This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

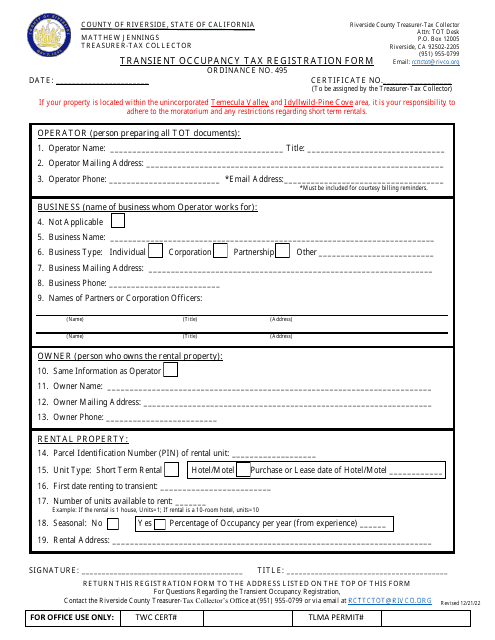

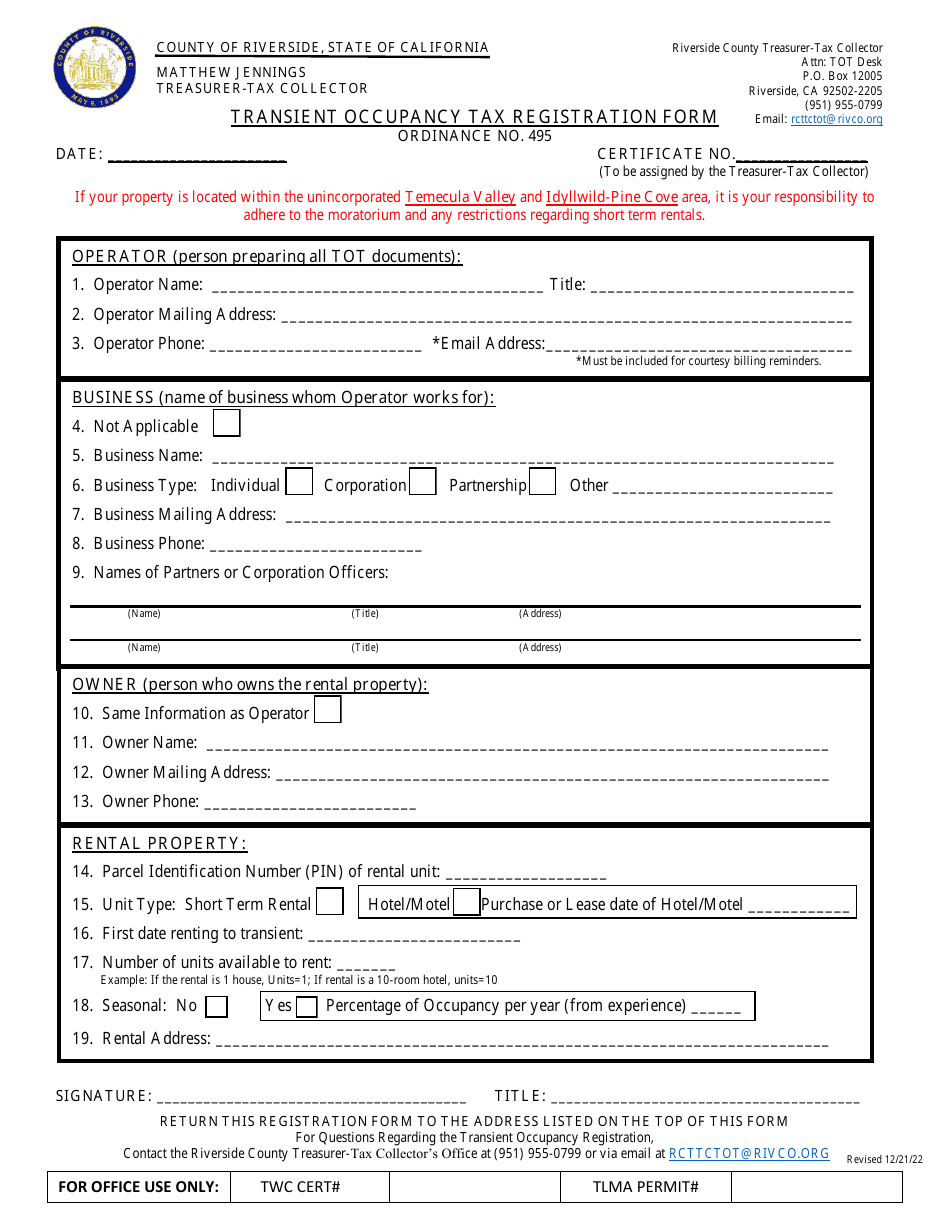

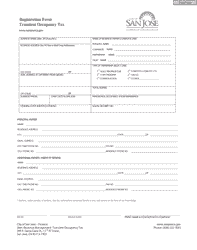

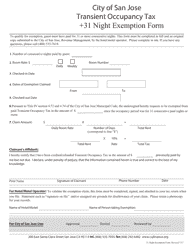

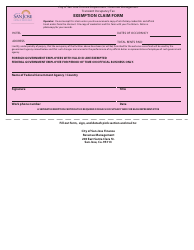

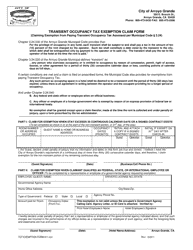

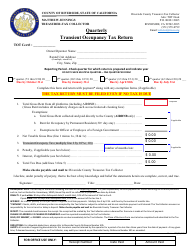

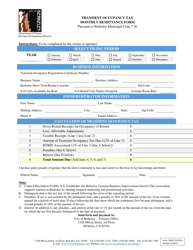

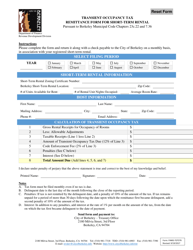

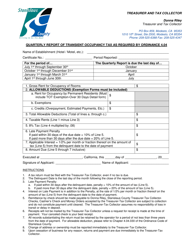

Transient Occupancy Tax Registration Form - Riverside County, California

Transient Occupancy Tax Registration Form is a legal document that was released by the Office of the Treasurer-Tax Collector - Riverside County, California - a government authority operating within California. The form may be used strictly within Riverside County.

FAQ

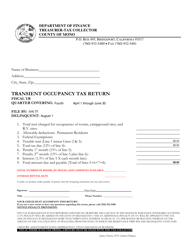

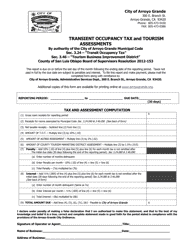

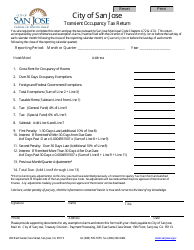

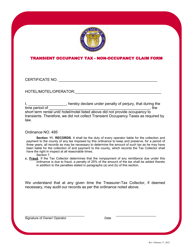

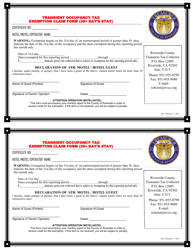

Q: What is a transient occupancy tax?

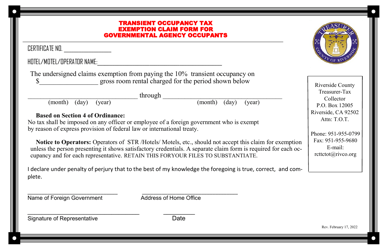

A: Transient occupancy tax is a tax imposed on visitors who stay in hotels, motels, vacation rentals, or other temporary lodging accommodations.

