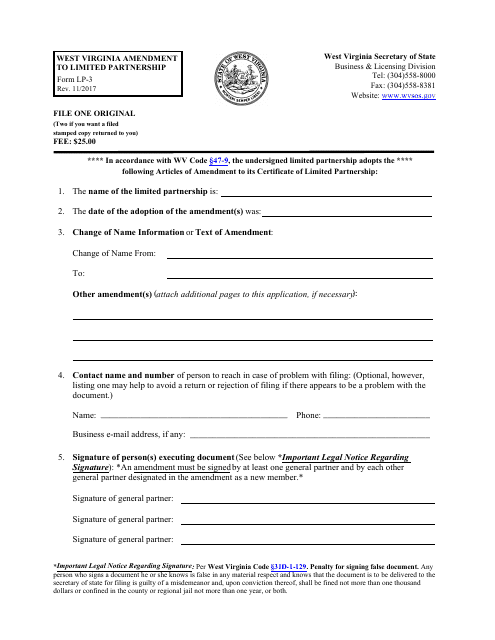

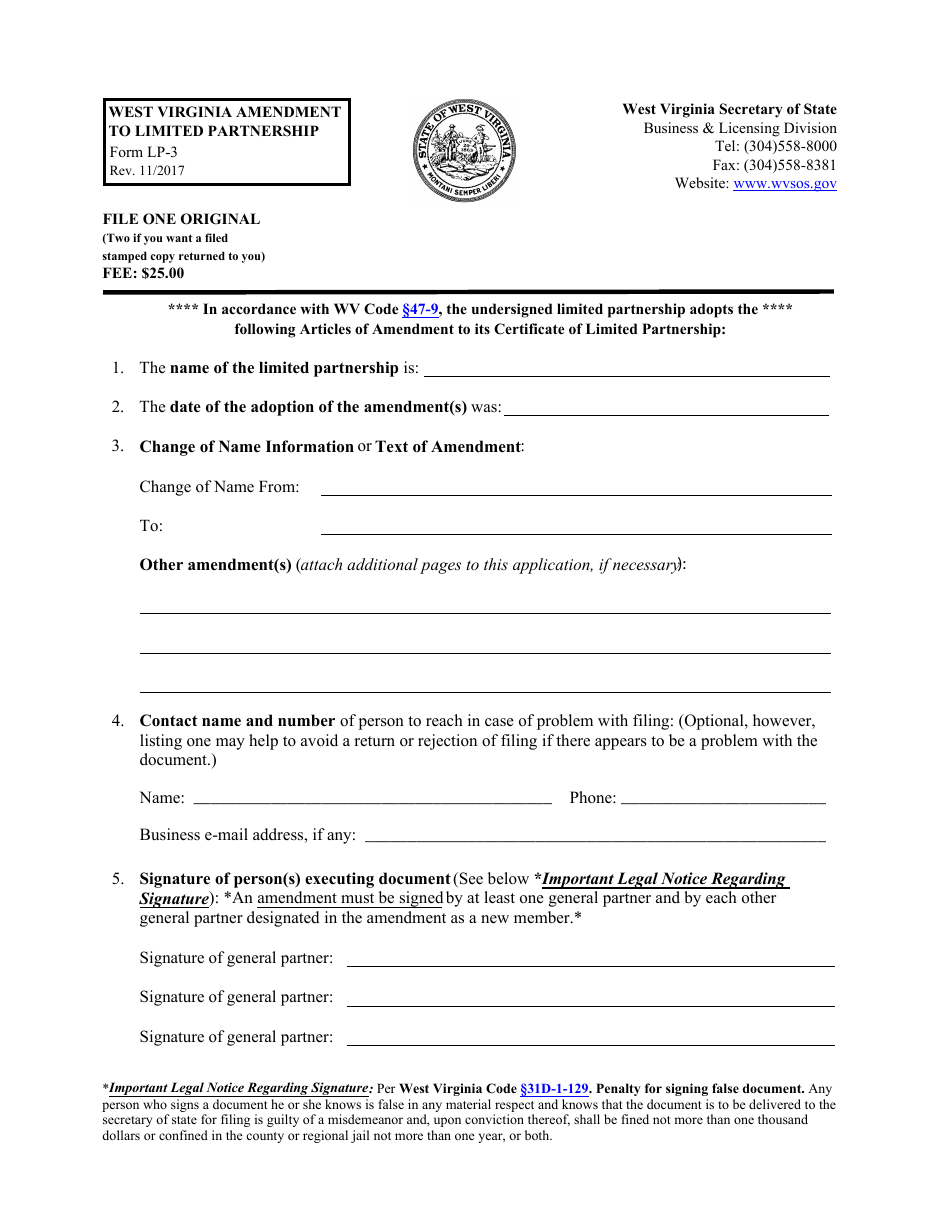

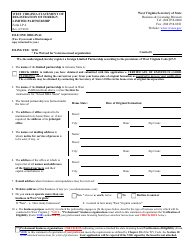

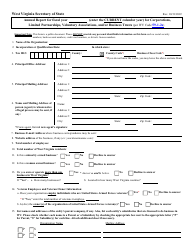

Form LP-3 West Virginia Amendment to Limited Partnership - West Virginia

What Is Form LP-3?

This is a legal form that was released by the West Virginia Secretary of State - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LP-3?

A: Form LP-3 is the West Virginia Amendment to Limited Partnership form.

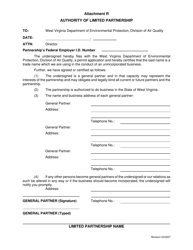

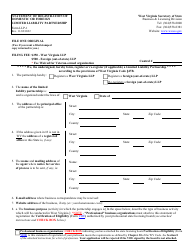

Q: What is a Limited Partnership?

A: A Limited Partnership is a business structure that consists of general partners who manage the business and have unlimited personal liability, and limited partners who invest capital but have limited liability.

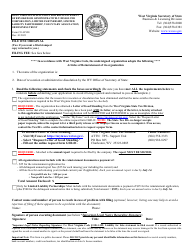

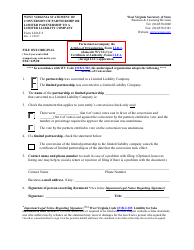

Q: When do I need to file a Form LP-3?

A: You need to file a Form LP-3 when you want to make amendments or changes to an existing Limited Partnership in West Virginia.

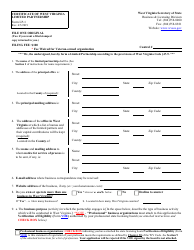

Q: What types of changes can be made with Form LP-3?

A: Form LP-3 allows you to make changes to the Limited Partnership's name, address, registered agent, business purpose, and other provisions.

