This version of the form is not currently in use and is provided for reference only. Download this version of

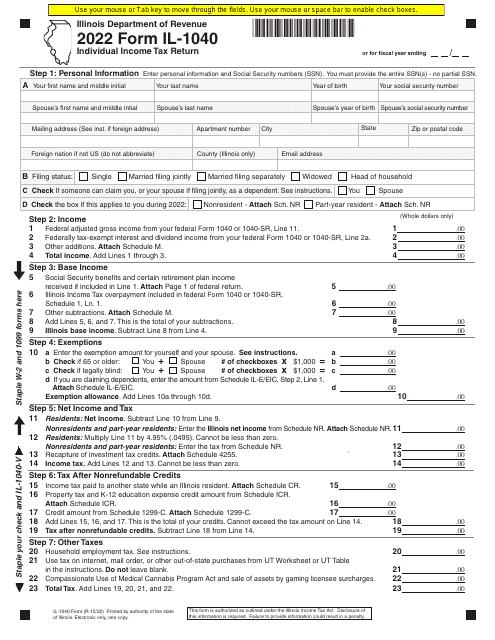

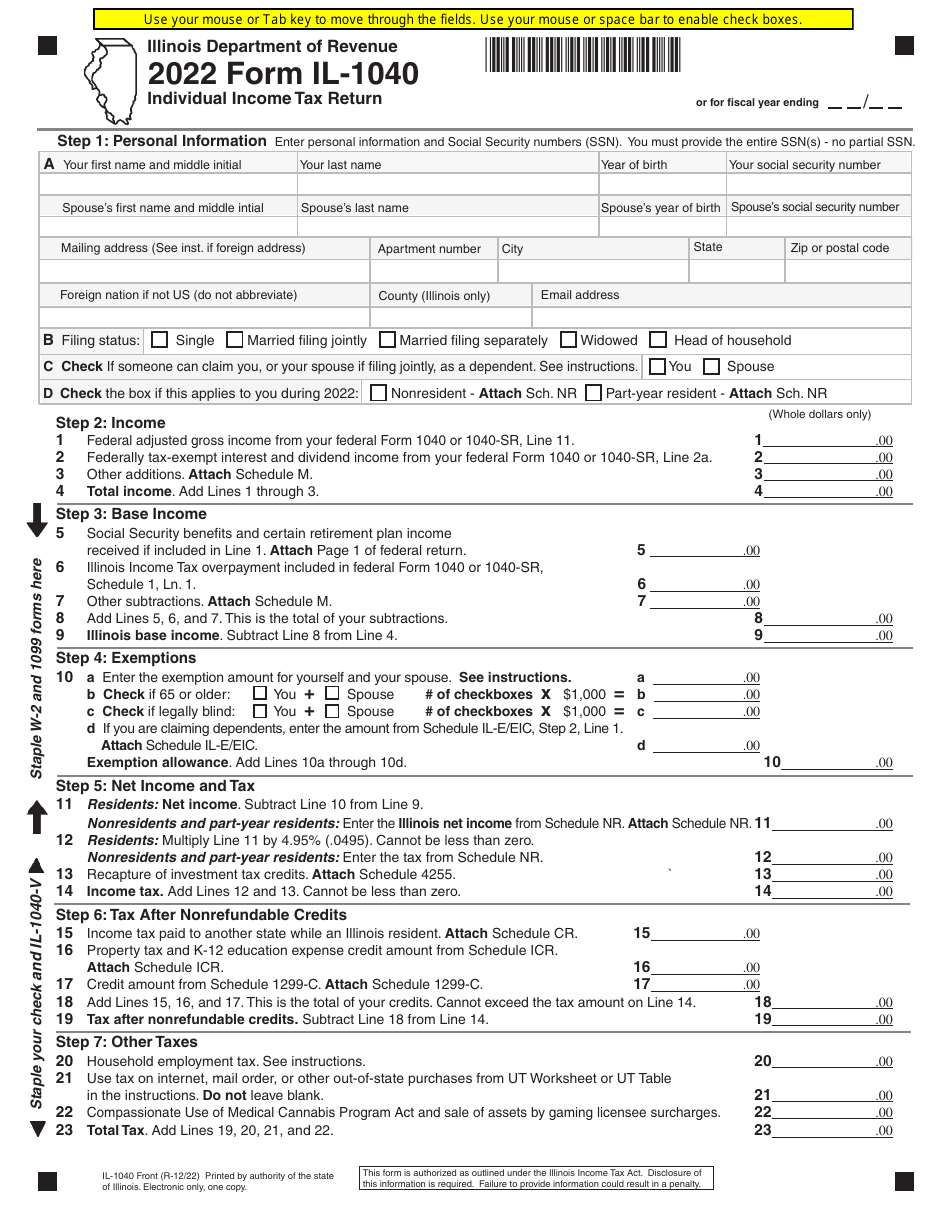

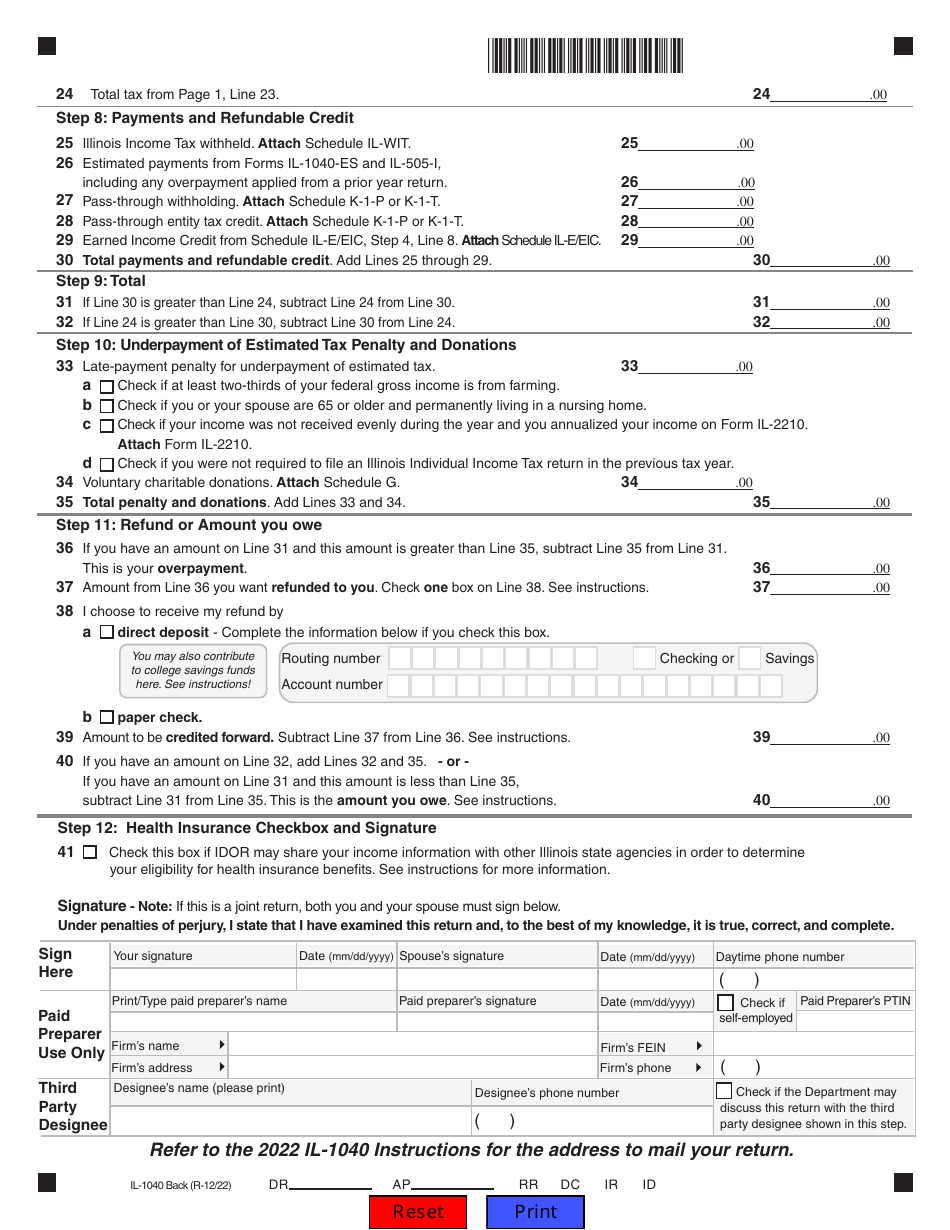

Form IL-1040

for the current year.

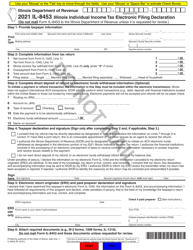

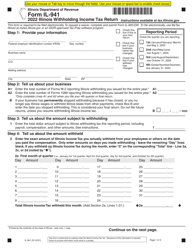

Form IL-1040 Individual Income Tax Return - Illinois

What Is Form IL-1040?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL-1040?

A: Form IL-1040 is the Individual Income Tax Return for the state of Illinois.

Q: Who needs to file Form IL-1040?

A: Any individual who is a resident of Illinois and has earned income during the tax year needs to file Form IL-1040.

Q: When is the deadline to file Form IL-1040?

A: The deadline to file Form IL-1040 is usually April 15th, but it can vary depending on holidays and weekends.

Q: What if I can't file my Form IL-1040 by the deadline?

A: You can request a filing extension, which will give you extra time to file your Form IL-1040.

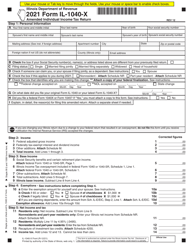

Q: Are there any specific deductions or credits available on Form IL-1040?

A: Yes, Illinois offers various deductions and credits that you may be eligible for. Consult the instructions for Form IL-1040 for more details.

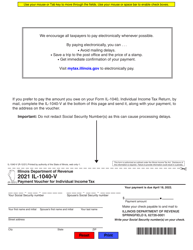

Q: Can I file Form IL-1040 electronically?

A: Yes, you can file Form IL-1040 electronically using the Illinois Department of Revenue's e-file system.

Q: Do I need to include my federal tax return with Form IL-1040?

A: No, you do not need to include a copy of your federal tax return with Form IL-1040. However, you may need to provide certain information from your federal return.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1040 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.