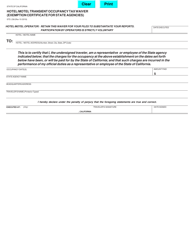

Q: Who is required to register for transient occupancy tax in Riverside County, California?

A: Owners or operators of hotels, motels, vacation rentals, and other temporary lodging accommodations in Riverside County are required to register for transient occupancy tax.

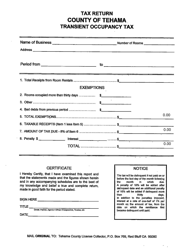

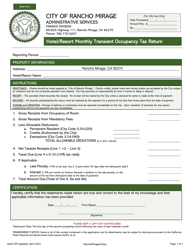

Q: What information is required on the transient occupancy tax registration form?

A: The transient occupancy tax registration form typically requires information such as the name and address of the lodging accommodations, the owner's name and contact information, and the number of available rooms or units.

Q: Is there a fee for registering for transient occupancy tax in Riverside County?

A: Yes, there is a fee for registering for transient occupancy tax in Riverside County. The fee amount may vary and can be found on the registration form or obtained from the Riverside County Tax Collector.

Form Details:

- Released on December 21, 2022;

- The latest edition currently provided by the Office of the Treasurer-Tax Collector - Riverside County, California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Office of the Treasurer-Tax Collector - Riverside County, California.