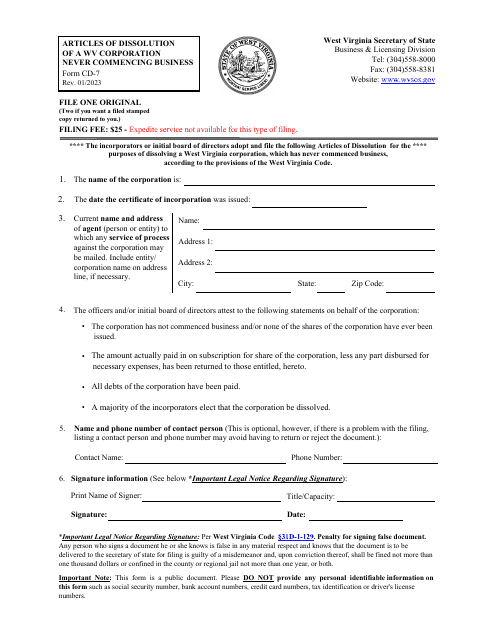

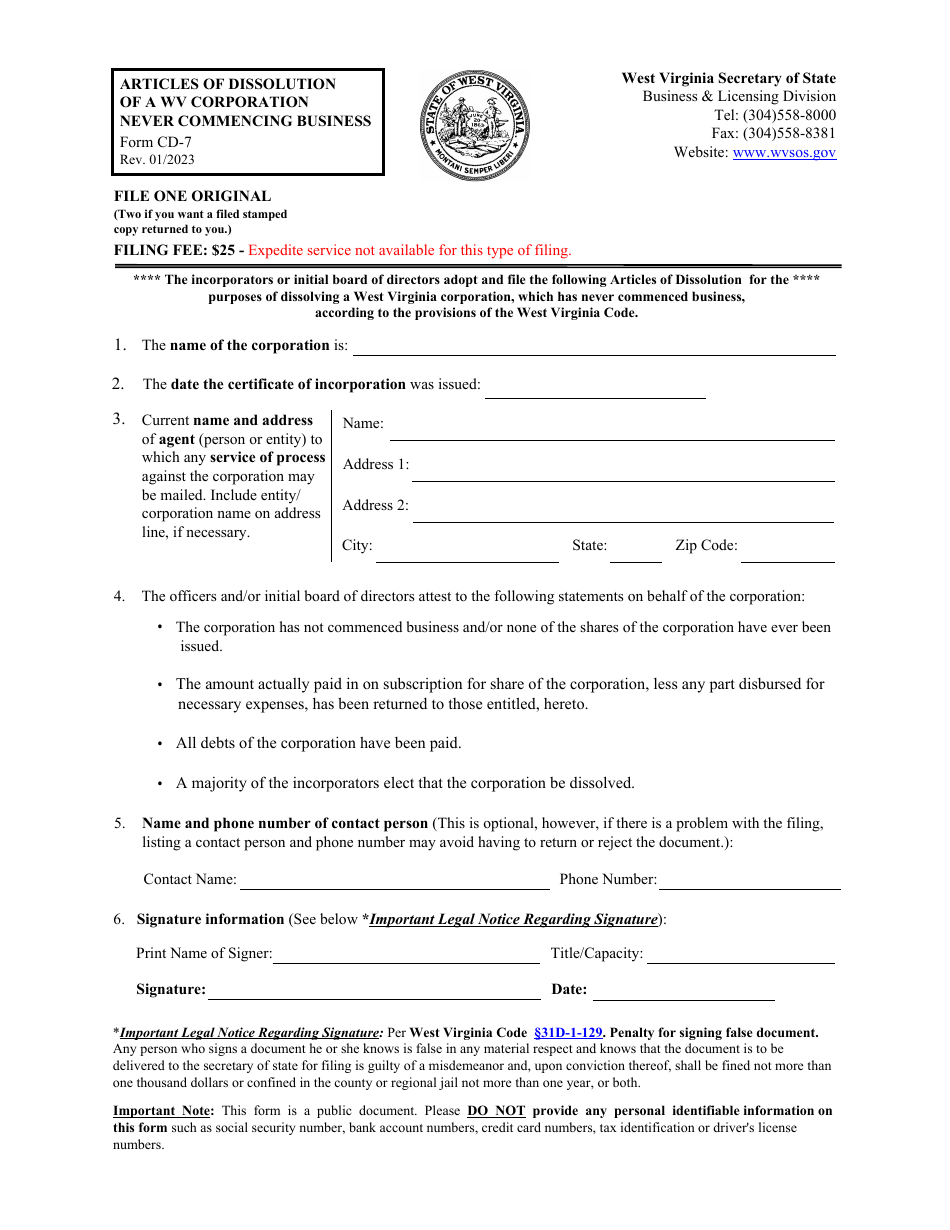

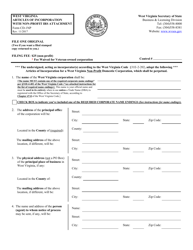

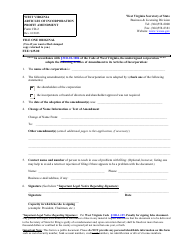

Form CD-7 Articles of Dissolution of a Wv Corporation Never Commencing Business - West Virginia

What Is Form CD-7?