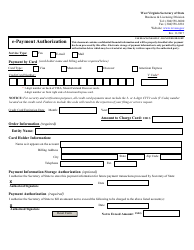

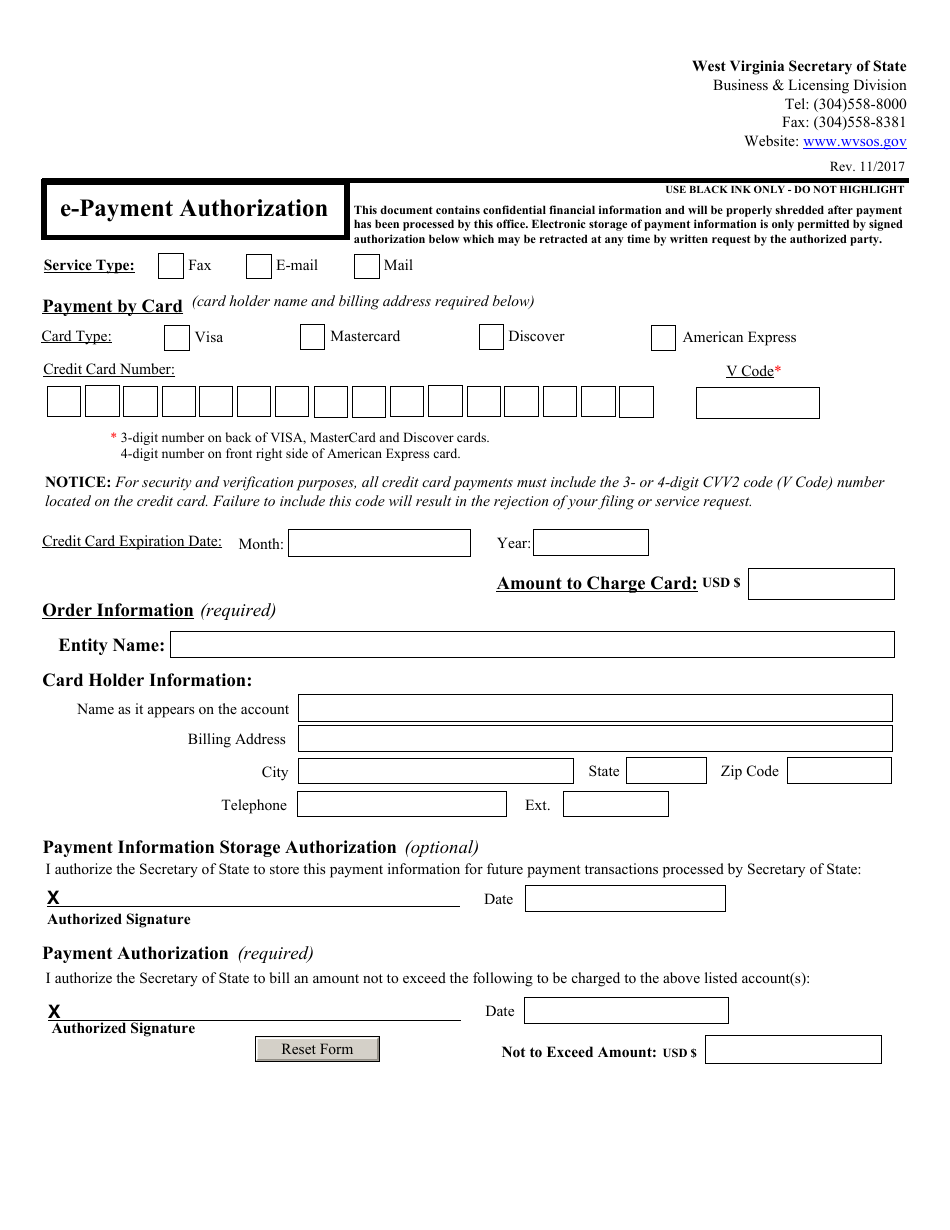

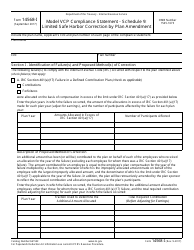

Q: Do I need to pay a fee to file Form LP-3?

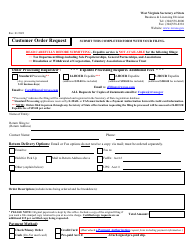

A: Yes, there is a filing fee associated with filing Form LP-3. The fee amount may vary, so it's best to check with the West Virginia Secretary of State for the current fee schedule.

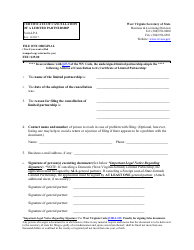

Q: How do I fill out Form LP-3?

A: You must provide the required information on Form LP-3, including the name of the Limited Partnership, the specific amendment(s) being made, and the signatures of the general partners.

Q: What happens after I file Form LP-3?

A: After filing Form LP-3, the changes will be recorded by the Secretary of State, and you will receive a stamped copy of the amended document as proof of the filing.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the West Virginia Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LP-3 by clicking the link below or browse more documents and templates provided by the West Virginia Secretary of State.