specifically for agricultural cooperative associations in West Virginia that seek to obtain 501(c)(3) non-profit status.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the West Virginia Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CAD-1NP by clicking the link below or browse more documents and templates provided by the West Virginia Secretary of State.