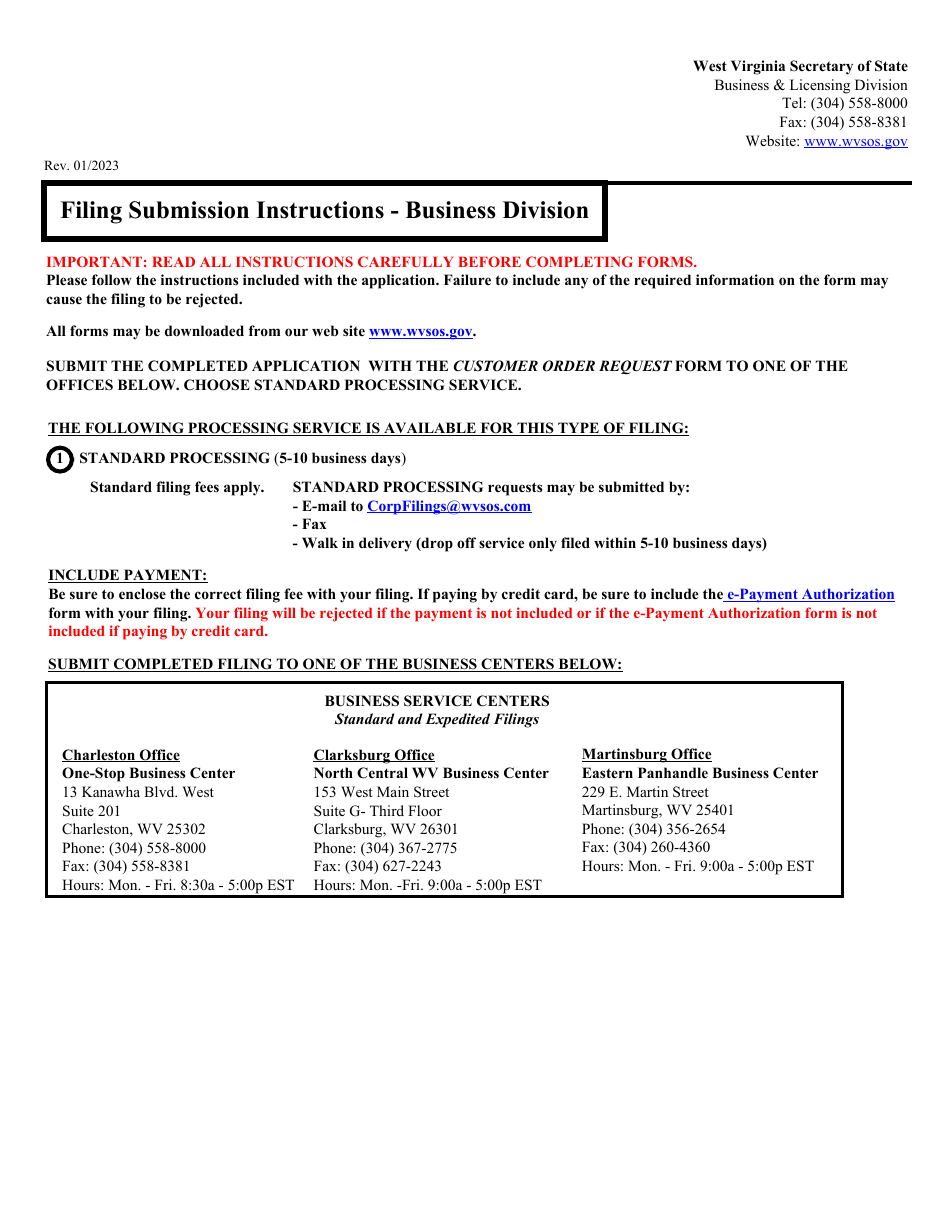

This is a legal form that was released by the West Virginia Secretary of State - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CD-7?

A: Form CD-7 is the Articles of Dissolution for a West Virginia corporation that never commenced business.

Q: What is a West Virginia corporation?

A: A West Virginia corporation is a business entity that is incorporated under the laws of West Virginia.

Q: What does it mean to dissolve a corporation?

A: To dissolve a corporation means to legally terminate its existence as a business entity.

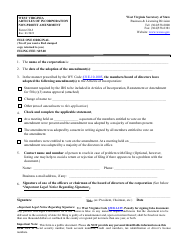

Q: When is Form CD-7 used?

A: Form CD-7 is used when a West Virginia corporation wants to dissolve and has never commenced its business operations.

Q: Is Form CD-7 specific to West Virginia?

A: Yes, Form CD-7 is specific to West Virginia and is used for dissolution of corporations in the state.

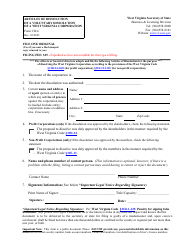

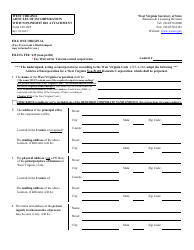

Q: What information is required in Form CD-7?

A: Form CD-7 requires information such as the corporation's name, date of incorporation, and a statement that the corporation has never commenced business.

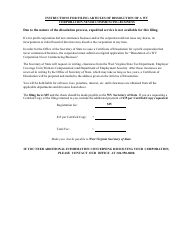

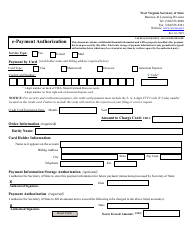

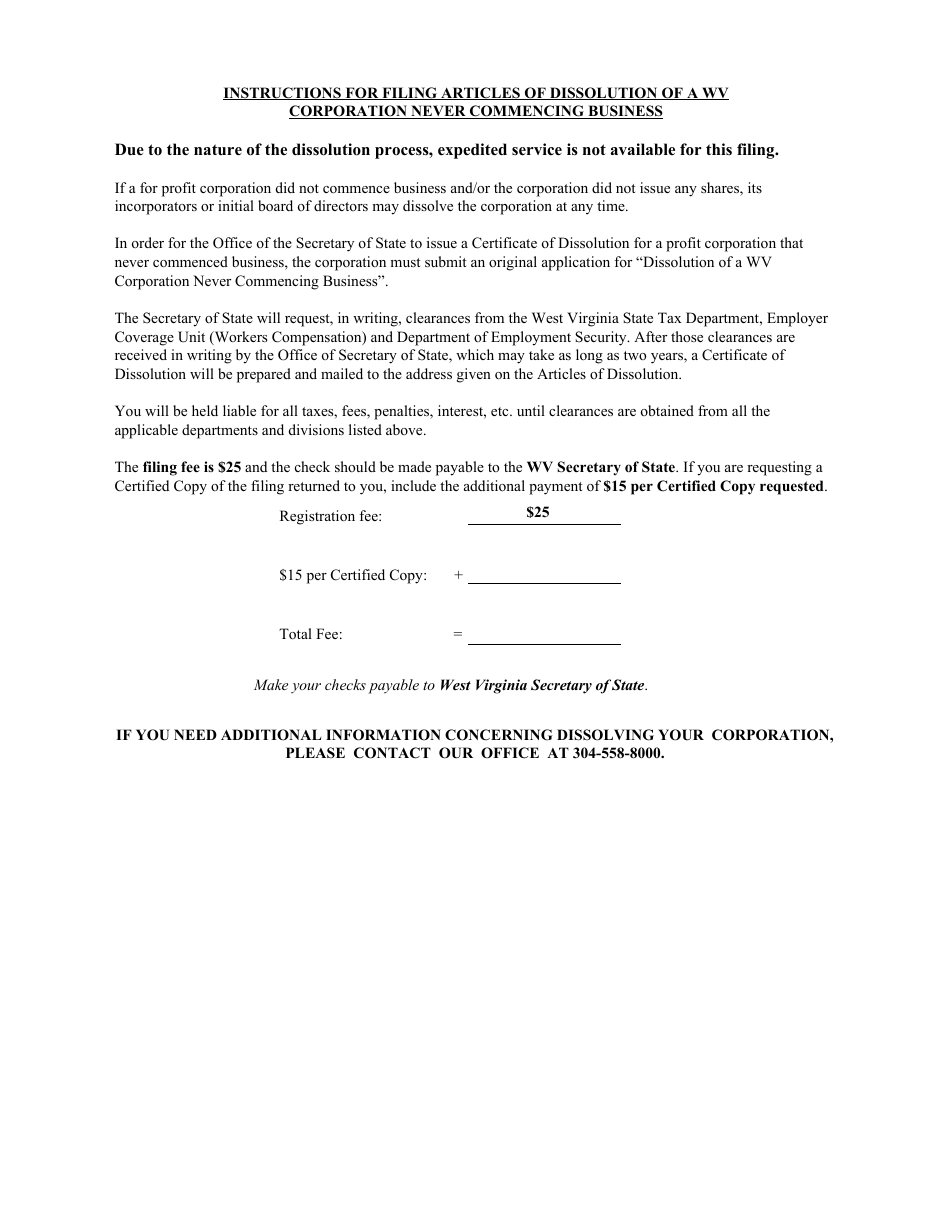

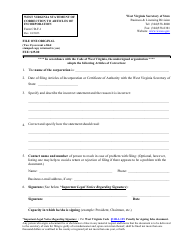

Q: Are there any fees for filing Form CD-7?

A: Yes, there may be filing fees associated with Form CD-7. The exact fees can be obtained from the West Virginia Secretary of State's office.

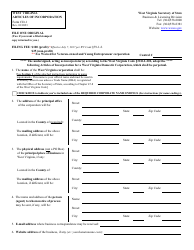

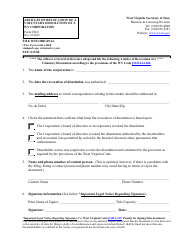

Q: What happens after filing Form CD-7?

A: After filing Form CD-7, the corporation's existence will be terminated, and it will no longer have any legal obligations or rights.

Q: Can a dissolved corporation be reinstated?

A: In some cases, a dissolved corporation can be reinstated by filing the necessary paperwork and paying any outstanding fees or penalties.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the West Virginia Secretary of State;

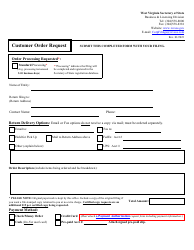

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CD-7 by clicking the link below or browse more documents and templates provided by the West Virginia Secretary of State.